-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS - DJIA Record High, Cracks 30,000

US TSY SUMMARY: Risk Appetite Grows

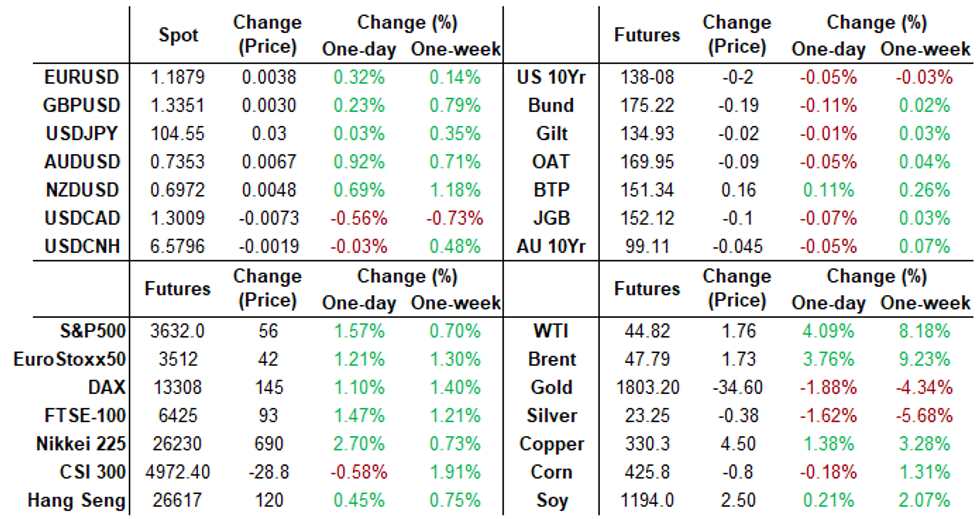

Long-end support after early London Block buys evaporated quickly, Tsys chopped lower through NY session as equities made new highs (DJIA cracked 30,000 for first time, climbed to 30116.51 all-time high). No market react to headline "TRUMP WEIGHING SANCTIONS RELATED TO CRACKDOWN IN HONG KONG: NYT".

- Modest, short term bounce after decent 7Y auction stopped through: $56B 7Y Note drew high yield 0.653% rate (0.600% last month) vs. 0.657% WI; 2.37 bid/cover vs. 2.24 prior.

- Heavy volumes tied to Dec/Mar futures rolls, more than half complete ahead next Monday's first notice.

- Eurodollar futures volume Spike, on more LIBOR retirement positioning? Over -50,000 EDH2 at 99.71-.705. Massive volumes centered in Eurodollar Reds (EDZ1-EDU2) both outright and on spreads recorded this month most likely due to LIBOR transition to the Secured Overnight Financing Rate (SOFR) positioning and risk mitigation.

- The 2-Yr yield is up 0.3bps at 0.1622%, 5-Yr is up 0.8bps at 0.3924%, 10-Yr is up 2.1bps at 0.875%, and 30-Yr is up 4.4bps at 1.5974%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles- O/N -0.00187 at 0.08013% (-0.00250/wk)

- 1 Month -0.00713 to 0.14300% (-0.00713/wk)

- 3 Month +0.02575 to 0.23225% (+0.02737/wk)

- 6 Month +0.00075 to 0.25450% (+0.00575/wk)

- 1 Year +0.00000 to 0.33563% (-0.00087/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $62B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $201B

- Secured Overnight Financing Rate (SOFR): 0.05%, $913B

- Broad General Collateral Rate (BGCR): 0.04%, $343B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $315B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.399B accepted vs. $4.407B submission

- Next scheduled purchase:

- Mon 11/30 1010-1030ET: Tsys 20Y-30Y, appr $1.750B

- Mon 11/30 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- +3,000 short Sep 96/Green Sep 93put strip, 8.5

- +3,000 Blue Jun 92 puts, 9.0

- +2,500 long Green Dec'22 95 puts, 6.0 vs 99.65/0.25%

- -5,000 Blue Mar 93 puts, 7.25 vs. 99.455/0.10%

- -2,000 Red Dec 97 straddles, 9.0

- buyer Blue Jan 93/95 straddle strip at 28.5

- Overnight trade recap:

- 50,000 Dec/Mar 100 call spds, cab

- Mar 100 calls straight-up at cab

- +10,000 TYG 144.5 calls, 1

- 11,300 TYG 127.5 puts, 1/64

- Overnight trade

- +5,000 TYH 132 puts, 4

- 3,600 USG 171/178 call over risk reversals, 0.0

EGBs-GILTS CASH CLOSE: Can't Resist Soaring Equities

Core yields shrugged off higher equities for most of Tuesday's session, but UK and German yields bottomed out around 1500GMT and began moving sharply higher as European stocks rocketed following the U.S. cash equity open. Not to be outdone, 10-Yr BTP yields hit a record low (0.596%).- French and German business confidence data were slightly weaker than expected, reflecting November lockdown woes, but this did not have a lasting impact. Speakers including ECB's Lagarde also did not move the needle.

- ECB's Lane and de Cos speak after the European close Tuesday; no scheduled speakers Wednesday and no key data scheduled. In supply, Italy sells CTZ and linkers.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1bps at -0.743%, 5-Yr is up 1.7bps at -0.745%, 10-Yr is up 1.8bps at -0.563%, and 30-Yr is up 1.6bps at -0.149%.

- UK: The 2-Yr yield is up 1.1bps at -0.018%, 5-Yr is up 1.5bps at 0.024%, 10-Yr is up 1.2bps at 0.33%, and 30-Yr is down 0.1bps at 0.901%.

- Italian BTP spread down 3bps at 117.5bps

- Spanish bond spread down 1.5bps at 63.7bps

- Portuguese PGB spread down 1bps at 59.6bps

- Greek bond spread down 1.8bps at 123.3bps

EUROPE FLOW SUMMARY: EGB Downside Plays

Today's options flow included:

- 0LU1 99.75p, sold at 4.75 in 3k (ref 99.91)

- 0RM1 100.37/50/62/75c condor, bought for 9 in 4k

- 2RH1 100.62/100.50/100.37p fly 1x3x2, sold at 2.75 in 3.5k

- RXF1 176.00/174.00ps vs 179.50c, bought the put spread for 5 in 5k

- RXF1 177.00/176.50 put spread sold at 13 in 1.5k

- RXG1 175.50 put vs 179.50/180.50 call spread, paid 15.5 in 1.9k

- RXG1 176.00/173.00 put spread bought for 40 in 2k

- IKF1 150.50/147.50ps vs 152.5c, bought the put spread for 24 in 2k

- UBG1 220.00/215.00/210.00p fly, bought for 58-60 in 1k

FOREX: JPY Sold as Equities Roar

The JPY was comfortably the poorest performer in G10 Tuesday, with USD/JPY topping the Monday high with relatively little resistance and prompting AUD/JPY to near a new multi-month high. JPY traded poorly alongside rallying equities worldwide. The Dow Jones crested 30,000 for the first time on record as further US states (notably Pennsylvania and Nevada) certified their election counts in favour of Biden).- This worked in favour of antipodean and commodity-tied FX, with NZD, AUD and NOK outperforming. NZD/USD showed above the 0.70 level for the first time since mid-2018, opening congestion resistance above of 0.7060.

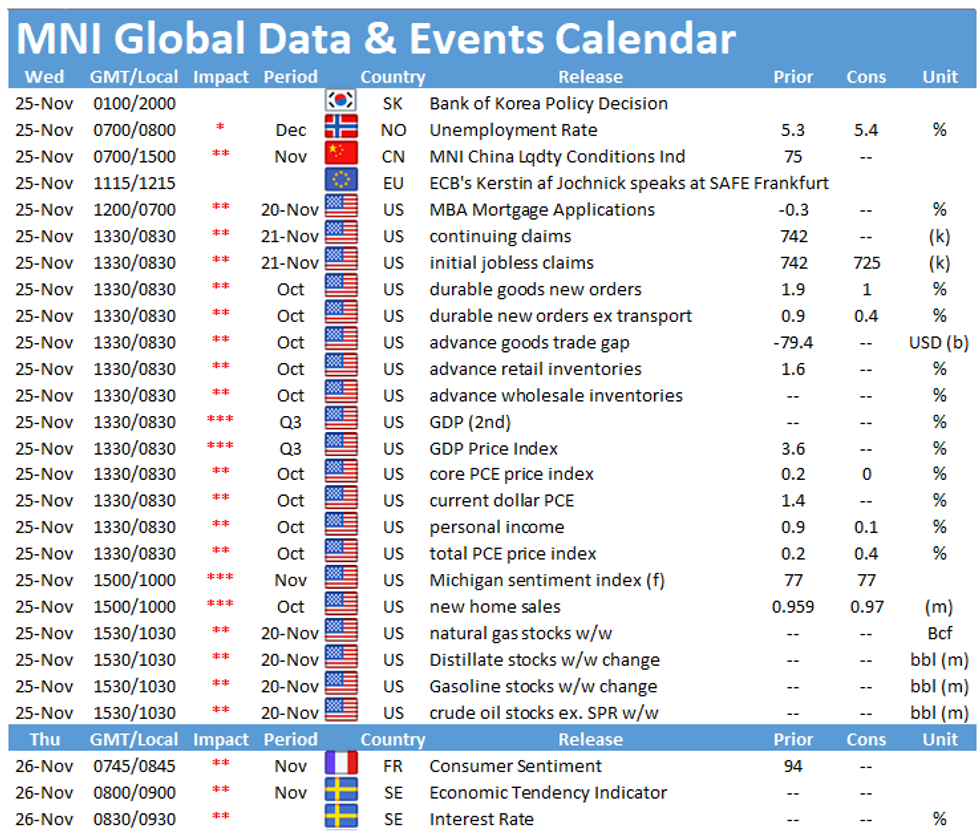

- Markets will likely quieten down either side of the Thanksgiving holidays on Thursday. As a result of the Thursday closures, data's frontloaded to Wednesday, with weekly jobless claims, secondary pass at GDP, trade balance, personal income/spending and durable goods orders as well as the FOMC minutes.

OPTIONS: Expiries for Nov25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E773mln), $1.1750-65(E735mln), $1.1800-10(E554mln), $1.1835-50(E718mln)

- USD/JPY: Y102.90-103.00($1.9bln-USD puts), Y104.00($965mln), Y105.50($630mln), Y105.96($500mln)

- EUR/GBP: Gbp0.8875-0.8900(E1.1bln-EUR puts)

- AUD/JPY: Y73.60-65(A$2.75bln)

- USD/CNY: Cny6.6136($500mln)

EQUITIES: Dow Jones Tops 30,000 to Crest at an Alltime High

Continued upside across global equities helping the Dow Jones top 30,000 for the first time on record. Notable point contributors today are Boeing (+3.8%), Goldman Sachs (+3.0%) and Visa (+2.3%), all rising as markets take confidence from Trump's decision to allow Biden's staff to begin the transition process.- The rising tide has lifted markets elsewhere, with European stocks closing with gains of 1.2-2.0% while the S&P adds close to 1.5%.

PIPELINE: Supra-Sovereigns Drives $6.5B US$ Issuance

- Date $MM Issuer (Priced *, Launch #)

- 11/24 $2.25B #Rep of Turkey 10Y +6.0%

- 11/24 $2B #IDA (Int Dev Assn, extn of World Bank), 10Y +19

- 11/24 $1.25B *Kommunivest 3Y +4

- 11/24 $1B #NWB (Nederlandse Waterschapsbank) 5Y +9

COMMODITIES: Crude Hits a Multi-month High as Markets Buoyant Globally

- Echoing the sentiment seen across equity and fixed income markets, energy products rallied Tuesday, with WTI and Brent crude futures adding to recent gains and reach new mulit-month highs. WTI crude futures rose above the $45/bbl mark for the first time since March.

- Spot gold fell sharply, extending the week's losses to close to $75/oz. This narrows sharply the gap with spot gold and nearest major support at the $1797.13 200-dma - a level last crossed in March.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.