-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMajor Takeaways From Czech General Elections

- The outlook over Czech government remains uncertain in the short term following the general elections' results this weekend.

- We saw that Czech statistics showed that PM Babis' party ANO was defeated by the SPOLU alliance (Civic Democratic Party (ODS), KDU-ČSL, and TOP 09), which gathered 27.79% of the vote (vs. 27.12% for ANO).

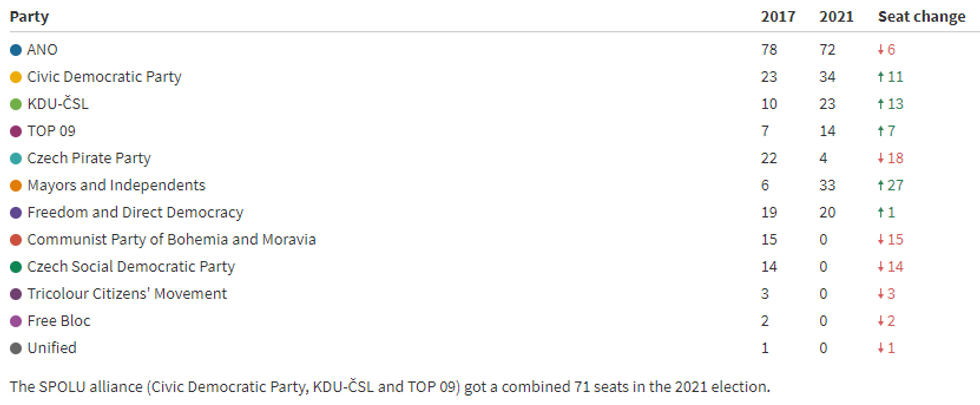

- The electoral system means that ANO secured 72 seats at the parliament (out of 200), ahead of SPOLU's 71 (see chart). The centre-left bloc made up of the Czech Pirate Party and SPAN (Mayors and independents) won 37 seats.

- Both the Communist Party of Bohemia and Moravia (KSCM) and the Social Democrats (CSSD), who ruled as part of Babis coalition government, failed to win 5% of the vote, the threshold to enter parliament.

- Hence, the two 'democratic coallitions' – SPOLU and Pir-STAN – have a chance to form a majority government, capturing 108 seats at the parliament. The two coalitions announced on Saturday that they have signed a memorandum of their will to govern together. In that case, it is likely that Czech foreign policy will be more aligned with the EU/US and diverge from the China/Russia agenda.

- Czech President Milos Zeman, who was expected to lead post-election talks about forming a new government, was taken on hospital on Sunday, which complicates efforts to form a government.

- President Zeman needs now to appoint a prime minister who must then go to parliament for a vote of confidence. Even though PM Babis will most likely lose a vote of confidence in parliament, it is possible that Zeman keeps Babis as PM without parliament's approval.

- Even though the uncertainty over the Czech government's outlook will remain elevated in the coming weeks, there was no reaction in markets with Czech equities continuing to test new highs and USDCZK flat at around 22 this morning.

Source: Flourish

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.