-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Kiwi Lags High-Beta Peers, Jobs Market Report Under Microscope

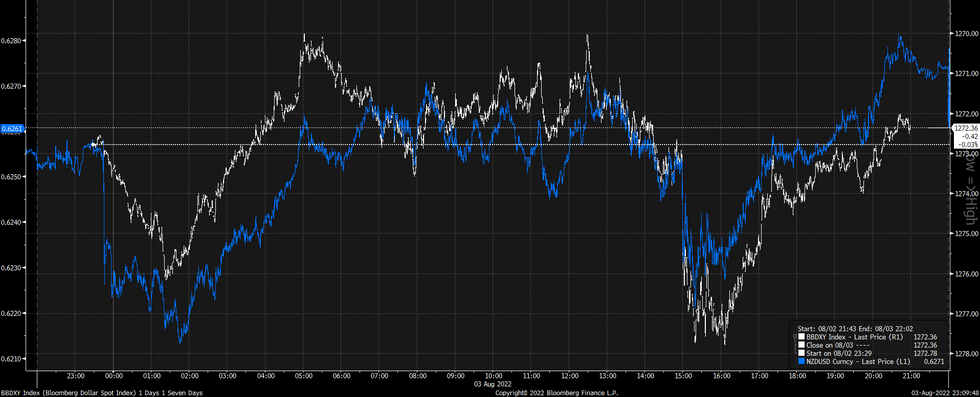

The kiwi dollar lagged its commodity-tied peers on Wednesday, yet NZD/USD eked out some gains. The reaction to New Zealand's latest labour force survey may have helped keep a lid on the NZD. Otherwise, the pair clung to the coattails of the BBDXY index.

- New Zealand's jobs report was mixed, even as the NZD went offered in initial reaction. The unemployment rate unexpectedly ticked away from record lows, which was driven by weak underlying data. Still, the labour market remains extremely tight, with strong outcomes for labour cost inflation raising concerns over the risk of a wage-price spiral.

- The amount of tightening priced for the August meeting of the RBNZ's Monetary Policy Committee slipped just 3bp as participants parsed the labour market report. The Big 4 kiwi banks have all emphasised upbeat wage figures, with Westpac pushing their forecast peak for the OCR to 4.0% from 3.5%.

- Resilient risk appetite supported high-beta FX later in the day, as equity markets in Europe & the U.S. saw benchmark indices creep higher. Commodity markets were mixed, with the aggregate BBG Commodity Index virtually unchanged on the day.

- The improvement in risk backdrop came on the back of better than expected data prints out of the U.S. as well as the removal of the immediate risk of a forceful Chinese retaliation for U.S. House Speaker's visit to Taiwan.

- NZD/USD trades at $0.6271, little changed on the day. Topside focus falls on Aug 1 high of $0.6353, a break here would expose Jun 16 high of $0.6396. Conversely, bears need a sell-off past Jul 14 low of $0.6061 to jump back into the driving seat.

Fig. 1. NZD/USD vs. BBDXY Index (inversed)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.