-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: When Lock-Ups Come In Handy

US TSY SUMMARY: Delayed PPI Release Dampens Strong Number

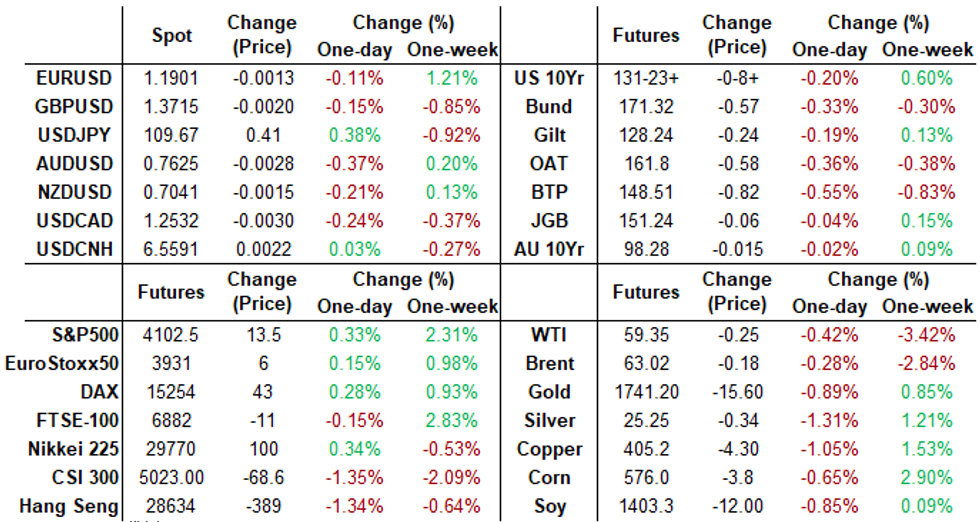

Rates held mildly weaker levels after Friday's closing bell, off early session lows even as equities continued to extend session highs after the bell, ESM1 around 4110.0, no obvious driver. (timing of CNBC interview headlines w/ ECB Pres LaGarde: RECOVERY WILL MOVE FAST IN SECOND HALF OF 2021, coincided with the move, but unlikely the driver).- Friday was an exceedingly disappointing day for data delivery as the Labor Dept's Bureau of Labor Statistics suffered technical difficulties that prevented it from delivering the March PPI data on time. After several minutes equities started to trade weaker, spurring rumors data had been disseminated to some dealers. A few minutes later the BLS annc'd the much stronger than expected data on Twitter: headline +1.0%, core (ex. food and energy) +0.7%. Rates and equities traded weaker, extending session lows around 0900ET.

- Rates and equities both started to bounce after Pres Biden set out a 16% increase in non-defense discretionary spending to $769B (3.3% of GDP), and 1.7% boost in defense spending to $753B in his first budget proposal to Congress Friday.

- The 2-Yr yield is up 0.8bps at 0.1568%, 5-Yr is up 2.9bps at 0.8643%, 10-Yr is up 3.9bps at 1.6585%, and 30-Yr is up 2.8bps at 2.3348%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00013 at 0.07475% (+0.00000/wk)

- 1 Month +0.00075 to 0.11125% (+0.00087/wk)

- 3 Month -0.00025 to 0.18750% (-0.01225/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00063 to 0.21138% (+0.01013/wk)

- 1 Year -0.00100 to 0.28575% (+0.00525/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $75B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $257B

- Secured Overnight Financing Rate (SOFR): 0.01%, $896B

- Broad General Collateral Rate (BGCR): 0.01%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $350B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, appr $3.601B accepted vs. $9.143B submission

- Next scheduled purchase:

- Mon 4/12 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 4/13 1500ET updated purchase schedule release. The Desk plans to purchase appr $80B over the monthly period from 3/12/21 to 4/13/21.

US TSYS/OVERNIGHT REPO: Slight Moderation

Largely steady as slight moderation in 10s continue. 1M Bills go negative, GC creeps lower, current levels:

T-Bills: 1M -0.0025%, 3M 0.0076%, 6M 0.0228%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | 0.00% | 0.00% |

| 3Y | -0.12% | -0.16% |

| 5Y | -0.07% | -0.12% |

| 7Y | 0.00% | -0.08% |

| 10Y | -0.26% | -0.11% |

| 30Y | -0.12% | -0.06% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, +10,000 long Green Dec 90/93 1x2 call spds, 4.5

- +20,000 Sep 99.93 calls, 0.5

- +5,000 short Sep 99.68/99.75/99.81 call flys, 2.0 vs. 99.67/0.10%

- +4,000 long Green pack (EDM3-EDH4) 100 call strip, 18.0

- +10,000 Green May 90/92/93 broken put flys, 1.0

- +5,000 Red Mar 98 calls, 2.5 vs. 99.43/0.05%

- Overnight trade

- 9,200 Green May 99.56 calls

- 1,600 Green Apr 99.18/99.31/99.43 put flys

- 3,400 Blue Apr 85 puts, 4.0

- Block, 5,000 Blue May 82/85 2x1 put spds, 4

Treasury Options:

- +2,600 TYM 134 calls, 6

- 2,000 TYM 132/133 call spds, 24

- -3,400 TYM 129.5/134 strangles, 26-25

- +3,000 TYK 132.5 calls, 10

- -4,000 FVK 124 calls 6-7

- 4,250 TYM 135 calls, 5

- over 8,000 TYM 130 puts, 23

- Overnight options

- 5,000 TYM 127 puts, 4

- -5,000 TYM 133 calls, 21

- -3,000 wk3 132.25 calls, 7

- 5,000 wk3 TY 131.5 puts, 16

- 5,600 FVM 122/123 put spds

- Block, +5,000 TYM 132 calls, 56

EGBs-GILTS CASH CLOSE: Bear Steepening Move Falters Late

Gilts and Bunds shifted from a bear steepening move in the morning, to a bear flattening in the afternoon as short-end yields consolidated their rise and yields on 10s through 30s faded lower. Overall though, the initial move proved too much to overcome, with curves steeper on the day.

- Main catalyst for the afternoon move was higher-than-expected US producer price data, which kept pressure on short-/intermediate Tsys, with Europe mirroring.

- Earlier in the session, BTPs sold off on a BBG report that the Draghi gov't will try to bring forward up to E40bn of new borrowing. Spreads wider on the session, w Italy underperforming the periphery.

- Otherwise, data (weak German and French IP) and speakers didn't really have a lasting impact.

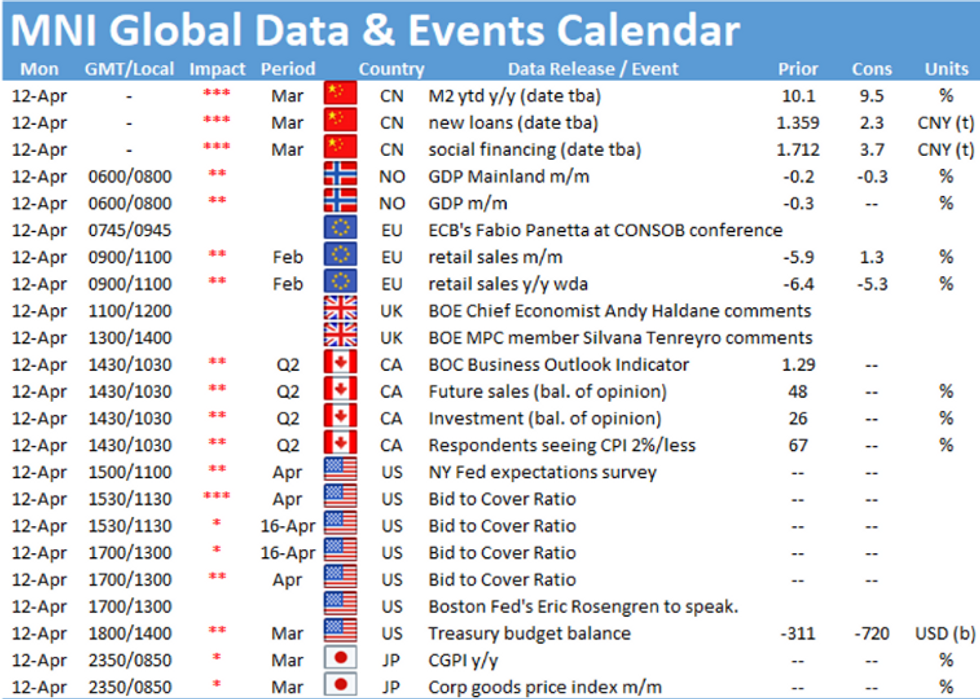

- Attention next week is on UK Feb GDP Tuesday, with EGB issuers including EFSF, Netherlands, Italy and Germany (and possibility of Ireland, Finland, or Slovakia also).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.2bps at -0.702%, 5-Yr is up 3.5bps at -0.633%, 10-Yr is up 3.3bps at -0.303%, and 30-Yr is up 1.8bps at 0.242%.

- UK: The 2-Yr yield is unchanged at 0.046%, 5-Yr is up 1.3bps at 0.353%, 10-Yr is up 2.5bps at 0.774%, and 30-Yr is up 2.1bps at 1.305%.

- Italian BTP spread up 3.2bps at 103bps/ Spanish up 1bps at 68bps

OPTIONS/EUROPE SUMMARY: More Upside Than Downside

Friday's options flow included:

- OEK1 135.75c, bought for 1.5 in 9k (said to be a short cover)

- RXK1 170.5/172.5^^ sold at 37 and 38 in 1.5k

- RXK1 173.5c, bought for 5.5 in 4.25k

- 2RZ1 100.25/100.50 RR, bought the call for 0 in 2.25k

- 0LZ1+0LH2 99.875 call strip bought for 9.75 in 10k

- 0LZ1 100c, bought for 2.5 in 5k

- 0LU1 99.75/99.62/99.50p fly, bought for 2 in 5k (ref 99.73)

- 0LZ1 99.87/100cs, bought for 1.5 in 10k

- 2LM1 99.62/99.50ps vs 99.87c, sold the ps at 7 in 10k

- 2LZ1 99.50/99.62/99.75c ladder, bought for 0.25 in 10k

FOREX: Stellar Canadian Jobs Report Sees CAD Back on Track

- CAD outperformed all others in G10 Friday, with a stellar jobs report helping fuel gains in the currency. Canada added three times as many jobs as expected in March, with over 300k jobs gained. This pressed the unemployment rate sharply lower and well below forecast, dropping to 7.5% vs. Exp. 8.0%.

- USD/CAD secured a second session of losses, reinforcing the importance of this week's support at the 1.2620 50-dma. 1.2502 undercuts as next support, marking the April 5th low.

- Contrasting with its oil-tied counterpart in CAD, NOK slid throughout the session, falling in tandem with WTI and Brent crude futures, which faded into the Friday close. USD/NOK snapped a multi-week losing streak, rising back above the 50-dma.

- Focus in the coming week turns to US earnings season, with the biggest name US banks due to report. Markets also watch UK industrial production, German ZEW survey, US CPI & retail sales numbers. Central bank decisions are due from the RBNZ as well as the Turkish and South Korean central banks. Fed speak will be in focus ahead of the pre-decision media blackout, which kicks in at the end of the week.

FX OPTIONS: Expiries for Apr12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1915-30(E1.3bln)

- EUR/GBP: Gbp0.8600-05(E530mln)

- USD/CAD: C$1.2600-15($600mln)

- USD/CNY: Cny6.4925($500mln)

PIPELINE: Healthy Start for April, $43.37B Total Issuance on Week

- Date $MM Issuer (Priced *, Launch #)

- 04/09 No new names on docket as yet for Friday

- $17.52B Priced Thursday; $43.37B/wk

- 04/08 $5B *KFW 2Y -2

- 04/08 $4.1B *Organon $2.1B 7NC3 4.125%, $2.0B 10NC 5.125%

- 04/08 $4B *Japan Bank of Int Cooperation (JBIC) WNG $1B 3Y +4, $3B 10Y +24

- 04/08 $1B *MassMutual $400M 3Y +32, $600M 3Y FRN SOFR+36

- 04/08 $1B *Canadian Pension Plan (CPPIB) WNG 3.5Y +1

- 04/08 $1B *News Corp 8NC3 3.875%

- 04/08 $920M *Sumitomo Life Insurance 60NC10 3.375%

- 04/08 $500M *AIIB WNG 5Y FRN SOFR+22

EQUITIES: Stocks Inch Higher Still, RSI Hits Overbought

- Cash equity indices traded in minor positive territory Friday but managed to hit another all-time high in the process. The S&P500 inched higher to 4,107.89, setting a particularly high bar for upcoming earnings season, which begins next week.

- In futures space, the e-mini S&P rally has now tipped the index into overbought territory according to the RSI for the first time since late August last year.

- Consumer discretionary firms outperformed Friday, with technology not far behind. Energy and consumer staples were the laggards, both slipping over 0.5% apiece on a sectoral basis. Strength in US markets continues to bleed into European indices, with the EuroStoxx50 nearing new post-Global Financial Crisis highs.

- Focus turns to Q2 earnings season, with the largest US bank names reporting next week. Updates are due from Goldman Sachs, JPMorgan Morgan Stanley, Bank of America, Wells Fargo, Citigroup and others. This keeps the financials sector in focus, with the bulk of the larger reports due on Thursday.

COMMODITIES: Oil, Metals Retreat as USD Finds More Stable Footing

- Both WTI and Brent crude futures traded into negative territory into the Friday close, shedding around 0.5% apiece while largely respecting the recent ranges. The week's decline in the USD index had flattered prices through the first half of the week, but this effect faded into the Friday close as the DXY clawed back lost ground.

- Directional parameters for crude are unchanged, with the 50-dma the first barrier for any recovery in prices at $60.56 for the WTI continuation contract.

- This worked against both oil and metals prices as gold and silver also resided in negative territory. Spot gold found resistance at the $1758.94 50-dma, which managed to contain and then reverse price action back below the Thursday lows. This heightens the importance of the level headed into next week's key releases which include US CPI & retail sales as well as plenty of pre-April meeting Fed speeches.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.