-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI ASIA MARKETS ANALYSIS - New Stock Highs After Employ Miss

US TSY SUMMARY: Risk On Despite "Grim" Jobs Report

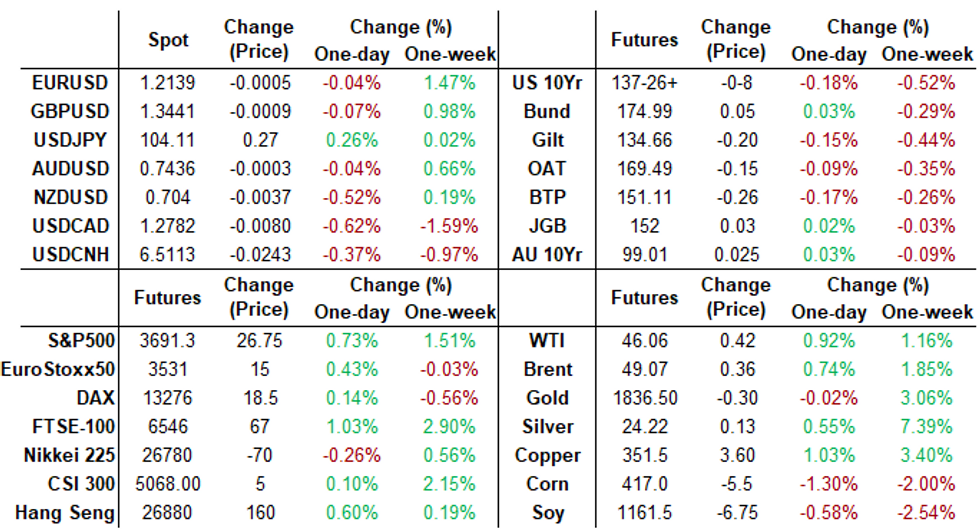

Equities surged to new all-time highs (ESZ0 3694.25), Tsy ylds climbed to mid-March levels (10YY 0.9842%; 30YY 1.7481%) despite Friday's November jobs report miss (+245k vs +475k expected). Not saying much, but US trade deficit at $63.1B in Oct, down from expectations of $64.8B.- Thinking goes: "Grim" jobs data (according to P.E. Biden) -- makes getting fiscal stimulus more likely than not. Decent chop immediately after the release, markets reversed initial react just as quickly.

- Focus revolved around fiscal stimulus (as has been the case most of the week). Hse Sp Pelosi and Sn Ld McConnell aim to bundling an omnibus spending bill to fund gvt with COVID-19 package by Dec 11.

- Surge in Eurodollar futures volume: Near 80,000 Green Jun'23/Sep'23 spds at +0.135 as well as over 40,000 Green Jun'23/Green Sep'23/Blue Dec'23 flys from 0.075 to 0.080 on the day. Driver again is the LIBOR transition deadline date: On November 18 -- the Fed Board of Govs suggested an extension to key US$ LIBOR benchmarks from December 31, 2021 to June 2023.

- The 2-Yr yield is up 0.2bps at 0.1507%, 5-Yr is up 2.9bps at 0.4226%, 10-Yr is up 6.1bps at 0.9675%, and 30-Yr is up 7.8bps at 1.731%.

US TSY: Short Term Rates

US EURODLR/LIBOR: Heavy Volumes As US$ LIBOR Transition Deadline Date Timing Gels

- After a slow start to the session, outright and spd volumes in Reds through Greens (EDZ1-EDU3) has jumped: Near 80,000 Green Jun'23/Sep'23 spds at +0.135 as well as over 40,000 Green Jun'23/Green Sep'23/Blue Dec'23 flys from 0.075 to 0.080 on the day.

- Driver again is the LIBOR transition deadline date: On November 18 -- the Fed Board of Govs suggested an extension to key US$ LIBOR benchmarks from December 31, 2021 to June 2023.

- ISDA takes the discussion further in a LIBOR transition webinar today finalizing the June 2023 date, see link:

- http://assets.isda.org/media/f1a442f2/80e230bf-pdf/

- Benchmark Retirement, We Get There When We Get There

- More from ISDA on what to expect when June 2023 arrives:

- "The overnight, one-month, three-month, six-month and 12-month rates would cease to be published and so swaps would fall back to the fallback rate - ie, the Bloomberg-published compounded SOFR plus the spread adjustment. The spread applied here will have been fixed in early 2021, at the time of the announcement relating to all US dollar LIBOR tenors."

- "Similarly, as the one-week and two-month tenors can no longer be calculated using linear interpolation (because the overnight, one-month and three-month tenors would no longer be available), swaps using those tenors would also, from the end of June 2023, fall back to the fallback rate.

- O/N +0.00050 at 0.08325% (+0.00300/wk)

- 1 Month -0.00100 to 0.15175% (-0.00300/wk)

- 3 Month +0.00050 to 0.22588% (+0.00050/wk)

- 6 Month -0.00163 to 0.25575% (-0.00163/wk)

- 1 Year +0.00037 to 0.33675% (+0.00637/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $60B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $170B

- Secured Overnight Financing Rate (SOFR): 0.08%, $954B

- Broad General Collateral Rate (BGCR): 0.06%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $345B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $24.137B submission

- Next scheduled purchases:

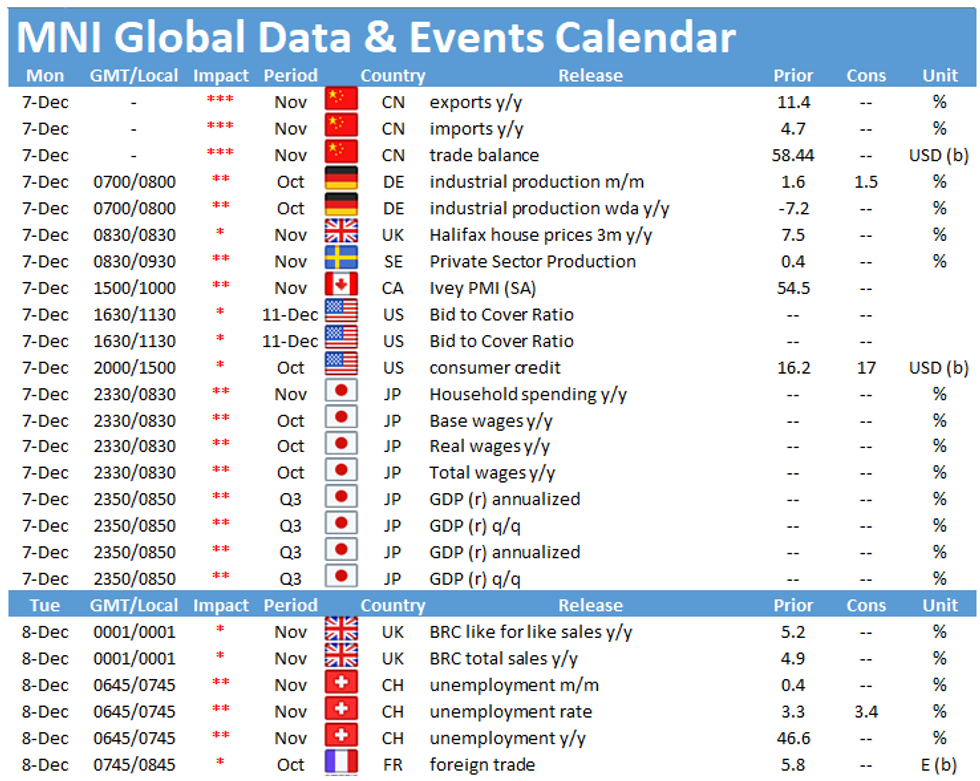

- Mon 12/07 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 12/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 12/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 12/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 12/11 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- +10,000 long Green Jun 92/95 put spds 1.0 over the Green Jun 95 puts

- 2,000 long Green Mar 97 calls, 9.5

- -4,000 short Mar 96/98 strangles, 1.25

- -5,000 Gold Dec 91 puts, 2.0

- Overnight trade

- 4,000 Mar 95/96/97 put flys

- 3,000 Dec 95/96/97 put flys

- 1,500 Green Jan 96/97/98 call trees

- +3,000 TYG 136 puts vs. TYF 137 puts, 0.0 net

- -1,500 wk2 TY

- -10,000 TYG 135.5 puts at 13/64

- -20,000 TYG 136.5 puts at 27/64

- Overnight trade

- +5,000 TYF 136/137 put spds, 8

EGBs-GILTS CASH CLOSE: Steeper Curves On The Cusp Of Brexit Deal

The UK and German curves steepened with long ends under some pressure, while periphery spreads widened slightly Friday.

- US nonfarm payrolls release triggered downside in the afternoon. Brexit headlines a key driver of European markets earlier, with Reuters reporting an EU official saying a deal looked "imminent" (though markets proved somewhat sceptical). Negotiations have wrapped up for the day, but set to continue this weekend.

- German factory orders surprised to the upside this morning; BOE's Saunders said that a multi-pronged approach could be most effective if further easing is required.

- Beyond Brexit, next week we also get UK Oct GDP figures, and of course the ECB decision Thursday.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1bps at -0.747%, 5-Yr is down 0.2bps at -0.752%, 10-Yr is up 0.9bps at -0.547%, and 30-Yr is up 2bps at -0.12%.

- UK: The 2-Yr yield is up 1.2bps at -0.035%, 5-Yr is up 2bps at 0.023%, 10-Yr is up 2.9bps at 0.351%, and 30-Yr is up 3.1bps at 0.924%.

- Italian BTP spread up 1.4bps at 117.2bps

- Spanish bond spread up 0.1bps at 62.8bps

EUROPE OPTIONS SUMMARY: Early 2021 Bund Put Buying Features

Friday's options flow included:

- DUH1 112.30/40/50/60c condor vs 112.20/10ps, bought for 1.5 in 5k

- RXF1 176.00 put bought for 19.5 in 3k

- RXG1 173.00 put bought for 9 in 2k

- RXH1 175/173ps 1x1.5, bought for 17.5 in 5.5k

- ERJ1 (Apr) 100.625/100.75cs 1x2, bought for 0.25 in 3k

- LM1 100.00/100.125/100.25c fly, bought for 1.25 in 6k

- LH1 100.12/100.25cs, sold at 0.5 in 3.85k (ref 99.96, 10 del)

- LZ0 99.87/100.00cs, sold at 8.75 in 3k (profit taking)

FOREX: Contrasting Jobs Data Sees USDCAD Plunge

CAD as comfortably the best performer, surging against all others as the US and Canadian jobs reports diverged. While the US nonfarm payrolls release missed expectations (jobs added 245k vs. Exp. 460k), the Canadian counterpart firmly beat expectations, with 62,000 jobs added vs. forecasts of just 20,000. As a result, USD/CAD fell further, hitting new multi-year lows of 1.2790 in the process.- Sterling remains a victim of the ebb and flow of Brexit headlines, with negotiations concluding on Friday without a firm commitment. Hopes still clearly run high for a deal by the end of the weekend however, with GBP/USD touching a new multi-year high above 1.35 ahead of the close. A lack of a deal by Sunday evening would be a disappointment, and could prompt another volatile week for the currency.

- Focus in the coming week turns to the German ZEW Survey, UK industrial/manufacturing production data and US inflation numbers. Central bank rate decisions are due from the Eurozone, Canada and Brazil.

OPTIONS: Expiries for Dec7 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E655mln), $1.1840-50(E675mln), $1.2000(E583mln), $1.2045-55(E794mln), $1.2100-15(E621mln)

- USD/JPY: Y103.45-50($550mln), Y104.00-05($515mln), Y104.50($700mln), Y105.00($605mln)

- AUD/USD: $0.7350(A$606mln)

- USD/CAD: C$1.2900($620mln)

EQUITIES: Another Stock Surge, With US Relief Bill Seen Imminent

US equity markets touched fresh alltime highs shortly following the open, with a disappointing Nonfarm Payrolls release doing little to rock the boat. Expectations for a further COVID stimulus package were running high in the close, with reports of fresh impetus among US lawmakers helping buoy sentiment. Broad-based gains were seen across the Dow Jones, S&P 500 and NASDAQ.- The sectoral breakdown was supportive of the reflation theme, with energy and materials outperforming, while utilities and consumer staples lagged.

- Higher WTI crude oil prices helped boost the likes of Occidental Petroleum, Apache and National Oilwell Varco, who all traded higher by 7% or more.

PIPELINE: GS Launched, Friday's Sole Issuer

Date $MM Issuer (Priced *, Launch #)

- 12/04 $2.5B #Goldman Sachs $2.2B 6NC5 fix +67, $300M 6NC5 FRN SOFR+79

- -

- $8.6B Priced Thursday; $23.65B/wk

- 12/03 $1.5B *Barclays 4NC3 +80

- 12/03 $1.5B *Citigroup PerpNC5, 4.0%

- 12/03 $1.5B *BMO $900M 3Y +27, $600M 3Y FRN SOFR+35

- 12/03 $1B *FS KKR Capital 5Y +325 *upsized from $400M

- 12/03 $1B *Seagate Tech $500M 8.6NC3 3.12%, $500M 10.6NC5 3.37%

- 12/03 $800M *Juniper Networks 5Y +80a, 10Y +115a

- 12/03 $750M *National Bank of Canada 4NC3 +40

- 12/03 $550M *AIG Global 3Y +28

COMMODITIES: Reflation Still The Theme as Copper Hits New Highs

Despite stalling in the middle of the week, copper futures resumed their incline Friday, hitting new multi-year highs in the process. Reflation clearly remains the theme, with firm equities, energy and industrial metals prices holding into the Friday close.- The strength in commodities comes despite a soft November US jobs report, with signs of an imminent US fiscal deal and a buoyant oil futures curve following the OPEC+ agreement the primary support.

- Gold traded slightly weaker despite a less-than-rosy outlook for the USD. Losses were contained, however, with gold edging lower by only $5/oz and remaining well clear of 200-dma support at $1804.50.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.