-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI ASIA MARKETS ANALYSIS - Fri Employ Data Welcome Distraction

US TSY SUMMARY: Fri Data Welcome Distraction

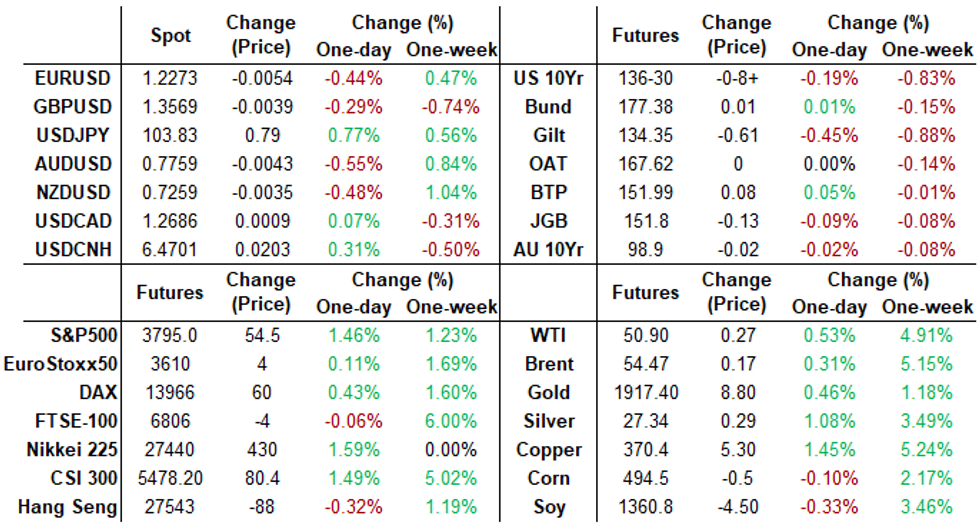

Really Decent volumes on net despite a rather quiet second half, TYH1>1.5M futures. Risk-appetite continued through the session, equities making new all-time highs (ESH1 3803.25), rate futures correspondingly weaker, 10YY tapped 1.08% while curves continued to extend 4+ year highs (5s/30s 141.202H).

- Relative calm after storm following Wed's protestor breach in the Capitol, possibly partially tied to Trump muzzled from social media platforms: Facebook, Twitch, Twitter over accusations of inciting Wed's DC Capitol riots.

- Slow stream of resignations through the day, some cabinet members (Elaine Cho, Mitch McConnel's wife) amid growing chatter of implementing the 25th amendment to remove the president less than 2 weeks before pres elect Biden takes office on Jan 20.

- Focus on Fri's Dec employ data, +50k est, curves extend bear steepening and heavy option positioning for more (Fed BULLARD: EXPECT LONGER-TERM RATES TO RISE AS ECONOMY RECOVERS, Bbg).

- The 2-Yr yield is unchanged at 0.1369%, 5-Yr is up 2.9bps at 0.4545%, 10-Yr is up 3.6bps at 1.071%, and 30-Yr is up 3.2bps at 1.8456%

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00012 at 0.08650% (+0.00887/wk)

- 1 Month +0.00112 to 0.13200 (-0.01188/wk)

- 3 Month -0.00288 to 0.23400% (-0.00438/wk)

- 6 Month -0.00150 to 0.25238% (-0.00525/wk)

- 1 Year +0.00263 to 0.33238% (-0.00950/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $56B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $139B

- Secured Overnight Financing Rate (SOFR): 0.10%, $978B

- Broad General Collateral Rate (BGCR): 0.08%, $361B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $335B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 20Y-30Y, $1.734B accepted vs. $4.851B submission

- Next scheduled purchase:

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- +50,000 short Jun 99.25/100.25 put over risk reversals, 0.5 net. Update on massive buying in Red Mar'22, another 85,000 bought from 99.795 to .805, 150,000 bought last few minutes pushes total volume over 237,000.

- BLOCK, 13,410 short Dec 92/95 put spds, 3.0

- BLOCK, +15,000 Green Jun 93 puts, 3.0

- Overnight trade

- 5,000 Mar 99.81/99.87/99.93 call flys

- 5,000 short Apr 96/97/98 2x3x1 put flys

- 5,500 Blue Feb 98/91 put spds

- 3,000 Green Mar 95/96 put spds

- Mar 99.81/99.88 1x2 call spds and Mar 99.81 calls outright

- +10,000 TYG 136.5/137.5 put over risk reversals, 1 vs. 136-31.5/0.58%

- +5,200 TYG 136.5/137.5 put over risk reversals, 1

- 3,000 FVG 125.5/126 call spds, 14.5

- 3,600 FVH 125/125.25/125.5 put trees, 0.0

- >5,000 FVG 125.25/126 call over risk reversals, 0.5

- -3,500 TYH 135 puts, 8-9

- +5,000 TYG 135/TYH 134 put spds, 2

- 5,000 TYG 138 calls, 4 (total volume >53k)

- +20,000 TYG 137.5/138 1x2 call spds, 2-3

- Block: -45,000 TYG 137 puts, 22/64 vs.

- Block +60,000 TYH 136.5 puts, 29, roll up/out

- +2,000 TYG 137 puts, 21

- 1,500 TYG 136.75/137.25/137.75 put trees

- Overnight trade

- Block, -20,000 TYH 135.5/136/136.5 put trees, 1.0

- -2,000 wk3 TY 137.75/138.25 put spds, 29

- 1,000 USG 138.5/USH 167 put spds

EGBs-GILTS CASH CLOSE: Gilts Weaker, Bunds Weaker On Supply

Thursday saw weakness in Gilts with bear steepening in the curve, though fairly directionless trade in Bunds, with a generally risk-on tone prevailing.

- Another day of large supply weighed on EGBs in the morning with France and Spain selling a combined EUR17bn of bonds/linkers at auction. Periphery spreads little changed.

- Strong German factory data this morning, with Eurozone/Italy inflation largely in line. Friday sees Eurozone industrial production data. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.2bps at -0.704%, 5-Yr is down 0.5bps at -0.734%, 10-Yr is down 0.2bps at -0.522%, and 30-Yr is up 0.6bps at -0.131%.

UK: The 2-Yr yield is down 0.1bps at -0.135%, 5-Yr is up 2.2bps at -0.056%, - UK: The 2-Yr yield is down 0.1bps at -0.135%, 5-Yr is up 2.2bps at -0.056%, 10-Yr is up 4.1bps at 0.284%, and 30-Yr is up 5bps at 0.873%.

- Italian BTP spread down 0.7bps at 108bps

- Spanish bond spread unchanged at 56.6bps

EUROPE OPTIONS: Summary

- Mostly Sterling Upside:

- RXG1 179.5/180.5cs, bought for 3.5 in 3k

- RXG1 177.5/176.5ps, sold at 32.5 in 5k, Likely profit taking

- RXG1 177/176/175/174 p condor, sold at 21.5 in 1k

- RXH1 179c, bought for 28 in 5k

- DUG1 112.30/112.20ps trades 3.5 in 6k

- LH1 100.12/100.25cs, bought for 1.25 in 1.5k and 3k

- LM1 100.12/100.25cs x3 vs 100.00p, bought the cs for 3.5 and 3.75 in 21k x 7k (ref 100.05)

- LM1 100.25/100.375 call spread bought for 1 in 4k

- LM1 100.12/25/37c ladder, bought for 1.5 in 5k

- LU1 100.12/100.00/99.87p fly 1x3x2 sold at 1 in 2k

- 0LM1 100.25/100.375/100.50/100.625 call condor bought for 1 in 3k

FOREX: Dollar Stages Tepid Bounce Off Multi-Yr Low

After hitting a new multi-year low yesterday, the dollar bounced slightly Thursday, prompting a minor uptick in the USD index to the best levels since late December. The bounce, so far, has been insufficient to prompt any sort of trend reversal, but the greenback did see some stiff support as US equity markets once again hit alltime highs. Confirmation from US President Trump that he will oversee an orderly handover of power on January 20th followed the final hurdle being removed from President-Elect Biden also helped support the greenback.

- The risk-on theme elsewhere was reinforced by the Japanese Ministry of Finance stating they would work with the central bank in order to prevent disorderly strengthening of the JPY - leading the Japanese currency to be the weakest performer in G10 Thursday.

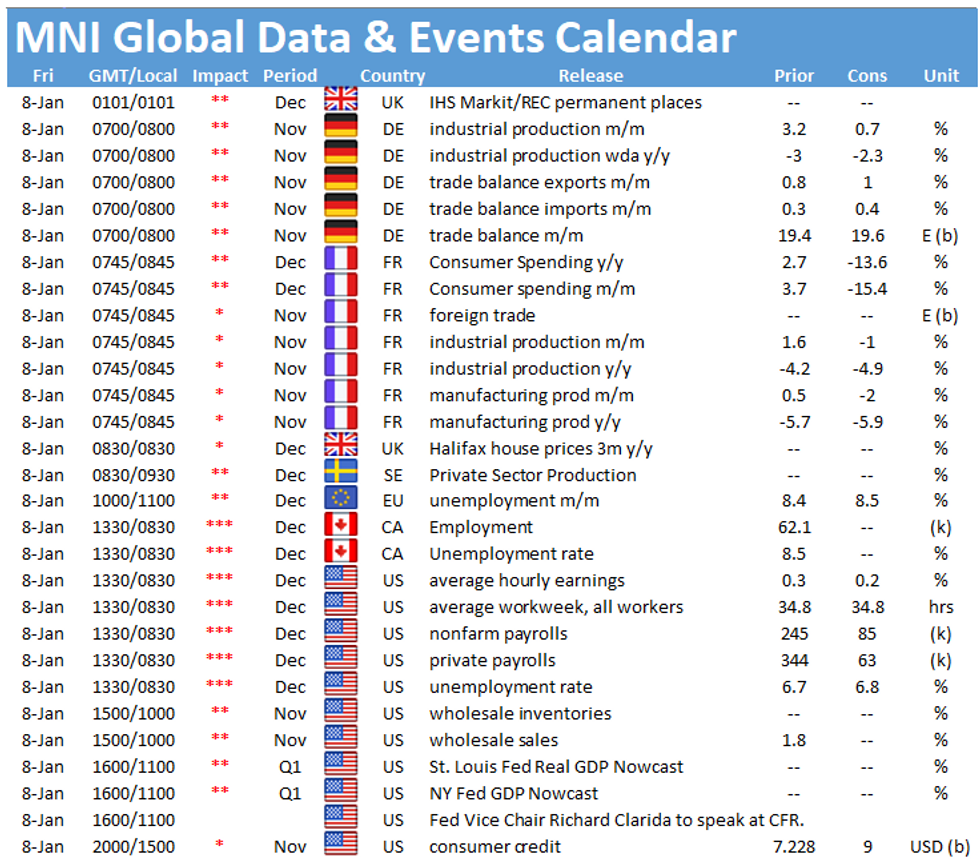

- Focus Friday turns to the US jobs report, with the US seen adding around 50k jobs in the month of December - the lowest since COVID crisis struck in early 2019. Canadian jobs data also crosses.

FX OPTIONS: Expiries for Jan 8 NY Cut 1000ET (Source DTCC)

- EUR/USD: Jan11 $1.2095-1.2110(E1.6bln), $1.2295-1.2300(E3.8bln-EUR puts), $1.2310-15(E2.1bln-EUR puts); Jan12 $1.2200(E1.3bln-EUR puts), $1.2300(E1.9bln)

- USD/JPY: Jan12 Y104.00($1.2bln-USD puts); Jan13 Y103.00($1.4bln), Y104.00-15($1.2bln)

- GBP/USD: Jan11 $1.3700-15(Gbp1.2bln-GBP puts); Jan12

- $1.3995-1.4000(Gbp986mln-GBP puts)

- AUD/USD: Jan11 $0.7625(A$1.2bln-AUD puts), $0.7724-25(A$1.3bln-AUD puts)

PIPELINE: Over $75B High Grade Debt Issued First Wk 2021

- * Date $MM Issuer (Priced *, Launch #)

- * 01/07 $3.5B #World Bank (IRBD) $2.35B 2Y FRN SOFR+13, $1.15B 2027 Tap SOFR+34

- * 01/07 $3B #Standard Chartered $1.5B 4NC3 +89, $1.5B 6NC5 +100

- * $12.9B Priced Wednesday; $66.8B/wk

- * 01/06 $4B *ADB 10Y +15

- * 01/06 $3B *Toyota Motor Cr $1B 3Y +25, $750M 3Y FRN SOFR+33, $700M 5Y +40,

- $550M 10Y +62.5

- * 01/06 $2.25B *BNP Paribas 6NC5 +90

- * 01/06 $2B *Kommunalbanken 5Y +9

- * 01/06 $1B *AerCap Ireland 5Y +155

- * 01/06 $650M *Ares Capital +5Y +180

EQUITIES: Stocks All-Time Highs, Banks Lead

Equity markets in the US surged further Thursday after President Trump confirmed he would oversee an orderly transition of power to the Biden administration on January 20th, despite his protests that the election was rigged. Risk-on was evident from the off, with the e-mini S&P hitting new all time highs shortly following the cash open.

- The financials sector was an early beneficiary, with the likes of Citigroup, Bank of America and JPMorgan rising as much as 3%. Tech names and consumer discretionary firms also traded well, while utilities and consumer staples were the sole sectors in the red.

COMMODITIES: Gold, Silver Retreat On US$ Strength

Despite the USD index hitting the lowest levels in over two years yesterday, the index bounced modestly Thursday to keep commodities under pressure and weigh on both gold and silver. The losses were manageable, with price contained to recent ranges.

- Oil markets made furtive gains, outperforming despite the firmer greenback. WTI and Brent crude futures made minor gains but did manage to hit new post-COVID cycle highs. WTI now targets the late February 2020 highs at $54.50 over the short-term.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.