-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, July 12

MNI US OPEN - Harris Overtakes Biden in Democratic Nomination Betting Odds

MNI ASIA MARKETS ANALYSIS: Hedging For Recovery

US TSY SUMMARY

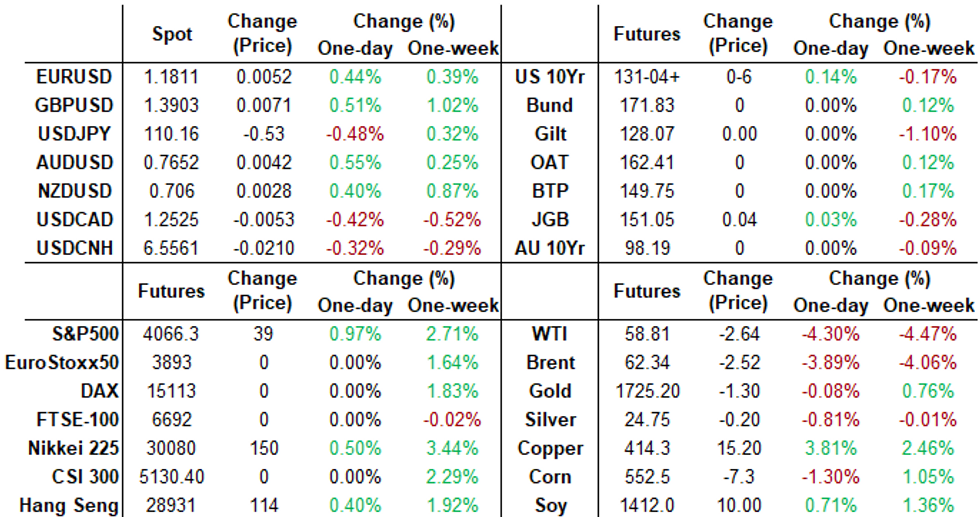

Inside range session Monday, Tsy futures mildly higher for the most part, 30Y Bond weaker after some choppy first half trade on light volume (TYM1<800K). Much of Asia out on extended weekend (Australia, New Zealand, China, Taiwan and Hong Kong), Europe close for Easter Monday holiday. Expect pick-up in activity, depth of market upon return; FX LIBOR settles resume Tue.- Rates sold off prior to mid-morning ISM Services PMI that hit a series high in March: 63.7, well above market expectations (BBG: 58.7). Previous high in near 25Y history of series was 62.0 in Aug'97. Rise was broad-based w/ New Orders recording a gain of 15.3 points. Business Activity increased 13.9pt, while Employment rose by 4.5pt. Prices paid rose again, up 2.2 points to 74.0.

- Modest chop on two-way flow w/rates climbing back to hold narrow range through the second half. FI option flow centered on buying low delta puts, continued hedging for economic recovery/reflation.

- Unscheduled comments from Tsy Sec Yellen: GLOBAL MINIMUM TAX CAN ENSURE MORE LEVEL PLAYING FIELD, HELP SPUR INNOVATION, GROWTH PROSPERITY. Link: Tsy.

- CNBC interview w/Cleveland Fed Mester on the close: JOBS REPORT WAS GREAT BUT STILL 8.5M OUT OF WORK; EXPECT HIGH (but unsustainable) READINGS ON INFLATION IN NEXT COUPLE MONTHS, Bbg

- The 2-Yr yield is down 1.4bps at 0.1724%, 5-Yr is down 3.9bps at 0.9382%, 10-Yr is down 0.5bps at 1.7163%, and 30-Yr is up 0.2bps at 2.358%.

SHORT TERM RATES

US DOLLAR LIBOR: No settles across currencies Friday and Monday due to Easter holiday

STIR: FRBNY EFFR for prior session:- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $92B

- Tsy 0Y-2.25Y, appr $12.801B accepted vs. $46.852B submission

- Next scheduled purchases:

- Tue 4/06 1010-1030ET: Tsys 20Y-30Y, appr $1.750B

- Wed 4/07 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Fri 4/09 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

US TSYS/OVERNIGHT REPO: 3s, 10s Still Special

Slight cooling of overnight repo across the curve, 3s ans 10s remains at special. Bills bounce slightly, current levels:

T-Bills: 1M 0.0127%, 3M 0.0152%, 6M 0.0304%; Tsy General O/N Coll. 0.04%

| Duration | Current | Old Issue |

| 2Y | 0.03% | 0.02% |

| 3Y | -0.55% | -0.16% |

| 5Y | 0.01% | -0.15% |

| 7Y | 0.03% | -0.07% |

| 10Y | -0.76% | -0.12% |

| 30Y | -0.18% | -0.02% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Red Jun 95/97 put spds, 6.0

- +15,000 Green May 91 puts 4.0 over 92/93 call spds

- Update, +30,000 Red Dec 97/98 1x3 call spds, 0.0

- Block, 10,000 Green Jun 88/91 put spds, 6.5

- +3,000 Blue Jul 81 puts 13.5 over 83/85 put spds vs. 98.205/0.54%

- 3,000 Blue Sep 83/86/88 put flys

- +5,000 Green May 99.18/99.31/99.43 call flys, 2.75

- +1,250 Gold Sep 96.37 puts, 1.5

- +10,000 Red Jun'22 97/98 1x2 call spds, 0.0

- Overnight trade

- +9,000 Green Jun 91/92/93 put trees, 3.0

- 5,000 TYM 130 puts, 29

- -12,500 FVK 123.5 calls, 11-13

- 1,100 USM 151/152 put spds, 11

- Overnight trade

- 6,500 wk2 TY 131.5 calls, 6-5

- 2,200 wk2 TY 130.5 puts, 8

- Block, 10,000 FVM 122.25/122.75 put strips vs. 20,000 FVM 123.75 calls, 1 net/puts over

- 4,800 TYK 133.5 calls, 2

FOREX: Dollar Dropped as Stocks Roll Higher Still

- After a solid start to the holiday-thinned Monday session, the dollar reversed in NY hours, pressing the greenback to fall sharply against all others in G10. EUR/USD rallied back above the $1.18 handle, opening key Fib resistance marking the retracement of the 2021 downtrend as well as the 1.1884 200-dma.

- The move was also evident in USD/JPY, which undid much of the progress made at the beginning of last week as prices briefly showed below the Y110 level.

- The weakness in the dollar coincided with a rip higher in US equities (both futures and cash) which performed particularly well from the Monday open and hit new record levels. The firm risk sentiment was evident in consumer discretionary and communication services firms outperforming, which topped the pile Monday.

- US data was wholly pro-inflationary, with both the Markit and ISM Services Indices beating forecast and showing a sharp move higher in input prices (Markit's gauge was highest since records began).

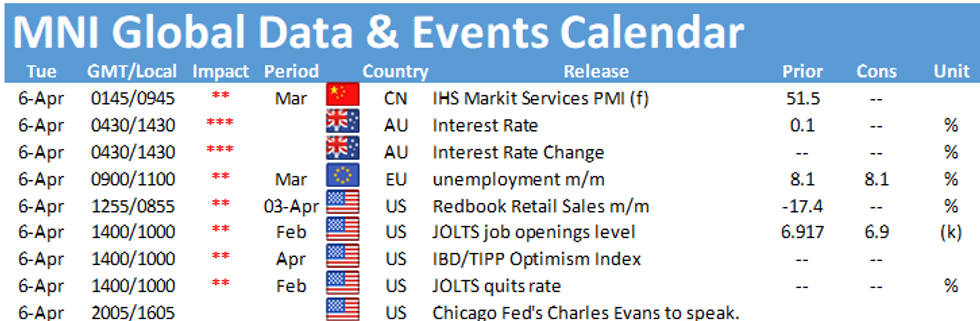

- Focus turns to China's Caixin PMI, the RBA rate decision and US JOLTS job openings numbers.

FX OPTIONS: Expiries for Apr06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E1.6bln), $1.1825(E584mln), $1.1975-95(E1.4bln), $1.2000-05(E1.1bln)

- USD/JPY: Y107.65-80($1.8bln), Y108.00-05($761mln), Y108.70($810mln), Y110.00-10($580mln)

- EUR/GBP: Gbp0.8700(E620mln)

- AUD/USD: $0.7640-50(A$974mln), $0.7735(A$517mln)

PIPELINE: April Kicks Off $4.45B High-Grade Issuance

- $4.45B To price Monday

- Date $MM Issuer (Priced *, Launch #)

- 04/05 $2B #Marvell Tech $500B 5Y +75, $750M 7Y +105, $750M 10Y +125

- 04/05 $1B #Equitable Financial Life $350M 2Y +35, $650M 2Y FRN SOFR+39

- 04/05 $850M #Protective Life 2Y +33, 5Y +68

- 04/05 $600M #Principal Life Global Funding $300M 2Y +43, $300M 2Y FRN SOFR+45

EQUITIES: Stocks Surge at the Open, US Hits New Alltime High

- Having topped 4,000 last week, equities progressed further Monday, with the S&P hitting new all time highs shortly after the open in both cash and equity indices. The risk-on sentiment was evident in consumer discretionary and communication services outperforming, while the only lagging sector was energy thanks to a near 4% pullback in WTI and Brent crude futures.

- Economic re-opening skewed firms including Norwegian Cruises, Carnival, Caesars Entertainment and United Airlines saw particularly sharp gains, rising by well over 4% apiece Monday.

- European indices were closed due to Easter Monday market holidays.

COMMODITIES: Oil Hits Reverse, Vienna Meeting in Focus

- WTI and Brent crude futures slid sharply Monday, with both benchmarks dropping close to 4% despite the faltering greenback in currency space.

- Energy markets look ahead to this week's meeting in Vienna of Iran, the EU and US, at which the three groups look to re-examine the nuclear deal with Iran. A positive outcome between the three parties could lead to Iranian supply coming back onto the market in the coming months.

- WTI crude's pullback sees markets dip back below the 50-dma at $60.03 (a level that continues to draw focus as prices oscillate either side) and exposes support at the March lows of $57.25. A slip and close below here would materially weaken the outlook.

- Silver and gold were largely non-directional, despite a weak USD back drop.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.