-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: 29-Year High In U.S. Core CPI...And Bonds Rally

HIGHLIGHTS:

- U.S. May Y/Y CPI Highest Since 2008; Core Highest Since 1992

- ECB Optimistic, But No Talk of PEPP Taper (MNI STATE OF PLAY)

- Yellen Warns of Global K-Shaped Recovery US Avoids

- GOP Sen-McConnell Has Told Fellow Reps He Is 'Open' To Bipartisan Infra Plan

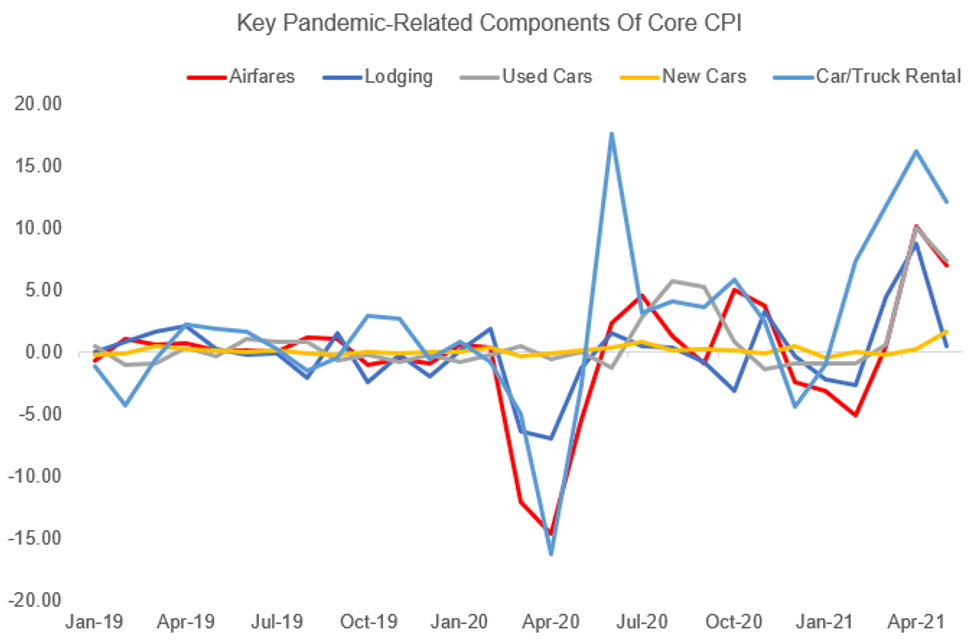

Source: BLS, MNI

Source: BLS, MNI

NEWS:

U.S. DATA: U.S. CPI in May increased 0.6% following a larger 0.8% gain in April, the Bureau of Labor Statistics said Thursday. From a year earlier, CPI was up 5%, beating expectations for an increase to 4.7% and the highest y/y percent increase since August 2008. Prices of used cars and trucks rose sharply in May, increasing 7.3% over April and accounting for roughly one-third of the m/m increase, the BLS said. The food index was up 0.4%, the same as April, and the energy index was unchanged, with a decline in gas prices offsetting increases in electricity and natural gas prices. From a year earlier, food prices were up 2.2% and energy costs rose 28.5%. Excluding food and energy, CPI was up 0.7% m/m and 3.8% y/y, the largest y/y increase since 1992.

ECB: The European Central Bank will continue buying bonds flexibly and in accordance with market conditions but still at a "significantly higher" pace than seen at the beginning of the year, ECB president Christine Lagarde said Thursday. Lagarde said there was "unanimous support for the introductory statement and broad agreement over what was proposed", although she acknowledged some debate on the pace of purchases and some of the analytical aspects of the use of instruments. "That's why I used the phrase 'broad agreement.' [...] There was some divergence about some particular aspects," she said. No other wording was proposed, Lagarde added. The central bank left other policy settings unchanged, with the deposit rate remaining at -0.5%, new asset purchases under the ECB's APP scheme at EUR20 billion a month. The overall envelope for the pandemic emergency purchase programme remained at EUR1.85 trillion, although the president acknowledged there was scope to buy less, or to adjust PEPP to buy more, as need dictated.

ECB: Euro area inflation will likely rise through the rest of 2021 as higher fuel costs and unwinds of 2020 temporary tax cuts work their way out of the consumer price index, European Central Bank President Christine Lagarde Citing the inflation projections of the ECB staff economists, Lagarde said inflation was expected to average 1.9% over 2021, 1.5% in 2022 and just 1.4% in 2023. Growth is projected at 4.6% in 2021, 4.7% in 2022 and 2.1% in 2023. That would see all output lost through the pandemic by H1 2022.U.S.: U.S. Treasury Secretary Janet Yellen Thursday said she is confident that America has avoided a K-shaped recovery, but warned many low-income nations appear on track for that outcome unless rich countries support them. "When I took office, one of my greatest concerns was a K-shaped recovery from the pandemic; a recovery where high-income households rebounded quickly – or even emerged better-off – while low- and middle-income families suffered for a very long time," she said about the American economy. "We can be confident now that's not going to happen."

U.S. MONEY MARKETS: Overnight reverse repo usage rose $32.0B to a fresh high of $534.9B today, with 54 counterparties involved. That's the 4th consecutive day of all time highs. Continued high takeup will almost certainly be a question for Fed Chair Powell at next Wednesday's FOMC press conference, though the downward pressure on market rates may not yet be enough to force the Fed to adjust administered rates.

U.S. FISCAL: Wires and social media reporting comments from Republican Senator Susan Collins (R-ME) saying that Senate minority leader Mitch McConnell has told fellow GOP senators that he is 'open' to a bipartisan infrastructure plan. Following the breakdown in talks between the White House and Sen. Shelley Moore-Capito (R-WV), former GOP presidential candidate, Sen. Mitt Romney(R-UT), is now leading a new effort to reach a bipartisan consensus. However, Romney's insistence of no new taxes to pay for the plans could prove a major obstacle. Should Collins' comments prove accurate and McConnell is willing to reach a deal with the White House it could prove a major boost to getting a deal through that isn't reliant on a reconciliation process.* Nevertheless, the prospect of a true bipartisan deal with support from Senate GOP leadership remains slim given the bitter relations between the two sides at present.

BOC: Bank of Canada Deputy Governor Tim Lane said Thursday that while inflation over the next several months will be faster than expected and may breach the top of the central bank's target band of 3%, the pressure is transitory. Slack in the economy will slow things down later this year, Lane said in the text of a speech, though over the next few months CPI gains will exceed the BOC's April projection, which called for a 2.9% average in the second quarter. The remarks came hours after the U.S. reported 5% CPI inflation for May, and Fed officials have also called such pressures temporary.

U.S. FISCAL: The Treasury Department Thursday said the U.S. has racked up a record USD2.1 trillion deficit through the first eight months of the fiscal year, with a USD132 billion deficit in the month of May. The May federal budget deficit was another shift down in recent months, from April's USD226 billion and March's USD660 billion, as the dispersal of the Biden administration's USD1.9 trillion fiscal relief slows. Receipts in May were USD464 billion, up USD290 billion, or 167%, compared to the year-ago month. Outlays were USD596 billion, up USD23 billion, or 4%, compared to May 2020.

FRANCE (MNI INTERVIEW): A rebound in consumer spending means France's economy may not need an additional stimulus package proposed for later this year, but the government will be on the lookout for labour market bottlenecks, the French Treasury's chief economist told MNI. For full article contact sales@marketnews.com

US TSYS SUMMARY: Impressive Post-CPI Rally Sends Yields To Multi-Month Lows

Tsys initially sank on above-expected May inflation, but decisively reversed course shortly thereafter to session highs with participants looking through the 29-year high in core Y/Y CPI. The curve bull flattened and futures volumes eclipsed 2M for the first time since the Jun-Sep roll.

- And not at all a risk-off move, given that stocks hit all-time highs. Indeed it was basically one-way traffic lower for yields after the initial spike, with bears appearing to capitulate toward the end of the session.

- The 2-Yr yield is down 0.8bps at 0.1469%, 5-Yr is down 2.4bps at 0.7259%, 10-Yr is down 4.1bps at 1.4503%, and 30-Yr is down 2.2bps at 2.1462%. Sep 10-Yr futures (TY) up 7.5/32 at 133-00 (L: 132-10 / H: 133-01).

- Implied breakevens headed modestly higher, meaning real yields fell sharply - suggesting market participants both acknowledge higher inflation pressures, while also deferring to the FOMC's insistence that the current spike is only temporary (and that they will be patient before tightening policy).

- The strength in Tsys made an otherwise mediocre 30Y Bond auction look even better given the circumstances - 1.2bps tail, bid-cover a little better than previous auction but weaker than average. While yields bounced off session lows and curve steepened slightly following the auction, the demand for duration was impressive given the lack of concession, and the rally continued afterward.

- It's a quiet calendar from here until the FOMC, with UMich sentiment and a new NY Fed purchase schedule the only things on the data /supply/speaker docket until Tuesday.

MNI: US MAY CPI 0.6%, CORE 0.7%; CPI Y/Y 5.0%, CORE Y/Y 3.8%

US CPI Beats Expectations, With Core Goods Prices Sticky

Strong price pressures were evident in the May CPI report.

- Unrounded CPI headline +0.6442; core +0.7373. So headline almost beat expectations by even more on a rounded basis (was +0.6% vs +0.5% expected). Core was a "solid" +0.7% (vs +0.5% expected).

- Core goods prices looking sticky at +1.82% M/M (just a slight deceleration from April's huge +1.99%), core Services at +0.37% (from +0.54% April).

- Chart below shows a few key reopening- / bottleneck related sectors in core % m/m. All but New Cars (chip-related) saw decelerations, but especially lodging away from home.

US CPI: Shelter Prices Picking Up After A Lull

A few other notes on services prices in May:

- Medical Care services decelerated to -0.09 M/M%, the lowest reading of the year, and that's 7% or so of CPI. Medical care commodities- a little under 2% of CPI weighting - accelerated to +0.24%, highest since Mar-20.

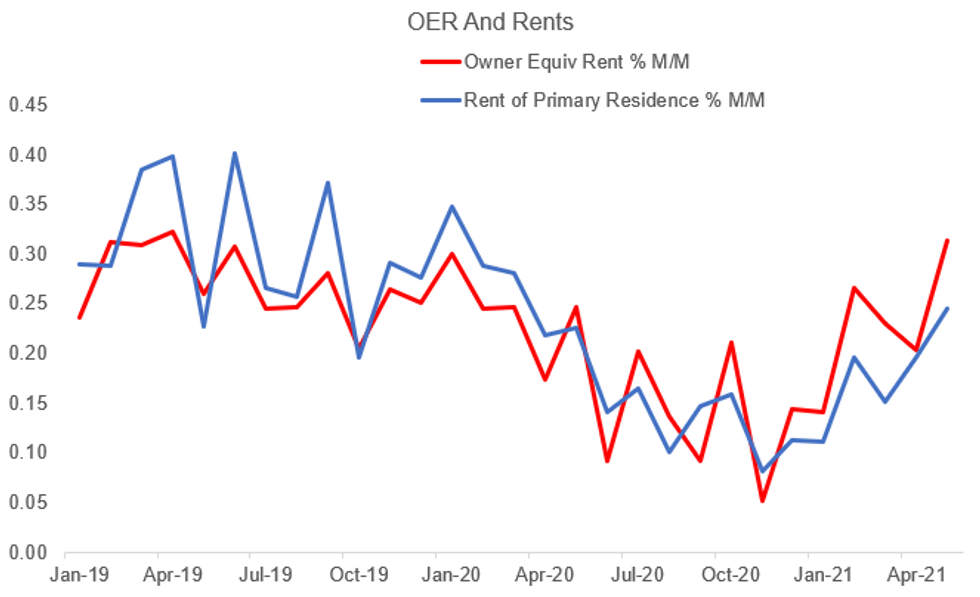

- And very closely watched: shelter costs are beginning to accelerate. owner equivalent rent rang in at +0.31%, highest since April 2019, while rents up +0.24%, highest since Mar-20.

- The latter is key to inflation expectations for the rest of the year: most analysts expect OER and private sector rents to pick up from a recent lull. Combined, they're around one-third of the CPI basket.

Source: BLS, MNI

Source: BLS, MNI

MNI BRIEF: U.S. Jobless Claims Edge Down to 376,000

U.S. weekly jobless claims fell by 9,000 in the latest week to 376,000, indicating recent brisk progress in the labor market may be slowing. A Richmond Fed economist told MNI this month additional job gains may be harder to come by due to employment mismatches and lingering issues from the pandemic.

USD LIBOR FIX - 10-06-2021

O/N 0.05575 (0.00112)

1W 0.05788 (-0.00525)

1M 0.07263 (-0.002)

2M 0.10463 (-0.0015)

3M 0.11900 (-0.00575)

6M 0.14825 (-0.00863)

12M 0.23925 (-0.00163)

SOFR Steady Tuesday

| REPO REFERENCE RATES (rate, change from prev. day, volume): |

| * Secured Overnight Financing Rate (SOFR): 0.01%, no change, $896B |

| * Broad General Collateral Rate (BGCR): 0.01%, no change, $374B |

| * Tri-Party General Collateral Rate (TGCR): 0.01%, no change, $355B |

STIR: Overall Fed Funds And 75th Percentile Hanging In There

| New York Fed EFFR for prior session (rate, chg from prev day): |

| * Daily Effective Fed Funds Rate: 0.06%, no change, volume: $64B |

| * Daily Overnight Bank Funding Rate: 0.04%, no change, volume: $259B |

Of note is that the 75th percentile of transactions was again at 0.07% for the 2nd consecutive day Wednesday, after dipping to 0.06% Monday (leading to speculation the overall effective rate could dip below 0.06%).

NY Fed Operational Purchase

Tsy 4.5-7Y, $6.001B accepted vs $20.067B submission

Next scheduled purchase:

- Fri 6/11 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 6/11 1500ET Update NY Fed Operational Purchase Schedule

EGBs-GILTS CASH CLOSE: Peripheries Outperform On ECB Steadiness

Periphery EGBs outperformed Thursday as the ECB maintained steady policy. Bunds and Gilts were hit in sympathy with US Tsys after a stronger-than-expected US inflation print, but yields ended well off session highs (Gilts underperformed).

- Italian and Greek spreads tightened sharply as the ECB meeting did not offer many significant surprises; staff macro projections were revised higher.

- Supply came from Italy (BTPs, EUR7.75bn) and Ireland (IGBs,EUR1.25bn).

- UK GDP highlights Friday's docket; several speakers including ECB's Holzman and Knot, BOE's Bailey/Ramsden/Cunliffe as well as Chancellor Sunak.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.9bps at -0.685%, 5-Yr is down 1.3bps at -0.628%, 10-Yr is down 1.2bps at -0.256%, and 30-Yr is unchanged at 0.312%.

- UK: The 2-Yr yield is up 0.9bps at 0.067%, 5-Yr is up 1.2bps at 0.321%, 10-Yr is up 1.7bps at 0.747%, and 30-Yr is up 1.3bps at 1.279%.

- Italian BTP spread down 2.2bps at 105.1bps/ Greek spread down 1.7bps at 106.1bps

FOREX: G10 Currencies Trade Within Narrow Ranges

- The heavily anticipated inflation prints from the US came and went, prompting no meaningful reaction in the greenback. Dollar Indices find themselves in minor negative territory on Thursday, despite US CPI readings beating market expectations.

- An initial spike in the USD on the release was quickly faded as a deeper dive into the figures, failed to garner sustained enthusiasm.

- EURUSD was confined to a 50-pip range over the ECB policy decision and press conference. Markets were given few clues regarding PEPP and future policy and as such, whipsawed either side of unchanged on the day. EURJPY however, did fail at the first notable resistance level of 133.81, the June 4 high, steadily retreating around 50 points thereafter.

- Despite a choppy session, firmer equities drove stronger performance in the likes of AUD and NZD, rising around 0.3%. The outperformer in G10 is GBP (0.37%) after failing below 1.41, however, it is worth noting that GBPUSD spot resides unchanged from the negative EU comments that soured sentiment on Wednesday at 1.4170.

- Overall G10 currencies have struggled to make any significant moves. Greater volatility was witnessed in EM, with substantial gains in both TRY (+1.96%) and ZAR (+1.08).

- With the bulk of the event risk completed, few fireworks are expected on Friday. UK Industrial Production tomorrow morning before BOE's Bailey is due to speak at an online event. The US session will be headlined by University of Michigan Sentiment.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.