-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Reiterating Taper View

US TSY SUMMARY: Minority Fed Speakers Reiterate Taper View

Tsys futures finished the session mixed, Bonds outperforming mildly weaker 2s-10s. Rates held narrow range since midmorning.

- Similar price action to Thu's Tsys in Euro FI: disappointing German PMI had mkt discounting taper talk, with Tsys moving higher in turn in early NY trade. Tsys pared gains along with equities after Markit Services PMI comes out stronger than expected 70.1 vs expected 64.3, Composite 68.1 vs. last of 63.5.

- Rates and equities pared gains, after Fed Harker comments: HARKER SAYS FED SHOULD START HAVING CONVERSATION ABOUT TAPERING SOONER RATHER THAN LATER, Rtrs

- Not a marked react, but rates and equities continuing mild risk-on unwind since Harker kicked off. Dallas Fed Kaplan comments: "Would Not Be Surprised by 'Odd or Unusual' Job Data; Better for Fed to Act 'Sooner Rather Than Later', Dj

- Surge in June/Sep futures roll and June Tsy options expiration added to robust volumes.

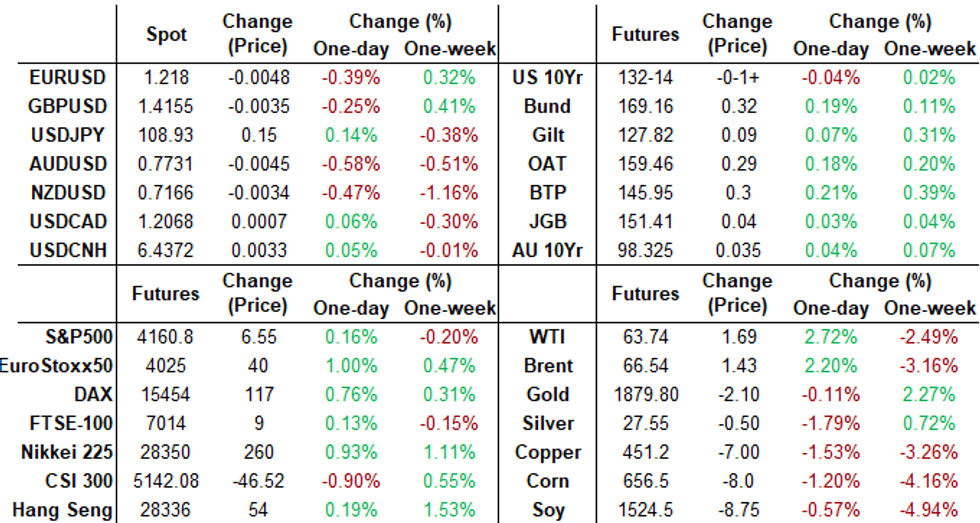

- The 2-Yr yield is up 0.8bps at 0.1533%, 5-Yr is up 1bps at 0.8212%, 10-Yr is down 0.3bps at 1.6216%, and 30-Yr is down 1.3bps at 2.3176%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00138 at 0.05975% (-0.00225/wk)

- 1 Month -0.00087 to 0.09163% (-0.00587/wk)

- 3 Month -0.00313 to 0.14700% (-0.00813/wk) ** (Record Low)

- 6 Month -0.00550 to 0.17875% (-0.00888/wk)

- 1 Year -0.00437 to 0.25963% (-0.00625/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $66B

- Daily Overnight Bank Funding Rate: 0.05% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.01%, $872B

- Broad General Collateral Rate (BGCR): 0.01%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $358B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $10.794B submission

- Next scheduled purchases:

- Mon 5/24 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Tue 5/25 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 5/26 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 5/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

US TSYS/OVERNIGHT REPO:

Holding steady while bills and GC dip: T-Bills: 1M -0.0025%, 3M 0.0051%, 6M 0.0152%; Tsy General O/N Coll. 0.00%.

| Duration | Current | Old Issue |

| 2Y | -0.01% | -0.01% |

| 3Y | -0.01% | -0.01% |

| 5Y | -0.11% | -0.05% |

| 7Y | -0.05% | 0.00% |

| 10Y | -0.01% | -0.09% |

| 30Y | -0.01% | -0.09% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Blue Jun 87/88/90 call flys, 2.5

- +2,500 Blue Sep 81/82/83/85 put condor, 2.0

- 2,000 Blue Sep 77/80/82 put

- Overnight trade

- 2,700 short Sep 95/96/97 put flys

- 1,800 Red Mar 92/93/95 put trees

Treasury Options:

- Update, over 15,500 TYN/TYZ 129.5/132 put spd spds over last hour, 4 net

- 3,000 TYU 127.5/128.5/129.5 put flys

- +4,800 TYM 131/133 even over 130.5 puts

- -2,000 TYQ 131.5 straddles, 151

- Block, +35,000 FVM 124.25 calls, 1, +24k more on screen .25-.5

- -10,000 TYN 132.5 calls, 18

- 5,000 TYN 132.5 straddles, 1-21

- Overnight trade

- +3,000 TYN 131.5 straddles, 121

- Block, -10,000 USN 160 calls, 15

- 10,000 wk4 10Y 130/130.5 put spds, 1

- 5,000 wk4 TY 130.5 puts, 2

- 1,500 TYU 131.5/132.5 3x2 put spds

- 2,000 TYN 129.5 puts, 9

- 10,500 FVU 123 puts

- 8,100 FVU 122.75 puts

EGBs Bull flatter going into the weekend

A busy but contained session for EGBs.

- Friday focus was on PMI releases, with a beat for France and the EU, while Germany saw a miss.

- Big beat for the US PMI, provided some small widening in TY/Bund spreads (2.3bps)

- The US PMIs triggered some selling interest, whilst EGBs holds onto gains, after Largarde's comment on Yields "Seen Yields increase lately, closely monitoring those".

- Peripherals have mostly traded inline with Germany, although Greece outperforms and sits 3bps tighter on the session

- After market, Moody rating on Greece.

- Bund futures are up 0.27 today at 169.11 with 10y Bund yields down -1.7bp at -0.127% and Schatz yields down -0.6bp at -0.660%

- BTP futures are up 0.28 today at 145.93 with 10y yields down -2.3bp at 1.034% and 2y yields down -0.4bp at -0.252%

- OAT futures are up 0.27 today at 159.44 with 10y yields down -1.7bp at 0.246% and 2y yields down -0.7bp at -0.639%.

FOREX: USD Reverses Early Weakness, Posts Firm Friday Performance

- Early dollar weakness overnight was followed by a strong reversal as we approached the close, resulting in broad dollar indices gaining around 0.3% on Friday.

- The Greenback had started to firm as New York sat down and was further buoyed by weakness in equities, prompting a bout of safe haven demand to close the week.

- EURUSD was unable to make fresh highs for the week above 1.2240 before consistent supply led us back towards Wednesday lows around 1.2160. A late recovery in equities spurred a minor 20 pip bounce as the pair looks set to close around 1.2180.

- GBPUSD had a firm rejection of the 2021 highs, falling just 3 pips shy of the important resistance at 1.4237. The rejection brought cable straight back towards 1.42 before the poorer global sentiment caused the pair to retreat a further 50 pips to close around 1.4150. Despite the rejection, this will constitute the highest weekly close since 2018.

- AUD and NZD were the biggest losers in the G10 space as the equity markets suffered. While barometers for EMFX stayed fairly stable, the Brazilian real and Colombian Peso led the global decline with losses over 1%.

- CHF (-0.12%) and JPY (-0.14) held narrow ranges as the historically considered haven currencies performed comparatively better on Friday against the dollar. USDCAD was also capped to just a 0.1% gain in a week where the pair made fresh 6-year lows just above the 1.20 handle,

biuy eecle. Mayt 3ET - European and Canadian holidays to begin next week before we see the RBNZ decision, German IFO, the second reading of US GDP and Friday's headline of US Core PCE.

FX OPTIONS: Expiries for May24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2145-60(E1.0bln-EUR puts), $1.2200(E1.1bln, E1.03bln EUR puts)

- AUD/USD: $0.7615-35(A$654mln), $0.7710-25(A$1.3bln-AUD puts), $0.7750(A$556mln-AUD puts)

- USD/CAD: C$1.2150($875mln-USD puts)

- USD/CNY: Cny6.5125($780mln)

- Larger option expiry pipeline

- EUR/USD: May25 $1.2095-1.2105(E1.0bln-EUR puts); May26 $1.2075-90(E1.35bln-EUR puts); May28 $1.2195-1.2200(E1.1bln-EUR puts)

- USD/JPY: May25 Y107.50-60($1.1bln), Y107.85-108.05($1.5bln); May26 Y108.00($1.0bln); May28 Y110.00($1.4bln-USD puts), Y110.50($976mln)

- GBP/USD: May28 $1.4200(Gbp706mln-GBP puts)

- EUR/GBP: May26 Gbp0.8600-15(E1.1bln)

- EUR/CHF: May28 Chf1.1000(E930mln-EUR puts)

- AUD/USD: May26 $0.7740-50(A$1.0bln-AUD puts), $0.7770-85(A$987mln-AUD puts)

- USD/CAD: May27 C$1.2195-1.2205($1.4bln); May31 C$1.2400($1.1bln-USD puts)

- USD/MXN: May28 Mxn19.75($1.3bln-USD puts)

PIPELINE: $35B High-Grade Debt Issued on Wk

After a strong start to the week with $34B debt issued Mon-Tue (only $1B Wednesday), issuance evaporating ahead the weekend.

- Date $MM Issuer (Priced *, Launch #)

- 05/21 $1.5B #Athene Global Funding 3Y FRN SOFR+70

- 05/21 $500M #Cargill WNG 30Y +85

- 05/20 No new issuance Thursday

EQUITIES

- DJIA up 123.69 points (0.43%) at 34207.84

- S&P E-Mini Future down 2.45 points (0.14%) at 4152

- Nasdaq down 64.75 points (-0.2%) at 13470.99

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.