-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Biden Bid? Tsys And Equities Gain

US TSY SUMMARY

Rates reversed early losses, finished near modest session highs Wednesday, even as equities climbed to new all-time highs, ESH1 3850.0. Relative modest volumes and quiet trade as markets preoccupied with President Biden/VP Harris inauguration, a seemingly all-day affair that started with Pres Trump's early WH exit.

- Decent volumes on two-way trade in the first half gave way to better buying in the lead up to the US Tsy 20Y Bond auction re-re-open, long end extending session highs briefly. Pick-up in corp debt issuance, return of domestic banks generated two-way hedging.

- Rates gapped lower after weak auction: US Tsy $24B 20Y bond auction re-re-open (912810ST6) tailed 1.2bp: high yield of 1.657% (1.470% last month) vs. 1.645% WI, on a bid/cover 2.28% (2.39% previous).

- Heavy second half selling in Eurodollar lead quarterly futures -60k EDH1 at 99.81(-0.005); Block: 10,000 Green packs (EDH3-EDZ3), -0.0075 at 0914:10ET, paper focus on sector since late 2020. 10k Old Red packs (EDZ2-EDU3) blocked last Friday while option accounts have been building large rate hike insurance positions via buying puts

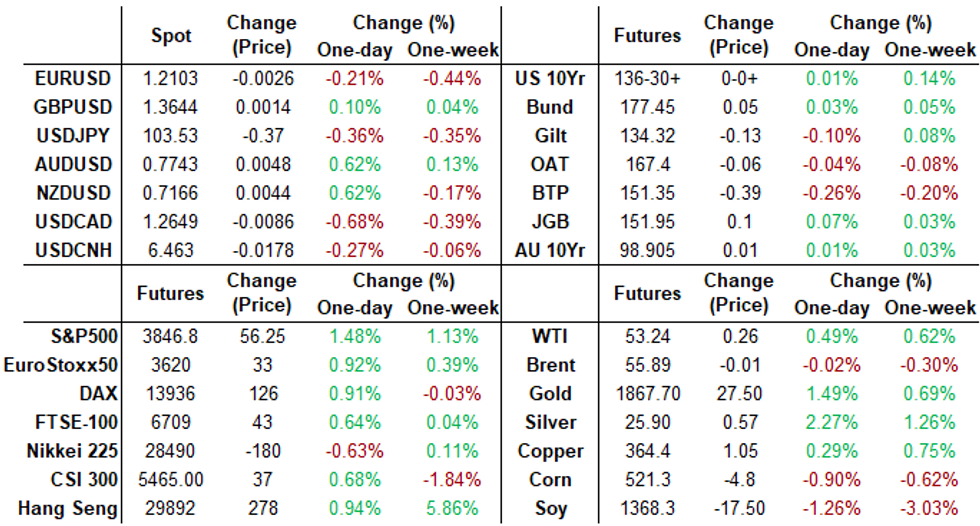

- The 2-Yr yield is down 0.4bps at 0.127%, 5-Yr is up 0.2bps at 0.447%, 10-Yr is down 0.2bps at 1.087%, and 30-Yr is up 0.5bps at 1.8388%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00150 at 0.08663% (+0.00000/wk)

- 1 Month -0.00100 to 0.12850% (-0.00100/wk)

- 3 Month -0.00125 to 0.22238% (-0.00100/wk)

- 6 Month +0.00200 to 0.23788% (-0.01025/wk)

- 1 Year +0.00425 to 0.31725% (-0.00538/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $61B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $162B

- Secured Overnight Financing Rate (SOFR): 0.07%, $936B

- Broad General Collateral Rate (BGCR): 0.05%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $323B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.401B accepted vs. $7.983B submission

- Next scheduled purchases:

- Thu 1/21 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 1/22 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- -11,000 Mar 81 straddles from 3.25-3.0

- -5,000 Red Dec'22 96 puts, 7.0

- Overnight trade

- 9,000 Green Jun 92 puts, 1.0

- Block, 5,000 Blue Apr 90/91/92/95 broken call condors, 2.0 w/another 16k on screen

- +6,200 Blue Jun 90/91/92/95 broken call condors, 0.5

- 2,100 Blue Jun 88/91 put spds, 5.5

- 1,100 Blue Mar 90/95 strangles, 2.0

- -2,000 TYJ 134.5/137 strangles, 36

- -5,000 TYH 136 puts, 11

- -2,000 USH 163 puts, 6

- 5,280 wk5 TY 135.5/136.5 put spds vs. TYH 135/136.5 put spds

- Overnight trade

- Block, +10,000 TYJ 133.5/138 put over risk reversal, 6 vs. 6,000 FVH 125-24.75

EGBs-GILTS CASH CLOSE: BTP Retrace, ECB Eyed Thursday

BTPs were the focal point again Wednesday, with spreads widening in a "buy the rumour, sell the fact"-type move following PM Conte's successful survival of confidence votes Monday and Tuesday.

- Bunds saw little movement, while Gilts underperformed amid bear steepening. Before the open, UK Dec inflation data surprised to the upside.

- Though no change is expected, ECB decision/presser is the focal point Thursday; contact us if you haven't seen the MNI Preview. We also get supply from Spain, France, and the UK. Closing levels/10-Yr Periphery EGB spreads/Bunds:

- Germany: The 2-Yr yield is down 0.3bps at -0.71%, 5-Yr is down 0.6bps at -0.722%, 10-Yr is down 0.3bps at -0.529%, and 30-Yr is down 0.4bps at -0.118%.

- UK: The 2-Yr yield is up 1bps at -0.117%, 5-Yr is up 0.8bps at -0.033%, 10-Yr is up 1.2bps at 0.301%, and 30-Yr is up 2.2bps at 0.881%.

- Italian BTP spread up 3.4bps at 114.8bps / Spanish spread up 0.9bps at 60.4bps

EUROPE OPTIONS: 100K Red Sep Sterling Puts Catch The Eye

- Wednesday's options flow included:

- RXH1 177/176ps, sold at 30 in 3.1k

- RXH1 177.5/178.5cs 1x1.5 trades 23 in 1.5k

- 3RM1 100.375/100.25 put spread (+) vs 100.50/100.625 call spread (-), bought for 1 in 3k

- LH1 100^, sold at 5.25 in 4k

- LU2 99.00 puts bought for 2.75 in 100k

- 3LH1 99.625p, bought for 2.75 in 4k

- 3LH1 99.75p vs 2LH1 99.87p, bought the blue for 1.75 in 4k

FOREX: Haven FX Hit as Biden Assumes Office

Haven currencies were sold Wednesday, with CHF, USD and JPY trading poorly as equities globally rallied in response to the smooth inauguration of Joe Biden as the 46th President of the US.

- EUR also traded poorly, undoing much of the Tuesday rally to zero in on the week's lows at 1.2054, but a resumption of USD weakness kept the technical picture in tact. Nonetheless, the bearish risk clearly remains present, allowing overbought conditions to unwind.

- While the Bank of Canada kept rates unchanged, CAD managed to hit new multi-year highs vs. the USD at 1.2606 as the Bank declined to utilise any form of 'micro' cut to interest rates to manage policy. The Bank also appeared upbeat on growth in the second half of 2021, leaving unchanged as the most likely path for policy at this juncture.

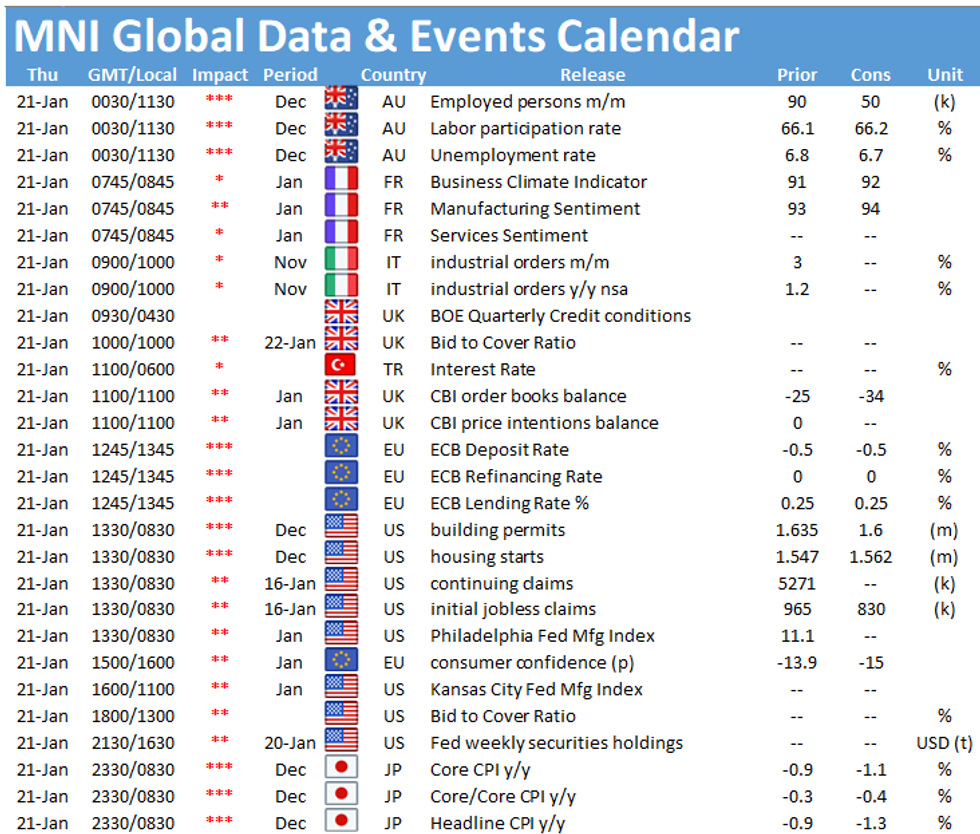

- Focus Thursday turns to Australia's December jobs report, weekly US jobless claims data and central bank decisions from Japan, Indonesia, the Eurozone, South Africa and Turkey.

FX OPTIONS: Larger Option Pipelines

- EUR/USD: Jan22 $1.2275(E1.95bln); Jan25 $1.22430-40(E1.2bln-EUR puts); Jan27 $1.2250(E1.45bln)

- USD/JPY: Jan22 Y103.30-50($1.3bln)

- USD/CHF: Jan29 Chf0.8800($1.3bln)

- AUD/USD: Jan25 $0.7550(A$2.8bln), $0.7650(A$1.4bln); Jan27 $0.7500(A$1.2bln)

- USD/CNY: Jan25 Cny6.57($1.0bln)

PIPELINE: Domestic Bank Issuance Returning

- Date $MM Issuer (Priced *, Launch #)

- 01/20 $7.5B #Morgan Stanley $3B 3NC2 +40, $2.5B 11.25NC10.25 fix/FRN +85, $2B 31NC30 fix/FRN +97

- 01/20 $5.5B #Goldman Sachs $2.25B 2NC1 +35, $750M 2NC1 FRN SOFR+41, $2.5B 11NC10 fix/FRN +90

- 01/20 $3B *Asia Infrastructure Inv Bank (AIIB) 5Y +6

- 01/20 $2.45B #Panama 2032 tap +112, 2060 tap +155

- 01/20 $2B *Gazprom 8Y 2.95%

- 01/20 $2B #Kingdom of Bahrain $500M 7Y 4.25%, $1B 12Y 5.25%, $500M 30Y 6.25%

- 01/20 $1B *QNB Finance (Qatar National Bank) 5Y +95

- 01/20 $450M *Korean Southern Power 5Y +40

- Next on tap:

- 01/21 $1B Kommunekredit WNG 5Y +9

- 01/21 $1B Canada Pension Plan Inv Brd (CPPIB) 10Y +25a

- 01/21 $Benchmark European Bank for R&D (EBRD) 5Y +5a

- 01/?? $Benchmark SK Innovations 3Y +150a, 5Y +175a

EQUITIES: All-Time Highs On 46's First Day

Equity markets welcomed the smooth inauguration of Joe Biden as the President of the United States, hitting new all time highs in the process. The S&P 500 rallied to just shy of the 3,850 mark, with communication services and real estate sectors the main beneficiaries. Netflix performed particularly well, adding over 15% (near $40bln in market cap) after beating expectations on post-market earnings Tuesday.

- European markets lurched higher alongside their US counterparts, with core European indices rising as much as 0.8%. Italian stocks outperformed, rising over 1% as the political crisis evident earlier in the week continued to abate.

COMMODITIES: WTI, Brent Make Progress W/USD Decline

Both WTI and Brent crude futures traded well Wednesday, notching up gains of close to 1% as the USD traded soft. The rally in WTI stopped just short of the cycle highs printed on Jan13 at $53.93, with the price action capped ahead of that level.

- Both gold and silver traded well despite strength in global equity markets. Both metals added over 1% apiece, allowing spot gold to break north of the 50-dma resistance that had successfully contained price action this week at $1,860.19.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.