-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Equities Recovering

US TSY SUMMARY: 30Y Auction Tail Near 2Bp

Rates finish stronger, holding narrow second half range after making session highs around noon time, robust volumes, TYM1 near 1.6m late. Equities stronger, but off early Monday all-time highs (ESM1 +63.0 after NY FI close.

- Post-Data Chop in Rates and Equities: Tsys and equities dropped post data -- PPI +0.6% vs. +0.3% est, weekly claims fall to 473k vs. 490k est, continuing claims more or less in-line -- then quickly bounce back near opening levels.

- Final leg of Tsy supply: $27B 30Y auction -- Tsys Gapped Lower on Weak 30Y, 1.8Bp Tail. US Tsy $27B 30Y bond auction (912810SX7) drew 2.395% high yield (2.320% last month) vs. 2.377% WI; w/ 2.22 bid/cover (2.47 prior). Indirects drew 59.88% vs. 60.96% prior, 20.06% directs vs. 21.95%, and 20.05% for dealers vs. 17.09% prior.

- VIX pared gains after run through 200-day moving avg: CBOT VIX pared gains, currently -4.76 at 22.83 vs. an overnight high of 28.93.

- The vol index blew through 50- and 200-day moving average yesterday on a run to 28.38 (Early March levels).

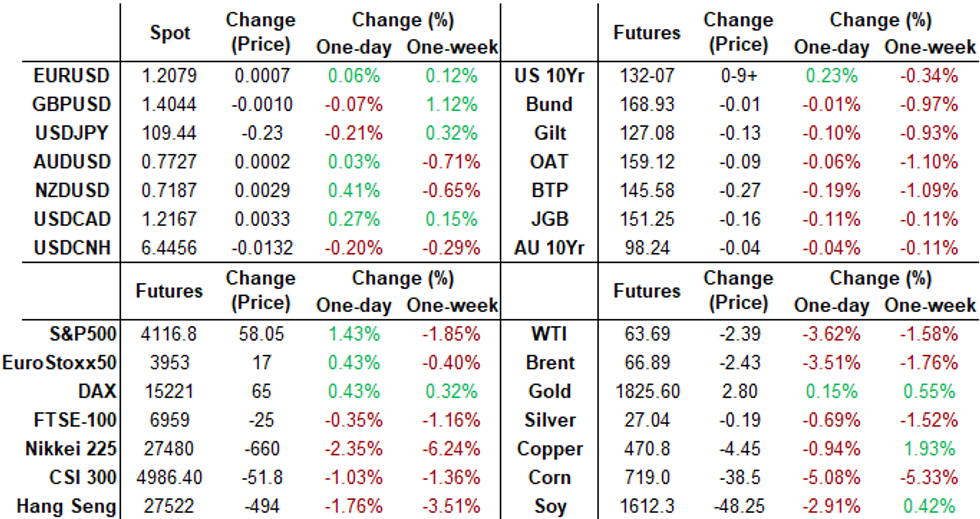

- The 2-Yr yield is down 0.6bps at 0.1569%, 5-Yr is down 3.1bps at 0.8321%, 10-Yr is down 2.9bps at 1.6625%, and 30-Yr is down 1.8bps at 2.3931%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00225 at 0.06225% (-0.00188/wk)

- 1 Month +0.00275 to 0.10088% (-0.00050/wk)

- 3 Month +0.00175 to 0.15588% (-0.00400/wk) ** (vs. Record Low 0.15413% on 5/12)

- 6 Month +0.00250 to 0.19263% (-0.00012/wk)

- 1 Year -0.00025 to 0.26463% (-0.00637/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $67B

- Daily Overnight Bank Funding Rate: 0.05% volume: $253B

- Secured Overnight Financing Rate (SOFR): 0.01%, $895B

- Broad General Collateral Rate (BGCR): 0.01%, $378B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $352B

- (rate, volume levels reflect prior session)

New Buckets: 7-10Y, 10Y-22.5Y, 22.5Y-30Y as the Desk plans to purchase approximately $80 billion over the monthly period from 5/14/21 to 6/11/21:

- Fri 5/14 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Mon 5/17 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 5/18 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 5/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Green Sep 86/88 put spds 1.0 over Green Jun 92 puts

- +4,000 Blue Jul 97.87/98.12 2x1 put spds, 1.0

- +1,500 short Sep 99.68/99.75/99.87 broken call flys, 2.0 vs. 99.71/0.10%

- -2,000 Blue Sep 87/90 call spds over 80/82 put spd

- +5,000 short Jun 95/96/97 put flys, 1.5

- +5,000 Blue Jun 83/85/86 put flys, 2.0 vs. 98.65/0.08%

- +4,000 Blue Dec 75/77 3x2 put spds, 6

- -2,000 Blue Sep 80 puts, 7.0

- +4,400 TYM 132.5/133.5

- +3,300 TYM 132.5/133.5 1x2 call spds, 8

- +3,000 USM 156 calls, 49-48

- +4,000 TYU 128.5/129.5/130.5 put flys, 6

- +3,500 TYM 131 puts, 4 vs. 132-00.5/0.0.12%

- 4,000 TYN 129.5/130.5 put spds, 17

- Wednesday trade note: some 40,000 TYM 133 calls bought at 4 -- unwinding short w/open interest falling 43,358 to 95,208

EGBs-GILTS CASH CLOSE: Inflation Fears Fade...For Now

Bunds and Gilts clawed back early sharp losses from around midday London time onward, with yields ultimately closing up but well off highs.

- This came against a backdrop of recovering equities, with US Data still inflationary (high PPI, low jobless claims) but not nearly the level of surprise of Wednesday's CPI, which fuelled the selloff.

- Curves have faded their steepening bias to trade fairly flat on the session.

- EGB periphery spreads mostly wider, Italy 3.0bps wider. Supply may have been a factor; Italy sold E9.25bln of BTPs; Ireland sold E1.5bln of IGBs).

- Ascension Day holiday in several countries (France, Germany, Netherlands and others) meant little data today.

- Friday sees little data (Spain final Apr CPI), and the ECB April meeting accounts.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.2bps at -0.658%, 5-Yr is up 0.6bps at -0.512%, 10-Yr is up 0.3bps at -0.12%, and 30-Yr is down 0.9bps at 0.437%.

- UK: The 2-Yr yield is down 0.2bps at 0.103%, 5-Yr is up 0.7bps at 0.409%, 10-Yr is up 1.2bps at 0.898%, and 30-Yr is up 1.3bps at 1.438%.

- Italian BTP spread up 3bps at 117.7bps / Spanish spread up 2.1bps at 70.6bps

FOREX: US Dollar Unphased By Bounce In Equities, USDCAD Rebounds

- G10 currencies took a back seat on Thursday as global equity indices staged a recovery during the US session. Dollar indices remain in marginal positive territory as the greenback struggled to pick a direction. G10 ranges remained fairly subdued while larger moves were seen in the EM space with the likes of MXN and RUB rising close to 1%.

- CHF led gains, appreciating ~0.3% against both the EUR and the USD. NZDUSD also higher, advancing 0.25% to 0.7175 as of writing, with mildly firmer risk sentiment propping the kiwi off its lows. Despite the minor gains, the pair still resides down 1.5% since the start of the week.

- USDCAD has had a fairly strong bounce after failing to break through multi-year support on Wednesday. Risk-off prompted the initial bounce back above noted pivot support at 1.2062. The level has recently been flagged as potentially reinforcing the current medium-term bear leg if breached or lead to a reversal if the support manages to contain CAD strength.

- CAD weakness was exacerbated by comments from the Bank of Canada. Governor Tiff Macklem, in a press conference, said that a further appreciation of the Canadian dollar would create risk for the bank's outlook. While nothing entirely new, USDCAD took another leg higher towards then end of the session to briefly print above 1.22 (+0.54%).

FX OPTIONS: Expiries for May14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E715mln)

- USD/JPY: Y109.45-50($975mln), Y110.00($680mln)

- GBP/USD: $1.3990-05(Gbp539mln)

- AUD/USD: $0.7750(A$981mln)

- USD/CAD: C$1.2125-40($555mln), C$1.2280-85(C$575mln)

PIPELINE: Slow Finish After Heavy Start to Wk

- Date $MM Issuer (Priced *, Launch #)

- 05/13 $1.85B #JP Morgan PerpNC5 $25par pfd, 4.625%

- 05/13 $1.5B #Arthur J Gallagher $650M 10Y +90, $850M 30Y +115

- 05/13 $1.45B #Goodyear $850M 8Y 5%, $600M 10Y 5.25%

- 05/13 $750M #Vornado Realty 00M $5Y +135, $350M 10Y +180

EQUITIES: Stocks Bounce, But No Full Recovery Yet

- Stock markets across Europe and the US traded higher Thursday, with most indices bouncing after a few sessions of protracted selling pressure. The e-mini S&P pierced the key 50-dma support at 4054.00, but the ability for prices to avoid closing below the mark will be a relief for bulls.

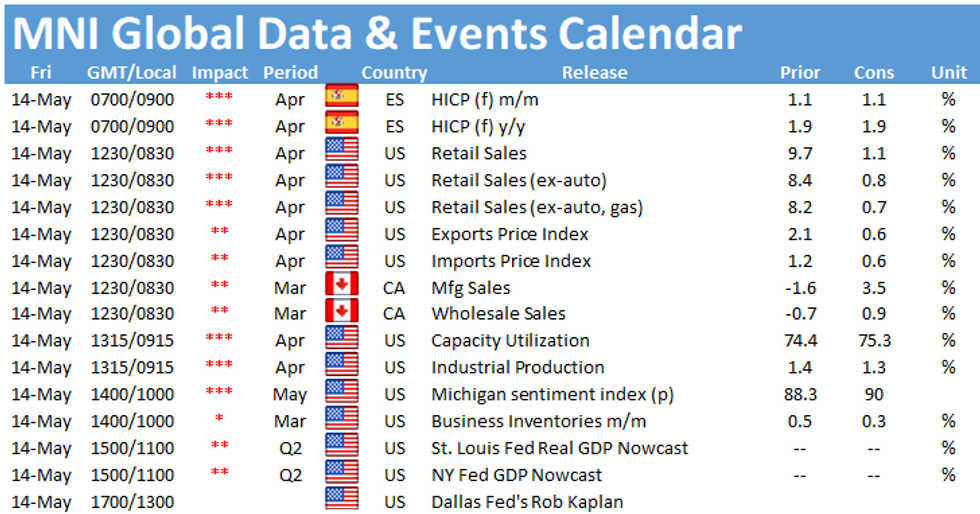

- There was little fundamental or macro newsflow behind the bounce, with profit-taking and position squaring ahead of Friday's retail sales release the likely driver.

- Utilities and financials were the strongest performers Thursday, showing that the bounce in the recently-fragile tech and consumer discretionary sectors has been left wanting. Energy was the sole sector in the red as WTI and Brent crude futures gave up the week's gains to trade solidly in the red.

COMMODITIES: Crude Hits Reverse as Colonial Flow Back Online

- Having been propped up for much of the early half of the week, WTI and Brent crude futures hit reverse Thursday, selling through the week's lows and key support at $63.68/bbl to narrow the gap with the May low of $62.91/bbl.

- The pressure on oil came as the operators of the Colonial Pipeline confirmed that flow will likely resume at full capacity in the coming few days and, while there may be some pockets of disruption in the near-term, there will be no further supply issues.

- Selling pressure in WTI fed through into Brent crude, which faces the first test at the $66.14 50-dma. A close below would open the early April lows.

- Metals markets came under acute selling pressure throughout Thursday trade, with China-listed iron ore in particular suffering. The benchmark dropped over 10% at some points in the session following yesterday's commitment from the Chinese authorities that they would rein in runaway prices.

- Gold rebounded, with the yellow metal erasing early weakness to trade slightly higher into the Thursday close.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.