-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

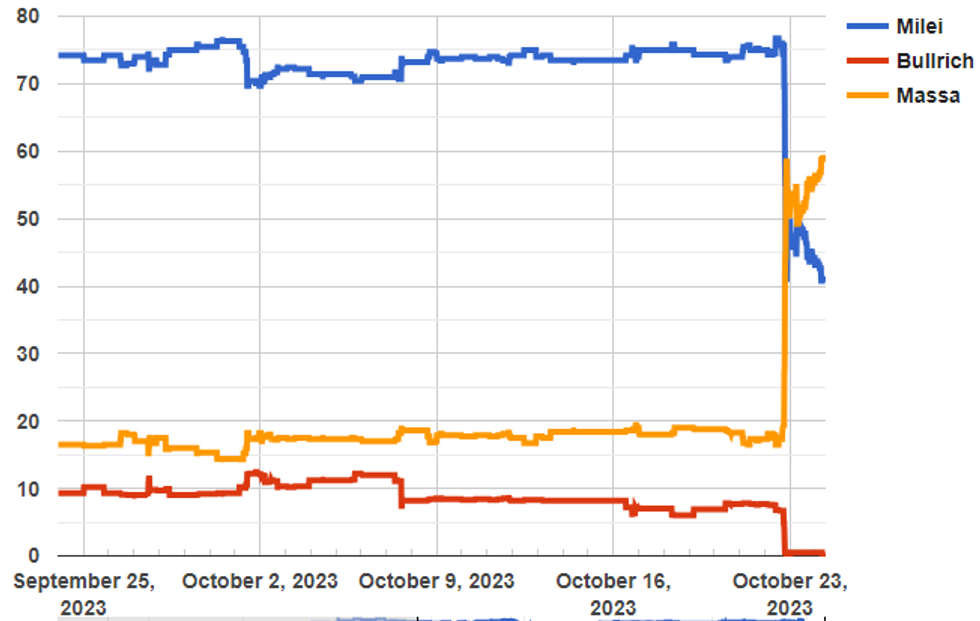

Free AccessMassa Favourite In Betting Markets After Strong 1st Round

Economy Minister Sergio Massa has leapt into first place in political betting markets following his strong performance in the 22 October presidential election first round. According to date compiled by electionbettingodds.com, political bettors give Massa a 59.0% implied probability of winning the run-off, compared to 41.0% for his right-wing libertarian challenger Javier Milei.

- Massa from the Peronist Homeland Union (UP) scored an unexpected first place with 36.7% of the vote, while Milei came second with 30.0%. For Massa this result represents a 9.4% increase on the combined support for UP candidates in the August PASO primary.

- Conservative JxC candidate Patricia Bullrich came in third with 23.8% of the vote, meaning she misses out on the 19 Nov run-off. Her vote share was down from a combined 28.3% for JxC candidates in the PASO primary. This could suggest that some JxC voters who backed the more moderate Horacio Rodríguez Larreta in the primary switched their votes to Massa in the first round in order to try to deny the firebrand Milei the presidency.

- The split of Bullrich's vote come the run-off could prove crucial. With Milei receiving the same vote share in the first round as he did the primary, he will have to win almost all Bullrich's voters to get over the 50% mark required.

- In contrast, Massa is likely to pick up the votes of 4th and 5th placed candidates Juan Schiaretti (Federal Peronist, 6.8%) and Myriam Bregman (far-left, 2.7%), putting him within touching distance of the presidency.

Source: electionbettingodds.com, Betfair, FTX, Predictit, Smarkets, Polymarket

Source: electionbettingodds.com, Betfair, FTX, Predictit, Smarkets, Polymarket

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.