-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA MARKETS ANALYSIS - Targeted Relief Better Than None

US TSY SUMMARY: Yld Curves Bull Flatten On Modest Volumes

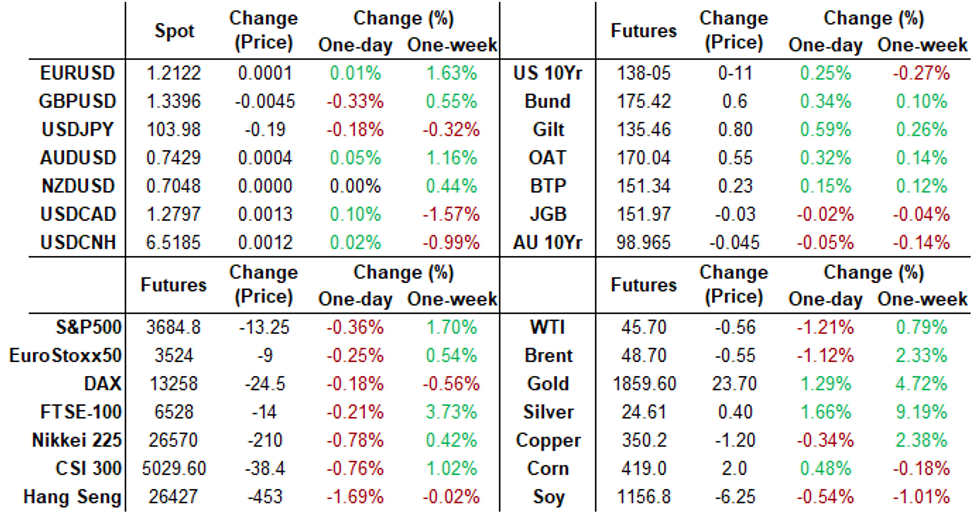

Fairly muted opening session for the new week, modest volumes (TYH under 1M after the bell), yld curves scale back from last Friday's 9-month highs (mid-March lvls). Tentative risk-on unwinds with no fiscal stimulus deal annc (though Sen leader McConnell annc Sen will pass a one-week stopgap spending bill to keep govt running. Equities did pare losses after McConnell mentioned targeted aid bill, a non-starter for Democrats deemed not enough aid.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00037 at 0.08288% (+0.00300 last wk)

- 1 Month -0.006300 to 0.14575% (-0.00300 last wk)

- 3 Month +0.00450 to 0.23038% (+0.00050 last wk)

- 6 Month -0.00262 to 0.25313% (-0.00163 last wk)

- 1 Year +0.00150 to 0.33825% (+0.00637 last wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $56B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $152B

- Secured Overnight Financing Rate (SOFR): 0.09%, $951B

- Broad General Collateral Rate (BGCR): 0.07%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $333B

- (rate, volume levels reflect prior session)

- NY Fed Operational Purchase

- Tsy 20Y-30Y, $1.734B accepted vs. $5.217B submission

- Next scheduled purchases:

- Tue 12/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 12/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 12/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 12/11 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- 4,000 short Mar 96 puts

- -4,000 Blue Sep 90 puts, 10.0 vs. 99.27/030%

- 6,000 Sep 98 calls w/Red Dec 95/97 call spds, 25.5 total

- +5,000 Green Jum93 puts, 2.5

- -3,000 Green Sep 92/96 call over risk reversals, 1.0

- Blue Mar 88/91/93 put flys, 7.0

- Overnight trade

- +2,000 Red Mar/Red Jun 96/97 put spd strip, 7.0

- Block +20,000 Green Mar 95 puts, 1.5, another +10k screen

- 2,000 TYF 136.25/136.75/137.25 put flys, 5/64 (same package on wk2 TY traded earlier)

- 1,500 USG 168/170/172 put flys, 15/64

- +1,500 TYH 137.5 puts, 51/64

- -2,500 TYF 136.25 puts, 4/64

- -1,800 TYF 138.5 calls, 5/64

- 2,500 wk2 TY 136.25/136.75/137.25 put flys

- 4,000 USF/USG 170 put spds 51-52

- +1,500 USG 168/170/172 put flys, 16

- 2,000 USF 171/172 put spds

- Overnight trade

- 10,000 TYF 135.5 puts, 3

- 1,250 USH 170/171 put spds

- 1,600 USF 170/172 put spds adds to block

- Block, -10,000 TYF 137/137.5 put spds 2 over TYG 136.5/138.5 put spds

- Block -5,000 USF 170/172 put spds, 47 vs. 171-27/0.40%

EGBs-GILTS: Curves Flatten On Brexit (And Not Much Else)

Monday saw a mostly quiet session with no meaningful data, supply, or speakers, and all the attention on Brexit headlines over the weekend and early on in the day. Most headlines focused on divisions between the EU-UK , in contrast w Friday's more optimistic tone.

- Gilts unsurprisingly outperformed; UK and German curves bull flattened while periphery spreads widened. And most of the move happened in early London trade, with limited price movement the rest of the day.

- Ultimately we continue to await developments ahead of this week's European Council, and attention on UK parliament as they eye the Internal Market Bill.

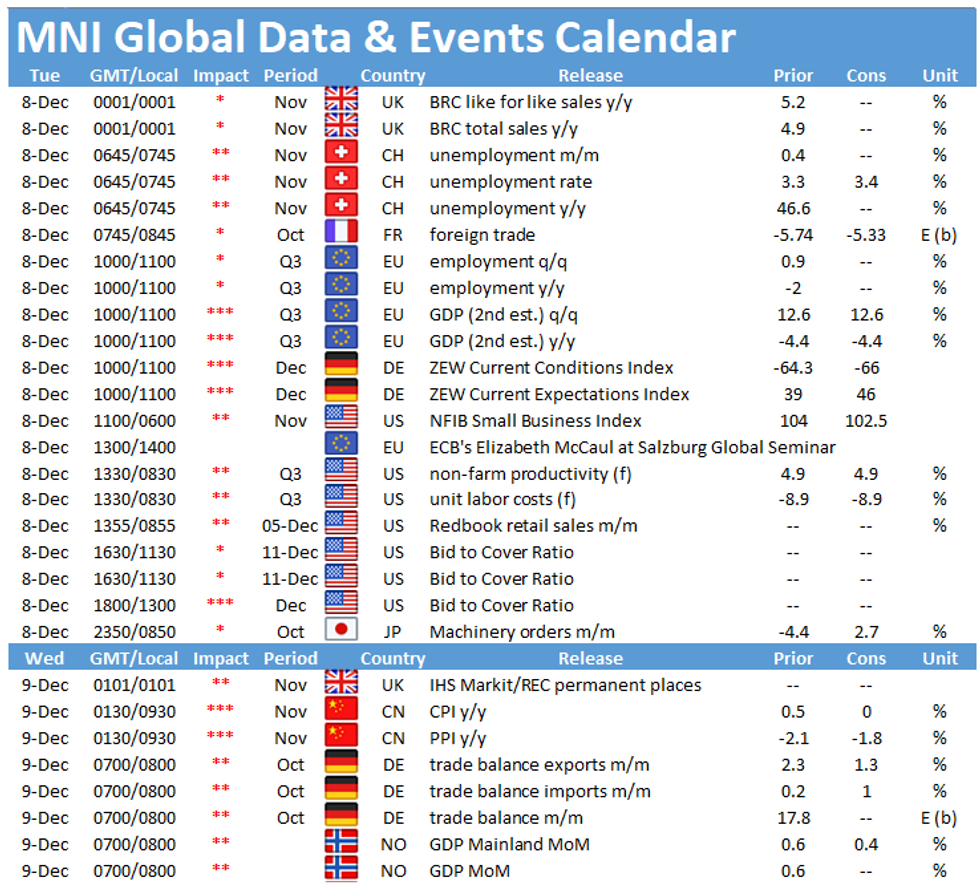

- Tuesday's docket includes German Dec ZEW and Gilt supply.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.2bps at -0.759%, 5-Yr is down 2.5bps at -0.777%, 10-Yr is down 3.5bps at -0.582%, and 30-Yr is down 3.6bps at -0.156%.

- UK: The 2-Yr yield is down 4bps at -0.075%, 5-Yr is down 5.3bps at -0.03%, 10-Yr is down 6.8bps at 0.283%, and 30-Yr is down 7bps at 0.854%.

- Italian BTP spread up 2bps at 119.2bps

- Spanish spread up 0.6bps at 63.4bps/ Portuguese up 0.9bps at 59.9bps

EUROPE FI SUMMARY: Abundance Of Bund / Schatz Puts

Monday's options flow included:

- RXF1 176.5p, sold at 15 in ~1k

- RXF1 176.00p, sold at 9 in ~1.3k

- RXF1 177p, bought for 28 in 3.5k

- RXG1 177p, bought for 66-67 in 2k

- DUF1 112.50/60cs was sold at 0.5 in 2k. Desk also report, was bought for 1 in 1.25k

- DUF1 112.30/112.20ps, bought for 1 in 4.5k

- DUF1 112.40/112.50/112.60c fly, bought for 2.25 in 8k

- DUG1 112.30/112.20/112.00 p fly, bought for 1.5 in 7.75k

- ERU1 100.25/100.125ps, bought for 2.5 in ~1.6k

- LF1 100c, bought for 1.75 in 4k

- LH1 99.87/100/100.12c fly 1x3x2, sold at 4.5 in 6k

- 0LH1 100.00/99.87ps, sold at 5 in 3k

- 0LJ1/0LK1/0LM1 99.87/99.75ps 1x2 strip, bought for 3 in 5k

- 2RM1 100.50/100.25ps with 100.50/100.37ps as a strip, sold at 7.5 in 2.5k

FOREX: Brexit Deal in the Balance, Sterling Slipping

As all weekend reports of Brexit deal progress were quashed ahead of the European open, GBP slipped sharply against all others, dropping close to 2 cents against the USD as markets ratcheted up the implied probability of a disruptive end to the transition period on Dec31. Options markets clearly took note, with short-end GBP options premiums shooting to fresh multi-month highs. GBP/USD traded as low as 1.3225 before staging an impressive bounce - rising to just below 1.34 ahead of the US close.

- Nonetheless, GBP was the poorest performing currency in G10 Monday. NOK, AUD and SEK were the strongest. A bounce in oil prices after early underperformance helped boost commodity-tied currencies, with WTI returning into positive territory ahead of the COMEX close on broad USD weakness.

- Focus Tuesday turns to the ongoing Brexit negotiations and Germany's ZEW survey.

FX OPTIONS: Expiries for Dec8 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E1.5bln), $1.2070-75(E1.2bln), $1.2100(E1.7bln), $1.2150(E521mln), $1.2200(E792mln)

- USD/JPY: Y102.85-00($538mln), Y103.30-50($553mln), Y104.00-05($1.0bln), Y104.85-00($1.2bln)

- AUD/USD: $0.7400-05(A$1.75bln mostly AUD calls)

- AUD/NZD: N$1.0660(A$500mln)

EQUITIES: Mixed Finish After Record High DJIA

- The Dow Jones Industrial Average hit a new record at the open Monday, but the risk-on sentiment failed to persist into the close as US equities faded, taking their cue from a mixed finish in Europe. The e-mini S&P traded in a relatively tight range, with mid-session resilience fading in the final few hours of trade.

- Energy and financial names led losses, with healthcare and real estate not far behind. The outperforming sectors included communication services and utilities. Notable stock moves included American Airlines and Boeing (both higher by 3% or more) as markets took a rosier view on the prospects for flying and international travel.

PIPELINE: $11.35B To Price Monday, Dealers Lead

- Date $MM Issuer (Priced *, Launch #)

- 12/07 $2.5B #Morgan Stanley 6NC5 +60

- 12/07 $2B #Societe Generale 6NC5 +110

- 12/07 $2B #CVS $750M 2027 Tap +67, $1.25B +10Y +95

- 12/07 $1.35B #CIBC $750M 3Y +32, $600M 3Y FRN SOFR+40

- 12/07 $1.1B #KeyBank $750M 3NC2 fix/FRN +28, $350M 3NC2 FRN to SOFR+34

- 12/07 $1.9B #NASDAQ $600M 2NC1 +30, $650M 10Y +75, $650M 20Y +80

- 12/07 $500M #Codelco WNG 30Y +148

- 12/07 $Benchmark Charles Schwab investor call

- 12/07 $Benchmark Kingdom of Morocco investor call on 7Y, 12Y and 30Y

COMMODITIES: Markets Erase Soggy Start, Oil, Metals Firmer

A broad risk-off theme twinned with USD strength provided an initial anchor for commodity prices, but this effect was erased ahead of the close, as a record high open for the Dow Jones Industrial Average helped boost risk appetite.

This prompted oil markets to reverse early weakness and return higher, with WTI crude futures keeping pressure on the Friday multi-month high of $46.68.

A similar story for precious metals after gold erased early downside to trade firmly into the close. Monday's rally opens first resistance at the 50-day EMA of $1870.00 but a break above here would open the next leg higher to target $1888.90, the 61.8% retracement of the Nov 9 - 30 sell-off.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.