-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI ASIA MARKETS ANALYSIS: 10Y Yield Rejects 5% High

- MNI US-CHINA: WSJ: Chinese FM Wang To Visit US This Week, Lay Groundwork For Xi Trip

- MNI SECURITY: Pentagon: No Sign Iran Directly Involved In Attacks On US Troops

- MNI NATO: Swedish PM: We Look Forward To Being NATO Member

- Chevron to Buy Hess for $53 Billion in Latest Oil Megadeal, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS 10Y Yields Reject 5% High, Fund Managers Buy Bonds

- Unwinding weekend short hedges centered on Israel-Hamas and BoJ sources triggered cheapening in Asia hours after 10Y yield climbed above 5% for the first time since Sep'07 earlier to 5.0187% high.

- Early block buy of +8,237 TYZ3 105-23 (buy through 105-22 post-time offer at 0839:08ET, DV01 $536,000) contributed to the early support followed by the long end after Pershing Square fund manager/CEO Bill Ackman tweeted he had covered shorts in Tsys in light of "too much risk in the world to remain short."

- Reuters reported asset manager Vanguard is bullish on longer-dated Treasuries after this year's brutal selloff, betting that the Federal Reserve is at the end of its rate hiking cycle and that the economy will slow next year.

- Short end SOFR futures remained weak (SFRU3-SFRM4 down 0.0025-0.020) despite Bill Gross announced buying of SOFR futures amid "INDICATIONS THAT US ECONOMY IS SLOWING SIGNIFICANTLY" Bbg.

- As a result, Treasury yield curves rejected mid-2022 highs, finished the session broadly flatter: 3M10Y -5.840 at -61.602 vs. -45.127 high, 2Y10Y -5.282 at -21.655 vs. -11.024 high.

- Projected rate hikes remained static into early 2024: November holding at 1.6%, w/ implied rate change of +.4bp to 5.333%, December cumulative of 5.7bp at 5.386%, January 2024 cumulative 9.4bp at 5.423%, while March 2024 slips to 5.3bp at 5.381%. Fed terminal at 5.438% in Jan'24. Fed terminal at 5.425% in Feb'24.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00721 to 5.32444 (-0.00368 total last wk)

- 3M -0.02025 to 5.37822 (-0.00436 total last wk)

- 6M -0.03039 to 5.43909 (+0.00540 total last wk)

- 12M -0.05824 to 5.38011 (+0.02130 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $87B

- Daily Overnight Bank Funding Rate: 5.32% volume: $229B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.396T

- Broad General Collateral Rate (BGCR): 5.30%, $560B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $548B

- (rate, volume levels reflect prior session)

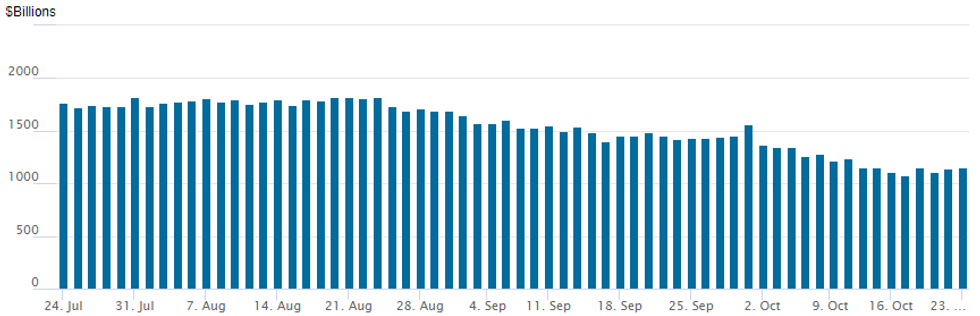

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage climbs to $1,157.976B w/101 counterparties vs. $1,138.756B in the prior session. Compares to last Tuesday's $1,082.399B - the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR/Treasury option trade continued to rotate around low delta SOFR call structures and Treasury puts and put structures Monday. Flow bias turned bullish as underlying futures bounced off lows after 10Y yield topped 5% for the first time since late Sep'07, marking 5.0187% high. Projected rate hikes remained static into early 2024: November holding at 1.6%, w/ implied rate change of +.4bp to 5.333%, December cumulative of 5.7bp at 5.386%, January 2024 cumulative 9.4bp at 5.423%, while March 2024 slips to 5.3bp at 5.381%. Fed terminal at 5.438% in Jan'24. Fed terminal at 5.425% in Feb'24.

- SOFR Options:

- -4,000 SFRH4 95.00/95.25 call spds, 2.25 vs. 94.62/0.05%

- 2,000 0QZ3 95.06 puts, 8.5

- +10,000 SFRZ3 94.50/94.62 2x1 put spds, 0.5-0.75

- +5,000 SFRH4 94.50 puts, 14.5 ref 94.65

- 2,400 SFRF4 94.75/95.25/95.75 call flys ref 94.645

- 2,000 0QZ3 95.62/96.00/96.37 call flys

- 2,000 0QX3 95.56/95.12 strangles ref 95.31

- 1,000 SFRZ3 94.56/94.62/94.68 call flys ref 94.565

- 1,500 SFRH4 94.75/95.50 call spds ref 94.66

- Treasury Options:

- Block 10,000 TYX3 106/106.5 2x1 put spds, 0.0 vs. 106-16/0.15% at 1515:20ET

- 5,000 FVX3 105 calls 8-7.5 ref 104-18.5 to -18.25

- 1,500 USZ3 111/113/115/117 call condors ref 107-24

- -6,600 TUZ3 100.75 puts, 6.5 ref 101-07.12

- 3,000 TYZ3 108 calls, 21 ref 105-22.5

- 2,000 TYX3 105 puts, 16 ref 105-19.5

- 8,000 FVX3 104.25/104.75 1x2 call spds, 3

- 4,000 TYX3 106 puts, 45 ref 105-14.5

- over 4,100 TYZ3 105 puts, 60 ref 105-13

- 7,500 TYZ3 103/104 put spds, 19 ref 105-13.5 to -14

- 1,800 FVX3 103.5 puts, 5.5 ref 104-03.5

- 1,100 FVZ3 105.5/107 2x3 call spds ref 104-03.5

- 3,000 FVX3 104 puts, 16 ref 104-03.75

- 1,000 TYX3 104/105/105.5 1x3x2 put flys ref 105-18.5

EGBs-GILTS CASH CLOSE: BTPs Outperform As Core FI Reverses Higher

An early sell-off Monday fully had reversed by the cash close, with Bunds and Gilts benefiting from a bid in US Treasuries.

- Bunds underperformed Gilts, though an early German bear steepening flipped to flattening as the USD weakened and equities rose alongside a broader move lower in rates. Gilts leaned bull flatter overall (2s30s flatter, 2s10s a little steeper on the day).

- It was difficult to pinpoint a specific reason for the reversals, which accelerated after high-profile market participants (incl Bill Ackman and Bill Gross) expressed the view that the recent US yield rise had gone far enough.

- We note though that our Europe Pi positioning update today showed significant structural shorts across Eurex contracts, with the trade potentially getting overcrowded as yields pushed to fresh multi-year highs.

- BTPs outperformed, with 10Y spreads down 7bp after S&P affirmed the sovereign at BBB; Outlook Stable; Greek spreads were close behind, after attaining investment grade status at S&P Friday.

- Focus Tuesday is on flash October PMIs, with the ECB decision Thursday the clear focus for the week - MNI's preview went out today. The UK's ONS publishes new labour market data Tuesday morning (though won't publish the Jun-Aug LFS data).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at 3.134%, 5-Yr is down 0.3bps at 2.78%, 10-Yr is down 1.5bps at 2.874%, and 30-Yr is down 2.6bps at 3.068%.

- UK: The 2-Yr yield is down 5.7bps at 4.832%, 5-Yr is down 5.7bps at 4.579%, 10-Yr is down 5.2bps at 4.599%, and 30-Yr is down 6.2bps at 5.049%.

- Italian BTP spread down 7bps at 196.6bps / Greek down 6.6bps at 141.8bps

EGB Options: Limited Rates Trade To Start ECB Week

Monday's Europe rates / bond options flow included:

- SFIX3 94.55/94.40 1x2 put spread, receiving 0.25 to buy the 1 leg in 2k

- ERU4 96.125/96.75^^ sold at 44 in 1k

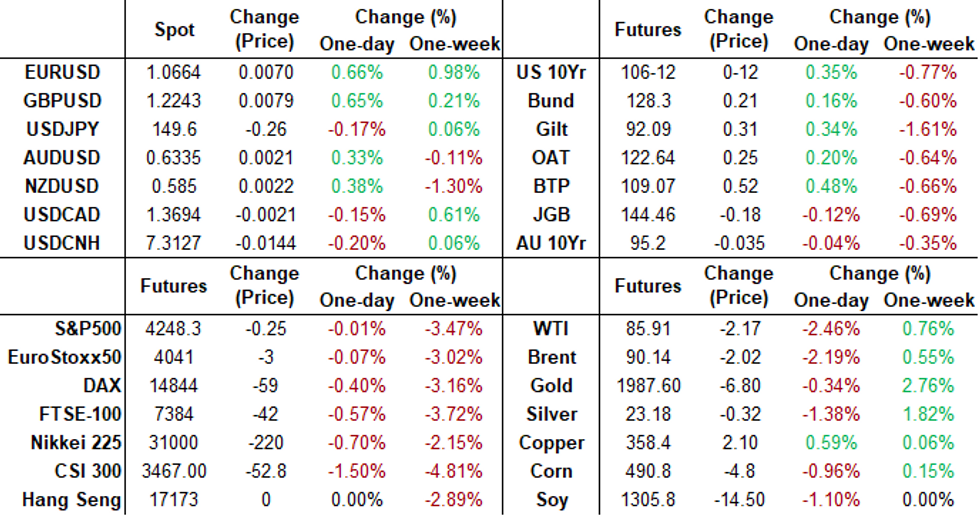

FOREX Greenback Slides Amid Yields Reversal, EURUSD Back Above 1.0650

- The USD index has dropped over half a percent on Monday with single currency outperformance most notable across G10, prompting EURUSD to rise above 1.0650, fresh one-month highs for the pair. The moves come alongside a strong recovery for US treasuries, with specific outperformance noted in the long-end, and a firm bounce for major equity indices.

- EURUSD has been on a steady grind higher and following the breach of the mid-October highs, the pair is now inching its way above 1.0650 in recent trade. This is considered a bullish development and a confirmed break above the Oct 12 high is required to signal scope for a stronger correction. In the short-term, this places the focus on the 50-day EMA which intersects today at 1.0677, however, further out, 1.0737 and 1.0769 are levels of note.

- In similar vein, the likes of GBP, AUD and NZD are all moving higher in sympathy with the lower yields, while the Swiss franc, Chinese Yuan and Canadian dollar all underperform.

- The lower core yields have placed the JPY moderately on the front foot, with USDJPY once again unable to make any inroads above the 150.00 mark and slowly edging away from that level throughout US trade.

- On Tuesday, we get the October round of flash European PMIs. For the Eurozone, the September composite print saw a small uptick from August but remained in contractionary territory at 47.2. Additionally, the UK’s ONS says it will publish a new series of labour market data using additional sources to produce adjusted levels and rates for employment, unemployment and inactivity.

FX Expiries for Oct24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0485(E892mln), $1.0550-65(E2.3bln), $1.0600-10(E1.5bln), $1.0650-60(E1.0bln)

- USD/JPY: Y149.50($1.0bln), Y149.95-00($1.8bln), Y151.00($882mln)

- GBP/USD: $1.2245-55(Gbp846mln)

- NZD/USD: $0.5840-50(N$531mln)

- USD/CAD: C$1.3630-45($503mln)

Late Equity Roundup: Weaker Energy Tempers Communications Lead Rally

- Stocks are firmer in late Monday trade, S&P Eminis and Nasdaq indexes outperforming Dow stocks: S&P E-Mini futures are up 19 points (0.45%) at 4267, Nasdaq up 114.1 points (0.9%) at 13098.86, DJIA up 15.19 points (0.05%) at 33138.75.

- Stocks had bounced off early lows, mirroring a bounce in Tsys after Pershing Square fund manager/CEO Bill Ackman tweeted he had covered shorts in Tsys in light of "too much risk in the world to remain short." While that doesn't say much for risk sentiment, the bounce in rates and softer projected rate hike expectations does.

- Leaders: Communication Services sector continued to lead gainers, buoyed by media and entertainment shares: Omnicom Group +2.7%, META +2.65%, Interpublic Group +2.25%. Meanwhile, semiconductor shares helped Information Technology sector gain momentum in the second half: Nvidia +3.5%, SolarEdge +3.28%, Broadcom +1.82%.

- Laggers: Energy and Materials sectors continued to underperform in the second half, oil and gas shares weaker as crude traded lower (WTI -2.60 at 85.48): Occidental -3.78%, Chevron -3.61% (following news of $53B purchase of Hess Energy), ConocoPhillips -2.56%. Chemical shares weighed on Materials, particularly FMC -11.95% after announcing broadly weaker forward guidance and cost structure review.

E-MINI S&P TECHS: (Z3) Clears Key Support

- RES 4: 4514.50 High Sep 18

- RES 3: 4479.38 Trendline resistance drawn from the Jul 27 high

- RES 2: 4410.92/4430.50 50-day EMA / High Oct 12

- RES 1: 4360.16 20-day EMA

- PRICE: 4264.00 @ 1445 ET Oct 23

- SUP 1: 4215.25 Intraday low

- SUP 2: 4194.75 Low May 24

- SUP 3: 4166.25 1.50 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4134.00 Low May 4

S&P e-minis maintain a softer tone and the contract has started the week on a bearish note. Support at 4235.50, the Oct 4 low and bear trigger, has been breached. The break of this support confirms a resumption of the downtrend and opens 4197.75, the May 24 low. Price remains below resistance at the 50-day EMA, at 4410.92. A clear breach of this average is required to strengthen bullish conditions. Initial resistance is at 4360.16, the 20-day EMA.

Oil Drops on Comments Exculpating Iran from US Troop Attack

Crude Has Dropped Further on the Day, after headlines in which the US said it had not seen direct orders from Iran for its proxies to attack US troops.

- WTI DEC 23 down -2.7% at 85.74$/bbl

- WTI DEC 23-JAN 24 down -0.19$/bbl at 1.07$/bbl

- WTI JAN 24-FEB 24 down -0.23$/bbl at 1.02$/bbl

- WTI DEC 23-DEC 24 down -1.58$/bbl at 8.03$/bbl

- Wires carrying comments from the Pentagon stating that the, "US has not seen a direct order from Iran for its proxies to increase attacks against US troops in the middle east." This follows an uptick in violence in the Middle East against US troops.

- The headlines may help counter the concern of rising tensions, and in particular the fear that oil supply could be disrupted by the outbreak of a regional war.

- Chevron earlier agreed a deal for US producer Hess in a $53bn all-stock transaction it said today in a move for US onshore, Gulf of Mexico and Guyana assets. The deal highlights US oil’s consolidation efforts following Exxon’s recent acquisition of Pioneer as well as the desire to produce more energy security in the Atlantic Basin following rising energy security instability of late.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/10/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/10/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 24/10/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 |  | EU | ECB Bank Lending Survey (Q3 2023) | |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/10/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/10/2023 | 0900/0500 | * |  | US | Business Inventories |

| 24/10/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/10/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/10/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/10/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 24/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.