-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

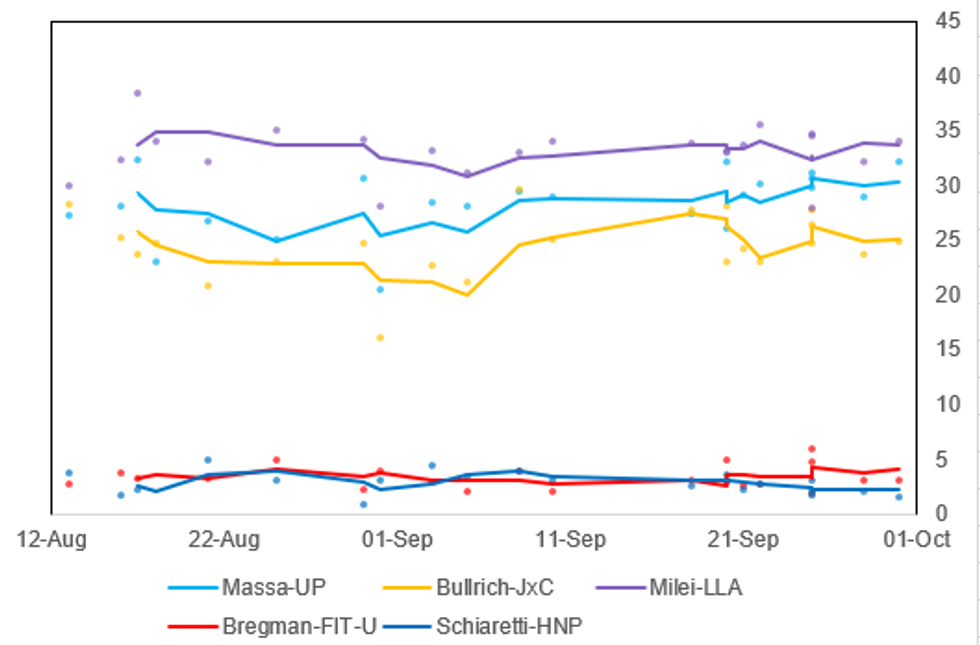

Free AccessLibertarian Milei & Peronist Massa Lead In Race For Run-Off: Polls

Opinion polling ahead of the 22 October presidential election shows right-wing libertarian candidate Javier Milei and Economy Minister Sergio Massa from the Peronist Union for the Homeland (UP) leading in the race to go through to a second round run-off that would take place on 19 November. It should be noted that given the close margins in most polling and the propensity for Argentine elections to deliver surprises (see the PASO primaries in August), conservative Juntos por el Cambio (JxC) candidate Patricia Bullrich cannot be discounted from making the final two.

- Polling over the final week of September gave Milei an average of 32.7% support, with Massa on 30.6% and Bullrich on 25.5%.

- Of the three most likely scenarios, Milei vs. Massa has the widest ideological and policy split in terms of potential winners. Milei vs Bullrich would see a notable shift to the right in policy making in either outcome. Bullrich vs Massa would preclude the prospect of full dollarisation and major cutbacks in gov't spending.

- Massa has sought to distance himself from the left-wing populist agenda of the Peronist movement, saying he would bring individuals from Bullrich and Milei's camp into gov't if he won.

- Bullrich has proposed a half-way house between Milei's dollarisation and maintaining the peso, advocating for 'binmonetarism', where the use of the US dollar would be legalised for certain official circumstances but the peso used more generally.

Chart 1. Argentina Presidential Election Opinion Polling, % and 3-Poll Moving Average

Source: CEOP, CB Consultora, UdeSA, Circuitos Consultora, Atlas Intel, Aresco, Proyección Consultores, Opinaia, CELAG, Giacobbe & Asociados, Federico Gonzalez y Asociados, Analogias, Consultora Tendencias, Opinion Lab, Analogias, DC Consultores, OPSA, MNI

Source: CEOP, CB Consultora, UdeSA, Circuitos Consultora, Atlas Intel, Aresco, Proyección Consultores, Opinaia, CELAG, Giacobbe & Asociados, Federico Gonzalez y Asociados, Analogias, Consultora Tendencias, Opinion Lab, Analogias, DC Consultores, OPSA, MNI

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.