-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - CNH Slippage Puts Rate in Range of Record Lows

MNI China Daily Summary: Tuesday, December 31

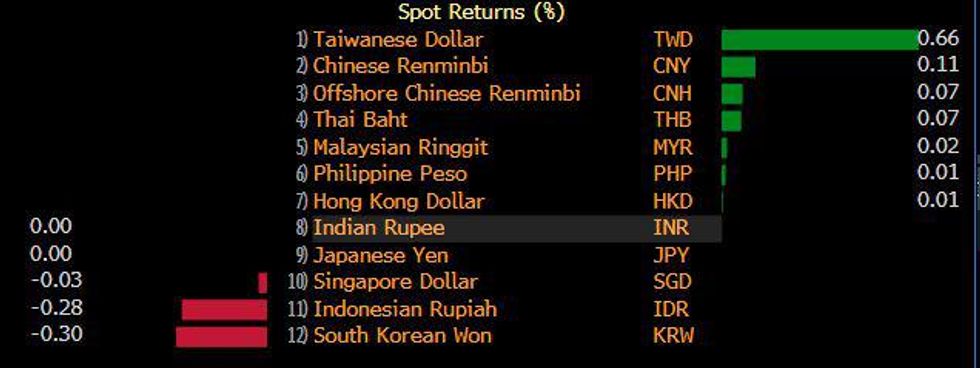

Mixed Session For Asia EM Amid Risk Off Flows

Asian EM FX was mixed on Tuesday but within narrow ranges, equities declined in the region as risk off sentiment took hold after indications that the US stimulus package could take several months to pass.

- CNH: Yuan gained despite a weaker fix, PBOC withdrew CNY 278bn of liquidity from the system, even as LNY and tax payments loom. Markets look for clues as to Biden's stance on China.

- SGD: Modestly higher, has been in a tight range awaiting industrial production data. USD/SGD last at 1.3273.

- TWD: USD/TWD is off session lows and back above 28.00 at 28.05, the pair closed on the level yesterday. Industrial production rose above expectations.

- HKD: USD/HKD down 5 pips at 7.7511, the Hang Seng took a beating today as Tencent saw profit taking after brushing against a $1tn valuation.

- KRW: Won is the weakest of Asia EM FX, impacted by outflows from local equities. USD/KRW last up 3.50 at 1104.10.

- IDR: Bank Indonesia stepped into spot & domestic NDF markets to shore up the rupiah as USD/IDR caught a light bid in early trade. USD/IDR last up 40 pips at 14050.

- MYR: Ringgitt slightly stronger, USD/MYR at 4.0425, Int'l Trade & Industries Min Azmin Ali downplayed calls for a nationwide "total lockdown," noting that it should be weighed against alternative scenarios.

- THB: USD/THB down 20 pips at 29.970, ANZ suggested that Thailand could be added to the U.S. Treasury's list of currency manipulators, as its FX purchases are expected to top the 2% threshold upon the release of Q4 GDP data.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.