March 14, 2025 03:44 GMT

SOUTH KOREA: Korean update Swaps Pricing Vs. Pre-BOK February Meeting Levels

SOUTH KOREA

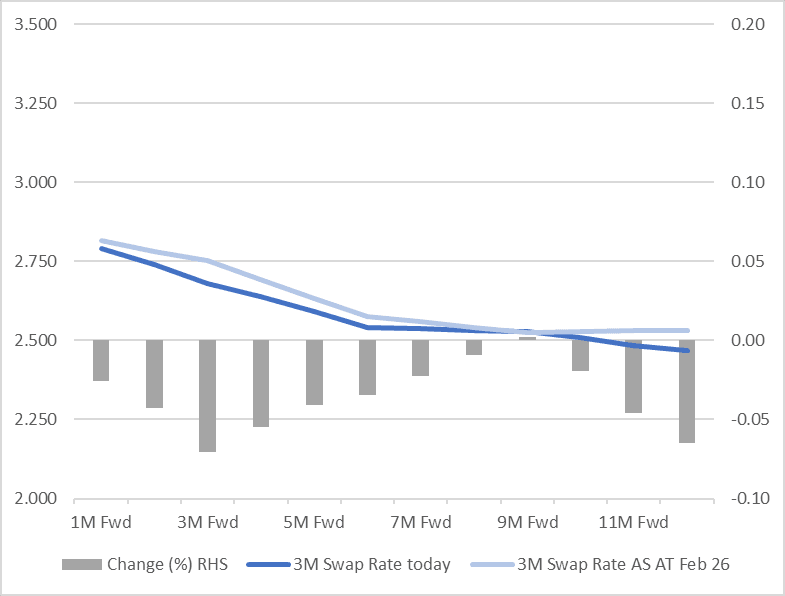

- A strong sell today has seen Korean swaps re-pricing the chance of cuts in the next 12 months.

- For last night’s close, the swaps curve doesn’t have a full rate cut priced in now until August (from September last week) and 37bps priced in over next 12 months.

- The government bond curve has 34bps of cuts priced in over the next 12 months compared to 36bps at the start of the week.

- A 25 bps cut at the next meeting is given a 20% probability according to the swaps pricing (versus 26% earlier in the week).

- Bond futures have sold off on the news of a press conference in China on the subject of ‘boosting consumption.’

- Government bonds are mixed with the short end lower whilst 10YR KTBs and longer are higher in yield.

134 words