-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS - Hope Abounds While Covid Surges

US TSY SUMMARY: Risk-On Gained Momentum, Pared Late

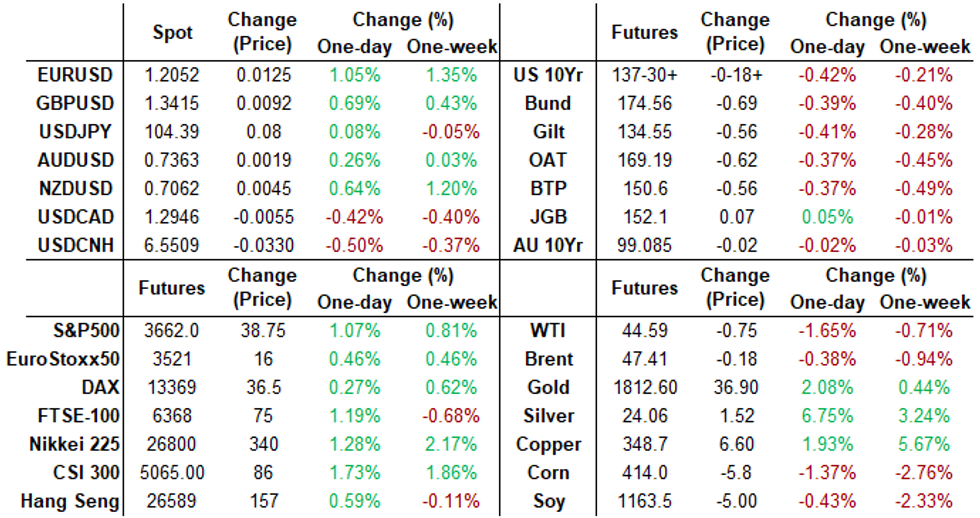

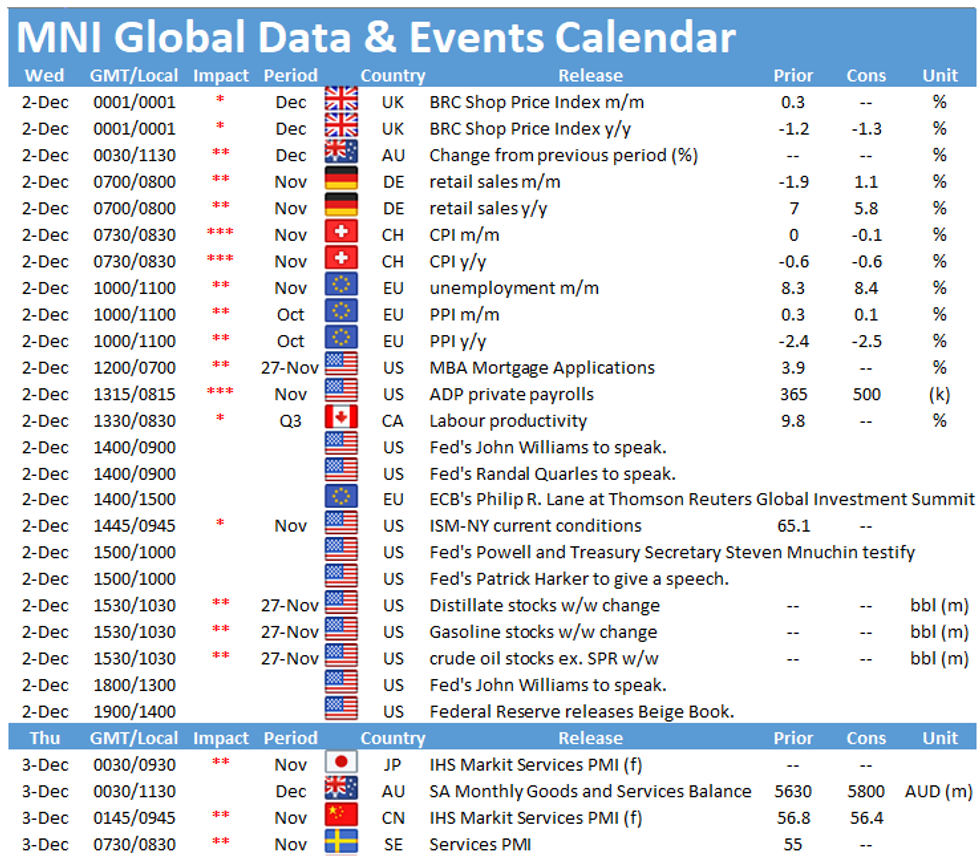

Tsy futures broadly weaker after the bell, but off late session lows, taking cues from equities scaling off new all-time highs (ESZ0 3660.0 vs. 3677.5H). 30YY up 10bp at one point, yld curves broadly steeper but off highs. Heavy volumes, TYH just below 2M after the bell.

- No single driver for steady rise in yields back to mid-November levels (10YY 0.9360%H; 30YY 1.6830%H), just diminishing rolls, extension trades, re-positioning after massive month end volume late Monday, stops were triggered on the way down, interest in steepeners surged again.

- Of course the rally in equities added impetus to the move tied to hope over a COVID stimulus being passed in the near term. Perhaps some knock-on support for risk after Times Radio report that UK-EU talks had entered the 'tunnel' with a deal in sight.

- US$ slumped (DXY -.675 to 91.195) and gold surged +37.5. The 2-Yr yield is up 2bps at 0.1682%, 5-Yr is up 5.5bps at 0.4161%, 10-Yr is up 8.1bps at 0.9194%, and 30-Yr is up 9.5bps at 1.6622%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00450 at 0.08050% (+0.00025/wk)

- 1 Month -0.00575 to 0.14763% (-0.00712/wk)

- 3 Month +0.00437 to 0.23200% (+0.00662/wk)

- 6 Month +0.00375 to 0.25875% (+0.00137/wk)

- 1 Year +0.00288 to 0.33313% (+0.00275/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $61B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $190B

- Secured Overnight Financing Rate (SOFR): 0.09%, $1.055T

- Broad General Collateral Rate (BGCR): 0.08%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $341B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $5.999B accepted vs. $17.202B submission

- Next scheduled purchases:

- Wed 12/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 12/03 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 12/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- 5,000 Red Dec'21 95 puts, 1.5 vs. 99.72/0.10%

- 5,500 short Jan 96/97 put spds

- -5,000 Blue Mar 95/96/97 call flys, 2.5

- -2,000 Blue Dec 92/93/95/96 put condors, 9.0

- +2,000 Red Sep'22 97 straddles, 18.0

- +2,500 Red Sep'22 96/97/98 call flys 1.0 over Red Sep'22 95 put

- +3,000 Red Sep'22 97/98 1x2 call spds, 0.0

- Overnight trade

- 5,000 short Mar 96/97 2x1 put spds, 1.5

- 1,500 Red Mar/Jun 97 call calendar

- 8,500 TYH 136.5/137 put spds, 8/64

- 4,000 TYF 137 puts, 7/64, part tied to TYF 137/137.5/138 put tree

- 3,000 TYD 140 calls, 7/64

- 3,500 USH 170/171 put spds

EGBs-GILTS CASH CLOSE: Tunnel Vision For Gilts

UK curve steepening, which was prevalent throughout the session amid a global core FI sell-off, accelerated on a Times Radio report that UK-EU talks had entered the 'tunnel' with a deal in sight. Gilt 5s30s rose from a low of 83.1bps to 86.8bps on the close.

- Earlier, some hawkish-leaning comments from ECB's Schnabel helped spark Bund weakness and periphery spread widening. Portugal's curve steepened (2s10s highest since Oct 9) after the IGCP announced short-end PGB buyback vs selling 8-9yrs.

- German Bobl and UK Gilt sales headline supply Wednesday; BOE's Haskel speaks.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 2.5bps at -0.718%, 5-Yr is up 3.5bps at -0.718%, 10-Yr is up 4.3bps at -0.528%, and 30-Yr is up 4.9bps at -0.117%.

- UK: The 2-Yr yield is up 1bps at -0.012%, 5-Yr is up 2.7bps at 0.035%, 10-Yr is up 4.2bps at 0.347%, and 30-Yr is up 5.5bps at 0.907%.

- Italian BTP spread up 0.5bps at 120.2bps

- Spanish bond spread down 0.5bps at 64.7bps

- Portuguese PGB spread down 0.1bps at 60.4bps

- Greek bond spread down 2.5bps at 118.5bps

EUROPE SUMMARY: Some German Downside

Tuesday's options flow included:

- RXF1 176/175/174p fly 1x2x0.5, bought for 6 in 2k

- RXG1 175p/180c^^, sold at 45.5 in 10k

- DUH1 112.30/112.20/112.00 broken p fly, bought for 1 in 2k

- LZ1 99.625/99.75/99.875/100.00 call condor sold at 5 in 9k

FOREX: JPY Trades Heavy as Stocks Surge to ATH

JPY was comfortably the poorest performing currency in G10 Tuesday as global equity markets started the month with a bang, resulting in US equity futures hitting new all time highs shortly after the open. The moves followed further signs that US lawmakers could be ceding ground and a compromise is within reach for a further package of fiscal aid during the lame duck period of Trump's administration and before Biden assumes office in January.- Brexit shenanigans drove GBP once more, with Times Radio reports that UK/EU negotiators could be aiming to secure a trade deal by the end of the week - although MNI sources refuted such a claim, claiming that this weekend could be too soon. GBP/USD unsurprisingly rallied on the news, but gradually pared gains into the US close.

- Focus Wednesday turns to Australian GDP and US ADP Employment Change. Speakers include Fed's Powell appearing in front of lawmakers for a second time, Fed's Williams and BoE's Haskel.

Expiries for Dec2 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1865-80(E1.9bln)

- USD/JPY: Y104.00-05($656mln), Y104.45-60($1.2bln), Y106.20($1bln)

- GBP/USD: $1.3150(Gbp610mln), $1.3300(Gbp600mln)

- EUR/GBP: Gbp0.8800(E799mln)

- USD/CHF: Chf0.9170($1.0bln-USD calls)

- AUD/USD: $0.7250(A$1.2bln), $0.7400(A$878mln)

- NZD/USD: $0.6960(N$733mln), $0.7068(N$1.1bln-NZD calls)

- USD/CAD: C$1.2950($1.0bln-$990mln USD puts), C$1.2975($1.3bln-USD puts), C$1.3000($668mln)

Key Price Signal Summary - E-Mini S&P Bulls Close In On Key Resistance

- Gold remains vulnerable. The focus is on $1763.5, 50.0% of the Mar - Aug rally and $1747.6, Jun 26 low. Resistance is seen at $1818.3, Nov 26 low. Oil markets focus: Support to watch in Brent (G1) is $45.87, Nov 27 low and in WTI (F1) at $43.33, Nov 11 high and $42.82, Nov 24 low.

- In the FX space, EURUSD remains positive and is closing in on this year's 1.2011 high from Sep 1. USDJPY key support lies at 103.18, Nov 11 low. Initial support is 103.65, Nov 18 low. Key EURGBP trendline resistance drawn off the Sep 11 high, intersects at 0.8990. The trendline capped gains Friday and Monday. It remains a pivotal resistance. The major monthly based resistance in Cable is 1.3372 (for December), a multi-year trendline drawn off the Nov 2007 high and is a key trend reference.

- FI focus: Bund fut: are under pressure and have probed support at 174.96, Nov 25 low. A break would open 174.45, Nov 16 low. Gilts (H1) support lies at 134.07, Nov 26 low and 133.81, Nov 25 low. BTPs are lower, the next firm support is at 150.39, Nov 18 low. Treasuries (H1) resistance is at 138-09+, the 20-day EMA.

- E-Mini S&P risk seeking bulls eye the key 3668.00 resistance, Nov 9 high. EUROSTOXX50 focus is on 3553.05, Feb 27 high.

EQUITIES: Solid Start to December

Despite some month-end selling pressure in stocks on Monday, Tuesday saw a broad-based rally across both US and European equity markets, with outperformance noted in the NASDAQ, which rose over 1.5%, while the Dow Jones posted more modest gains of 1%. US equity futures followed suit, with the e-mini S&P breaking north of the early November vaccine-inspired record highs, putting stocks on solid footing for the final month of a tumultuous 2020.

All sectors traded in the green, with communication services and financials outperforming, while tech also rallied. Gains came alongside soothing messages from prospective Treasury Secretary Janet Yellen, who stressed the urgency of acting swiftly with fiscal support as the US economy recovers from COVID-inspired weakness.

PIPELINE: $7.4B To Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 12/01 $1.5B #Prosus 30Y +215

- 12/01 $1.5B #BP Capital Mkts Am, 30Y +125

- 12/01 $1.5B *KBN (Kommunalbanken Norway) 3Y +4

- 12/01 $900M *Virginia Electric & Power 30Y +85

- 12/01 $900M *Southern California Edison 1Y L+37

- 12/01 $600M #Principal Life Global 3Y +30

- 12/01 $500M #CSX Corp WNG +30Y +85

COMMODITIES: Copper Squeezed to New High

Another day, another high for copper futures as the squeeze continued, boosting prices to $350.10. Industrial metals rallied alongside precious on Tuesday, helping gold to claw back Friday's losses and recovery back above the 200-dma at $1,801.32.

Oil futures inched lower, but held the bulk of recent gains as markets ponder the probability of an OPEC+ deal to extend recent output curbs. The latest reports suggest talks have been delayed by a further two days in order to allow for out-of-meeting negotiations so an agreement could be struck by end-of-week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.