-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMarcos SONA Gives Peso A Shot In The Arm

The Philippine peso comfortably outperforms its peers from the Asia EM basket as participants digest President Marcos' policy agenda and comments from BSP Governor Medalla.

- Most analysts assessed the first State of the Nation Address from President Marcos positively, as the leader pledged commitment to "prudent" fiscal management and laid out plans to boost economic growth to an ambitious target of +8% Y/Y. Marcos vowed to keep infrastructure spending at 5% of GDP, improve spending and administrative efficiency, and revamp the tax system to increase revenue collection. He also committed not to declare another lockdown, citing the need to balance public health and economic concerns.

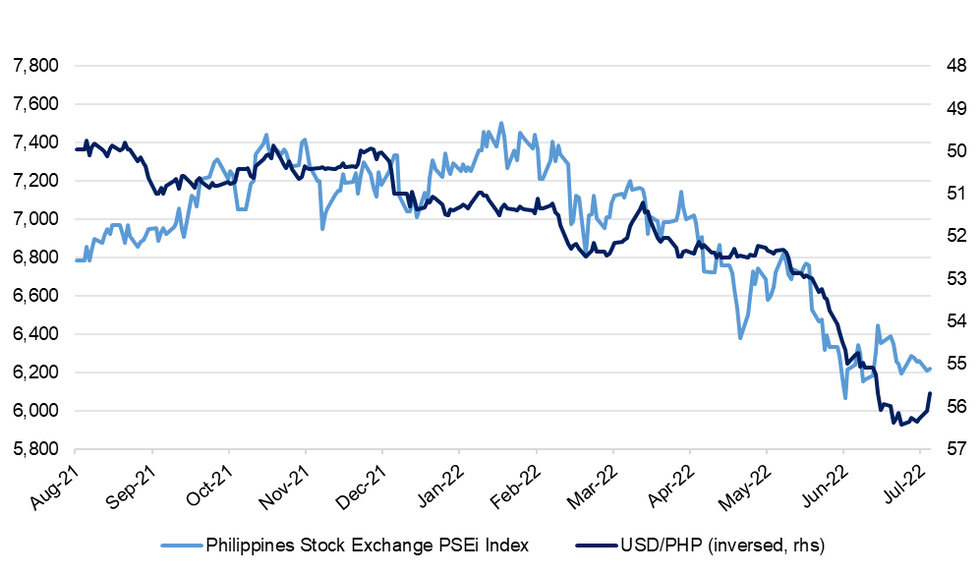

- With the new President's maiden SONA seen removing some near-term uncertainties and having pro-growth implications, local equities may now get some reprieve. Benchmark stock index flirted with bear market last month as the peso cratered (see Figure 1), which means Marcos' pro-growth agenda will be much welcomed.

Fig. 1: Philippines Stock Exchange PSEi Index vs. USD/PHP (inversed)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Budget balance data released this morning served as a reminder of the need to increase fiscal efficiency, with monthly deficit printing at PHP215.5bn in June, pushing the YtD shortfall to PHP674.2bn.

- Elsewhere, BSP Governor Medalla effectively described the August monetary policy review as a decision between a 25bp and a 50bp hike to the key interest rate, adding that oil prices and Fed action will inform policymakers' discussions. The market is still pricing 75bp worth of rate hikes over the next three months, per Bloomberg MIPR tool. Within that period, Bangko Sentral will hold two monetary policy meetings, in August and September.

- Spot USD/PHP has tumbled and last deals -0.415 at PHP55.680. The RSI has pulled back from oversold territory, after a mild bearish divergence unfolded over the past month or so. Downside technical focus turns to Jun 29 low of PHP54.600. Conversely, bulls look for a rally towards recent highs just shy of PHP56.500.

- USD/PHP 1-month NDF last seen -0.120 at PHP55.760, with bears setting their sights on Jun 28 low of PHP54.740. Topside technical focus remains on the all-time high of PHP56.740. The RSI dived under the 70 oversold threshold, even as there was no evident bearish divergence beforehand.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.