-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

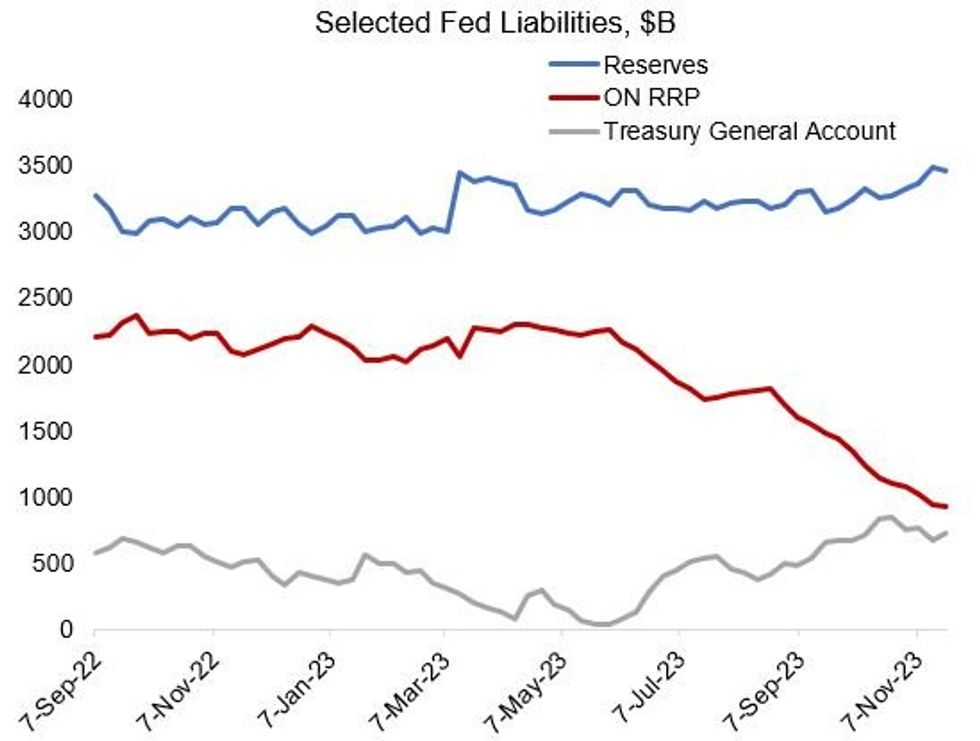

Free AccessLittle Sign Of Reserve Scarcity So Far (3/3)

Insofar as reserve scarcity itself is concerned, MNI again sees no sign that it is developing (eg bank deposit rates on offer, repo rates, Fed funding facility usage (including BTFP), and borrowing from FHLBs). That’s of course due to the unexpected build in reserves in the past 5 months, and in spite of some analyst expectations earlier in 2023 that we could see problems toward end-year.

- The SMP survey noted above implies a rough estimate that reserve scarcity will kick in at around $2.4-2.8trn, which is around the broad consensus. Of course that’s around $1-1.4trn below current levels, with some estimates going even lower.

- Fed leadership has been very dismissive of running into reserve scarcity (including Chair Powell at the last press conference: “hard to make a case that reserves are even close to scarce”) but the debate will ramp up as reserves begin to pull back next year as QT continues.

- Aside from the level of ample reserves itself, there are other considerations. MNI’s Policy Team interviewed Cleveland Fed economist Joseph Haubrich who estimated that the buffer of reserves (on top of the level of reserves that is considered “ample”) that the Fed will need to keep funds rate volatility in check is closer to $60bln than the several hundred billion posited elsewhere, including at the Fed Board. More here.

- "Compared to what they say you need for ample reserves, my numbers don't look that big," he told MNI in an interview. "I was a bit surprised it was as small as it was, particularly since I also show the FOMC is acting as if the cost of too-low reserves was over 20 times as high as the cost of reserves being too high."

Source: Federal Reserve, MNI

Source: Federal Reserve, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.