-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Resign Vs. Impeach; Stimulus Talk

US TSY SUMMARY: Choppy Day

Another day in the rearview after the midweek political mayhem that surrounded the DC siege, market attention turned to more prosaic matters of employment figures, economic outlooks and a debate over additional stimulus.

- Alright, there was a persistent droning debate over removing Trump from office by impeachment, the 25th amendment or by resignation through the day -- but focus was more on the much weaker than expected Dec NFP -140k vs +50k est.

- Rates gapped bid but just as quickly reversed/extended lows as focus on large upward revisions to Oct (+645k) and Nov (+336K) kicked off much better selling pressure w/over 90,000 TYH1 from 136-25 to -22. More chop on Dec headline miss, dampening prospect of carry-over surge in early 2021 was dampened by Fed VC Clarida expecting "brighter economic outlook" later in yr and beyond.

- Heavy volumes, rates clawed off midday lows as equities reversed/traded weaker as D-WV Manchin expressed opposition to $2k stimulus. Late headlines that Pres elect Biden will sketch out another economic relief package next wk helped stocks recover late.

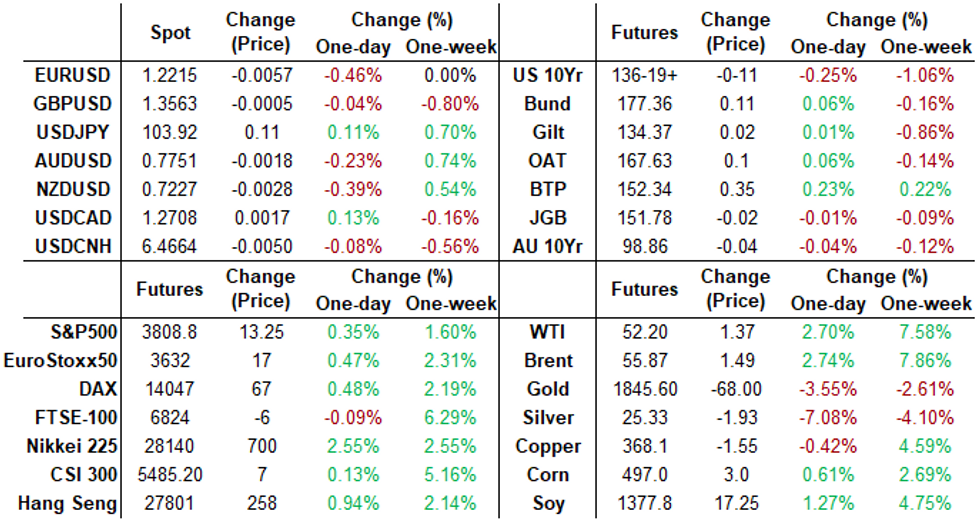

- The 2-Yr yield is unchanged at 0.1369%, 5-Yr is up 2.7bps at 0.4865%, 10-Yr is up 3.9bps at 1.1187%, and 30-Yr is up 2.3bps at 1.8761%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00000 at 0.08675% (+0.00912/wk)

- 1 Month -0.00625 to 0.12638 (-0.01750/wk)

- 3 Month -0.00037 to 0.22438% (-0.01405/wk)

- 6 Month -0.00475 to 0.24650% (-0.01113/wk)

- 1 Year +0.00038 to 0.32963% (-0.01225/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $59B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $142B

- Secured Overnight Financing Rate (SOFR): 0.10%, $951B

- Broad General Collateral Rate (BGCR): 0.08%, $361B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $340B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 0Y-2.25Y, $12.801B accepted vs. $37.746B submission

- Next week's scheduled purchases:

- Mon 1/11 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Tue 1/12 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options- +10,000 Red Dec'22 90 puts, 3.0

- +5,000 Green Jun 93 puts, 4.0

- Block, +30,000 Blue Mar 88/96 put over risk reversals, 1.0 vs. 99.30-.305/0.10%

- (recap put skew plays since last week: +50k short Jun 99.25/100.25 put over risk reversals, 0.5 net Thu; +50k Green Mar 92/100.2 put over risk reversals 0.25 net last wk)

- Overnight trade

- 5,000 Blue Mar 92/95 2x1 put spds,

- 2,000 Blue Feb 91/92/93 2x3x1 put flys

- +3,000 Mar 99.75/99.81 put spds, 1.0

Treasury Options

- 2,000 TYG 136.75/137.5 1x3 call spds, 6 vs.

- 2,000 TYG 136/136.75 3x1 put spds, 1 2-leg over

- 2,000 TYG 136.75 straddles vs.

- 6,000 TYG 136/137.5 strangles

- 6,600 TYH 135/136 put spds, 13

- -3,500 TYH 137.5 puts, 103

- -7,000 TYH 136.5 puts, 33

- 23,000 TYH 135.5 puts, 15

- Overnight trade

- Block, +20,000 TYG 138.5 calls, 2

- 13,000 TYH 136 puts, 21-23

- +8,000 TYH 137.5 calls, 21-22

- 6,700 TYH 138 calls, 13

EGBs-GILTS CASH CLOSE: BTP Yield Touches New All-Time Low

While Bunds and Gilts traded with little direction, BTPs were the star of the session, with the 10-Yr yield touching a fresh all-time low of 0.504% before retracing higher.

- A fairly constructive if largely uneventful morning session (no 1st tier data. no issuance and no speakers) ahead of US Nonfarm payrolls. While we saw some knee-jerk downside price action on the latter, ultimately Gilts and Bunds settled in ranges.

- The ECB speaker slate is a little more active next week, with Lagarde among others appearing. Plenty of supply too, including the UK, EFSF, Netherlands, Austria, Germany, Portugal, and Italy.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.3bps at -0.701%, 5-Yr is up 0.4bps at -0.73%, 10-Yr is up 0.3bps at -0.519%, and 30-Yr is up 0.5bps at -0.126%.

- UK: The 2-Yr yield is up 0.7bps at -0.128%, 5-Yr is up 1.2bps at -0.044%, 10-Yr is up 0.4bps at 0.288%, and 30-Yr is down 0.3bps at 0.87%.

- Italian BTP spread down 3bps at 105bps / Spanish down 0.6bps at 56bps

EUROPE OPTIONS: Summary

Bund And Schatz In Decent Size; Friday's options flow included:

- RXH1 175.5p/179.5c, sold at 42 in 10k

- DUG1 112.20/112.00ps, bought for 0.75 in 15k

- DUG1 112.30/20/00p fly, sold at 2.5 in 2.5k

- 0RH1 100.50/37ps, bought for 1 in 8k

- 3RM1 100.37/100.25ps vs 100.50/100.62cs, bought the ps for 0.25 and 0.5 in 5k

- 3RM1 100.00/99.875 put spread bought for 0.5 in 5k (v 100.375)

- LM1 100.12/100.25/100.37c fly, bought for 1.5 in 2k

- LM1 100.00/100.12cs 1x2, sold the 1 at 0.25 in 2.5k

- 0LH1 100.12/100.25cs, bought for 1.5 in 2k

- 0LF1 100.125 call sold at 0.25 in 7k

- 2LM1 99.50p, bought for 1 in 4k (ref 99.88 LH3)

- LH1 100/100.12cs + 100.25/100.50cs + 100.37/100.50 vs LM1 100.12/100.37/100.62c fly, bought the M1 for flat in 10k

FOREX: US$ Mixed As Market Looks Through NFP

The headline change in nonfarm payrolls missed expectations, although once net revisions were factored in the release was broadly inline with market expectations. As a result, markets looked through the December NFP release, with more focus resting on Biden's looming inauguration on January 20th and the continued upside in US equities.

- The USD traded mixed, with the EUR one of the poorest performers and GBP among the strongest. USD/JPY finished the week particularly well, extending the recovery off Wednesday's 102.59 low. The pair is testing the 50-day EMA at 103.97. A break and close above would strengthen S/T bullish conditions and signal scope for stronger rally.

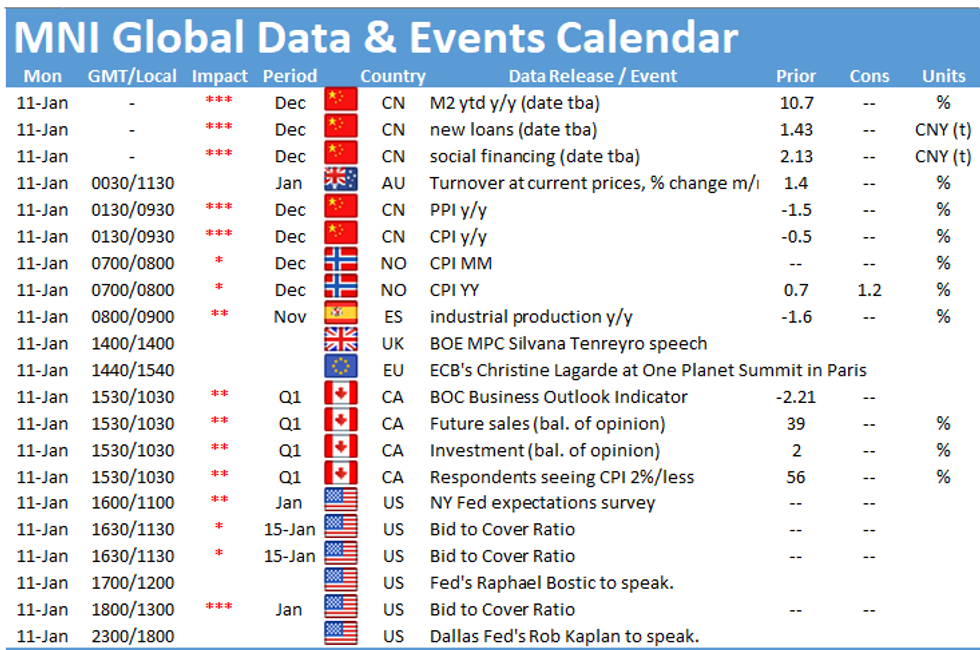

- Various inflation gauges take focus in the coming week, with CPI & PPI data due from China, Japan and the US. The central bank speakers schedule will also be of interest, with notable speeches including BoE's Tenreyro on negative rates, ECB's Lagarde, Fed's Powell and Fed's Clarida on the topic of the new Fed framework.

FX OPTIONS: Expiries for Jan 11 NY Cut 1000ET (Source DTCC)

- EUR/USD: Jan12 $1.2200(E1.3bln-EUR puts), $1.2250(E1.3bln-EUR puts), $1.2300(E2.1bln)

- USD/JPY: Jan12 Y104.00($1.2bln-USD puts); Jan13 Y103.00($1.4bln), Y104.00-15($1.2bln)

- GBP/USD: Jan12 $1.3995-1.4000(Gbp986mln-GBP puts)

PIPELINE: Strong Start For 2021 With Near $75B Issuance

- Date $MM Issuer (Priced *, Launch #)

- $7.25B Priced Thursday; $74.05B/wk

- 01/07 $3.5B *World Bank (IRBD) $2.35B 2Y FRN SOFR+13, $1.15B 2027 Tap SOFR+34

- 01/07 $3B *Standard Chartered $1.5B 4NC3 +89, $1.5B 6NC5 +100

- 01/07 $750M *Northwestern Mutual Global Funding 5Y +38

- $12.9B Priced Wednesday; $66.8B/wk

- 01/06 $4B *ADB 10Y +15

- 01/06 $3B *Toyota Motor Cr $1B 3Y +25, $750M 3Y FRN SOFR+33, $700M 5Y +40, $550M 10Y +62.5

- 01/06 $2.25B *BNP Paribas 6NC5 +90

- 01/06 $2B *Kommunalbanken 5Y +9

- 01/06 $1B *AerCap Ireland 5Y +155

- 01/06 $650M *Ares Capital +5Y +180

EQUITIES: Unwinding Early Strength

US markets traded mixed Friday, with the Dow Jones edging off early gains to finish lower while the S&P 500 held recent gains. All three major US indices traded well following the cash open but sporadic and reportedly programmatic sales worked against headline indices as strength faded into the close.

- The e-mini S&P hit new all-time highs ahead of the cash open at 3817.75, securing a near 4% rally from the Monday lows.

- Communication services and financials were the laggards, countering upside in consumer discretionary and real estate firms.

COMMODITIES: Gold Hit Hard As Support Gives Way

Despite softer equity markets into the Friday close, Gold came under considerable pressure throughout the day as several key technical supports gave way. Both the 100- and 50-dmas gave way ahead of the close, exposing the key support at the 1838.66 200-dma. Treasury yields remain a key driver for metals at this point, with the rise above 1% in 10y US yields still a focus for precious metals markets.

- Both WTI and Brent saw further support into the Friday close as both contracts hit the best levels since February last year. February highs at $54.50 remain the short-term target for WTI.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.