-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk-On, Ignores Forced Stock Unwinds

US TREASURY SUMMARY: Risk-On

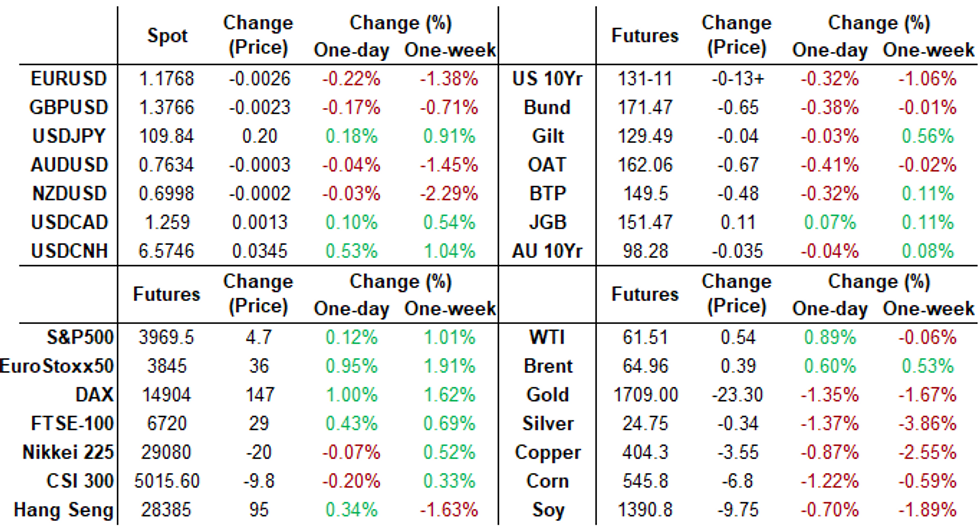

Dire pandemic warnings from CDC director and large dealer losses tied to forced equity unwinds (Archegos fund $20B blow-up continues to trigger massive block sales at several dealers) apparently taken with some reservations Monday. Risk-on tone resumed in second half: Tsy extended sell-off as equities pared losses as equities traded higher.- S&P futures tapped 3971.25 -- just off all-time high of 3977.0 on March 17. High yield marks: 10YY 1.7259%, 30YY 2.4238%.

- Early London hours story that Deutsche Bank may have avoided the forced liquidation pain of fund debacle debatably triggered a sell-off in rates as losses on forced unwinds may not be as bad or as systemic as feared -- despite sporadic reports of large block sales from Morgan Stanley, Wells Fargo, JPM on day.

- While CDC head warned of "impending doom" over case rise, the surge in the amount of people vaccinated and/or expected to receive tempered those concerns somewhat. Meanwhile, shipping traffic on the Suez Canal resumed as the Ever Given container ship was refloated Monday, ending the expensive back-log of ships (est $10B/day drag on global trade).

- Eurodollar and Treasury option trade saw renewed interest in low-delta put buying, hedging rate hike risk starting mid-2022 through 2023.

- Late session: 2-Yr yield is up 0.2bps at 0.1407%, 5-Yr is up 2.1bps at 0.8861%, 10-Yr is up 3bps at 1.7063%, and 30-Yr is up 3bps at 2.4081%.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS 0.07Y; Govt inflation-linked, 0.02. Notice the bounce in US Tsy, Agency and MBS estimates, and drop in Credit extension est vs. last year.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.07 | 0.09 | -0.03 |

| Agencies | 0.03 | 0.05 | -0.03 |

| Credit | 0.09 | 0.09 | 0.16 |

| Govt/Credit | 0.08 | 0.09 | 0.06 |

| MBS | 0.12 | 0.06 | 0.03 |

| Aggregate | 0.09 | 0.08 | 0.04 |

| Long Gov/Cr | 0.1 | 0.09 | 0 |

| Iterm Credit | 0.09 | 0.08 | 0.09 |

| Interm Gov | 0 | 0.08 | 0.01 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.05 |

| High Yield | 0.12 | 0.1 | 0.12 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N -0.00050 at 0.07288% (-0.00350 total last wk)

- 1 Month +0.00125 to 0.10850% (-0.00113 total last wk)

- 3 Month +0.00350 to 0.20250% (+0.00212 total last wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00037 to 0.20288% (+0.00087 total last wk)

- 1 Year +0.00075 to 0.28150% (+0.00450 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $75B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.01%, $924B

- Broad General Collateral Rate (BGCR): 0.01%, $374B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $347B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $19.405 submitted

- Next scheduled purchases:

- Tue 3/30 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 3/31 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Pause for Easter Holiday, Resume April 5:

- Mon 4/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +15,000 Green Sep 83/86/88 put flys, 3.0

- +12,000 Green Sep 83/86/88/91 put condors 6.75-7.0

- +22,500 Jun 99.75/99.81 2x1 put spds, 0.25

- -3,000 Dec 97 straddles, 8.0

- +4,600 Red Dec' 90/92 put spds, 3.0 vs. 99.555

- +2,500 Blue Sep 82 puts, 44.5

- +5,000 Green May 86/88/91 put flys, 1.75

- Overnight trade

- 7,250 short Sep 95/96/97 put flys

- 3,000 short Jun 99.62/99.68/99.75 put flys

- BLOCK, -5,000 short Mar 90/92 put spds 1.5 over 97 calls

- 9,200 Jun 99.812 calls, 2.5

- 3,000 Green Jun 90 puts

Treasury Options:

- 4,000 TYK 131.75 calls 33 over wk1 132.5 calls

- -1,400 TYK 131.5 calls, 47

- -1,700 USK 158 calls, 34-33

- +3,000 FVK122.75 puts, 5-5.5

- 2,000 TUK 110.37 puts, 3

- +11,000 TYK 133 calls, 14

- +2,000 TYM 134 calls, 17

- 7000 TYK 130 puts, 11-14

- Overnight trade

- 10,500 FVK 124 calls, 16-17.5

- +11,000 TYK 133.5 calls, 9

- 5,300 TYK 129 puts, 5

- +4,000 TYK 130 puts, 13

- +4,700 TYM 129/131 put spds, 28

- -3,000 USM 158 calls, 122-126

- 1,000 USK 158 calls, 50

EGBs-GILTS CASH CLOSE: Early Rally Gives Way To Bear Steepening

Early bull flattening gave way to bear steepening over the course of Monday's session, as weekend concerns over a hedge fund default and Suez Canal blockage dissipated.

- Bund yields jumped around 0900BST on news that Deutsche Bank's exposure to Archegos was relatively limited. Later, fairly high offer-to-cover on BoE's short-dated APF (3.50x) contributed to the bearish tone.

- Periphery spreads tightened, led by Greece (10Y GGB -1.8bps vs Bunds). UK 5s30s hit highest levels since Mar 19; Germany since the 24th.

- Data showed ECB net asset purchases slowed slightly last week, though E19.0bn of PEPP buys was comparable to last week's accelerated pace.

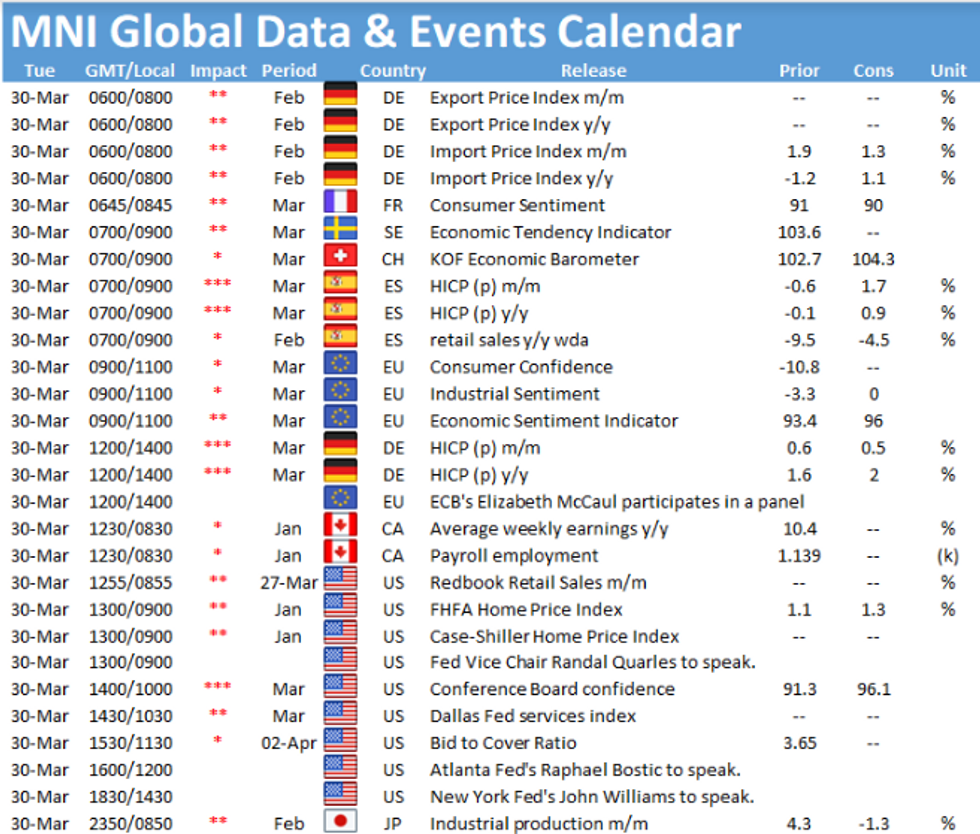

- Attention turns to Tuesday's inflation data (Spain and Germany), as well as BTP supply.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.6bps at -0.709%, 5-Yr is up 1.9bps at -0.657%, 10-Yr is up 2.8bps at -0.318%, and 30-Yr is up 3.2bps at 0.248%.

- UK: The 2-Yr yield is up 0.6bps at 0.067%, 5-Yr is up 0.9bps at 0.341%, 10-Yr is up 3.1bps at 0.788%, and 30-Yr is up 3.7bps at 1.319%.

- Italian BTP spread down 0.7bps at 95.7bps/ Spanish spread down 0.2bps at 63.1bps

OPTIONS/EUROPE SUMMARY: Flurry Of Late Vol And Downside Rate Plays

Monday's options flow included:

- OEM1 135.0/134.5 put spread, bought for 10 in 1.8k

- OEM1135.25/134.75/134.25p ladder, sold at 10 in 1.5k

- DUM1 112.20/10/00p fly vs 112.40c, bougt the put fly for 1 in 5k

- RXK1 172/173/173.5/175c condor, sold at 23 in 4k vs RXK1 176.5c, bought for 1.75 in 4k

- 3RU1 100.25/100.125/100.00 put ladder bought for 0.75 in 5k

- 3RZ1 100/99.75ps, bought for 3 again, now 9k total done

- 0LU1 100/99.87ps 1x2, bought the 2 for 7.5 in 6k (ref 99.715)

- 0LZ1 99.62/99.7599.875c ladder, bought for 3 in 2k

- 0LZ1 99.75/99.875/100.125 broken 1x3x2 call fly, buys the wings and receives 0.5 in 10k

- 0LH2 99.625^ bought for 33 in 2k

- 2LM1 99.375 put bought for 5 in 4k (v 99.51)

FOREX: EUR/GBP Hits New Cycle Lows

- As UK lockdowns begin to ease, GBP is outperforming, with EUR/GBP hitting fresh 2021 lows Monday. The cross now eyes support at 0.8521, the 38.2% retracement of the 2015 - 2020 rally. This level was tested Monday and bears will be eyeing any close below.

- EUR was among the session's poorest performers, with EUR/USD remaining in the March downtrend and touching 1.1761 in the process. This retains the negative view for the single currency despite better performance in the EuroStoxx50, which hit the highest levels since 2008.

- The greenback was mixed, with a slightly steeper US Treasury curve helping support the USD index.

- Focus Tuesday turns to Japanese jobs & retail sales numbers, regional and national German CPIs and US consumer confidence data for March. Fed's Quarles & Williams are both speaking.

FX OPTIONS: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1740(E541mln), $1.1800(E503mln)

- USD/JPY: Y109.00($700mln)

- AUD/USD: $0.7640(A$839mln), $0.7700(A$810mln), $0.7960(A$1.1bln)

- USD/CAD: C$1.2500-15($712mln)

PIPELINE: $2B Lowe's Matches BMW Debt Issuance

- Date $MM Issuer (Priced *, Launch #)

- 03/29 $2B #Lowe's $1.5B 10Y +90, $500M 30Y +107

- 03/29 $2B #BMW US $750M 3Y +50, $750M 3Y FRN SOFR+53, $500M 10Y +87.5 (BMW US issued $4B last year on April 6: $1.5B 3Y, $1.5B 5Y, $1B 10Y each +350)

- 03/29 $1B *Duke Energy Carolinas $550M 10Y +85, $450M 30Y +105

- 03/29 $925M #Burlington Northern Santa Fe 30Y +87.5

- 03/29 $700M *Korea National Oil $400M 5Y +52.5, $300M 10Y +75

- 03/29 $500M #Kohl's 10Y +167

- 03/29 $Benchmark Ghana 4Y 0% coupon, 8Y 8%a, 13Y 9%a, 21Y 9.5%a

- 03/29 $Benchmark Bahrain Nogaholding 8Y Sukuk

- 03/29 $200M #Maldives 5Y Sukuk 10.5%

- Expected Tuesday:

- 03/30 $Benchmark Dexia Credit 5Y +16a

EQUITIES: EuroStoxx50 Hits New Post-GFC High

- US equity markets were mixed early Monday, with the S&P 500 in minor negative territory from the off while the Dow Jones very slightly outperformed.

- Utilities and communication services were the top performers, with financials and energy at the bottom-end of the table. Banks suffered on contagion concerns from the fallout of Archegos Capital, although a number of US banks looked to clarify that their exposure is contained.

- Stocks in Europe were mixed, with UK and Spanish equities lagging, while the EuroStoxx 50 resumed its uptrend. The index hit its best level since the Global Financial Crisis, extending the recovery from the Coronavirus low to close to 70%.

COMMODITIES: Ever Given Freed, Whippy Price Action In Oil

- Two-way price action in Oil as crude futures swung from negative to positive amid a multitude of headlines. News that the container ship blocking the Suez Canal had been refloated prompted some headwinds in the space, with WTI futures dipping to $60/barrel. However, dips remained well supported.

- Reuters reported that Russia would support stable oil output from OPEC+ ahead of a meeting with the producer group later this week. The news was a calming effect on the markets and led to WTI trading up just shy of 1% with Brent futures up 0.5% at $65/barrel.

- A marginally stronger US dollar further soured sentiment in precious metals. Gold prices that had been somewhat coiled, respecting a short-term $1,725-45 range, finally broke lower. Stops were triggered through last week's lows and extended through the March 18 low of 1,719.42.

- This signals scope for a deeper pullback to $1699.3, Mar 12 low and the trigger for a test of key support at $1676.9. From a short-term trend perspective, the overall recovery from this March 8 low remains intact.

- Bitcoin surged 7% on Monday and continues the stellar recovery after dipping to $50,000 late last week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.