-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Biden Admin Take Reins Next Week

US TSY SUMMARY: Risk-Off Ahead Extended Holiday Weekend

Rates firmer after the bell Friday, near the mid-session range, a mild risk-off tone with equities weaker but off lows (ESH1 -20.0).

- Underscoring tone: heavy first half data included ugly Dec Retail Sales (-0.7% vs. 0.0% est) combined w/ other poor data this wk including jobless claims, suggests that economic activity at the end of the year was weaker than expected.

- Moderate volumes (TYH1>1.22M) two-way with better buying from prop and real$ in belly to long end earlier. Second half much more subdued as US accts looked forward to extended three-day holiday weekend ahead next week Wednesday inauguration for President-elect Biden.

- Ongoing headline risks: threat of violent protest in state capitols across the US not just DC, Covid items: vaccine inventory concerns weighed on equities (as did bank shares after earnings started to roll).

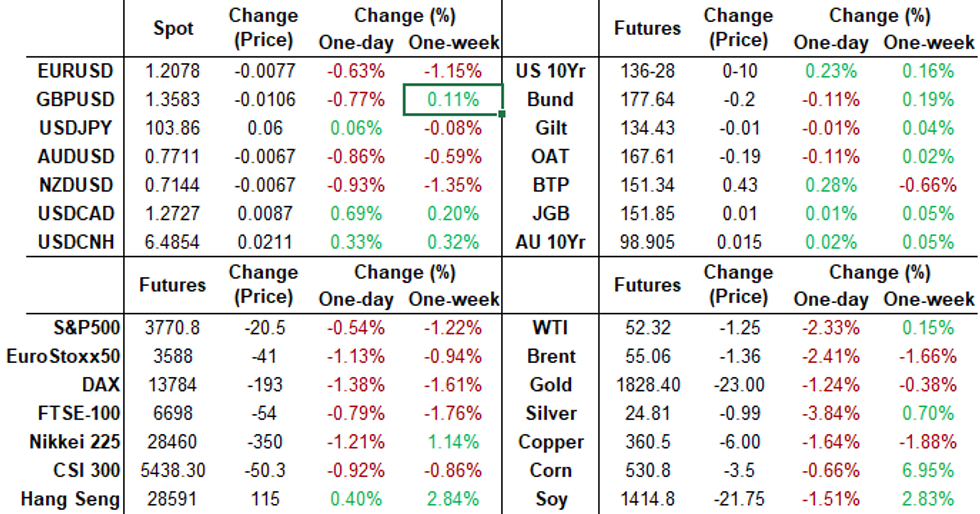

- The 2-Yr yield is down 0.4bps at 0.135%, 5-Yr is down 3bps at 0.4533%, 10-Yr is down 3.4bps at 1.0954%, and 30-Yr is down 2.3bps at 1.8493%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00012 at 0.08663% (-0.00012/wk)

- 1 Month +0.00062 to 0.12950% (+0.00312/wk)

- 3 Month -0.00225 to 0.22338% (-0.00100/wk)

- 6 Month -0.00312 to 0.24813% (+0.00163/wk)

- 1 Year -0.00312 to 0.32263% (-0.00700/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $150B

- Secured Overnight Financing Rate (SOFR): 0.08%, $887B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $321B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $36.688B submission

- Next week's scheduled purchases:

- Tue 1/19 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/20 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 1/21 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 1/22 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options- +5,000 Green Mar 97/98 call spds, 1.75

- +8,500 Blue Feb 85/88 put spds, 0.5

- +5,000 Blue Mar 88/92 2x1 put spds, 4.5

- +5,000 Blue Mar 88/90 put spds, 1.0

- Overnight trade

- BLOCK, -15,000 long Green Sep 95 calls, 17.5 adds to -70k (30k blocked_ 16-16.5/wk

- 5,600 Blue Sep 91/92/93 call flys

- +6,000 FVH 125.25/125.75 2x1 put spds, 4-4.5

- 2,000 TYH 139 calls

- +5,000 wk5 TY 136.25/137.25 1x2 call over risk reversals, 5 net/screen

- over 7,100 FVH 125.25 puts

- Overnight trade

- Block 10,000 TYH 137.5/138 call spds, 7

- 10,000 TYH 138 calls outright, 7

- 3,000 TYG 134/TYH 133.5 put spds

- 3,000 TYG 135.5/136 put spds, 3

EGBs-GILTS CASH CLOSE: Attention Turns To Next Week Events

The UK and German curves steepened over the course of Friday's session, reversing initial flattening. BTP spreads reversed most of Thursday's widening, with attention on Tuesday's Senate confidence vote that could decide the fate of the Conte government.

- Stronger-than-expected UK GDP numbers added to the negative Gilt tone on the open, but apart from that there was little in the way of market-moving macro events / data / speakers.

- Ratings reviews of the UK and Finland after hours Friday of some note.

- Next week to see an estimated E21.5bln in EGB auctions, plus syndications (possibly Greece; while the EU has issued an RFP for its SURE bond).

- We also get the ECB Governing Council meeting next Thursday. Closing Cash levels:

- German 2Y Yld +0.7bps at -0.72%, 10-Yr +0.7bps at -0.543%, 30-Yr +1.3bps at -0.133%

- UK 2Y Yld -1.4bps at -0.134%, 10-Yr -0.3bps at 0.288%, 30-Yr +0.3bps at 0.868%

- Italy/German 10-Yr Spread 3.6bps tighter at 115.7bps

EUROPE OPTIONS:

- Still Dominated By Stg Mid Structures. Friday's options flow included:

- DUG1 112.20/112.30/112.40 call fly sold at 5.5 in 1.1k

- DUG1 112.30/112.40/112.50 call fly sold at 2.5 in 1.25k

- DUH1 112.20/112.10 put spread bought for 1 in 2k

- DUH1 112.20/112.30/112.40 call fly bought for 3.5 in 1.5k

- RXG1 177.00/176.50/176.00 put ladder bought for 6 in 1k

- RXH1 180.50/182.50 call spread bought for 6.5 in 2k

- LH1 100.00 call (v 99.995) sold at 2.5 in 6k

- LZ1 99.875/100.00/100.125 call fly bought for 3.75 in 2.5k

- 0LH1 100.00/100.125 call spread sold at 2.25 in 16k

- 0LH1 100.00/100.125 1x2 call spread bought for 1.25 in 5.5k

- 0LH1 100.125/100.00/99.875 1x3x2 put fly (v 99.975), sold at 0.75 in 10.5k

- 0LJ1 100.00/100.125/100.25 call ladder bought for 2 in 3k

- 0LM1 100.00/99.875 1x2 put spread + 0LU1 99.875/99.75 1x2 put spread, strip bought for 3 in 8k

- 0LM1 100.00/99.75 put spread (v 99.955) bought for 9.25 in 10.5k

- 0LU1 99.875/99.75 1x2 put spread bought for 0.5 in 2k

- 0LU1 99.875/99.75/99.625 1x3x2 put fly, buys the wings for 0.5 in 8k

FOREX: Haven Currencies Make Some Headway

Friday was a broadly risk-off session, with equities soft, bonds strong and haven currencies in demand. The greenback and the JPY were the firmest currencies across G10, with markets responding to reports of fractures in the Pfizer/BioNTech supply chain, poorly received earnings from some of the US' largest banks and a lower-than-expected deluge of US data.

- USD, JPY strength resulted in EUR/USD hitting new multi-week lows, just to find some support at the 1.2082 50-dma and sent AUD/JPY lower by as much as 1.3% from the day's high. Commodity tied FX traded poorly, with AUD, NZD and NOK all suffering.

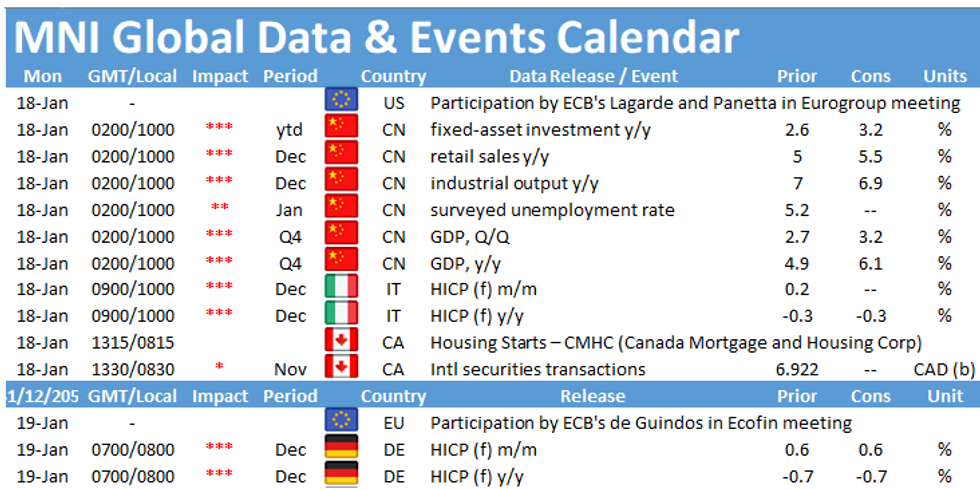

- Focus in the coming week remains on US earnings season, with reports due from some of the largest US banks as well as Netflix, UnitedHealth and IBM. The week should start slowly with a US public holiday Monday before central banks take focus. Decisions are due from the BoC, ECB and Norges Bank.

FX OPTIONS: Expiries for Jan 18 NY Cut 1000ET (Source DTCC)

- EUR/USD: $1.2080-00(E889mln)

- EUR/GBP: Gbp0.8840-50(E730mln)

- AUD/USD: $0.7345(A$836mln)

PIPELINE

$57.64B Running total issuance for week; $131.69B/month

- Date $MM Issuer (Priced *, Launch #)

- 01/15 $1B Nederlandse Waterschapsbank (NWB) 2Y +2

- $9B Priced Thursday

- 01/14 $3.25B *Oman $500M 2025 Tap 4.45%, $1.75B 10Y 6.25%, $1B 30Y 7.25%

- 01/14 $2.5B *Pioneer Natural $750M 3NC1 +55, $750M 5Y +65, $1B 10Y +105

- 01/14 $1.25B *Nationwide Building Society 3Y +37

- 01/14 $1B *EIB 5Y FRN SOFR+20

- 01/14 $500M *American Assets Trust 10Y +237.5

- 01/14 $500M *Public Storage WNG 5Y +43

EQUITIES: Stocks Sour Friday, Banks Hit Hard

A poorly-received set of earnings from Wells Fargo, Citigroup and JP Morgan sent US bank shares lower Friday, with a coinciding drop in commodities also hitting the energy, materials sectors. This dragged the e-mini S&P lower by close to 20 points, opening further the gap with all-time highs printed just a few weeks ago. The 50-dma undercuts as support at 3663.70.

- Focus remains on earnings, with the likes of Goldman Sachs, Morgan Stanley, Proctor & Gamble, Netflix, Bank of America and others all crossing in the coming week.

COMMODITIES: Oil Slips On Risk-Off, Stronger Dollar

WTI and Brent crude futures retreated further from the cycle highs printed earlier in the week as a broad risk-off theme developed, with equities and growth proxy currencies all suffering Friday.

- WTI and Brent slipped well over 2% apiece, relieving some of the overbought conditions that had been present on the recent march higher.

- Despite the risk-off theme, precious metals also fell, with USD strength over-riding any safe haven support. A close below the 1843.46 200-dma for gold would be the first since late November - a bearish sign for the yellow metal.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.