-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS - Midday Reversal Amid US Fiscal Uncertainty

MNI December FOMC Preview

The FOMC is likely to adopt new guidance on asset purchases at the December FOMC, but will fall short ofadjusting its purchase program in either scope or size, preferring to wait for further clarity over the outlook before taking such a step.

While an increase in the weighted average maturity of the Fed's asset purchases is not the consensus outcome from this meeting, it is expected by some market participants – setting up the potential for a mildly hawkish disappointment on Wednesday.

FOR FULL PDF PREVIEW USE THE FOLLOWING LINK:

US TSYS SUMMARY: Recovery From Session Lows, Awaiting Fiscal News

With no data or speakers and few macro events of note, Monday's session had a placeholder feel to it, with the Fed decision Wednesday lying in wait.

- Equities rose after the opening bell and fell continually afterwards, and parallel to this, Treasuries recovered from session lows, and curves came off steepest levels.

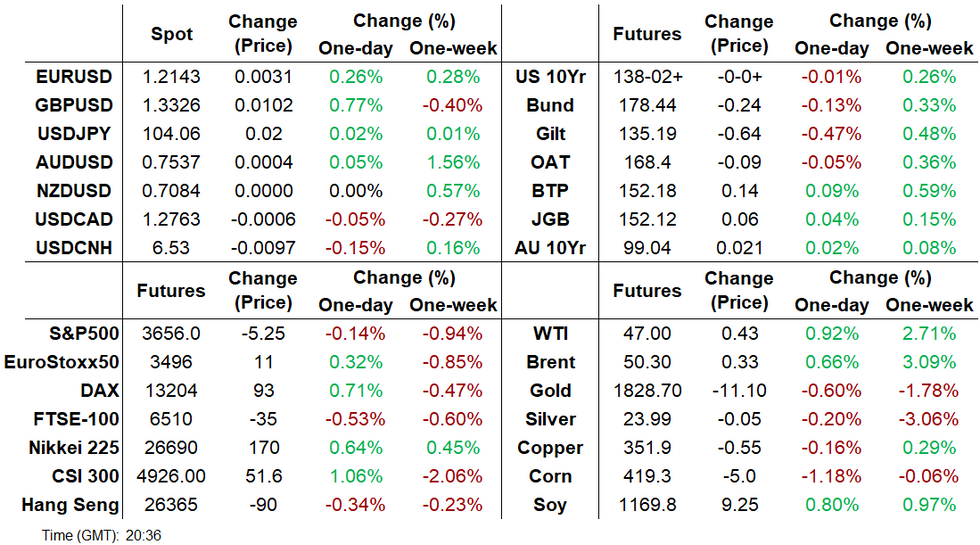

- The 2-Yr yield is unchanged at 0.115%, 5-Yr is down 0.6bps at 0.3591%, 10-Yr is down 0.3bps at 0.8931%, and 30-Yr is up 0.6bps at 1.6329%. Mar 10-Yr futures (TY) down 1.5/32 at 138-01.5 (L: 137-23 / H: 138-04).

- Volumes barely set to crack the 1mn for TYs though.

- We continue to await progress on the fiscal front. Though Bloomberg cited congressional aides as saying an omnibus spending bill is close to being agreed, this did not move the market at all, with most/all continuing to await further details on COVID stimulus negotiations.

- MNI's just published our December FOMC preview - let us know if you haven't received it.

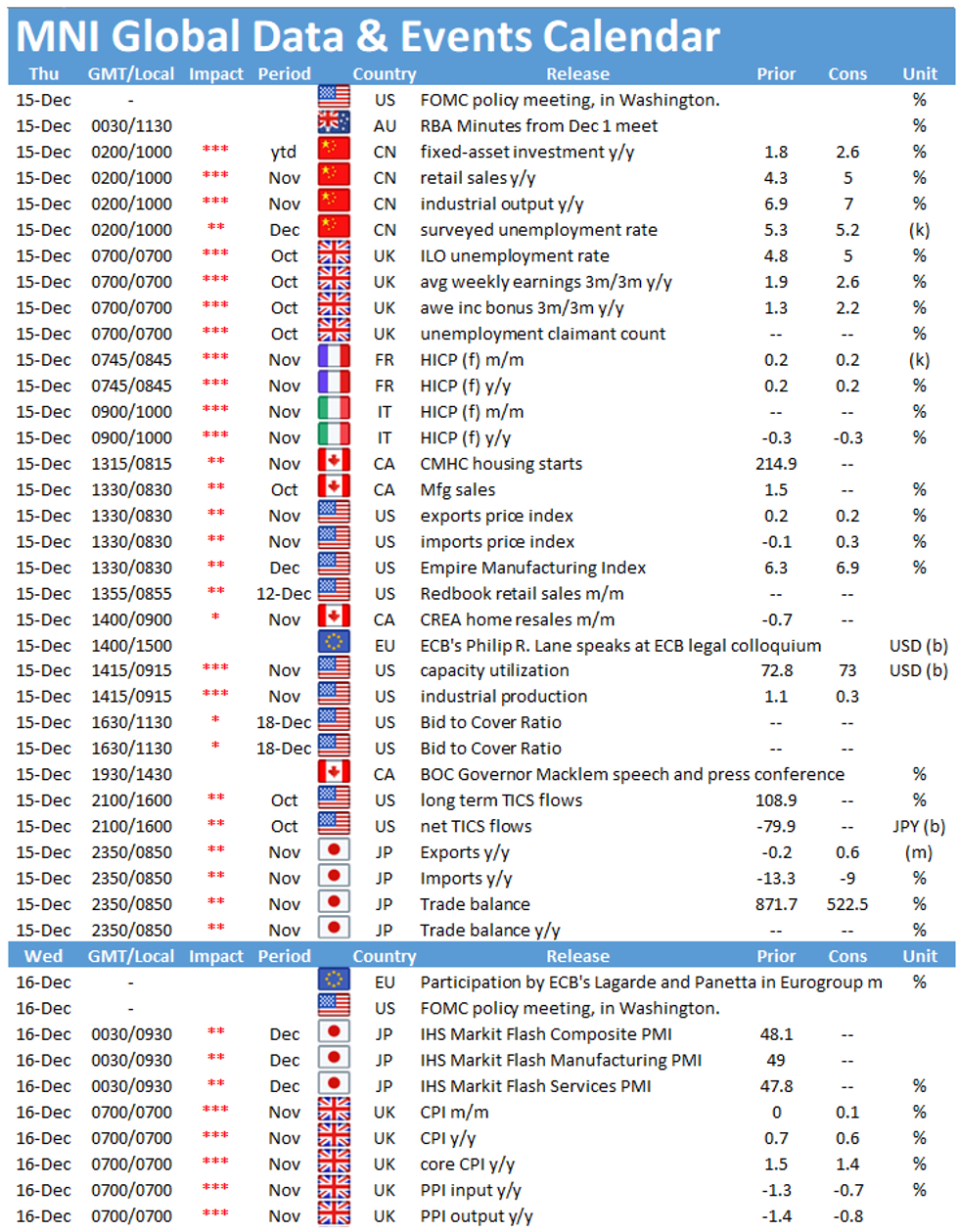

- A little more data coming Tuesday, with industrial production the highlight.

USD LIBOR FIX

US00O/N 0.08250 -0.00075

US0001W 0.09825 -0.00113

US0001M 0.15313 -0.00550

US0003M 0.21925 0.00275

US0006M 0.24713 -0.00162

US0012M 0.33488 -0.00100

New York Fed EFFR for prior session (rate, chg from prev day)

- Daily Effective Fed Funds Rate: 0.09%, no change, volume: $51B

- Daily Overnight Bank Funding Rate: 0.08%, no change, volume: $155B

REPO REFERENCE RATES (rate, change from prev. day, volume):

- Secured Overnight Financing Rate (SOFR): 0.08%, no change, $885B

- Broad General Collateral Rate (BGCR): 0.06%, no change, $357B

- Tri-Party General Collateral Rate (TGCR): 0.06%, no change, $338B

NY Fed Operational Purchase

Fed buys $1.732bn of 20-30Y Tsys, of $3.92bn submitted.

Next operations (2x Tuesday):

- Tue 12/15: 2.25-4.5Y, ~$8.825bn

- Tue 12/15: 7-20Y, ~$3.625bn (1100-1120ET)

EGBs-GILTS CASH CLOSE: Renewed Brexit Optimism Sinks Gilts

Gilts sold off on yet another Brexit deal deadline extension (reversing Friday's pessimism to some degree), though yields fell from session highs, while EGBs largely saw range trading Friday.

- The UK and German curves bear steepened, while periphery spreads tightened.

- After little data today, Tuesday kicks off with UK labor market data. ECB's Rehn speaks in the morning, but all attention is on Brexit and Thursday's BoE decision.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1.2bps at -0.771%, 5-Yr is up 1.4bps at -0.798%, 10-Yr is up 1.6bps at -0.62%, and 30-Yr is up 2.7bps at -0.212%.

- UK: The 2-Yr yield is up 2.3bps at -0.089%, 5-Yr is up 3.4bps at -0.061%, 10-Yr is up 5bps at 0.222%, and 30-Yr is up 4.9bps at 0.762%.

- Italian BTP spread down 3.3bps at 116.1bps

- Spanish bond spread down 1.5bps at 62.3bps/Portuguese down 1.7bps at 58.1bps

EUROPE OPTIONS SUMMARY: Week Opens With Mixed Trades

Monday's options flow included:

- 0LH1 100.00/100.12cs,sold at 2.75 in 2k

- 0LF1 100.00/100.12cs, sold at 2.5 in 1.5k

- LH1 100p, sold at 4.75 in 8kERH2 100.87/100.00 RR, bought the call for 0.75 in 5k (ref 100.585)

- RXG1 177.50/175.50ps 1x2, bought for 23 in 3.5k

- RXF1 178/177ps 1x2, bought for 11 in 1.75k

- DUG1 112.30p, sold at 2 in ~4.3kDUG1 112.40/30/20p fly, bought for 2.5 in 1.25k

- OEG1 135.25/135.00/134.75 put ladder bought for 2.5 in 4k

FOREX: CAD Reverses Course on Oil Drop

After a decent start to the week, WTI and Brent futures reversed into the NYMEX close, undermining early CAD strength and pressuring the currency to the bottom end of the G10 table. Weight went through in WTI and Brent crude futures following OPEC's outlook update in which they see daily global fuel demand dropping by around 1mln barrels per day across the first quarter of next year.

GBP was among the strongest currencies Monday, as markets welcomed the decision to extend trade deal negotiations as a sign that middle ground can be met before the end of the transition period on Dec31. Betting markets now see a trade deal as the odds-on outcome.

Chinese industrial production & retail sales data are due Tuesday as well as the UK jobs numbers for November. US import/export price indices and industrial production numbers also cross.

FX OPTIONS: Expiries for Dec15 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E1.2bln), $1.2100(E1.1bln-EUR puts), $1.2125-35(E1.0bln-EUR puts), $1.2175(E1.0bln-EUR puts)

EUR/GBP: Gbp0.8950-58(E1.1bln)

USD/JPY: Y102.90-00($746mln), Y104.00($559mln), Y104.50-55($948mln)

EUR/JPY: Y123.760(E501mln)

AUD/USD: $0.7420(A$802mln)

USD/CNY: Cny6.50($1.8bln), Cny6.5920($690mln), Cny6.65($2.0bln)

EQUITIES: Early Gains Sold, But Inside Last Week's Range

Stocks were mixed into the cash close despite a solid start. The S&P 500 gapped higher at the open, following inline with futures and European equity space, but gains were sold as a mid-session drop in oil dragged on energy names, which were comfortably the worst performing sector Monday.

Nonetheless, the e-mini S&P remains well within range of the alltime highs posted last week at 3714.75, which remain the key upside target. The VIX largely held last week's gains, sitting just below 25 points.

Oil & gas names were among the individual underperformers - the likes of Occidental Petroleum and Diamondback Energy fell well over 5% apiece, while pharmaceuticals traded well on M&A news, with Alexion Pharma rising over 30% after a $39bln approach from UK's AstraZeneca.

COMMODITIES: Oil Gives Up Gains on Downbeat OPEC Outlook

WTI and Brent crude futures started the session well, gapping higher alongside equities on positive Brexit newsflow and a generally weaker USD. This effect reversed, however, as OPEC released their latest outlook figures, cutting oil demand forecasts by 1mln barrels per day for the first quarter of 2021. Oil inched back up towards unchanged ahead of the close, but sits well off the day's highs.

In precious metals space, spot gold and silver trade with minor losses, with spot gold narrowing the gap with key support at the $1810.44 200-dma. A fall through here opens a retest of the late November lows and key support at $1764.80.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.