-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Still Pining For Stimulus

US TSY SUMMARY: Holding Out Hope For Stimulus

Early rate support evaporated quickly Wednesday -- despite weaker than anticipated private ADP employ data: +307k vs +440k exp, offset by a higher Oct revision: +404K vs. +365K.

- Nascent risk appetite ensued at varying degrees through the session, driven again by hopes of a fiscal stimulus agreement in the near term. Building "momentum" over an $908B bipartisan relief bill apparently behind late session duration drop in Tsys, futures making new session lows/equities moving higher.

- Tsys bounced right back to prior levels, equities trimmed gains, one desk posited that "unless McConnell changes his shell, it doesn't matter what Pelosi and Schumer say they support." Deja vu.

- Fed's latest Beige Book shows some sign of deterioration in outlook compared to October's reading of anecdotal reports from central bank business contacts.

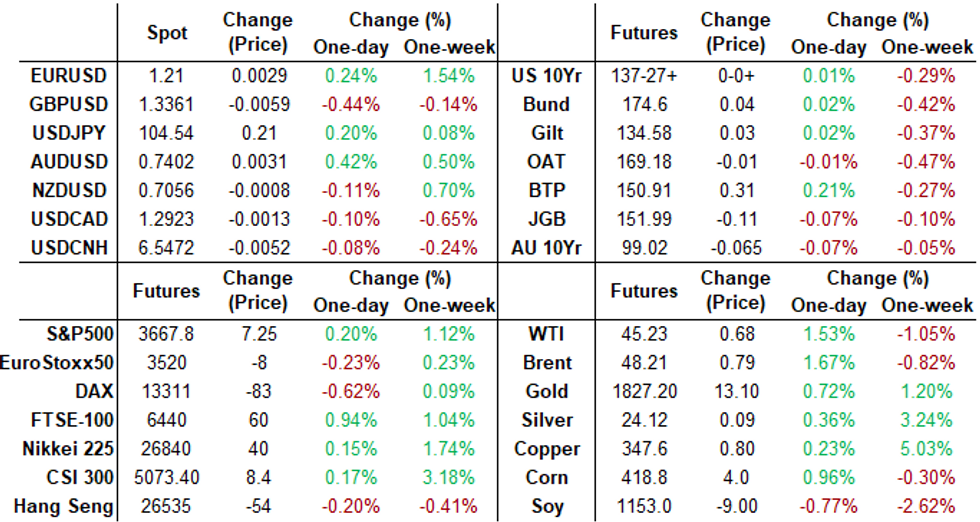

- Little if any market reaction to multiple Fed speakers on the day. The 2-Yr yield is down 0.4bps at 0.1623%, 5-Yr is up 0.5bps at 0.4209%, 10-Yr is up 2bps at 0.9459%, and 30-Yr is up 3.3bps at 1.7011%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00100 at 0.08150% (+0.00125/wk)

- 1 Month +0.00450 to 0.15213% (-0.00262/wk)

- 3 Month -0.00150 to 0.23050% (+0.00512/wk)

- 6 Month -0.00050 to 0.25825% (+0.00087/wk)

- 1 Year +0.00125 to 0.33438% (+0.00400/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $56B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $168B

- Secured Overnight Financing Rate (SOFR): 0.08%, $972B

- Broad General Collateral Rate (BGCR): 0.06%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $336B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $1.577B submission

- Next scheduled purchases:

- Thu 12/03 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 12/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- +5,000 long Blue Mar 97 calls, 10.5 vs. 99.68/0.40%

- +2,300 Green Jun 87/91/93 put flys, 1.5

- -6,000 Blue Mar 88/96 and 90/96 call over combo strip, 3.0

- +1,500 Red Sep'22/Green De'22 95 put strip, 9.5

- 1,500 Gold Dec 88/91 put spds, 1.5

- Overnight trade

- +4,000 Mar 97 puts, 1.25

- +2,000 Mar 99.81/99.87/99.93 call flys, 1.0

- +2,000 TYG 135.5/136.5 2x1 put spds, 13

- +1,500 TYF 136/137 2x1 and 134/136 put spds earlier

- +3,000 TYG 136 puts even over TYF 137 puts

- -2,500 USF 176 calls, 20/64 vs. 172-15/0.16%

- Overnight trade

- +4,000 wk1 US 170.5/171.5 put spds, 9-10

- +3,000 TYH 136.5/137 put spds, 10

- 2,000 TYF 137.5 straddles, 56

EGBs-GILTS CASH CLOSE: Strength In Gilt Short End And BTPs

Wednesday saw Bund and Gilt curves steepening and in BTPs which reversed most of Tuesday's yield rise.- Gilt yields climbed this afternoon despite this morning's news that a Brexit deal didn't seem to be as close as Tuesday's "tunnel negotiations" headlines implied. Fishing still a key difference w Brussels. Optimism this morning over the UK beginning COVID vaccinations in coming days largely looked priced in.

- EU looking to press ahead on a short-term solution on the COVID recovery fund w/o Hungary and Poland.

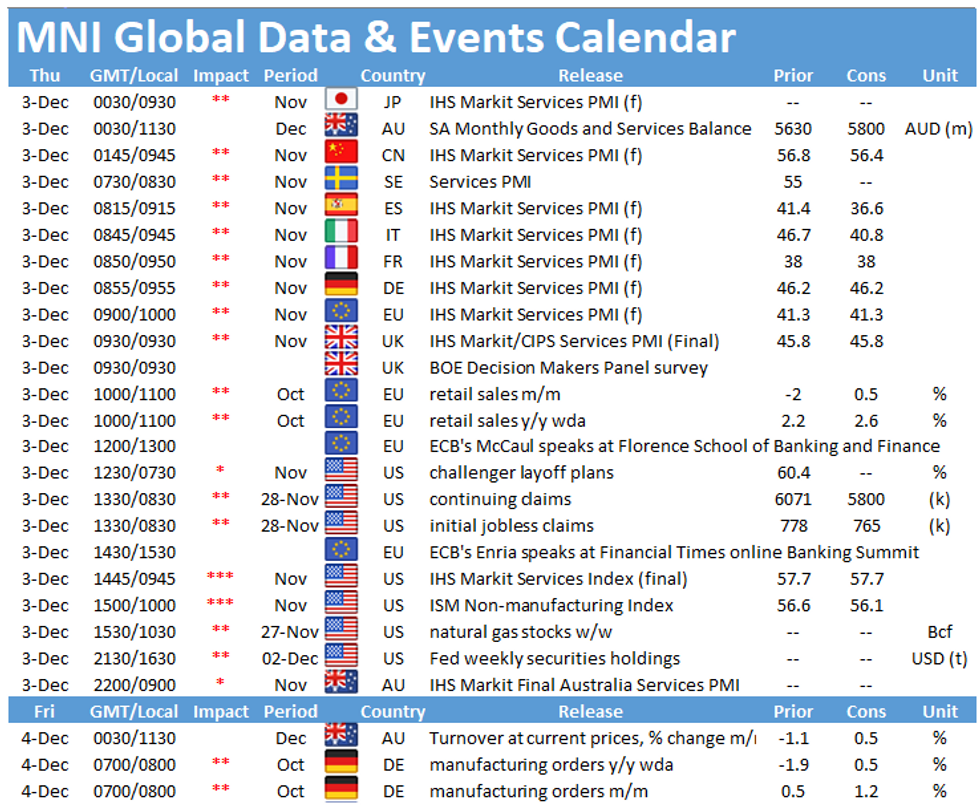

- Light schedule Thurs: France L-T OAT supply and Spain/Italy services PMI (finals elsewhere in Europe).

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.2bps at -0.716%, 5-Yr is up 0.3bps at -0.715%, 10-Yr is up 0.9bps at -0.519%, and 30-Yr is up 1.2bps at -0.105%.

- UK: The 2-Yr yield is down 1.4bps at -0.026%, 5-Yr is down 1bps at 0.025%, 10-Yr is up 0.7bps at 0.354%, and 30-Yr is up 1.2bps at 0.919%.

- Italian BTP spread down 5.1bps at 115.1bps

- Spanish bond spread down 2.5bps at 62.2bps

- Portuguese PGB spread down 1.9bps at 58.5bps

- Greek bond spread up 2.9bps at 121.4bps

Europe Roll Update: Bund And Buxl In Lead

Rolls picking up for Bund, which with Buxl is >40% complete through the roll ahead of next week's first notice.

| Current Est. Roll Complete % | Prev Session End-Day % | 1-Day pp Change | |

| DE - Schatz (2Y) | 24.9 | 20.8 | 4.0 |

| DE - Bobl (5Y) | 13.4 | 12.5 | 1.0 |

| DE - Bund (10Y) | 44.4 | 31.6 | 12.7 |

| DE - Buxl (30Y) | 40.7 | 33.8 | 6.9 |

| IT - BTP (10Y) | 14.7 | 12.5 | 2.1 |

| FR - OAT (10Y) | 31.3 | 27.9 | 3.4 |

FOREX: Sterling Dragged Off Perch as Deal Drags

GBP fell against all others Wednesday, with reports of a cautious warning from Brexit negotiator Barnier weighing from the off. This pulled GBP/USD off the week's multi-month high of 1.3441, with implied vols running suitably higher also with a deal still making little progress.- The single currency outperformed, with EUR/USD breaking above 1.21 for the first time since mid-2018. Short-end EUR vols also traded at multi-week high as the contracts begin to look ahead to next week's ECB decision.

- Trade in haven currencies was inconsistent, with JPY slipping against most others while CHF gained. CHF/JPY rallied sharply for a second sessions, clearing the October high to trade at the best level since September.

- Focus Thursday turns to Australian trade balance, final global PMI revisions for November, Eurozone retail sales and ISM services & weekly jobless claims data from the US. BoE's Saunders & Tenreyro and Fed's Bowman & Kashkari are scheduled to speak.

OPTIONS: Expiries for Dec3 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-1.1800(E1.1bln), $1.1870-85(E662mln), $1.1920-35(E884mln), $1.1945-50(E1.4bln), $1.1995-1.2000(E1.1bln)

- USD/JPY: Y102.00($812mln), Y103.00($1.9bln-USD puts), Y104.00($3.5bln-$3.46bln USD puts), Y104.45-50($1.6bln), Y105.00-10($1.1bln), Y105.45-50($900mln)

- AUD/USD: $0.7350(A$722mln). $0.7385-0.7400(A$1.3bln)

- USD/CAD: C$1.3000($618mln)

- USD/CNY: Cny6.60($1.2bln)

EQUITIES: Higher, But ATH Out of Reach

Despite an uninspiring showing from European equities, US markets managed to trade more positively, with the S&P500 erasing early weakness to grind back to flat. Futures, however, failed to mark a new alltime high, which remains out of reach for now at Tuesday's 3677.50 print.- In the US, energy and communication services traded well, while materials, staples and real estate were the laggards.

- Across Europe, trade was mixed, with UK's FTSE-100 outperforming while German, Italian names slipped.

PIPELINE: Philippines Launched

- Date $MM Issuer (Priced *, Launch #)

- 12/02 $2.75B #Philippines $1.25B 10.5Y +70, $1.5B 25Y 2.65%

- 12/02 $1.5B #Credit Suisse PerpNC 10Y 4.5%

- 12/02 $1B Calpine 10.5NC5.25 3.75%a

- 12/02 $Benchmark Fed Rep of Brazil R/O 5Y 2.87%a, 10Y 3.87%a, 30Y 4.75%a

- 12/03 $1B Seagate Tech 8.6NC3, 10.6NC5

COMMODITIES: Late Oil Rally as OPEC+ Near Deal

Both WTI and Brent crude futures underperformed earlier in the week as OPEC+ delayed making a decision on any extension to their output curbs. Prices advanced on Wednesday however, with prices adding over 2% for both crude benchmarks on reports that the OPEC+ group had made progress on coming to a harmonious decision as soon as the end of this week. A smaller than expected draw in DOE's crude oil inventories numbers had little effect, although WTI crude futures struggled to build above $46/bbl.

Gold advanced, rising further above the 200-dma which crosses today at $1802.26. A mixed outlook for equity markets (US markets were flat, albeit close to alltime highs) were also a supportive factor.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.