-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Aussie Trimmed Mean Falls To 3.2% In Nov

MNI FOMC Minutes Preview: December 2024

MNI ASIA OPEN: Ylds Climb on Strong JOLTS, ISM Prices Paid

MNI ASIA MARKETS ANALYSIS: 2025 Rate Cut Odds Cool

MNI ASIA MARKETS ANALYSIS: Second 7Y Tail Ahead Month-End

US TYS SUMMARY: Busy Session on Data, Fed-Speak, Tsy Supply, Month-End

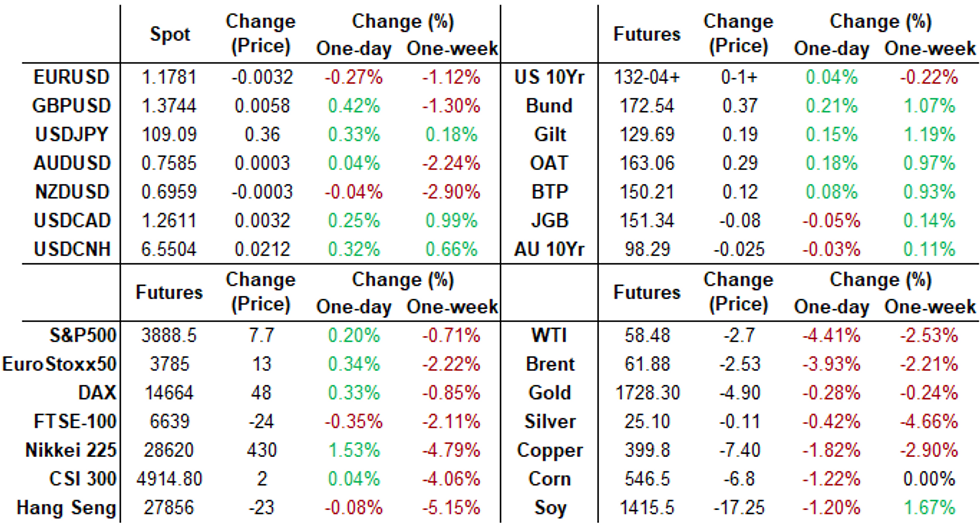

Fairly hectic session on decent volumes Thursday (TYM1>1.8M after the bell) with a lot of moving parts. Net change for Tsy futures after the bell mixed, near middle session range, curves steeper w/Bonds underperforming.- Data: Tsys drew immediate sellers after better than exp wkly claims (684K vs. 730K est; continuing claims 3.870M vs. 4.00M est). Decent 2-way trade followed as lvls held range on buy the dip and risk-off flow over deferred re-open plans and vaccine concerns (ongoing underlying theme).

- Fed Speak: Rates and equities both sold off/pared gains around midmorning, desks hard pressed to explain the sharp drop in WNM1 ultra-bond that lead the retreat -- Fed Chair Powell NPR interview not the driver, comments innocuous despite mkt comparison to Dunkirk (!?). Mixed Fed speak from Clarida, Bostic and Evans through second half: Evans least optimistic: rates may hold until 2024.

- Tsy supply: Another weak 7Y. Tsys sold off after US Tsy $62B 7Y Note auction (91282CBS9) drews high yield 1.300% vs. vs. 1.277% WI (huge 4bp tail last month: high yield of 1.195% vs. 1.155% WI); 2.23 bid/cover vs. 2.30 prior. Indirects drew 57.27% vs. 38.06% prior, directs 18.00% vs. 22.13%, dealers 27.73% vs. 39.81%.

- Month-end rebalancing has market on edge, "Balanced mutual funds are expected to sell $136bn of equities to buy fixed income," according to JPMorgan estimates.

- The 2-Yr yield is down 1.2bps at 0.1348%, 5-Yr is up 1bps at 0.8171%, 10-Yr is up 0.5bps at 1.6138%, and 30-Yr is up 2.6bps at 2.3358%.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS 0.07Y; Govt inflation-linked, 0.02. Notice the bounce in US Tsy, Agency and MBS estimates, and drop in Credit extension est vs. last year.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.07 | 0.09 | -0.03 |

| Agencies | 0.03 | 0.05 | -0.03 |

| Credit | 0.09 | 0.09 | 0.16 |

| Govt/Credit | 0.08 | 0.09 | 0.06 |

| MBS | 0.12 | 0.06 | 0.03 |

| Aggregate | 0.09 | 0.08 | 0.04 |

| Long Gov/Cr | 0.1 | 0.09 | 0 |

| Iterm Credit | 0.09 | 0.08 | 0.09 |

| Interm Gov | 0 | 0.08 | 0.01 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.05 |

| High Yield | 0.12 | 0.1 | 0.12 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N -0.00088 at 0.07550% (-0.00138/wk)

- 1 Month -0.00112 to 0.10913% (+0.00075/wk)

- 3 Month -0.00213 to 0.19300% (-0.00388/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00562 to 0.20388% (+0.00150/wk)

- 1 Year +0.00075 to 0.28075% (+0.00450/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.01%, $895B

- Broad General Collateral Rate (BGCR): 0.01%, $393B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $355B

- (rate, volume levels reflect prior session)

- Tsys 20Y-30Y, $1.735B accepted vs. $4.924B submission

- Next scheduled purchases:

- Fri 3/26 No buy operation

- Mon 3/29 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 3/30 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 3/31 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Pause for Easter Holiday, Resume April 5:

- Mon 4/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

US TSYS/OVERNIGHT REPO: Inching Slowly Off Lows

Overnight repo remains at special across the curve but continue to inch off early week lows. Current levels:

Tsy General O/N Coll. 0.03% vs. 0.00% on Monday; T-Bills: 1M 0.0051%, 3M 0.0127%, 6M 0.0355%;

| Duration | Current | Old Issue |

| 2Y | 0.00% | 0.01% |

| 3Y | 0.02% | -0.14% |

| 5Y | -0.23% | 0.02% |

| 7Y | -0.09% | 0.03% |

| 10Y | -0.13% | -0.13% |

| 30Y | -0.05% | 0.00% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 short Dec 91/95 put spds, 6.25

- -5,000 Green Sep 90 puts, 12.5

- +7,500 short Sep 92/93/95/96 put condors, 1.75

- -1,000 Blue Apr 85/87 strangles, 9.5

- 7,000 Jun 99.81/99.87 1x2 call spds

- Overnight trade

- 7,200 short Sep 99.50/99.68 put spds

- 3,500 Green Sep 85/87/88/90 put condors

- +8,500 TYM 129/130/131/132 put condors, 12-13 vs. 132-07.5-08/0.06%

- -2,000 USM 159 calls, 121-122

- +5,000 wk1 132.5 calls, 16

- +2,300 FVK 123.5 puts, 11

- Overnight trade

- 5,000 TYK 129.5/130.5/131.5 put flys

EGBs-GILTS CASH CLOSE: Core Curves Flatten

Bunds and Gilts enjoyed a positive (generally risk-off) session with core curves flattening Thursday. Semi-core and peripheries lagged, with Greek spreads underperforming.

- Eurostoxx equity futures bounced sharply from 2-week lows to hit week's best levels.

- Mixed headlines on the day. A detente between the UK and EU over vaccine supplies seemed tentative as European Union leaders met. Notably, the cash close came just before a very poor US 7-Yr Tsy auction which dragged Bund and Gilt futures lower.

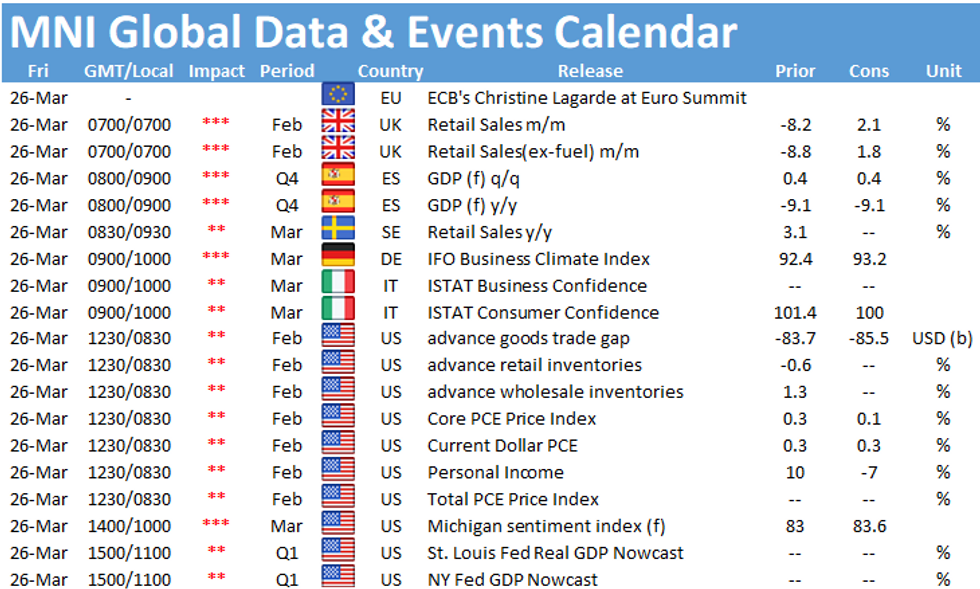

- French confidence data came in stronger than expected; Friday sees UK retail sales, German IFO and Italian confidence.

- Also Friday, we get speeches by BoE's Saunders and Tenreyro.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.4bps at -0.716%, 5-Yr is down 1.6bps at -0.698%, 10-Yr is down 3.1bps at -0.384%, and 30-Yr is down 3.5bps at 0.175%.

- UK: The 2-Yr yield is down 1.5bps at 0.046%, 5-Yr is down 1.9bps at 0.315%, 10-Yr is down 2.9bps at 0.729%, and 30-Yr is down 4bps at 1.242%.

- Italian BTP spread up 2bps at 96.4bps / Spanish bond spread up 1.8bps at 64.6bps

OPTIONS/EUROPE SUMMARY: Bund Upside And Short Cover

Thursday's options flow included:

- DUK1 112.10/112.00/111.90p fly, bought for 1.5 in 2k

- DUM1 112.20/30/40 call fly bought for 1.5 in 2.5k

- RXJ1 172p, bought for 11.5 in 5k

- RXK1 172/171/170p ladder, bought for 15 in 1.65k

- RXK1 174.50/175.50cs, bought for 10.5 in 25k

- RXK1 172c, bought for 114 in 5k (said to be a short cover of the 171/172cs 1x2)

- RXK1 169.50/168.50/167.50 put fly bought for 3 in 1.8k

- RXK1 170.5 put bought for 20 in 6k

- 2RU1 100.37/100.50cs 1x2, bought the 1 for 2.75 in 2k

- 3RZ1 100/99.87ps vs 100.50/100.62cs, bought the ps for 0.25 in 3.5k, and for flat in 7k all day

- 2LZ1 99.50/62/75c ladder, bought for 0.25 in 3.5k

- 2LZ1 99.12/98.75ps + 3LZ1 98.87/98.50ps strip, bought for 15.25 in 4k

- 3LU1 99.00/98.75ps, bought for 5.75 in 4k

FOREX: EUR/USD Chews Through Key Support

- EUR/USD bears chewed through key resistance at the $1.18 handle Monday, putting the pair at the lowest level since November 2020. The moves follow the break and close below the 200-dma earlier in the week, with the move opening 1.1746 as the next support ahead of 1.1695 - a key Fibo support.

- Oil sold off after Wednesday's sharp rally, undermining the strength in commodity-tied FX ahead of the Thursday close. This left NOK at the bottom of the pile, prompting USD/NOK to eye the first close above the 100-dma since October last year.

- GBP traded well, outpacing all others in G10 to partially reverse recent underperformance. This keeps key support at the 1.3625 100-dma intact for now, with focus turning to the

- Focus Friday turns to UK retail sales, German IFO in the European morning as well as US trade balance, personal income/spending and PCE releases. Central bank speakers include ECB's Rehn and BoE's Saunders & Tenreyro.

FX OPTIONS: Expiries for Mar26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E749mln)

- AUD/USD: $0.7765(A$1.7bln)

- USD/CAD: C$1.2900($520mln)

- USD/CNY: Cny6.40($1.1bln)

PIPELINE: $4.5B London Stock Exchange Leads Thu's $11.125 Total Issuance

$11.125B To price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 03/25 $4.5B #London Stock Exchange $500M 3Y +40, $1B 5Y +60, $1B 7Y +75, $1.25B 10Y +90, $750M 20Y +100 (EUR and GBP denominated debt issuance expected Fri)

- 03/25 $2.5B *ISDB (Islamic Development Bank) 5Y Sukuk +33

- 03/25 $2.525B #AmerisourceBergen $1.525B 2NC1 +60, $1B 10Y +110

- 03/25 $1.6B #Jackson Financial $600M 3Y +105, $500M 10Y +165, $500M 30Y +215

- 03/25 $1B Pilgrims Pride 10NC5 +10a

- 03/25 $Benchmark Pakistan 5Y, 10Y, 30Y investor calls

- 03/25 $2B Imola Merger Corp 8NC3 investor calls

EQUITIES: Stocks Shake Off Lower Open

- A lower open for stocks saw futures trade heavy, resulting in the e-mini S&P hitting March 9 lows, before sentiment turned ahead of the close and indices staged a modest bounce to trade in the green ahead of the close.

- The S&P500 traded heavy from the off, with energy firms leading losses as oil markets reversed the Wednesday rally. The sell-off abated after the London close, with utilities, materials and financials leading the bounce.

- Across Europe, sentiment was more mixed. The UK's FTSE-100 was the laggard, slipping by 0.6% while Germany, French indices held just above unchanged on the day.

COMMODITIES: Oil Prices Shrug Off Rebound, Resume Downward Trajectory

- Oil prices slumped 5% per barrel on Thursday, erasing yesterday's optimism and extending a string of softer sessions amid renewed global lockdowns. WTI crude futures tumbled back towards Wednesday's lows, where 57.25 remains the initial level to watch before more notable support at $55.65 - 38.2% retracement of the Nov 2 - Mar 8 rally.

- Suez-fuelled gains yesterday are being sold. The ship has still not been freed but for now, the market is shrugging off the blockage, as only a small percentage of the world's crude is shipped through the canal and companies such as Maersk are re-routing to other shipping lines.

- Precious metals are ending broadly unchanged after bouts of volatile price spikes. Gold has been struggling to find any direction as of late. A brief spike above $1,740 triggered a short-term flurry of buying, however this proved to be short-lived as the dollar index continued to inch higher. Spot gold reversed the entire move and trades down 0.35% at $1,728.50.

- Copper futures fell back below the 400 mark as Chinese demand concerns and the stronger dollar continue to impact the whole of the commodity space.

- Bitcoin came close to posting a $10,000 reversal in less than a week, printing lows of $50,440.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.