-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

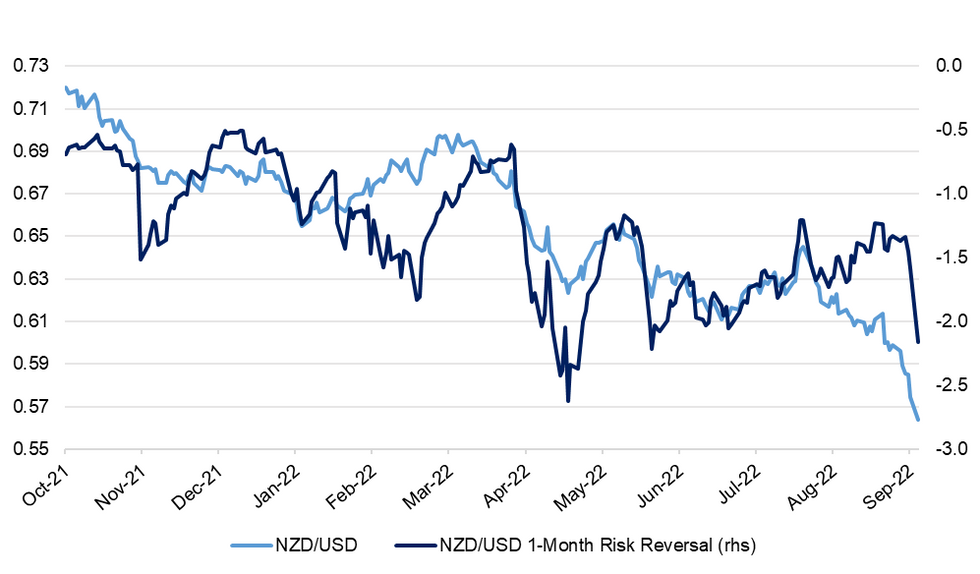

Free AccessKiwi Extends Drop On Turbulent Day, One-Month Risk Reversal Tanks

The kiwi capitulated in a risk-off environment and amid holiday-thinned liquidity on Monday. Strong USD outperformance and relatively fragile NZD sentiment sent NZD/USD to its lowest point since the outbreak of the COVID-19 pandemic in Mar 2020.

- Cross-asset signals were negative for the currency, with the aggregate BBG Commodity Index down 1.6% and with the equity space seeing a sea of red.

- NZD/USD implied vols were sharply higher, with both 1-month & 1-year tenors hitting four-month highs. One-month option skews sank to worst levels since mid-Jun, suggesting notable increase in bearish sentiment.

- NZD/USD trades +4 pips at $0.5641 as local financial markets re-open after a holiday. Below Mar 23, 2020 low of $0.5591 would bring Mar 19, 2020 low of $0.5470 into view. Bulls look for a rebound above the $0.6000 mark.

- The NZD was the second-worst G10 performer on Monday (after the NOK) and remains the second-worst performer this month (after the GBP), losing ~7.3% vs. the greenback only in September.

- RBNZ Gov Orr blamed the recent kiwi depreciation on a global "capital drain" into the U.S. which acts as a safe haven in uncertain times and where interest rates are being aggressively pushed higher. FinMin Robertson struck similar notes, flagging benefits to exporters despite being cognisant of increased costs of imports.

- Orr added that the Reserve Bank "still have some work to do" in its efforts to contain inflation, but "the tightening cycle is very mature, it's well advanced." Terminal rate pricing and market expectations for the next MPC meeting are broadly unchanged after Orr's comments, with the Committee expected to raise the OCR by 50bp on Oct 5.

- Domestic focus turns to ANZBO (Thursday), as well as ANZ-Roy Morgan Consumer Confidence, building permits & another round of comments from RBNZ Gov Orr (Friday).

Fig. 1: NZD/USD vs. NZD/USD1-Month Risk Reversal

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.