-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Positioning Ahead Fed Blackout

US TSY SUMMARY: Yld Curves Bend Steeper

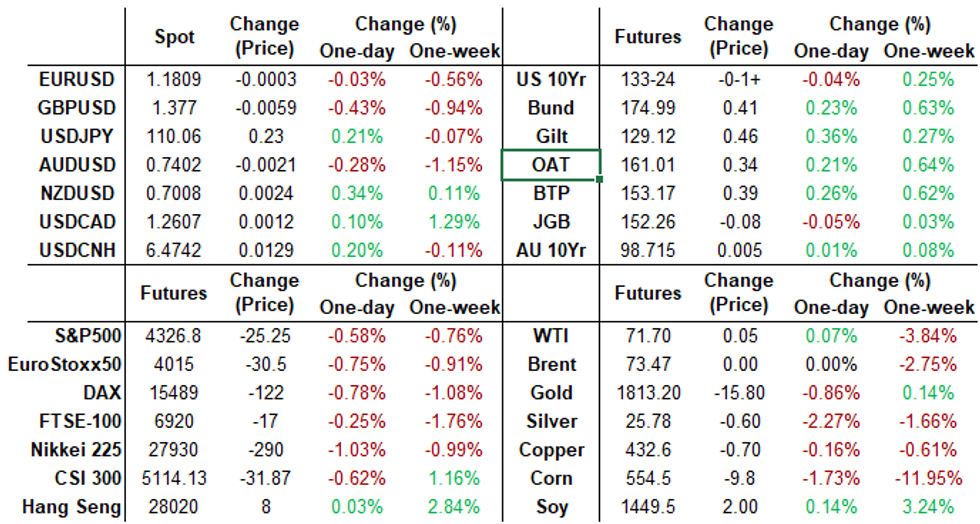

Rates and equities looked to finish out the session weaker Friday, the latter slipping to lows for the week (ESU1 4320.75) before bouncing to appr 4328.0 after the rate close. Tsys weaker for the most part as well, off lows and back near early overnight levels, curves mildly steeper with short end outperforming. Light volume: TYU appr 900k after the bell.- Retail sales better than expected -- Tsy futures gapped lower immediately after June R/S came out 0.6% vs. -0.3% estimate -- but rebound to pre-release levels just as quickly as revisions factor in a "wash" w/May to -1.7% from -1.3%. Equities held onto modest gains until midmorning when better selling/positioning ahead weekend pushed levels back to last July 9 levels.

- Aside from the early data -- pre-weekend position squaring appeared to be main driver, Fed goes into media blackout at midnight, maintaining radio silence in regards to monetary policy through July 29, day after next FOMC.

- The 2-Yr yield is up 0.2bps at 0.2255%, 5-Yr is up 0.5bps at 0.7798%, 10-Yr is up 0.5bps at 1.3037%, and 30-Yr is up 1.3bps at 1.9335%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00012 at 0.08575% (-0.00088/wk)

- 1 Month -0.00550 to 0.08363% (-0.01650/wk)

- 3 Month +0.00037 to 0.13425% (+0.00562/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00112 to 0.15213% (+0.00112/wk)

- 1 Year +0.00113 to 0.24213% (+0.00325/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $73B

- Daily Overnight Bank Funding Rate: 0.08% volume: $253B

- Secured Overnight Financing Rate (SOFR): 0.05%, $933B

- Broad General Collateral Rate (BGCR): 0.05%, $378B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $348B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $9.733B submission

- Next scheduled purchases

- Mon 7/19 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 7/20 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 7/21 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 7/22 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operations

NY Fed reverse repo usage slips to $817.566B from 72 counterparties vs. $776.216B on Thursday. Remains well off June 30 record high of $991.939B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options- Update, -40,000 Green Sep 98.75/98.87/99.37/99.50 call condors, 9.5 vs. 99.085-.115/0.05%

- +20,000 Blue Sep 98.50/98.87 call over risk reversals, 0.0 net vs 98.70/0.50%

- Update, -35,000 short Sep 99.37/99.50/99.87/100 call condors, 11.5 vs. 99.67/0.67%

- Block, +10,000 Blue Aug 98.62/98.75 call spds, 6.5 at 1157:40ET

- Update, total +15,000 Green Oct 99.87/99.93 put spds, 6.75-7.0

- +1,000 Green Sep 88 puts .75 over Blue Sep 82/85 put spds, flattener

- +1,000 Blue Sep 98.25/98.37/98.5/98.62 put condors, 2.5

- +10,200 Blue Jul 98.62 puts, 0.5

- -3,000 Green Aug 99.00/99.12 strangles, 10.5

- Overnight trade

- -5,000 Green Mar 88/93 call spds, 18.5 vs. 98.85/0.29%

- 3,100 Mar 99.75/99.81/99.87 call flys

- 3,500 Jun 99.62/99.75/99.87 put flys

- 3,000 Green Aug 98.62/98.81/99.00 put flys

- +5,000 wk3 TY 133.5 calls, 10

- >11,000 TYQ 132.5 puts, 2-3

- 3,000 TYQ 134.25 calls, 8

- -1,000 TYQ 133.75 straddles, 44

- +15,000 FVU 121.25/122.25/123.25 put flys, 8

- +2,500 TYQ 133/133.5 2x1 put spds, 4

- Overnight trade

- +13,000 TYU 130/131 put spds, 4

- Block +5,000 TYQ 134.25/135 1x2 call spds, 4.5, more on screen

FOREX: NZD Consolidates Gains, GBP Fades As UK Cases Rise

- A firm Q2 NZ CPI print saw the headline reading print above the RBNZ's target band, triggering an extension of NZD strengthening post the RBNZ earlier this week. This left the NZD atop the G10 FX table, up 0.45%

- Mild pressure in equities saw a firmer dollar for the majority of the session, however, the dollar index slowly inched back to unchanged on the day heading into the close.

- Despite the gradual retreat of the greenback, GBPUSD was the weakest currency pair on Friday, breaching the 1.38 mark and likely to close around 1.3780, down 0.35%. Potentially weighing on Sterling, headlines confirmed over 50,000 new coronavirus cases for the first time in six months Friday amid a warning from the British government's top medical adviser that the number of people hospitalized with COVID-19 could hit "quite scary" levels within weeks.

- Most other G10 currencies held narrow ranges on Friday with a lack of market catalysts to spark any price action approaching the weekend.

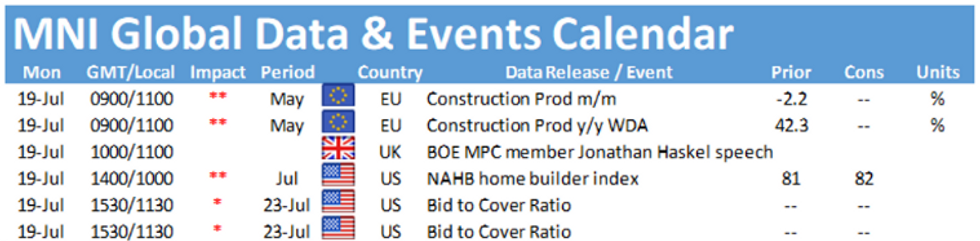

- BOE MPC Member Jonathan Haskel due to speak on Monday, with US NAHB Housing Market Index the only US data point.

FX OPTION EXPIRY

- EURUSD; 1.1800 (848mln)

- USDJPY: 110 (488mln)

- GBPUSD: 1.3835 (369mln)

- USDCAD: 1.2500 (3.73bn)

- NZDUSD: 0.7000 (407mln)

PIPELINE: MS, BoA Help Push High-Grade Issuance Over $42B/wk

- Date $MM Issuer (Priced *, Launch #)

- 07/?? $1.2B Xiaomi $800M 10Y, $400M 30Y Green bond

- $24.15B Priced Thursday; $42.385B for week

- 07/15 $8.5B *Morgan Stanley $2B 3.5NC2.5 +57, $3B 6NC5 +75, $3.5B 11NC10 +95

- 07/15 $7.75B *Bank of America $2B 6NC5 tap +77, $3.75B 11NC10 +100, $2B31NC30 +103

- 07/15 $2.75B *African Development Bank (AFDB) 5Y +1

- 07/15 $2.25B *New Development Bank (NDB) 3Y +14

- 07/15 $1.3B *Royalty Pharma $600M 10Y +105, $700M 30Y +155

- 07/15 $1B *ADT Security 8Y 4.12%

- 07/15 $600M *Cibanco 10Y +312.5

EQUITIES

Key late session market levels

- DJIA down 253.57 points (-0.72%) at 34823.73

- S&P E-Mini Future down 25.5 points (-0.59%) at 4334.25

- Nasdaq down 69.5 points (-0.5%) at 14483.54

European bourses closing levels:

- EuroStoxx 50 down 20.62 points (-0.51%) at 4035.77

- FTSE 100 down 3.93 points (-0.06%) at 7008.09

- German DAX down 89.35 points (-0.57%) at 15540.31

- French CAC 40 down 33.28 points (-0.51%) at 6460.08

COMMODITIES

- WTI Crude Oil (front-month) up $0.07 (0.1%) at $71.82

- Gold is down $16.07 (-0.88%) at $1812.19

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.