June 17, 2024 09:00 GMT

Labor Cost Index Revised Even Higher

EUROZONE DATA

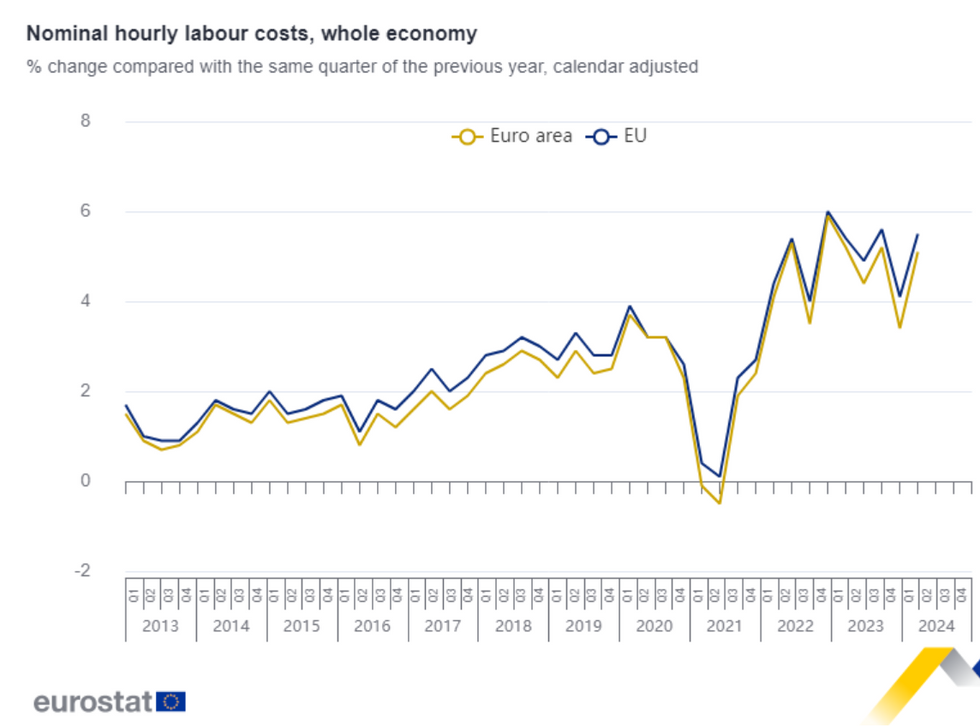

The final release of the Eurozone Q1 labour cost index showed growth of 5.1% Y/Y, upwardly revised by 0.2pp and a notable acceleration form the 3.4% Y/Y seen in Q4-23. However, this is still below the 5.9%Y/Y peak seen in Q4-24.

- Looking at the details only available in the final release, the data shows costs of hourly wages & salaries increased by 5.3% Y/Y (vs +3.1% prior) while the non-wage component increased by 4.5% Y/Y (+4.2% prior).

- There were some significant divergences across counties. While countries in eastern Europe generally saw the highest increases, out of the four largest Eurozone countries, Germany stood out at 5.9% Y/Y (partly driven by one-off inflation compensations), while France, Italy and Spain saw more moderate growth (at 2.7% Y/Y, 3.1%, and 4.7%, respectively).

- The data continues to contrast with other indicators of recent wage growth: the indeed wage tracker has moderated in Q1 and further in the beginning of Q2, with the May print coming in at 3.41% Y/Y, the sixth consecutive decline.

- The ECB continue to stress they expect wage growth to moderate going ahead, which they think will put downside pressure on services inflation going forward. They expect some 'bumps' along the way, however ('MNI Connect Live Stream with Luis de Guindos', June 12).

- A reminder that we published a deep dive into the mechanics of the GDP deflator and unit labour costs in March here.

MNI, Eurostat

MNI, Eurostat

244 words