-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessKiwi Remains Steady After Another Inflation Beat

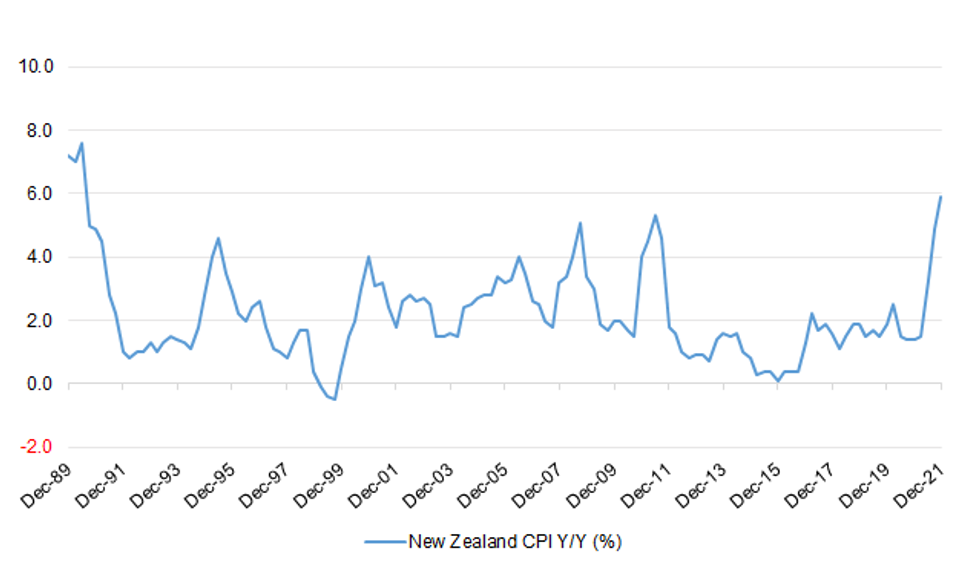

New Zealand's inflation remains red hot, with consumer prices up 5.9% Y/Y in the final quarter of 2021. Inflation accelerated to its fastest pace since 1990 and topped the consensus forecast of +5.7%, which matched the projection from the RBNZ's November MPS. Stats NZ commented that "price increases were widespread with 10 out of 11 main groups in the CPI basket increasing in the year," which highlights the broad-based nature of current inflationary pressures.

- The data has not moved the needle on RBNZ pricing to any observable degree so far. Note that the RBNZ will publish their preferred measure of core prices (sectoral factor model) at 15:00NZDT/02:00GMT.

- The report has overshadowed the latest developments on the Covid-19 front. Modelling from the Institute for Health Metrics and Evaluation suggests that New Zealand's daily Covid-19 cases could peak around 80,000 in mid-Feb. Meanwhile, the government said they have been preparing for up to 50,000 cases a day.

- The release of ANZ Consumer Confidence on Friday will conclude local data releases this week.

- NZD/USD has stabilised after dropping Wednesday in the wake of a hawkish pivot from the Fed, with Chair Powell noting that policymakers must be "nimble" to tackle the inflation threat. The rate last operates +6 pips at $0.6659.

- Bears look for a dip through a fresh cycle low of $0.6638 printed on Wednesday, before taking aim at Nov 2, 2020 low of $0.6589. Bulls need to retake Jan 19 high of $0.6812 to get some reprieve.

Fig. 1: New Zealand CPI Y/Y (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.