-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

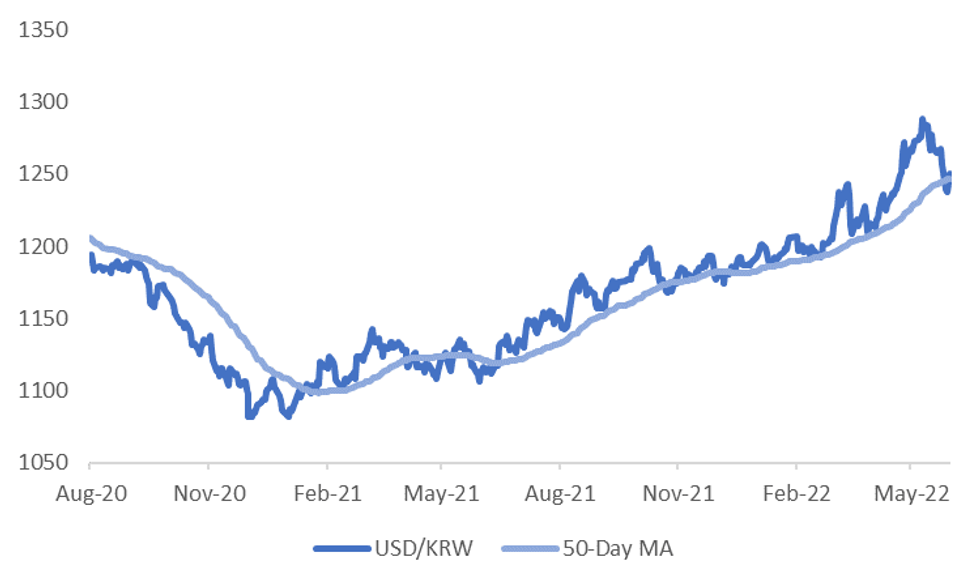

Free AccessUSD/KRW - Another False Break Of The 50-Day MA?

Spot USD/KRW has rebounded sharply today to 1250, +1% on the day, which puts it back above the 50-day MA of 1246.8. Dips below the 50-day MA have proven to be good buying opportunities in USD/KRW over the past 18 months.

- The first chart below plots spot USD/KRW against the 50-day MA. Since the beginning of 2021, spot moves below this level have proven to be false breaks.

- The broad uptrend in the USD over this period is obviously a key catalyst, but Korea-specific factors have been important as well, as we outline below.

Fig 1: USD/KRW Versus the 50-Day MA

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- The move into trade deficit territory has not helped the external position. The May trade deficit printed better than expected, but an onshore think-tank, the Korea Institute for Industrial Economics & Trade, expects a deficit of -$15.8bn for 2022, which would be the largest in 26 years. This mainly owes to stronger commodity prices boosting the import bill.

- The consensus forecast for the current account position is a surplus of 3.3% of GDP this year. However, this surplus is largely being recycled back offshore to overseas investments.

- At the end of last week, the National Pension Service stated it would increase its offshore equity allocation to 30.3% by end 2023, up from 27.8% this year. By 2027 this is expected to be 40.3%.

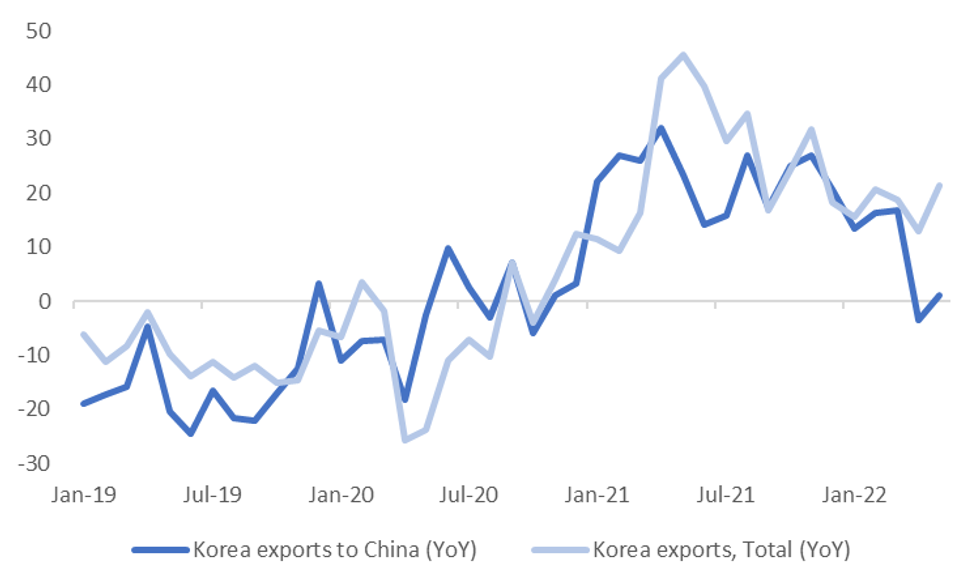

- Export growth also surprised on the upside in May. It will be interesting to observe how much impetus external demand China brings going forward though.

- The second chart plots total export growth for Korea and that to China, both in YoY terms. Export growth to China has lagged the broader trend in the past 18 months. Will this persist given China's on-going Covid-zero strategy, which will weigh on domestic demand, all else equal.

- The BoK, in its latest update, also expected a slower export growth picture in 2022.

- FX stability remains a strong focus point for the authorities, which can act as a buffer against these supportive USD/KRW factors outlined above.

Fig 2: Korea Export Growth - Total & China In YoY Terms

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.