-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Virus Variant More Rapid Transmitted

US TSY SUMMARY: Tsys Near Highs, COVID Variant More Rapidly Transmissible

Rates extended highs across the curve into the close as virus concerns at the start of winter gained traction.

- Tsys have quietly climbed back to overnight highs by midmorning, anemic volumes slow to improve. "Don't be short a quiet market," one trading desk cautions, keeping a wary eye on Covid data, stimulus bill, geo-pol related headline risks.

- By midday, Tsy futures extended session highs, risk-off measure with equities nearing overnight lows, apparently on the back of latest CDC headlines regarding new virus headlines. Trading desks suggested algos were keying in on "more rapidly transmissible" variant. Risk-off support continued on light volumes into the close (TYH appr 710k).

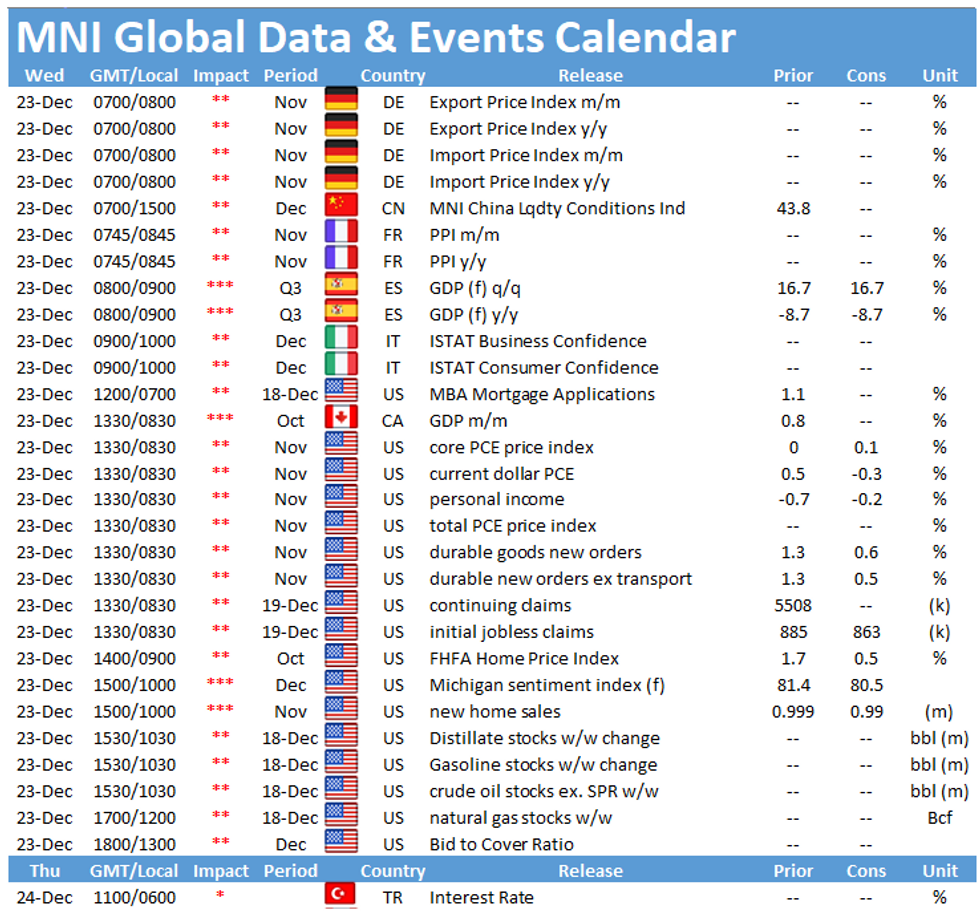

- No react to decent round of data (GDP, Cons Conf, Existing Home Sales), Covid-related headlines tempered slightly by stimulus relief passing Congress late Monday, still await Pres Trump signature today.

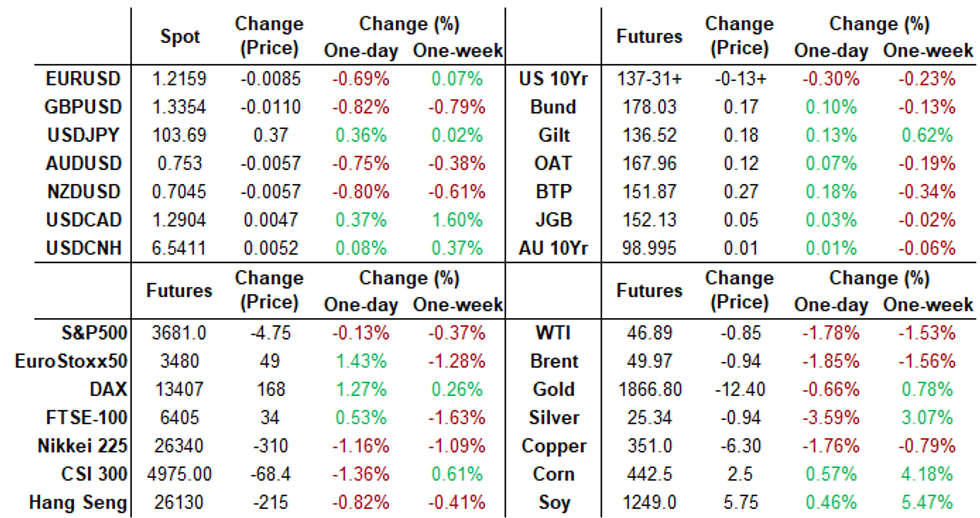

- US Tsy $15B 5Y-TIPS auction re-open (9127962Q1), yields -1.575% (compared to -1.320% prior) vs. -1.545%% WI; 2.86 bid/cover vs. 2.66 prior. The 2-Yr yield is down 0.4bps at 0.1169%, 5-Yr is down 1.8bps at 0.3622%, 10-Yr is down 1.8bps at 0.9164%, and 30-Yr is down 2.3bps at 1.6496%.

MONTH-END EXTENSIONS: Preliminary Bloomberg-Barclays US Month-End Index Extensions

Forecast summary compared to the avg increase for prior year and the same time in 2019. TIPS -0.03Y; Govt inflation-linked, -0.03.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.09 | 0.09 | 0.07 |

| Agencies | 0.06 | 0.06 | 0.09 |

| Credit | 0.06 | 0.09 | 0.07 |

| Govt/Credit | 0.07 | 0.09 | 0.07 |

| MBS | 0.09 | 0.05 | 0.09 |

| Aggregate | 0.08 | 0.08 | 0.06 |

| Long Gov/Cr | 0.07 | 0.09 | 0.06 |

| Iterm Credit | 0.04 | 0.08 | 0.06 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.07 | 0.08 | 0.06 |

| High Yield | 0.08 | 0.08 | 0.09 |

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00050 at 0.08513% (+0.00075/wk)

- 1 Month -0.00200 to 0.14325% (-0.00050/wk)

- 3 Month -0.00675 to 0.23813% (+0.00238/wk)

- 6 Month +0.00225 to 0.26275% (+0.00425/wk)

- 1 Year +0.00475 to 0.33725% (+0.00325/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $145B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.09%, $922B

- Broad General Collateral Rate (BGCR): 0.07%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $329B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchase

- Tsy 20Y-30Y, $1.735B accepted vs. $4.478B submitted

- Next scheduled purchase:

- Wed 12/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Mon 12/28 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- +5,000 Green Jun 96 puts, 6.5 vs. 99.675/0.38%

- -4,000 Blue Mar 92/93 put strips, 9.5

- +4,000 Red Mar'22 100.5 calls, 0.5 (open interest near 42k)

- +2,500 Jun/Sep 97 put spds, 0.25

- +2,000 Red Sep'22 87/93 2x1 put spds

- -40,000 TYH 136.5/137/138 put trees, 6

- 4,000 TYH 136/136.5 put strip, 31-32

- +20,000 FVH 125.75/126/126.25 call trees, 0.5

- 3,500 TYH 138/139 1x2 call spds, 8/64

- 4,500 TYH 138.5 calls 1-2

- +2,500 TYF 138.5 calls, 1

- 1,500 TYF 138.25/TYG 140 call spds, 1 net db/Feb bought over

- -1,000 USG 173 calls, 1-27

EGBs-GILTS CASH CLOSE: And Still We Wait For A Brexit Breakthrough

- Gilt and Bund yields finished near session lows, reversing the rises they incurred by midday. Periphery spreads slightly wider, with the risk tone mixed (equities up but EUR and GBP down).

- Competing headlines on whether the UK and EU were close to agreeing the fishing portion of the deal made up most of the intrigue overnight/this morning. Barnier's brief to ambassadors in the afternoon reportedly portrayed progress but with the two sides remain apart on fish and level playing field provisions.

- Only data Wednesday is Italy confidence; otherwise a quiet slate overall. Brexit and COVID developments likely still the focus.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is unchanged at -0.736%, 5-Yr is down 0.9bps at -0.762%, 10-Yr is down 1.5bps at -0.595%, and 30-Yr is down 2.2bps at -0.198%.

- UK: The 2-Yr yield is down 2.6bps at -0.133%, 5-Yr is down 2.6bps at -0.106%, 10-Yr is down 2.2bps at 0.183%, and 30-Yr is down 2.1bps at 0.733%.

- Italian BTP spread up 0.1bps at 115bps / Spanish bond spread up 0.9bps at 64.5bps

- Portuguese PGB spread up 1.1bps at 63bps

EUROPE OPTIONS SUMMARY: Bund Downside Liquidation

Tuesday's options flow included:

- RXG1 177.50/178.50 c/s vs RXF1 178.50/179.50 c/s sold at 42.5 in 1k (-Feb, +Jan). That's 5k on the day, sold down from 46

- RXG1 177.00/176.00 put spread sold at 25 in 2k (liquidation)

- LF1 100.00^ sold at 5 in 3.5k

- LH1 100.125/100.25 call spread bought for 1 in 2k

- 0LZ1 99.875/99.625 put spread bought for 6 in 6k (d -0.23%, ref 99.965)

- 2LF1 99.875/99.75 1x2 put spread bought for 1 in 3k

- 3LH1 99.75/99.625 put spread vs 2LH1 99.875/99.75 put spread, buys the blue for 0.5 in 3.6k

FOREX: USD Rebounds Further, But No Breakout Yet

The greenback was comfortably the best performer in G10 Tuesday, helping the USD index to recover further off the early December lows at 89.730. There was little sign of a recovery in risk appetite, with US equities sold off the overnight highs to trade lower in cash markets.- GBP had another bumpy session, with the ebb and flow of Brexit headlines still responsible for GBP volatility. GBP/USD initially at and around the Monday highs, but began to sell-off as the EU confirmed it had rejected the latest UK proposals on fisheries, leaving the clock still ticking before any pre-Christmas deal can be struck.

- USD, JPY were the strongest in G10, SEK, NOK and NZD traded poorly.

- Focus turns to Canadian GDP, US durable goods orders, personal income/spending and the early release of weekly jobless claims on Wednesday. There remain no central bank speakers of note.

FX OPTIONS: Expiries for Dec23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2150(E749mln), $1.2200-10(E1.1bln), $1.2240-50(E1.0bln), $1.2275-80(E955mln)

- USD/JPY: Y103.00($1.6bln-USD puts)

- GBP/USD: $1.3600(Gbp638mln)

- EUR/GBP: Gbp0.9145-50(E656mln)

- AUD/NZD: N$1.0700(A$684mln)

EQUITIES: Stocks Come Off Overnight Highs in Pre-Xmas Profit-Taking

After holding their ground in Asia-Pac trade and throughout the European morning, US equity futures gave up gains ahead of the close, prompting the S&P 500 cash to edge lower during the Tuesday session. Communication services and consumer discretionary firms made up the poorest performers on Wall Street, while tech and real estate names traded better.- Support still holds for the e-mini S&P at the 50-dma of 3551.06, but the Monday low should provide some initial support at 3596.00.

COMMODITIES: Soft Risk Sentiment Leads Oil Lower

While equities traded in only minor negative territory, commodities felt the effects of risk-off more broadly, with WTI and Brent crude futures slipping over 1% apiece Tuesday. Nonetheless, the Monday lows were in tact at $46.18 ahead of the close, which could provide some support going forward.- Possibly more notably, Argentinean supply concerns buoyed the Soybean market, with Soy prices hitting new multi-year highs as strike action from soy processors in Argentina and continued dry weather drained supply.

- Lastly, gold prices are lower and below the 50-dma at $1870.20, with the bouncing greenback largely responsible, with the yellow metal failing to benefit from soft risk sentiment.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.