-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA MARKETS ANALYSIS - Late Stock Bid, US$ Surge

US TSY SUMMARY: US TSY SUMMARY: Risk-On, Strong Markit PMI, US$ Surge

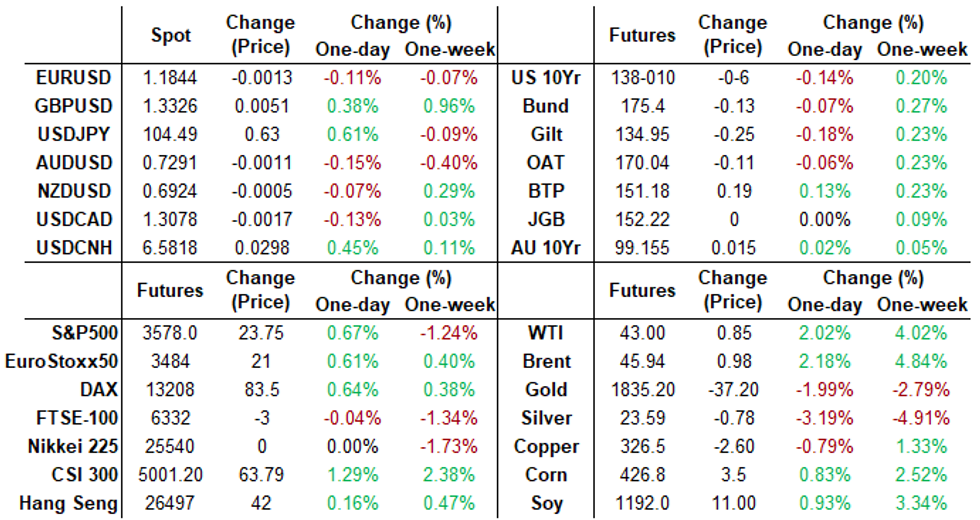

Tsys traded weaker on an inside range day after selling off during London morning hours Monday. Mild early chop: Tsys bounced off lows but quickly retraced following early headlines US mulling new "action against Beijing" DJ reported. Equities pared gains briefly but bounced after IHS Markit Nov prelim US PMI showed fastest overall expnsn in over 5.5 yrs, composite 57.9 from 56.3 in Oct. US$ Bounced to multi-yr high.

- Heavy volumes tied to lead quarterly roll, not the headlines for once, FV and TY saw over 1M rolls before the closing bell.

- Mixed auctions: US Tsy 2Y Auction Stopped Out: US Tsy $56B 2Y Note (91282CAX9) draws 0.165% (0.151% last month) vs. 0.167% WI, bid/cover 2.71 vs. 2.41 previous. US Tsy $57B 5Y Note auction (91282CAZ4) tailed .7bp , drawing high yld of 0.397% (0.330% last month) vs. 0.390% WI; 2.38 bid/cover vs. 2.38 prior.

- Light option volumes while supra-sovereign drove US$ debt issuance, Peru issuing $4B over 3 tranches longest of which out to 100Y.

- Tsy 2-Yr yield is up 0.6bps at 0.1635%, 5-Yr is up 1.5bps at 0.386%, 10-Yr is up 3.1bps at 0.8553%, and 30-Yr is up 3.9bps at 1.5589%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00063 at 0.08200% (-0.00062/wk)

- 1 Month +0.00000 to 0.15013% (+0.01375/wk)

- 3 Month +0.00162 to 0.20650% (-0.01712/wk)

- 6 Month +0.00500 to 0.25375% (+0.00275/wk)

- 1 Year -0.00087 to 0.33563% (-0.00288/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $196B

- Secured Overnight Financing Rate (SOFR): 0.05%, $920B

- Broad General Collateral Rate (BGCR): 0.04%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $316B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $7.084B submission

- Next scheduled purchases:

- Tue 11/24 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:

- -10,000 Red Mar'22 96 straddles, 13.0

- +4,000 Green Mar 95/96/97 2xx3x1 put flys

- 12,000 Mar 81/87 1x2 call spds

- +2,500 Gold Sep 80/85 2x1 put spds, 2.5

- 8,400 TYF 138.5 calls, 17

- +4,000 FVF 124.25p, 0.5

EGBs-GILTS CASH CLOSE: Shrugging Off Dollar Surge/Equity Drop

The European bond space largely ignored a strong move higher in the US dollar and equities falling to session lows in the afternoon.- Gilt yields maintained their sharp rise at the open amid a panoply of headlines/data (incl very strong PMIs in both the UK and US, and optimism on AZN vaccine and Brexit talks), largely shrugging off BoE TSC. Bund yields moved in similar fashion, while Italian spreads widened late in the day from the lows.

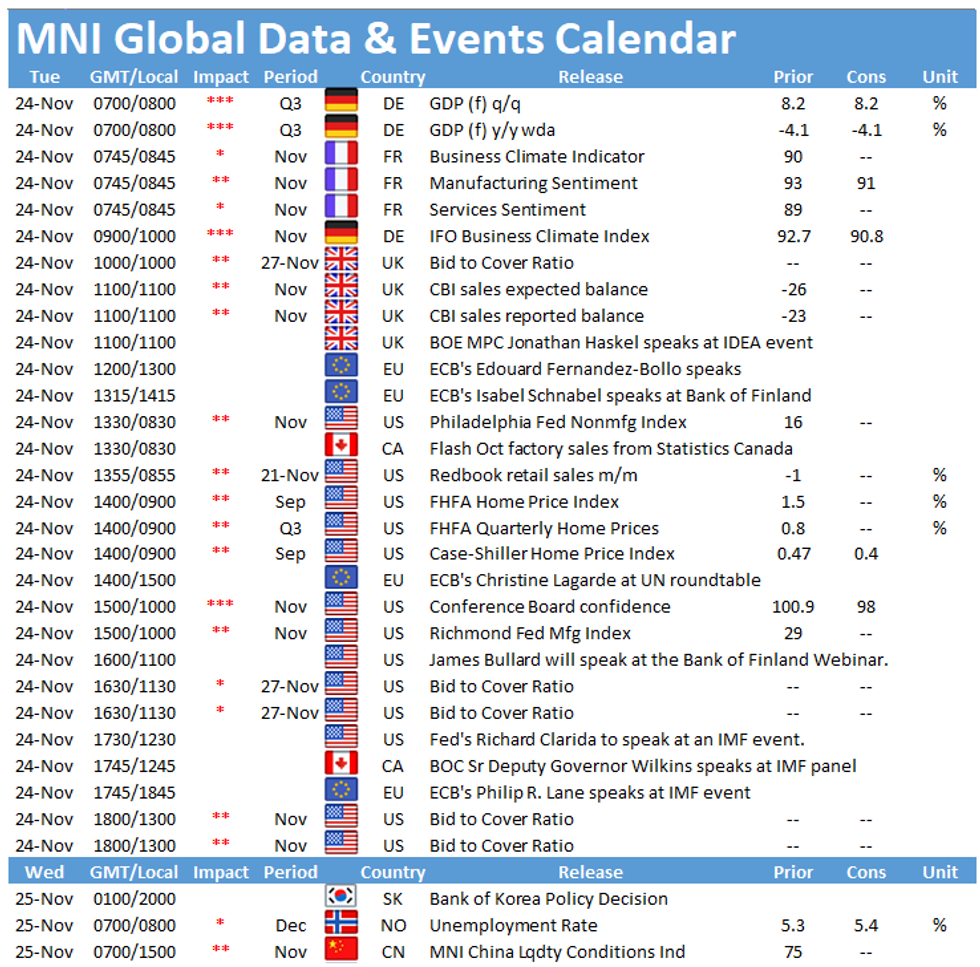

- Confidence indicators highlight Tuesday's data docket (incl German IFO), while in supply we get Dutch and UK supply. ECB's Lagarde and BoE's Haskel speak.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.2bps at -0.753%, 5-Yr is down 0.1bps at -0.762%, 10-Yr is up 0.2bps at -0.581%, and 30-Yr is up 1.1bps at -0.165%.

- UK: The 2-Yr yield is up 1.3bps at -0.029%, 5-Yr is up 1.6bps at 0.009%, 10-Yr is up 1.6bps at 0.318%, and 30-Yr is up 1.3bps at 0.902%.

- Italian BTP spread down 1.1bps at 120.5bps

- Spanish bond spread up 0.4bps at 65.2bps

- Portuguese PGB spread unchanged at 60.6bps

- Greek bond spread down 2.7bps at 125.1bps

FI OPTIONS EUROPE SUMMARY: More Early 2021 Schatz Downside

Today saw heavy activity in January Schatz puts, including 1x2 put spreads. This follows Feb/Mar downside on Friday (via broken put flies). Today's options flow included:

- DUF1 112.20 put bought for 1 in 12.5k

- DUF1 112.30/112.20ps 1X2, bought for 1.25 in 15k

- 0RM1 100.37/50/62/75c condor, bought for 8.75 in 4k

- LM1 99.75/99.87/100/100.12 broken c condor, bought for 10.25 in 5k

- 2LH1 99.75/99.50ps, bought for 2.75 in 10.5k

FOREX: Dollar Soars on Multi-Year High PMI

Stellar PMI data saved an underperforming greenback Monday. The USD was lower against most others in G10 the majority of European hours, but a multi-year high turnout in the November PMI numbers propped up the greenback, with follow through steepening in the US curve also lending some support. While it's unlikely a higher than expected PMI will swing the needle at the Fed in December, it could point to further strength in the PCE, Michigan, and Chicago PMI releases later in the week.- The JPY was the poorest performer in G10, sold alongside the uptick in the greenback and equity markets, with AstraZeneca's addition of another vaccine candidate helping bolster sentiment.

- GBP outperformed as negotiators meet in an attempt to finalise any Brexit deal this week - reports on both sides of the channel appear encouraging on this front.

- Focus Tuesday turns to November German IFO and US consumer confidence data. The speaker schedule includes RBA's Debelle, ECB's Lagarde & Lane, BoE's Haskel, BoC's Wilkins and Bullard & Williams of the Fed also speak.

OPTIONS: Expiries for Nov24 NY cut 1000ET (Source DTCC)

- USD/JPY: Y102.00($996mln-USD puts), Y105.00($1.5bln)

- EUR/GBP: Gbp0.8800(E510mln)

TECHS: Key Price Signal Summary

- Sterling appreciation has dominated the FX space this morning.

- EURGBP trendline resistance at 0.9021, drawn off the Sep 11 high remains intact. Attention is on the key support at 0.8861, Nov 12 low and the bear trigger. Cable is firmer too and bulls are eyeing the key 1.3482 resistance, Sep 1 high. The next hurdle is 1.3403, Sep 2 high.

- EURUSD directional triggers at 1.1920, Nov 9 high and 1.1746, Nov 11 low remain intact.

- USDJPY key support lies at 103.18, Nov 11 low.

- FI resistance levels to watch:

- Bund fut: 176.08, 76.4% of the Nov 4 - 11 sell-off

- Gilts: 135.55, 50-day EMA at is the next key chartpoint.

- has thus far stalled ahead of 138-21, its 50-day EMA.

- E-Mini S&P futures still trade below 3668.00, Nov 9 high. A break would resume the uptrend to open 3699.03, a Fibonacci projection. Price action on Nov 9 is a shooting star candle and still highlights a reversal threat. Watch 3506.50 key support, Oct 11 low.

- Key Gold support is $1848.8, Sep 28 low. Brent (F1) is firmer eyeing $46.86, Sep 2 high. WTI (F1) bull trigger is $43.33, Nov 11 high.

EQUITIES: European Weaker into the Close, US Outperforms

Continental European markets erased a good start (initially triggered by AstraZeneca's vaccine results) to finish marginally lower on the day. Catalysts for weakness into the close were thin on the ground, but varied from reports that Trump could be taking a more combative stance on China, better PMI data softening the case for more Fed easing and overriding USD strength all adding some weight.- US markets outperformed modestly, with energy and financials at the top of the table, while healthcare, tech and communication services dragged.

- The e-mini S&P traded in a range, with 3542.25 first support, while last week's highs of 3637 remain the upside target.

PIPELINE: Supra Sovereign Keep US$ Issuance Alive On Quiet Holiday Wk

- Date $MM Issuer (Priced *, Launch #)

- 11/23 $4B #Peru $1B 12Y +100, $2B 40Y +125a, $1B 100Y +170

- 11/23 $1.2B *Rep of Serbia, 10Y +2.35%

- 11/23 $500M *Sultanate of Oman 6Y 6.3%, $300M 11Y 6.9%

COMMODITIES: Gold Through to Multi-Month Lows on Stellar US PMI

Gold traded very heavy in early NY hours as the USD picked up markedly on the better than expected November PMI release. Equities started well out of the gate, prompting gold to break below the Sep low supports and hit the lowest levels since July 22nd.- MNI Tech points to support at the 38.2% retracement of the Mar - Aug rally at 1,837.10. A break through here opens July 8th highs of 1,818.00.

- Energy products traded well, with WTI and Brent crude futures adding 1-2% on AstraZeneca's vaccine news and generally firmer risk appetite (evident in higher US equities). Focus turns to any supply implications from a Houthi attack on an Aramco installation in Jeddah and the sustainability of Monday's oil bounce.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.