-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - US Stimulus Vote Monday Night

US TSY SUMMARY: Rates Well Off Pre-Open Highs

Rates surged higher in the lead-up to the NY open, risk-off largely driven by a new new virulent strain of COVID-19 reported in in south-east England and London, coupled w/lack of substantive progress in BREXIT negotiations.

- Tsys held well off late overnight highs while equities reacted negatively to midmorning headline: "U.S. MISSILE-FIRING SUBMARINE ENTERS PERSIAN GULF, NAVY".

- That said, risk-off bid for rates gradually evaporated, extending session lows into late trade after Congress released details of stimulus spending bill to be voted on Monday night. Yield curves held flatter levels amid moderate buying/position squaring after the bell.

- Better 20Y Bond Auction Re-Open: US Tsy $24B 20Y bond auction re-open (912810ST6) stopped through with high yield of 1.470% (1.422% last month) vs. 1.478% WI, on a bid/cover 2.39% (2.27% previous).

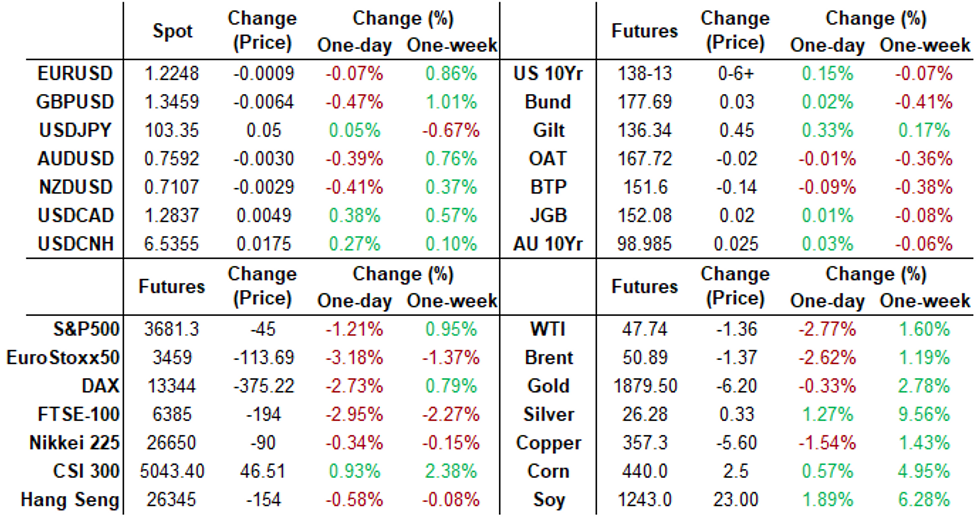

- The 2-Yr yield is unchanged at 0.121%, 5-Yr is down 0.2bps at 0.3798%, 10-Yr is down 0.8bps at 0.9379%, and 30-Yr is down 1.3bps at 1.679%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00025 at 0.08463% (+0.00113 net last wk)

- 1 Month +0.00150 to 0.14525% (-0.01488 net last wk)

- 3 Month +0.00913 to 0.24488% (+0.01925 net last wk)

- 6 Month +0.00200 to 0.26050% (+0.00975 net last wk)

- 1 Year -0.00150 to 0.33250% (-0.00188 net last wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $145B

- Secured Overnight Financing Rate (SOFR): 0.09%, $943B

- Broad General Collateral Rate (BGCR): 0.07%, $356B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $332B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $1.878B submitted

- Next scheduled purchases:

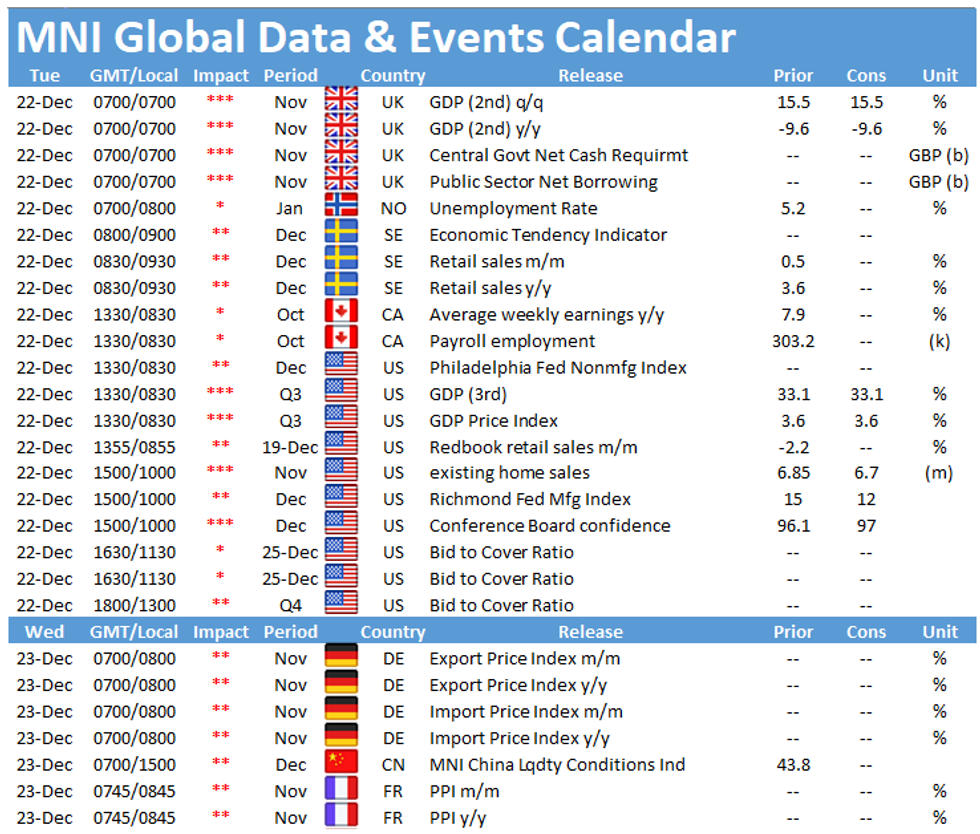

- Tue 12/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 12/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Mon 12/28 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- +2,000 Green Jun 92/95 put spds, 2.5

- Block, 20,000 short Sep 96/97 put spds, 3.0 vs. 99.795/0.20% at 1010:48ET

- Overnight trade

- 5,000 Green Mar 95/96 2x3 call spds,

- 2,500 Green Jun 100 calls

- +50,000 TYG 137/138 2x1 put spds, 6 vs. 137-26/0.05%

- +1,500 TYG 135.5/136.5 put spds, 7

- 3,100 TYG 137.5/138.5 1x3 call spds, 1

- 2,500 TYF 138.25 calls, 3

- 2,500 FVH 125.75 calls, 29-28

- -3,750 TYH 136.5 puts, 22/64

- +7,500 TYH 135.5 puts, 12/64 vs. 137-27.5 to -28/0.15%

- +2,500 TYF 137/137.5/138 put flys, 10

- +2,500 TYF 138 calls, 13-16, total volume over 10,800

- -3,500 TYG 136 puts 5, small sales 6

- Overnight trade

- 16,500 TYF 138 puts, 10

- 9,500 TYF 138.5 calls, 3-4

- 5,800 TYF 137.5 puts, 2

- 12,500 TYG 137/139 call over risk reversals, 1-2

- 3,900 USG 176 calls, 36-37

EGBs-GILTS CASH CLOSE: Flattening Reverses As U.K. Looks Isolated

The start of the week was dominated by COVID, both on fears of a mutant strain leading to severe lockdowns and travel bans for the U.K., and on the hope of a vaccine.

- COVID fears, plus hard Brexit looming, sparked strong bull flattening in the morning. Periphery spreads widened. But the moves largely reversed, starting w news the EMA had approved the use of the Pfizer-Biontech vaccine.

- Re the mutant strain, afternoon reports that E.U. would consequently impose a bloc-wide travel ban w the U.K. until midnight Tuesday, though easing the blow, similar reports said freight traffic would still be able to come to the U.K.

- As we came to the cash close, U.K. P.M. Johnson was due to speak, having convened the Cobra committee in the afternoon on the situation.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.1bps at -0.736%, 5-Yr is down 0.9bps at -0.753%, 10-Yr is down 0.9bps at -0.58%, and 30-Yr is down 1.6bps at -0.176%.

- UK: The 2-Yr yield is down 2.3bps at -0.107%, 5-Yr is down 3.8bps at -0.08%, 10-Yr is down 4.4bps at 0.205%, and 30-Yr is down 5.2bps at 0.754%.

- Italian BTP spread up 1.3bps at 114.9bps / Spanish spread up 2bps at 63.6bps

OPTIONS FLOW SUMMARY: Plenty Of Action

Monday's options flow included:

- DUG1 112.30/112.20 put spread bought for 2.5 in 2k

- DUH1 112.20/112.10 1x2 put spread bought for 1 in 2k

- RXG1 178.00/177.00 1x2 put spread bought for -1 in 1.5k

- RXG1 176.00/175.00/174.00 put ladder bought for 4 in 1k

- RXG1 177/176/175/174 put condor sold at 14.....Exiting position

- RXG1 176.50/175.50 put spread sold at 13 in 1.5k

- ERM1 100.50/100.625 combo, 1.5 put x 1 call (v 100.545); bought for 1.5 in 15k x 10k

- ERU2 100.375/100.75 combo bought for 1 in 3.5k all day (+put) (v 100.56)

- LF1 100.00^ sold down to 5.25 in 7k

- LG1 100.125/100.25 call spread bought for 1 in 3.5k (d +0.13%)

- LH1 100.00/100.125/100.25 call fly bought for 1.75 in 5k

- LM1 100.125/100.25 1x1.5 call spread bought for 1.5 in 5k

- LM1 100.125/100.375 call spread bought for 3.25 in ~12k

- 0LF1 100.125/100.25 call spread bought for 0.75 in 4k

- 2LH1 100.00^ bought for 16 in 1.25k

FOREX: Sterling Slides as Border Risks, COVID Threat Circle

GBP was comfortably the poorest performer in G10 Monday, with the currency slipping against all others in G10 after a new strain of COVID-19 was announced to be spreading in south-east England and London. This, twinned with lack of progress in Brexit negotiations and a disrupted flow of goods between the UK and France led to broad-based losses.- Equities had a choppy session, with broad-based losses noted across European and US markets. Renewed fears over COVID, profit-taking ahead of the Christmas break and a less-than-impressive debut for Tesla in the S&P500 all contributed.

- NOK also traded poorly, with subdued oil prices largely responsible, falling against all others with the exception of GBP. USD, JPY traded the strongest on Monday.

- Focus Tuesday turns to the final read of UK & US GDP for Q3 and December consumer confidence numbers.

FX OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-02(E1.5bln), $1.2070-75(E538mln), $1.2100(E1.1bln), $1.2120-25(E814mln), $1.2150-55(E1.4bln-EUR puts), $1.2200(E2.3bln), $1.2225-35(E903mln), $1.2300-10(E1.0bln)

- USD/JPY: Y103.00($1.2bln-USD puts), Y103.50-60($1.1bln), Y103.70-90($1.2bln), Y104.00($550mln), Y104.20-40($639mln)

- EUR/GBP: Gbp0.9000-10(E670mln)

- AUD/USD: $0.7440-50(A$1.1bln), $0.7500(A$630mln), $0.7530-50(A$711mln), $0.7570-80(A$1.4bln-AUD puts)

- USD/CNY: Cny6.50($1.1bln-USD puts), Cny6.55($536mln), Cny6.65($560mln)

- USD/MXN: Mxn20.00($1.3bln-USD puts)

EQUITIES: Stocks Sag on New COVID Strain, Tesla Inclusion

Equities across Europe and the US sagged Monday, with European indices the most hard it on escalating reports of a new, more infectious, COVID strain emanating from the South-east of England. European stocks closed lower by 2-3% apiece, with the US slipping around 0.8-1.0%.- Tesla's debut in the S&P500 was uninspiring, with the stock slipping just over 5% after a firm rally late last week. As one of the S&P500's largest components, Tesla's underperformance dragged on the headline indices.

- Energy and utilities names saw the largest declines, with losses minimized in financials, which was the only sector to post gains Monday.

PIPELINE: Issuance Grinding To A Halt Ahead Year-End

- Issuance Grinding To A Halt Ahead Year-End

- Date $MM Issuer (Priced *, Launch #)

- 12/21 No new issuance Monday; $52.24B/M

- 12/18-16 No new issuance Wed-Fri, $1.15B/wk

- $750M Priced Tuesday

- 12/15 $750M *Berry Global 5Y +120

- $1.4B Priced Monday

- 12/14 $1.4B *Microchip 3Y +80

COMMODITIES: Oil Slips with Equities

WTI and Brent crude futures traded sharply lower alongside global stock markets Monday, with WTI and Brent off over 4% apiece as risk sentiment soured ahead of the Christmas holidays.- A firm dollar was partly responsible, but concerns surrounding renewed global lockdown restrictions and slipping equity markets also contributed.

- Spot gold and silver initially slipped in early trade, with a bouncing dollar pressuring precious metals, but the sagging US equity open helped provide some support headed into US hours. Gold hit a low of $1855.31 before bouncing.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.