-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Surge After ISM Miss

US TSY SUMMARY: ISM Miss Weighs on Tsy Ylds

Robust volumes traded despite Asia and London out for extended holiday (Japan and China through Wednesday still). Rates and equities climbed higher while USD dipped as focus turns to US data, rounding out the week with headline employment report, April job gain mean estimate +978k.- Early two-way trade on inside range, Tsys followed Bund lead into the NY open, overnight rate sellers on the back of upbeat PMI and re-open plans in Europe.

- Tsys bounced on the open with for no obvious reason save perhaps unwinds of month-end positioning.

- Strong data through April hit a snag midmorning: Tsys surged post ISM: 60.7 vs. 65.0 est and 64.7 in March. over 175k TYM1 trades in appr 5 minutes post data. 10YY fell to 1.5763% low, 1.6118% after the bell as futures pared gains; 30YY fell to 2.2515% low, 2.2929% last.

- No new ground broken by several Fed speakers including Fed Chair Powell late session.

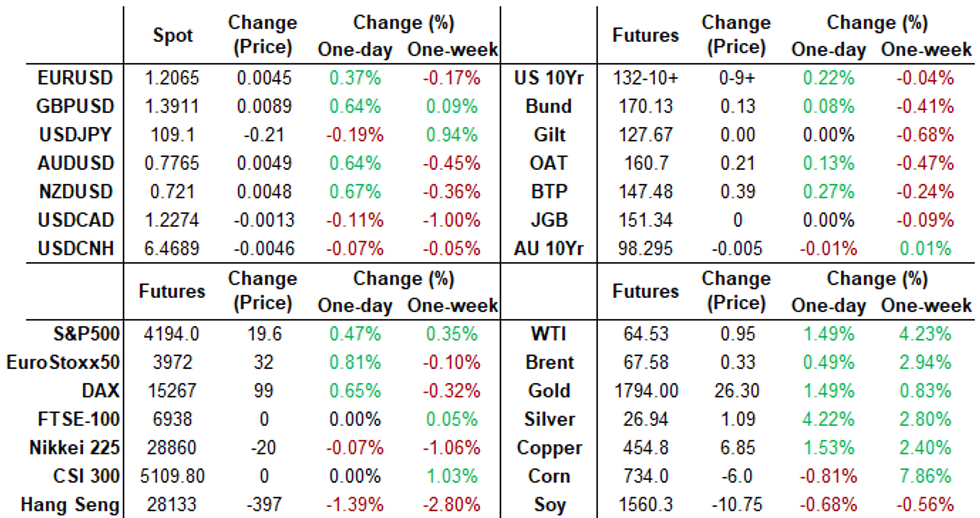

- The 2-Yr yield is up 0.2bps at 0.1604%, 5-Yr is down 1.4bps at 0.8317%, 10-Yr is down 1.6bps at 1.61%, and 30-Yr is down 0.5bps at 2.2913%.

SHORT TERM RATES

US DOLLAR LIBOR: No new settles Monday due to UK bank holiday, resume Tuesday. Friday sets':

- O/N -0.00150 at 0.07125% (-0.00212/wk)

- 1 Month -0.00288 to 0.10725% (-0.00375/wk)

- 3 Month +0.00075 to 0.17638% (-0.00500/wk) ** (Record Low 0.17288% on 4/22/21)

- 6 Month -0.00150 to 0.20488% (+0.00075/wk)

- 1 Year -0.00025 to 0.28113% (+0.00025/wk)

- Daily Effective Fed Funds Rate: 0.05% volume: $70B

- Daily Overnight Bank Funding Rate: 0.03%, volume: $235B

- Secured Overnight Financing Rate (SOFR): 0.01%, $924B

- Broad General Collateral Rate (BGCR): 0.01%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $351B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $27.933B submission

- Next scheduled purchases:

- Tue 5/04 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 5/05 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

US TSYS/OVERNIGHT REPO

Cooling ever so slightly: 2s-7s, 10s and 30s continue to lead specials. Other current levels:

T-Bills: 1M -0.0025%, 3M 0.0025%, 6M 0.0203%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | 0.01% | -0.02% |

| 3Y | 0.00% | -0.08% |

| 5Y | 0.01% | -0.08% |

| 7Y | 0.01% | -0.01% |

| 10Y | -0.12% | -0.09% |

| 30Y | -0.10% | -0.07% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, +2,620 short Mar 92/93 5x4 put spds, 3.5 net package at 1430:48ET

- +5,000 Blue Sep 82/83 put spds 1.75 over 88/90 call spds, ongoing

- +3,000 Blue Jul 80/90 put over risk reversals, 2.25 (paper looking at same package in Blue Dec)

- +6,000 Red Jun 92/96 2x1 put spds, 1.0

- Overnight trade

- +1,000 Blue Sep 81/82 put spds 0.5 over 87/88 call spds

- +10,600 wk1 TY 131/131.5 put spds, 4

- +1,200 TYQ 131.5/134.5 1x2 call spds, 49

- -2,500 TYM 132 calls, 44

- +2,000 TYN 131.5 straddles, 149

- +3,500 TYN 129.5/131.5 2x1 put spds, w/TYM 130.5 puts, 22 total

- 2,700 TYM 130.5/131.5 3x2 put spds, 14

- +4,000 FVN 123/123.5/124 1x1x2 call trees, 5-7cr

- 10,000 TYM 130.5/131.5 put spd, 9

- +3,000 FVN 122.25/122.75/123.25 put flys, 3.5

- Overnight trade

- 3,100 TYM 133 calls, 8-10

- 2,000 TYM 130 puts, 4

- 1,500 TYM 131 puts, 14

- 2,900 FVM 122.5/123/123.5 put trees

EGB/Gilt - Recovering Early Losses

Having sold off through to mid-morning, EGBs traded firmer through the remainder of the session with curves broadly bull flattening.

- The bund curve is 2bp flatter.

- OAT yields are 1-2bp lower with the long-end of the curve similarly outperfomring.

- BTPs have marginally outperformed core EGBs with cash yields 2-3bp lower on the day.

- Final Eurozone Manufacturing PMI data confirm that the economic recovery was underway in April.

- Market focus will be on the BoE MPC meeting on Thursday. Although no change in the main monetary policy instruments is expected, there is some speculation on the possibility that the asset purchase pace could be tapered.

FOREX: USD Slips as ISM Confirms Deceleration

- Monday was a generally quiet session for news, but markets still found excuses to nudge currencies, with a poorer-than-expected ISM Manufacturing release leading to a solidly USD negative environment. The employment component was of particular interest, with the rate of growth slowing to 55.1 from the 59.6 previous - which may cause some uncertainty in Friday's NFP release.

- At the other end of the table, one of last week's poorest performers, GBP, was the strongest currency in G10 Monday. Confirmation over the weekend that the UK will look to remove all Coronavirus restrictions in June may have helped solidify the outlook, but the UK Bank Holiday kept most traders away, clouding the signal somewhat.

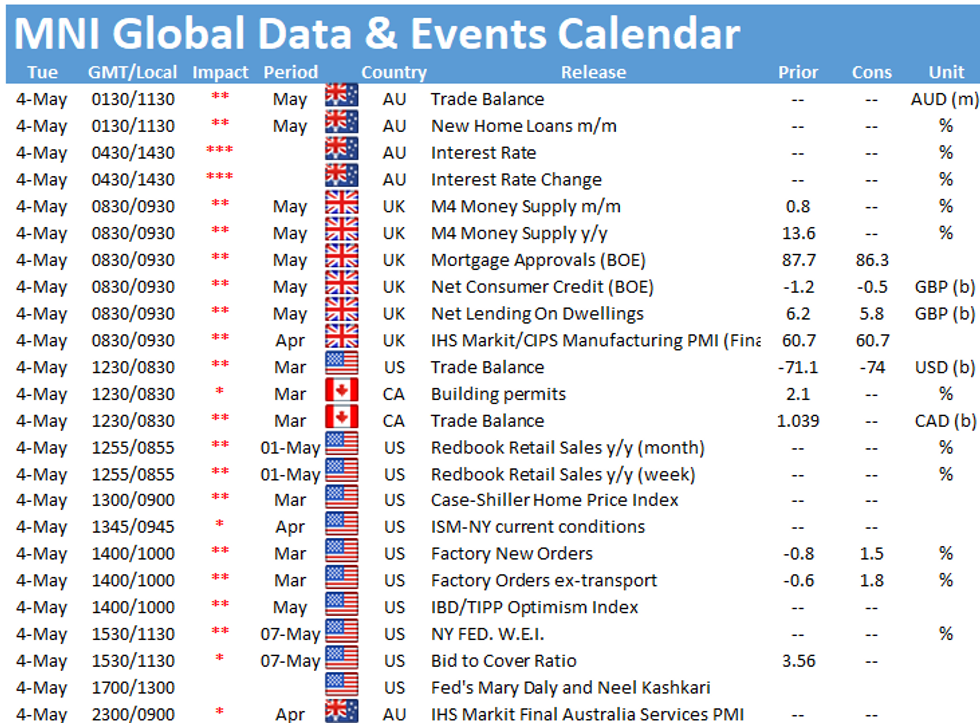

- Focus Tuesday turns to trade balance data from Australia, the US and Canada as well as the March factory orders numbers. The Reserve Bank of Australia rate decision also crosses. The RBA are seen keeping the main policy tools unchanged this month. Speeches are scheduled from ECB's Villeroy and Fed's Daly & Kaplan.

FX OPTIONS: Expiries for May04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2035-50(E1.0bln)

- GBP/USD: $1.3800(Gbp896mln)

- AUD/USD: $0.8000(A$1.1bln)

- AUD/NZD: N$1.0855-65(A$2.0bln-AUD puts)

PIPELINE: Bigger and Bigger

Equinix outpaces EBay that outpaced General Dynamics. All said and done, $9.425B to price Monday- Date $MM Issuer (Priced *, Launch #)

- 05/03 $2.6B #Equinix $700M 5Y +65, $400M 7Y +80, $1B 10Y +95, $500M 30Y +115. Last year, Equinix issued 2.6B on Jun 8: $500M 5Y +85, $500M 7Y +115, $1.1B 10Y +130, $00M 30Y +145

- 05/03 $2.5B #EBay $750M 5Y +60, $750M 10Y +100, $1B 30Y +135. Last year, EBay issued total $1.75B: $500M each 5Y +120, 10Y +170, $300M 5Y Tap +70, $450M 10Y tap +145

- 05/03 $1.5B #General Dynamics $500M 5Y +35, $500M 10Y +65, $500M 20Y +70. Last year General Dynamics issued $4B on March 23: $750M 5Y +295, $750M 7Y +300, $1B 10Y +300, $750M 20Y +295, $750M 30Y +295

- 05/03 $1.1B #Norfolk Southern $500M 10Y +70, $600M 100Y +180. NS issued $800M 30Y +178 on April 3, 2020.

- 05/03 $1B #Southern Co 30NC5 3.75%

- 05/03 $725M #NGPL PipeCo 10Y +165

EQUITIES: Solid Start to the Week

- Stock markets across the US and Eurozone finished higher Monday in a solid start to the week. US indices traded poorly into the Friday close, so bulls will have taken solace from stocks' ability to bounce amid clear appetite from dip-buyers. The e-mini S&P needs to secure a close above the Friday highs at 4201.50 to open a further challenge on new all time highs at 4211.00.

- Across the S&P500, energy and materials traded solidly. Further strength in commodities prices buoyed both sectors, with gains across oil, industrial and precious metals underpinning a share rally. Real estate was the sole sector in the red, with REITs coming under particular pressure.

- Earnings remain a focus, although the pace of releases has slowed. Key reports due this week include Pfizer, General Motors, T-Mobile US and PayPal.

COMMODITIES: Broad Commodities Complex Benefits From Sliding Dollar

- Commodity markets traded well Monday, with both WTI and Brent crude futures trading well. Oil markets benefited from the solid bounce in global equities, while a weaker dollar backdrop benefited commodities in general.

- Meanwhile, new cycle highs were printed in Lumber futures, which continue their sharp rally to hit another all time highs. This extends the YTD rally to close to 90%.

- Silver and gold were also beneficiaries, with silver rising sharply to pressure the gold/silver ratio to its lowest level since mid-March.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.