-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Declines to Extend Maturity of QE Purchases

EXECUTIVE SUMMARY:

- FED WANTS 'SUBSTANTIAL PROGRESS' BEFORE Q.E. SHIFT

- SCHUMER AND MCCONNELL SAY COVID RELIEF DEAL 'VERY CLOSE'

- U.S. TREASURY LABELS SWITZERLAND, VIETNAM AS CURRENCY MANIPULATORS

- BANK OF ENGLAND DECISION THURSDAY CLOUDED BY BREXIT OUTLOOK

- E.U.-U.K. DEAL COULD BE APPLIED PROVISIONALLY (MNI EXCLUSIVE)

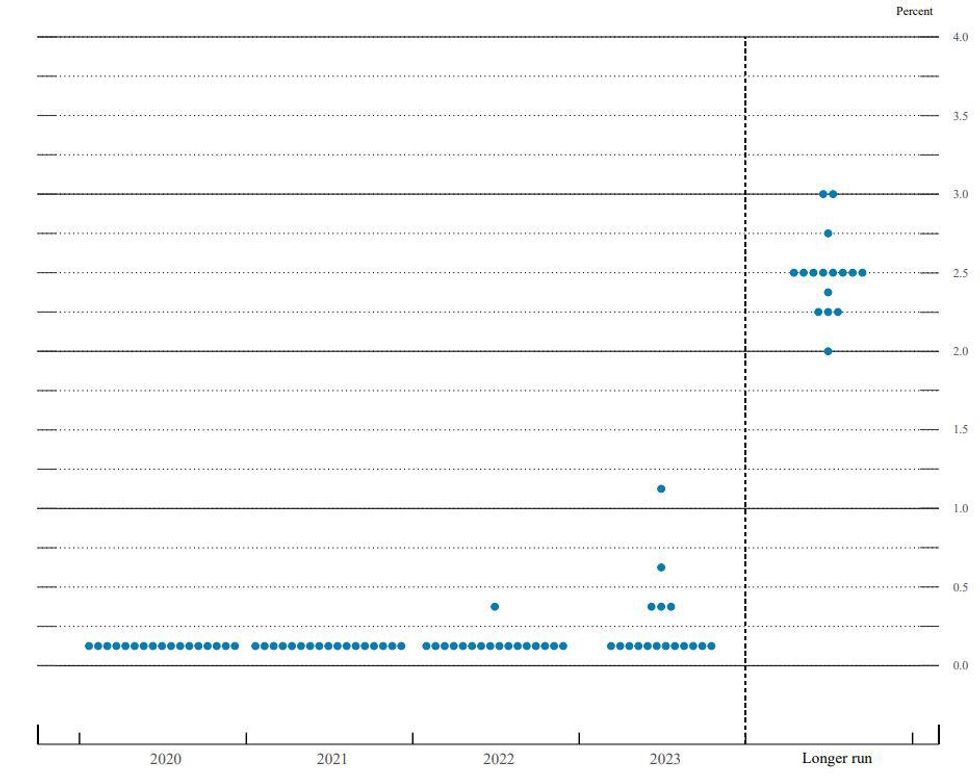

Fig. 1: Fed's December Dot Plot

NEWS:

FED: The Federal Reserve on Wednesday offered new guidance on its bond buying program, pledge to keep buying Treasuries and mortgage-backed securities at the current pace of at least USD120 billion a month until "substantial further progress" has been made towards full employment and price stability goals. "The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term," the Fed warned.

US FISCAL: Senate Minority Leader Chuck Schumer (D-NY) on the Senate floor talks up how close both sides are to a COVID-19 relief/gov't funding bill: "As we race the clock to reach a final accord before the end of the year we are close to an agreement. It's not a done deal yet but we are very close. The finish line is in sight. Everyone wants to get this done. Let's push through the few final meters and deliver the outcome that the American people very much need." If a deal is reached and approved by both chambers and signed by President Trump it would avoid a gov't shutdown due to take place on Friday 18 Dec when federal funding runs out.

US FISCAL: Politico's Burgess Everett tweets details of what he says is in, might be in, and out of the compromise COVID-19 aid bill:- "In the deal:-Stim check of $600-700-Unemployment weekly boost $300- $325bishfor small business, $257b for ppp [paycheck protection programme]. ?: Schumer+ Rs still battling over billions for idled venues and restaurant funding. Out: State/local [funding], liability [protection]."

- If this is the case it would mark a major climbdown for Senate majority leader McConnell, who had previously stated liability protection for businesses was a prerequisite of a deal. However, the total amount of the package, around USD900bn, seems closer to Senate Republican numbers than those of House Democrats.

US / FX: The US Treasury Department has labelled Switzerland and Vietnam as currency manipulators, but stopped short of officially stating the same about China. The semi-annual foreign exchange report stated that Switzerland and Vietnam had kept their currencies lower in an effort to stop "effective balance ofpayments adjustments". In the report China, Japan, South Korea, Germany, Italy, Singapore, Malaysia, Taiwan, Thailand, and India were all included on the watch list of potential manipulators without being named outright. The final three were added in the latest report, while Ireland was removed. This marks the first time since April 2019 that the US has named a country officially as a currency manipulator.

SNB: The SNB responded to the announcement with some zest, stating that the SNB's interventions in the FX market do not serve to stop BoP adjustments nor to gain a competitive advantage for the Swiss economy, that Switzerland does not engage in any form of currency manipulation and, indeed, that the SNB would be willing to intervene more strongly in the FX market.

BANK OF ENGLAND (MNI PREVIEW): The Bank of England had been hoping that much of the uncertainty that had clouded the November Monetary Policy Meeting would have been resolved by the December meeting. Indeed, the UK has started rolling out the first Covid-19 vaccinations and there is more clarity on the timing of the wider rollout to the population. However, the outcome of Brexit trade negotiations remains unclear at present although it does appear as though some progress is starting to be made. Recent activity is also likely to have been hit harder than the Bank's latest forecasts as they were made before the announcement of the English November lockdown. With this in mind, we think that the focus will be on the pace and technicalities of QE, and potentially negative rates. For full preview use this link: https://marketnews.com/boe-preview-december-2020-w...

UK-EU: Latest tweet thread from RTE's Tony Connelly on Brexit talks: "While both sides have a way to go, on the level playing field/state aid there is a landing zone in sight. On fisheries, both sides say that is "very difficult". It looks as if all the energy is going into the LPF and once cracked, they'll barrel into the fisheries stuff. Governance, or how to solve disputes, looks like it has been more or less done"

UK-EU (MNI EXCLUSIVE): UK and EU officials will find a way to ratify or provisionally apply a post-Brexit trade deal even if negotiations run close to the Dec. 31 deadline, although sources noted to MNI that a deal, while growing more likely, is still not assured. For full article contact sales@marketnews.com

US DATA: December flash US Composite PMI slipped from November's 68-month high, with manufacturing above expected (56.5 vs 55.8 survey) and services below (55.3 vs 55.9 survey) - though both lower than November.

* COVID lockdowns the culprit for the Services miss - per IHS Markit:"additional restrictions and softer demand impacted consumer-facing business once again."

* New orders continued to rise, though foreign orders weakened for the first time since July on COVID lockdowns in foreign markets.

* Firms also saw the biggest supply chain disruptions in the history of the data series (to 2007), with both manufacturers and service providers seeing rising input costs.* However, "Although manufacturers raised their selling prices at the fastest rate since April 2011, seeking to pass higher costs on to customers where possible, service providers recorded a softer pace of charge inflation amid continual efforts to drive sales."* The outlook for output over the next year remained high but slipped slightly from November on "the pandemic and surging costs', with business expectations at a 3-month low.* Dec also saw slower employment growth on weaker backlogs.

US DATA: U.S. retail sales plummeted in November, falling 1.1% when markets had expected a drop of 0.3%. October's 0.3% gain was revised down to -0.1%, marking the first monthly decline since April. Motor vehicle and parts sales fell 1.7% in November after a flat reading in October. Gas station sales slipped by 2.4% through November following a 0.2% decline in October. Excluding motor vehicle sales, retail sales were down 0.9%. Excluding motor vehicle and gas station sales, retail sales were down 0.8%.

DATA:

- MNI:US NOV RETAIL SALES & FOOD SVCS -1.1%; EX-MOTOR VEH -0.9%

- US OCT SALES REVISED -0.1%; EX-MV -0.1%

- US NOV RET SALES EX GAS & MTR VEH & PARTS DEALERS -0.8% V OCT -0.1%

- US NOV RET SALES EX MTR VEH & PARTS DEALERS -0.9% V US NOV -0.1%

- US NOV RET SALES EX AUTO, BLDG MATL & GAS -1.0% V OCT -0.1%

- U.S. DEC FLASH MANUFACTURING PMI 56.5 (55.8 EXP, 56.7 PRIOR)

- DEC FLASH SERVICES PMI 55.3 (55.9 EXP, 58.4 PRIOR)

- DEC FLASH COMPOSITE PMI 55.7 (58.6 PRIOR)

- MNI: US OCT BUSINESS INVENTORIES +0.7%; SALES +0.9%

- US OCT RETAIL INVENTORIES +0.9%

- MNI: US NAHB HOUSING MARKET INDEX 86 IN DEC

- US NAHB DEC SINGLE FAMILY SALES INDEX 92; NEXT 6-MO 85

- MNI: CANADA OCT WHOLESALE SALES +1.0%; EX-AUTOS +0.6%

- OCT WHOLESALE INVENTORIES -0.6%: STATISTICS CANADA

- CANADIAN NOV CONSUMER PRICE INDEX INFLATION +1.0% YOY

- CANADA MOM CPI INFLATION WAS +0.1% IN NOV

USD LIBOR FIX

- US00O/N 0.08125 -0.00075

- US0001W 0.10075 -0.00125

- US0001M 0.15788 0.00538

- US0003M 0.23638 0.00763

- US0006M 0.25550 0.00375

- US0012M 0.33313 0.00188

New York Fed EFFR for prior session (rate, chg from prev day):

- Daily Effective Fed Funds Rate: 0.09%, no change, volume: $50B

- Daily Overnight Bank Funding Rate: 0.08%, no change, volume: $142B

REPO REFERENCE RATES (rate, change from prev. day, volume):

- Secured Overnight Financing Rate (SOFR): 0.09%, 0.01%, $933B

- Broad General Collateral Rate (BGCR): 0.07%, 0.01%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.07%, 0.01%, $329B

US TSYS SUMMARY: Tsys Round-Trip As Fed Holds Steady (Apart From Guidance)

The FOMC decision was in line with expectations, with new asset purchase guidance but no change to the asset purchase program itself. The decision and optimistic-looking summary of economic projections were rightly seen hawkish, with TYs selling off 8+ ticks, but not quite to session lows.

- Tsys rebounded and curve steepening reversed as the Powell press conference went on, as he did not rule out future action if required. Effectively Tsys round-tripped to levels pre-decision by the end.

- The 2-Yr yield is up 0.4bps at 0.117%, 5-Yr is up 0.6bps at 0.3702%, 10-Yr is up 1.7bps at 0.9246%, and 30-Yr is up 1.6bps at 1.6662%.

- Mar 10-Yr futures (TY) up 0.5/32 at 137-28 (L: 137-19.5 / H: 138-00.5)

- Earlier in the day, very weak November retail sales data were met with a shrug.

- Just as Powell urged the stimulus focus be put on fiscal policy, we now look to Capitol Hill for a deal which sounds from all the main players to be forthcoming.

EGBs-GILTS CASH CLOSE: UK Yields Close On Lows Ahead Of BoE

The European FI space has moved more or less in line with global risk appetite and data. Strong Eurozone PMIs in the morning, and weak U.S. retail sales in the afternoon, helped move the needle for core FI weaker and stronger, respectively.

- BTP spreads tightened as risk appetite was generally positive (equities +, EUR and GBP hitting post-2018 highs).

- There remains some optimism on a Brexit deal soon, but headlines have been mixed as ever, and longer-dated Gilt yields ended the day up but at/near session lows. Of course contributing to Gilt uncertainty is Thursday's Bank of England meeting - contact us if you haven't seen our preview.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 3.1bps at -0.725%, 5-Yr is up 4.3bps at -0.744%, 10-Yr is up 4.4bps at -0.567%, and 30-Yr is up 3.9bps at -0.162%.

- UK: The 2-Yr yield is down 2.3bps at -0.077%, 5-Yr is down 0.2bps at -0.031%, 10-Yr is up 1.2bps at 0.272%, and 30-Yr is up 0.8bps at 0.834%.

- Italian BTP spread down 2.7bps at 110.3bps

- Spanish bond spread down 0.4bps at 59bps / Portuguese up 0.6bps at 56.1bps

FOREX: USD Fails to Hold Fed-Induced Gains

The greenback initially rallied on the back of the Fed's decision not to extend the duration of their asset purchase program - a move that markets interpreted hawkishly, which saw EUR/USD fall sharply to new daily lows of 1.2125. This move swiftly reversed ahead of the close, however, as Fed's Powell reassured markets that the Fed would use communication tools and guidance to avoid any future taper tantrum - allowing equities to resume their uptrend and, once again, challenge all time highs.

CAD was easily the poorest performer Wednesday, extending the market reaction to Tuesday's speech from BoC Governor Macklem, who warned that Canada could resume an economic tailspin in early 2021. Nonetheless, USD/CAD's rise stopped short of breaking the 1.28 handle.

NOK, GBP and EUR were the strongest in G10. CAD, CHF and USD were the weakest.

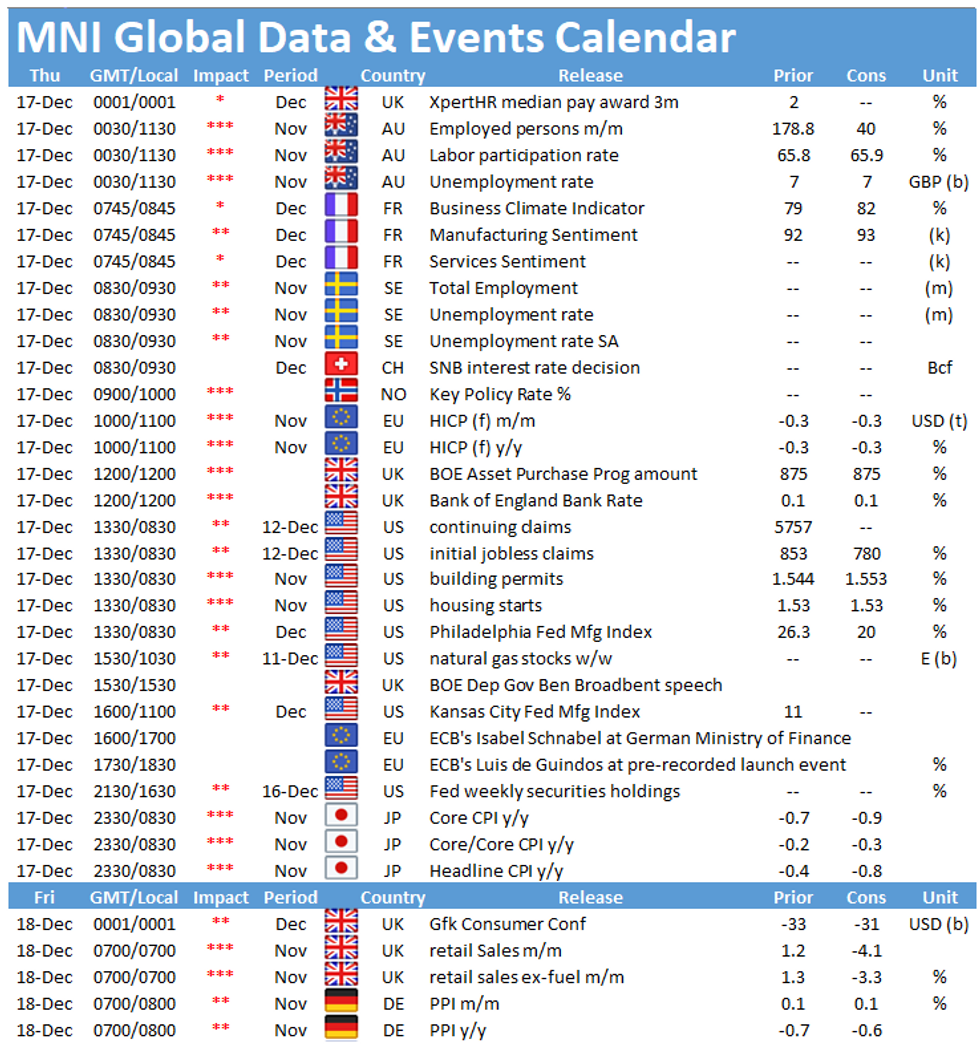

Focus turns to further central bank rate decisions, with the UK, Norwegian, Swiss and Mexican policy announcements all due Thursday.

EQUITIES: Stocks Narrow Gap with Alltime Highs

US equity futures narrowed the gap with alltime highs following the Fed rate decision, despite the initial statement being interpreted as somewhat hawkish. The Fed declined to extend the duration of asset purchases, however forced the message home to markets that the Fed would use communication tools to avoid any future taper tantrum. This makes further alltime highs a firm possibility before the end of the week.

Consumer discretionary and tech names outperformed, with utilities and industrials lagging slightly. The VIX pulled lower following the Fed decision.

COMMODITIES: Gold Recovers Fed-Induced Dip

Spot gold initially fell after the market interpreted the Fed's decision not to extend the duration of their asset purchases as hawkish. This pressured gold prices lower initially, prompting new session lows at $1844.90 before bouncing into the close to trade broadly flat on the day.

WTI and Brent crude futures found some support into the close following the weekly DoE crude oil inventories report. Headline oil inventories saw a larger draw than expected, with 3.1mln barrels drawn vs. Exp. draw of 1.1mln. WTI touched a new post-COVID crisis high at $47.94/bbl Wednesday.

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.