-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI ASIA MARKETS ANALYSIS - US Stimulus May Be Less Than Hoped

US TSY SUMMARY:

Tsy futures traded firmer into the closing bell -- catching a bid as Pres Biden talks to nation over relief plan. Note MNI story broke at same time:

- MNI EXCLUSIVE: Biden's Relief Plan Likely To Be Slimmed To $1T

- Early session: Intermediates to long end drew quick selling after better than expected MFG (59.1 vs. 56.5 est) and Services PMI (57.5 vs. 53.4 est), equities inched off lows as risk-on tone gained slightly. Yield curves flattening after climbing to new 4+ year highs yesterday.

- That said, there were heavy Tsy steepener blocks crossed on the day in 5s30s (27,575 FVH vs. 3,000 USH) and 2s/ultra-10s (19,258 TUH vs. 5,620 UXYH) around midmorning.

- Eurodollar futures saw ongoing heavy Blocks: 10,000 2Y bundles (EDH1-EDZ2, Whites through Reds) +0.0025 from 0926-0929ET, adds to late Thu: Blocks 12,500 2Y Bundles (White+Reds or EDH1-EDZ2), +0.0075; and 7,500 White packs (EDH1-EDZ1) crossed at 0.0075. may be related to talk ICE will annc end of LIBOR date early next week.

- The 2-Yr yield is up 0.4bps at 0.123%, 5-Yr is down 1.4bps at 0.4311%, 10-Yr is down 2bps at 1.0855%, and 30-Yr is down 2.1bps at 1.8487%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00075 at 0.08625% (-0.00038/wk)

- 1 Month -0.00525 to 0.12475% (-0.00475/wk)

- 3 Month -0.00250 to 0.21525% (-0.00813/wk)

- 6 Month +0.00150 to 0.23600% (-0.01213/wk)

- 1 Year -0.00313 to 0.31225% (-0.01038/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $204B

- Secured Overnight Financing Rate (SOFR): 0.04%, $922B

- Broad General Collateral Rate (BGCR): 0.02%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $324B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $40.551B submission

- Next scheduled purchases:

- Mon 1/25 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Tue 1/26 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 1/28 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- -2,000 Dec 97 straddles, 21.5

- +3,000 long Green Sep 93 puts, 18.0

- +2,500 Blue Sep 85/86/88 broken put tree, 1.0

- 7,000 Mar 99.75/99.812 put spds

- +12,000 Blue Jun 90/91/92/95 broken call condors, 0.5

- More Blue Sep 86 puts at 5.0/pit adding to Block and screen volume

- Overnight trade

- BLOCK, 5,000 Blue Sep 86 puts, 5.0 w/5k more on screen

- >7,000 TYG 137 straddles, 7

- 3,200 USH 182 calls, 2

- +2,000 TYJ 135 puts, 26

- -4,000 TYH 137 straddles, 58

- +4,400 TYJ 134/135 2x1 put spds, 1.0

- 1,750 TYJ 132/139 strangles, 7

- 6,750 TYH 138 calls, 7

- -10,000 TYG 137 calls, 2/64

- -2,500 TYH 136/137 strangles, 38

- +2,500 TYJ 137/137.5/138.5/139 broken call condors, 6

- 10,000 TYJ 131/134 put spds 4 over TYJ 138 calls

- USH 176 calls continue to trade, >5,600 now from 4-5

- Overnight trade

- BLOCK 10,000 TYJ 133/138 put over risk reversals, 2 net vs. 4k FVH 125-25.5

- 8,000 TYG 137 calls, 2-4

- 6,600 TYG 136.75 puts, 1

- 2,500 TYJ 134 puts, 14

- 4,000 FVH 125.25/125.75 2x1 put spds

- 3,000 USH 176 calls, 4

EGBs-GILTS CASH CLOSE: Italy Pol Risk Flares Up Anew

Friday morning saw Bunds and Gilts strengthen with BTP spreads sharply wider, though the moves moderated slightly in the afternoon.

- Italian political risk flared up again, with the tone set on the open by a report by Corriere Della Sera that PM Conte may opt for early elections if he can't form a majority gov't.

- Bunds strengthened and BTP spreads hit widest levels since November.

- The Eurozone manufacturing and services flash PMI prints were a touch better than expected, with Germany largely in line, and France disappointing. The UK saw a weak PMI svcs print, but more positively, data showed that the R rate has fallen to 0.8-1.0 (i.e. no longer exponential).

- Next week highlighted by supply: E17+bn in auction supply plus EU SURE syndication (we estimate E14bn of issuance).

- Closing Levels/10-Yr Periphery Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.7bps at -0.707%, 5-Yr is down 1.7bps at -0.716%, 10-Yr is down 1.6bps at -0.512%, and 30-Yr is down 1.9bps at -0.097%.

- UK: The 2-Yr yield is down 1.8bps at -0.125%, 5-Yr is down 1.8bps at -0.035%, 10-Yr is down 2.3bps at 0.308%, and 30-Yr is down 2.1bps at 0.892%.

- Italian BTP spread up 8.1bps at 126.3bps / Spanish spread up 1.3bps at 63.5bps

EUROPE OPTIONS: Sterling Blues, Straddle Sales

- Friday's options flow included:

- DUG1 112.40/112.30/112.20p fly sold at 5.5 in 5.25k

- DUH1 112.30/112.40/112.50c fly vs 112.20/112.10ps, bought for half in 5k

- OEH1 134.50/134.00ps, bought for 3.5 in 2k

- RXH1 117.5/176.5/176p ladder, sold at 13 in 1k

- RXH1 174/173ps, bought for 4 in 3k

- RXH1 177 puts -sold at 58.5 in 2k

- RXH1 175/173ps 1x2, sold at 7.5 in 4.5k

- RXH1 177.00/178.00 strangle sold at 90 in 2.25k

- ERZ2 100.50^, bought for 23.75 in 2k

- L Z1 99.875/100.00/100.12c fly, bought for 4 in 4k

- LZ1 100^, sold at 17 in 20k

- 3LU1 99.75/99.875/100.00c fly, bought for 2 in 20k

- 3LU1 99.37p vs 99.75/99.875cs, bought the put for 0.25 in 5k

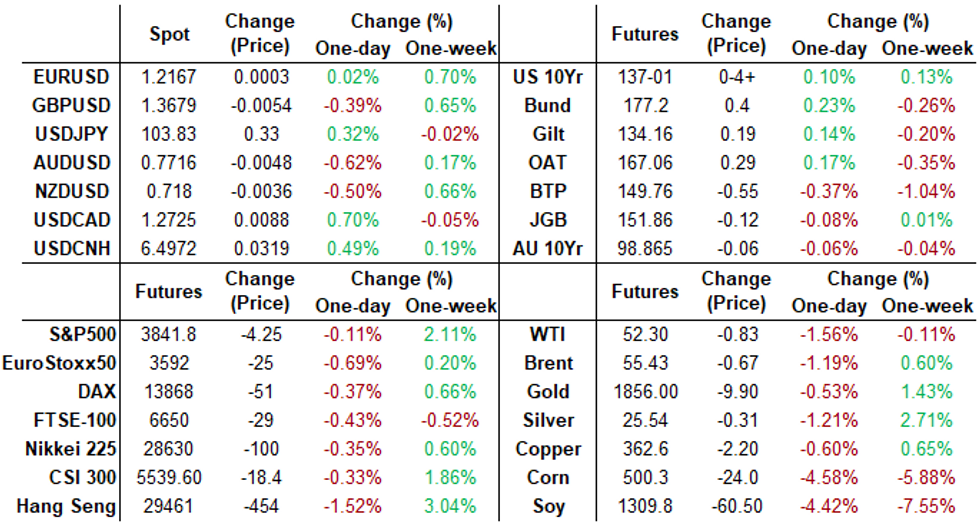

FOREX: Greenback, EUR Trade Firm Into the Close

Markets welcomed the smooth inauguration of President Biden earlier this week by bidding US equity markets to new all-time highs. The sentiment faded Friday, with stocks slipping on the continent and in the US in a wave of profit-taking on the recent risk rally. This flattered the greenback, which outperformed most others in G10, while EUR also traded well.

- Notably firm EU PMIs Friday morning supported the single currency from the off, although the primary support likely remained the ECB meeting Thursday, in which the ECB President looked unconcerned over currency strength. EUR/GBP recovered the Thursday losses as UK PMIs showed persistent economic weakness.

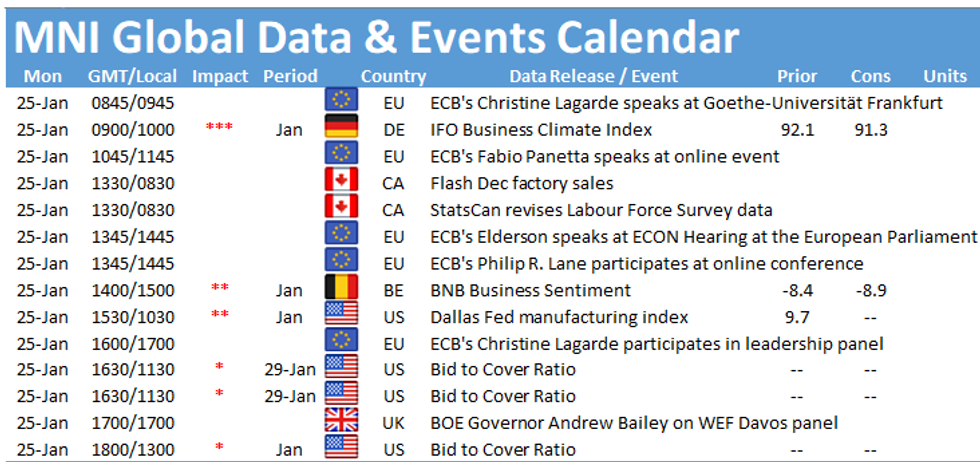

- Focus in the coming week turns to German IFO confidence data, Australian and German regional inflation, US prelim Q4 GDP and MNI Chicago PMI. The Fed rate decision is due Wednesday.

FX OPTIONS: Expiries for Jan 25 NY Cut 1000ET (Source DTCC)

- EUR/USD: $1.1975(E556mln), $1.2050-70(E658mln), $1.2230-40(E1.2bln), $1.2245-55(E936mln)

- USD/JPY: Y103.25-45($696mln)

- GBP/USD: $1.3370-80(Gbp689mln)

- AUD/USD: $0.7550(A$2.8bln), $0.7650(A$1.4bln), $0.7750(A$768mln), $0.7800(A$711mln)

- USD/CAD: C$1.2700($603mln)

- USD/CNY: Cny6.5700($1bln)

PIPELINE: British Columbia 10Y Pushed Wk's Total Issuance To $52.96B

British Colombia 10Y Sole Friday Issuer

- Date $MM Issuer (Priced *, Launch #)

- BC 10Y Pushed Wk's Total Issuance To $52.96B

- 01/22 $1.75B *Prov British Columbia 10Y +21

- $9.5B To price Thursday, $51.96B/wk

- 01/21 $2.5B *Citigroup 6NC5 fix-FRN +68

- 01/21 $2B *European Bank for R&D (EBRD) 5Y +3

- 01/21 $1B *Kommunekredit WNG 5Y +6

- 01/21 $1.2B *Bank of NY Mellon $700M 5Y +35, $500M 10Y +55

- 01/21 $1B *Development Bank of Japan WNG 10Y +22

- 01/21 $1B *Canada Pension Plan Inv Brd (CPPIB) 10Y +24

- 01/21 $750M *Aircastle 7Y +230

EQUITIES: Stocks Slip on Profit-Taking, Poorly Received Earnings

US equities slipped into the close Friday, shedding around 0.2-0.3% to remain within the weeks range. Profit taking amid negative received earnings was largely responsible, with updates from IBM and Intel prompted large losses for both names.

- 122 stocks in the S&P 500 report earnings next week, amounting to 36% of the index by market cap. Of that 36%, half of that is made up of just 5 companies: Apple, Microsoft, Tesla, Facebook and Visa.

COMMODITIES: Oil Slips as Crude Inventories Surge

WTI and Brent crude futures both traded lower into the close Friday. Futures contracts shed just over 1% apiece, with the (delayed) DoE crude oil inventories adding some weight after the data showed a 4mln build in headline crude stocks vs expectations for a draw of near 2mln bbls. This was countered somewhat by decent draws in Cushing OK reserves and gasoline stocks, but oil remained heavy into the close.

- Gold and silver dropped into the Friday close but respected recent ranges as the USD firmed in currency space. While equities slipped globally, gold saw little safe haven bid - indicating that the pullback in stocks was largely profit-taking rather than a real swing in sentiment.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.