-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA MARKETS ANALYSIS - Vaccine Headline Sensitivity Remains

EGBs-GILTS CASH CLOSE: Yields Come Off Lows

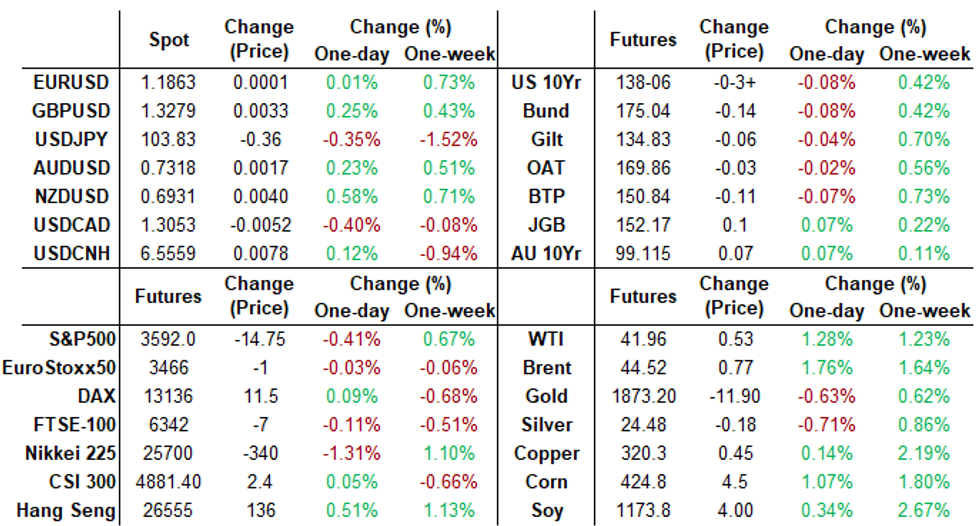

Over the course of Wednesday's session, Bund and Gilt yields climbed from early lows and curves steepened from flattest levels as equities gained ground. Periphery spreads widened from tightest levels (10-yr BTP 3bps wider from 118bps low vs Bunds).

- The session low yields for 10-yr Bunds and Gilts were the lowest since Nov 9 (the day Pfizer announced its COVID vaccine progress).

- Little in the way of driving newsflow. Morning Bund and Gilt supply came and went without much fanfare, and UK upside inflation miss was shrugged off.

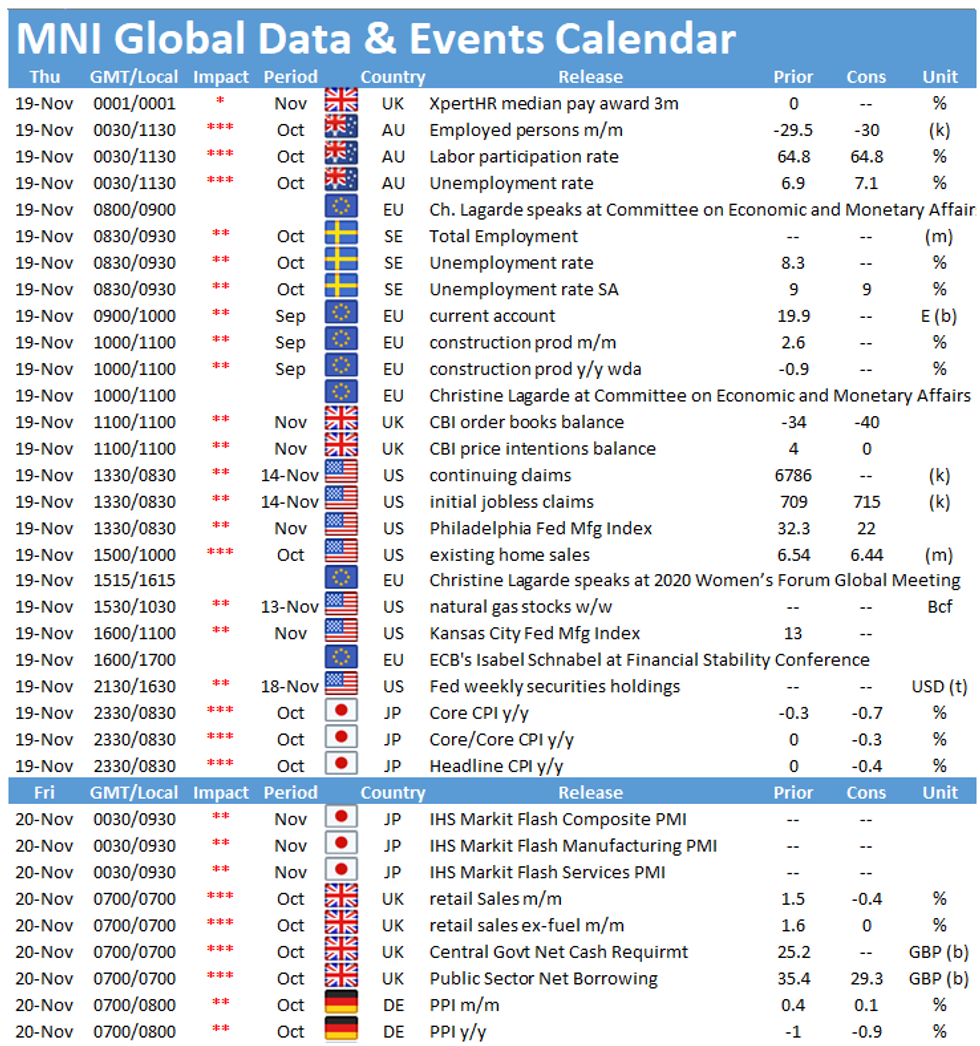

- On Thursday we get Spanish and French bond supply (E12.5bn) and ECB's Lagarde's hearing before the European Parliament.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.6bps at -0.727%, 5-Yr is up 0.6bps at -0.738%, 10-Yr is up 0.9bps at -0.554%, and 30-Yr is up 0.8bps at -0.149%.

- UK: The 2-Yr yield is up 0.8bps at -0.026%, 5-Yr is up 1bps at 0.016%, 10-Yr is up 1.3bps at 0.337%, and 30-Yr is up 1.9bps at 0.931%.

- Italian BTP spread up 0.7bps at 120.9bps

- Spanish bond spread down 0.3bps at 63.5bps

- Portuguese PGB spread down 0.2bps at 60.4bps

- Greek bond spread down 1.5bps at 121.8bps

US TSY SUMMARY: Long End Outperformed

Bonds outperformed despite a moderately choppy session, couple bouts of weakness (knee-jerk react to early Pfizer headlines and again after the 20Y Bond auction tailed). Decent overall volumes as Dec/Mar futures rolling accelerated.

- Vaccine headline sensitivity continues: Bit of a knee-jerk reaction to latest vaccine related headlines from Pfizer ahead the NY open, announcing 95% effectiveness vs. 90% that sent markets on a risk-asset buy spree last week Monday. Tsys pared gains, extending overnight lows. Futures bounced back to prior lvls, however, as storage and distribution issues remain.

- Weak 20Y bond auction, bonds extend losses: Tsys gapped lower after US Tsy $27B 20Y bond auction (912810ST6) tailed with high yield of 1.422% (1.370% last month) vs. 1.413% WI, on a bid/cover 2.27 (2.43 previous).

- Heavy Eurodollar futures volume centered in Reds (EDZ1-EDU2) centered around spreads most likely due to LIBOR transition to the Secured Overnight Financing Rate (SOFR) positioning and risk mitigation.

- The 2-Yr yield is up 0.4bps at 0.1732%, 5-Yr is up 1.6bps at 0.3952%, 10-Yr is up 2.1bps at 0.8783%, and 30-Yr is up 1.1bps at 1.6164%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00012 at 0.08225% (-0.00100/wk)

- 1 Month -0.00300 to 0.14650% (+0.01012/wk)

- 3 Month -0.00725 to 0.22375% (+0.00175/wk)

- 6 Month -0.00112 to 0.25688% (+0.01088/wk)

- 1 Year +0.00000 to 0.33875% (-0.00063/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $60B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $163B

- Secured Overnight Financing Rate (SOFR): 0.09%, $970B

- Broad General Collateral Rate (BGCR): 0.07%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $320B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.456B submission

- Next scheduled purchases:

- Thu 11/19 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 11/20 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

FOREX: Dollar Decline Continues, Putting DXY On Track to Test Nov Lows

USD weakness persisted Wednesday, pressuring the USD index to its lowest levels since November 9th. USD weakness was particularly evident against NZD, NOK and JPY, with USD/JPY logging its fifth consecutive session of declines. With the markets' view that fiscal stimulus in the US is highly unlikely, leaving a greater onus on the Fed to prop up the economy headed into the end of 2020.

The downtick in USD/JPY targets the early November lows at 103.18 initially, which would mark the lowest level for the pair since early March.

The single currency also traded poorly, prompting EUR/GBP to break back below the 200-dma at 0.8939 and narrow the gap with early November lows of 0.8861.

Australian jobs numbers, weekly US jobless claims & existing home sales and rate decisions from the Turkish, South African central banks are the highlights Thursday.

FX OPTIONS: Expiries for Nov19 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1685-00(E687mln), $1.1750(E653mln), $1.1790-00(E649mln), $1.1850-60(E822mln), $1.1870-75(E663mln), $1.1900(E824mln), $1.1965-70(E692mln)

USD/JPY: Y102.00($604mln), Y104.25-35($1.1bln), Y104.50-60($1.6bln), Y105.00($1.1bln)

AUD/NZD: N$1.0650(A$1.5bln)

AUD/USD: $0.7235-50(A$523mln)

PIPELINE: $8.8B High-Grade To Price Wednesday

Waiting for Bausch Health to launch- Date $MM Issuer (Priced *, Launch #)

- 11/18 $1.75B Bausch Health 8.25NC3.25, 10.25NC5.25

- 11/18 $1.5B #American Electric Power $450M 3NC1 +55, $600M 3NC1 FRN LIBOR+48, $450M 5Y +65

- 11/18 $1.5B *EBRD 5Y +7

- 11/18 $1.25B #VEON Holdings 7Y 3.375%

- 11/18 $1B #TJX $500M +7Y +53, $500M +10Y +73

- 11/18 $700M #Swedish Export Cr 2.5Y SOFR+27

- 11/18 $600M #Stryker WNG 3NC1 +40

- 11/18 $500M #JAB Holdings WNG 10Y +135

EQUITIES: Stocks Solid as Pfizer Up Efficacy

The S&P 500 held just below alltime highs Wednesday, inching very slightly higher. After an uninspiring start, equities were lifted as Pfizer presented further results of their COVID-19 vaccine candidate, upping the efficacy from an initial estimate of 90% to 95% - flagging that there are no risks of side effects to older vaccine-takers either.

Financials and energy outperform, with industrials not far behind. Healthcare and tech were the laggards. Airlines traded well, with United Airlines & American Airlines adding over 4% apiece.

E-mini S&P volumes were a little lower than recent averages, with no tier 1 data releases to excite markets. Suitably, the VIX retreated to its lowest levels since August.

COMMODITIES: Energy, Metals Buoyed by Dollar Retreat

WTI and Brent crude futures rose close to 2% apiece Wednesday, buoyed by a lower USD, which fell against all other currencies in G10. The weekly DoE inventories numbers helped, with crude oil inventories rising by a much lower than expected 769,000 bbls.

Gold erased early weakness, with spot prices rising back into positive territory at the London close. Platinum outperformed, rising to new multi-month highs of $956.05/oz.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.