-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Noms Begin Senate Hearings On Tues

MNI POLITICAL RISK ANALYSIS - Week Ahead 13-19 January

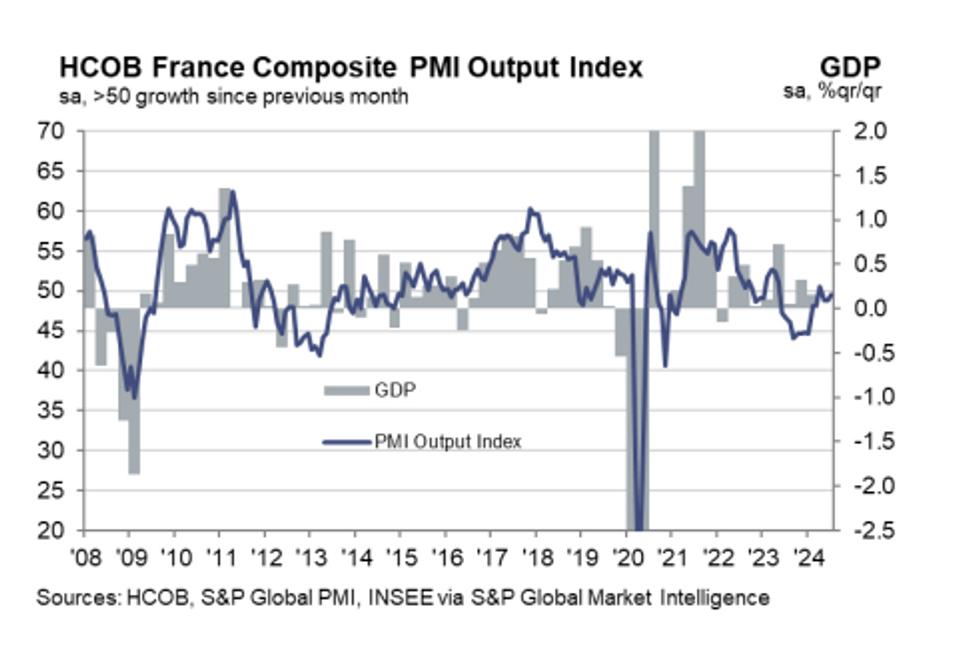

July Flash Services PMI Beats, But Inflation Pressures Evident

The French services PMI rose back into expansionary territory in the July flash round, at 50.7 (vs 49.7 cons, 49.6 prior). In contrast, manufacturing was weaker-than-expected at 44.1 (vs 45.9 cons, 45.4 prior). These dynamics add strength to the ongoing narrative that services activity is driving the Eurozone’s (gradual) economic recovery, while industry remains weak.

EGB futures have moved away from highs as a result of the services beat and worrying prices paid components (see below), with Bunds last +3 at 132.33 (vs a pre-data high of 132.47).

Key notes from the release:

- “Weak sales performances and delays from customers drove the slump in factory production, anecdotal evidence showed. On the other hand, business activity at services companies rose for the first time since April. The Olympic Games, as well as the end of the election period, were given as reasons for higher output”.

- “The latest survey data showed another month of job creation, extending the current period of rising employment to six months. Hiring was restricted to just the service sector”

- “July survey data signalled a marked intensification of cost pressures across France, led by a sharp acceleration in input price inflation at manufacturers”.

- “Higher commodity and raw material prices were commonly linked to the rise. In turn, selling charges were increased at the fastest rate for three months as companies endeavoured to pass on some of the burden of higher costs to their clients”.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.