-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

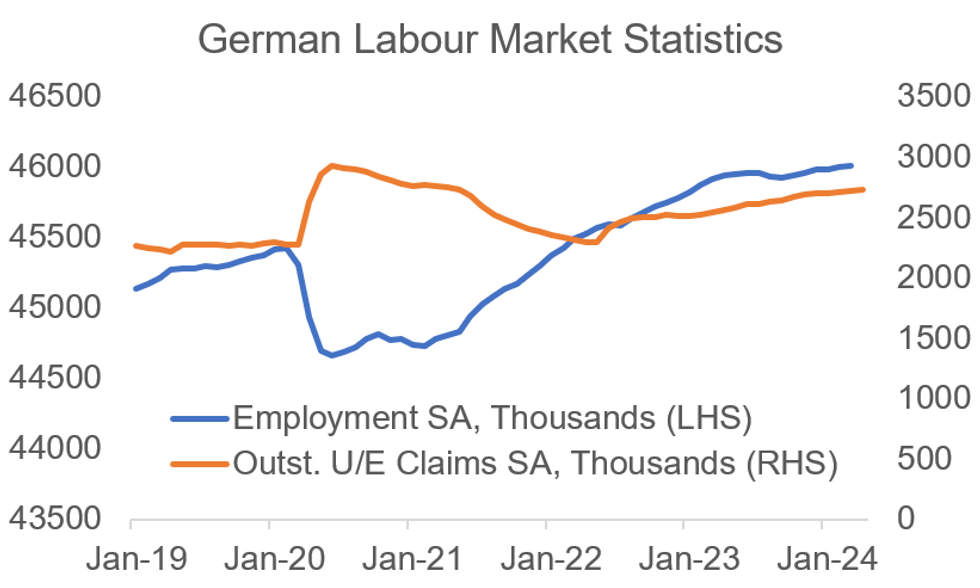

Labour Market Softer On Most Metrics Except Headline Employment

The German labour market is continuing its recent trend of cooling - apart from headline SA employment, the vast majority of relevant metrics deteriorated in April in their latest prints - unemployment and underemployment both rose on a seasonally-adjusted basis, demand for workers is decreasing, and business cycle related "Kurzarbeit" claims also inclined again most recently.

- Specifically, unemployment rose by 10.0k (8.0k cons, 6.0k prior, revised from 4.0k) in April on a seasonally-adjusted basis - the SA unemployment rate remained at 5.9%, as expected.

- Employment rose 8k in March (+0.0%, vs +4k prior), still extending its all-time high on a seasonally-adjusted basis but staying broadly flat during the last couple months - meanwhile, all of the prevalent increases were driven by the public sector and part-time employment according to the lastest detailed data available.

- The expected number of employees impacted by Kurzarbeit (which has to be reported in advance by companies and can be interpreted as an early indicator for future use of state benefits), also stood at a slightly higher level in April vs March on a like-for-like comparison of the employment agency (broadly +25%, note that the measure can be volatile).

- Underemployment excl. Kurzarbeit increased by 11.0k in April on a seasonally-adjusted basis (vs +11.0k in March).

- The seasonally-adjusted labour demand, reflected by the agency's job index "BA-X", decreased by 2p to 111 points in April (-12p vs April 2023; all-time high of 138p in May 2022; the index is normed to 2015=100 and reflects vacancy levels and develpoments)

- Looking ahead, the German labour market is expected to soften further slightly - the unemployment rate is expected to increase to up to 6.1% in the next quarters according to MNI's collation of sellside consensus, and the IFO Employment Barometer has printed in contractionary territory for 12 months consecutively now (96.0 April).

MNI, Destatis

MNI, Destatis

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.