-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOJ Tankan To Show Slipping Sentiment

MNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI ASIA MARKETS ANALYSIS: Weak EQs Tail-Wind For Tsys Pre-FOMC

US TSY SUMMARY: Yields Ebb in Lead-Up to FOMC

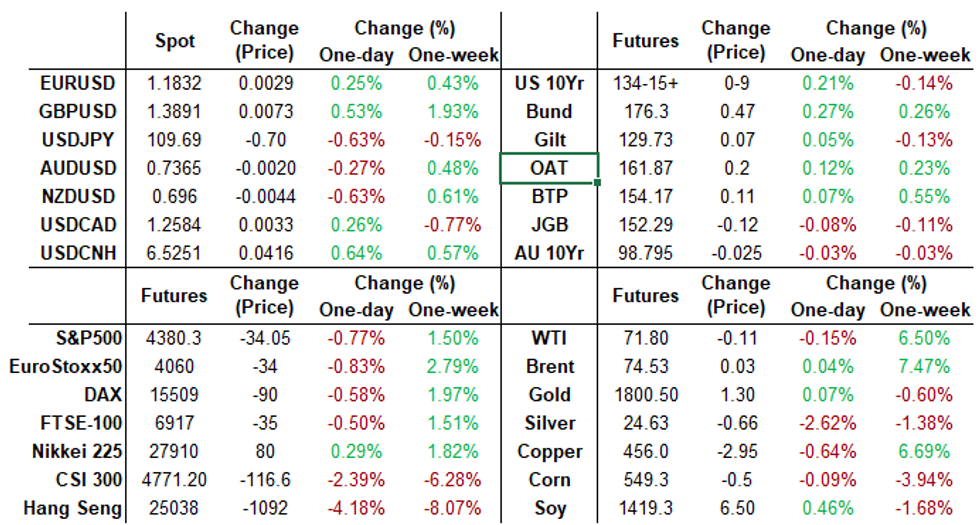

Tsys rallied Tuesday, weaker equities triggered by China stocks overnight (Shanghai Comp down 2.5% at 3,381.18 CSI 300 down 3.5% at 4,751.31) providing an early tail wind on an otherwise muted, pre-FOMC session.

- Yield curves broadly flatter w/30Y bonds holding early session highs after big miss on Durables (+0.8% vs. +2.1% exp -- softened somewhat by upward revision for prior: +3.2% vs. 2.3%). Trading desks reported carry-over buying in 2s-5s, two-way in 10s and more recently in 30s.

- Tsy futures held near session highs after $61B 5Y note (91282CCP4) auction tailed slightly: .01bp: high yield of 0.710% vs. 0.709% WI. Bid-to-cover 2.36x just over 5 month average of 2.35x. Indirect take-up climbed to 58.07% vs. 57.62% in June (59.01% 5M avg); direct bidder take-up slipped to 17.75% vs. 18.09% last month (5M avg of 16.29%); primary dealer take-up: 24.18% was still shy of the 5-month average of 24.70%. The next 5Y auction is tentatively scheduled for August 25.

- Focus turns to Wed's FOMC policy annc, no change in rate expected but many sell-side analysts anticipate more discussion regarding tapering.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; US Gov infl-linked 0.23Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.06 | 0.04 | 0.05 |

| Credit | 0.06 | 0.12 | 0.08 |

| Govt/Credit | 0.07 | 0.1 | 0.08 |

| MBS | 0.08 | 0.07 | 0.06 |

| Aggregate | 0.07 | 0.09 | 0.08 |

| Long Gov/Cr | 0.05 | 0.09 | 0.07 |

| Iterm Credit | 0.06 | 0.1 | 0.08 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.11 | 0.1 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00012 at 0.08088% (+0.00075/wk)

- 1 Month +0.00288 to 0.09013% (+0.00400/wk)

- 3 Month -0.00200 to 0.12963% (+0.00075/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00125 to 0.15850% (+0.00000/wk)

- 1 Year +0.00037 to 0.23900% (-0.00237/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $73B

- Daily Overnight Bank Funding Rate: 0.08% volume: $260B

- Secured Overnight Financing Rate (SOFR): 0.05%, $881B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $342B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $2.859B submission

- Next scheduled purchases

- Wed 7/28 No buy-operation scheduled due to FOMC

- Thu 7/29 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/30 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $927.419B from 71 counterparties vs. $891.203B on Monday (compares to June 30 record high of $991.939B).

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +30,000 Blue Sep 99.12/99.37 1x2 call spds 2.0

- -5,000 Blue Oct 90/92 call spds 1.5 over 83/85 put spds vs. 98.735/0.25%

- +5,000 short Sep 99.75/99.81 1x2 call spds, 1.0

- +5,000 Jun 100 calls, 1.0 vs. 99.785/0.10%

- +5,000 Blue Dec 98.50/98.75 call spds 0.75 over short Dec 99.50 calls

- -20,000 Red Dec'22 99.50/99.62 put spds, 3.75 vs. 99.585/0.12%

- -30,000 short Dec 99.37/99.50/99.62 call flys, 1.75 legs

- +5,000 Green Sep 99.00/99.12/99.25 call flys, 2.0

- +5,000 Red Sep 99.12/99.37 put spds, 2.0

- 10,000 TYU 133.5/134.5 put spds vs. TYV 132/133.5 put spds, 6 net cr/Oct sold over

- +2,000 TYU 137 calls, 7 vs. 134-17.5/0.11%

- 5,000 FVU 125 calls, 11

- Overnight trade

- 9,500 TYU 132 puts, 9

- 12,000 TYU 133 puts, 17-21, 20 last

- 14,300 TYU 135.5 calls, 20-22

- +5,000 wk5 TY 133 puts, 2 vs. 134-12/0.6%

- +8,000 FVU 123 puts, 4

- +3,500 wk1 FV 124.25/124.5 strangles, 23

EGBs-GILTS CASH CLOSE: Bund Yields Close At 5+ Month Lows

Bund yields (5Y through 30Y) closed at the lowest levels since February, with Gilts also strengthening and bull flattening Tuesday.

- Core FI strength accelerated into the cash close, as equities re-tested the session's weakest levels. The theme throughout the day was China's regulatory crackdown hitting local stocks, with spillovers into US and European markets. Periphery spreads widened.

- Comparatively little on the data front Tuesday. In supply, the UK sold GBP3bln of Gilt, while Italy sold E3.75bln of BTP short-term.

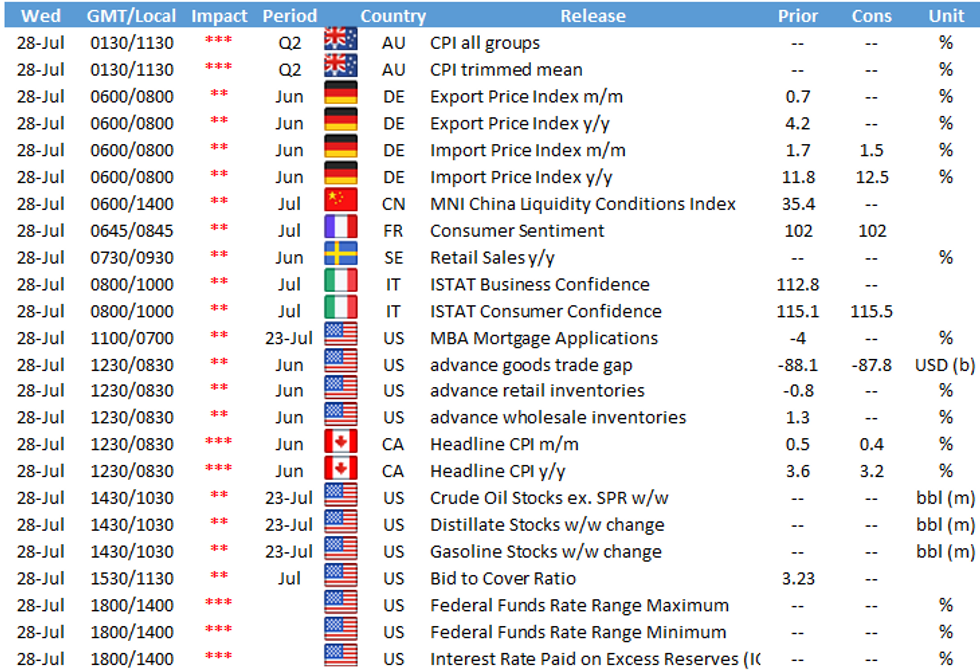

- On Wednesday, Germany sells E2.5bln of Bund, while we get some confidence data (German GfK, French consumer confidence, Italian manufacturing/consumer confidence). No central bank speakers scheduled, but the Federal Reserve meeting will be in focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at -0.746%, 5-Yr is down 1.9bps at -0.722%, 10-Yr is down 2.3bps at -0.441%, and 30-Yr is down 2.7bps at 0.037%.

- UK: The 2-Yr yield is down 0.4bps at 0.076%, 5-Yr is down 0.7bps at 0.271%, 10-Yr is down 1.3bps at 0.558%, and 30-Yr is down 1.9bps at 0.972%.

- Italian BTP spread up 1.7bps at 106.4bps/ Spanish up 1.5bps at 71.3bps

OPTIONS/EUROPE SUMMARY: Schatz Trades Feature

Tuesday's options flow included:

- DUU1 112.30/40/50c fly, bought for 3.5/3.75 in 10k

- DUU1 112.30/112.20ps,1x2 bought for 2.5 in 5k

- DUU1 112.30/112/20/112.10p fly, bought for 2.5 in 2.5k

- RXU1 174.5/177cs 1x2.5, sold the 1 at 62 in 2k

- RXU1 169p, bought for 1 in 3k

- 3RH2 100.25^ bought for 20.75 in 3k. Note: bought yesterday for 20.5 in 1.5k

- SFIH2 99.85/99.80ps, vs 99.95c, bought the ps for 0.25 in 2.5k

- 0LX1 99.87c, bought for 0.75 in 10k

- 0LZ1 99.625/99.75 call spread vs 2x 99.25/99.00 put spread, bought for 0.25 in 4k x 8k (bought the call spread)

FOREX: USDCNH Extends Gains As Safe Havens Back In Favour

- The offshore Yuan came under persistent pressure on Tuesday, extending losses throughout the US session. USDCNH broke through firm resistance at 6.50 in early trade and consolidated gains ahead of the US cash equity open.

- Steady CNH supply saw losses extend, aided by headlines relating to Chinese software firm Hello withdrawing their plans for a US IPO, further weighing on sentiment. USDCNH remains close to the highs of the day around 6.5280 with some analysts now expecting a push towards the 2021 highs at 6.5876.

- Sentiment certainly filtered through to other major G10 currencies, with the Japanese Yen the notable beneficiary. USDJPY sunk back through 110 and experienced 0.7% losses to reach 109.60. More significant moves seen in the crosses with AUDJPY (-1.00%) and in particular NZDJPY (-1.36%) bearing the brunt of the risk sell-off.

- Links to the Chinese economy created headwinds for the New Zealand Dollar, matching CNH as the worst performing currency against the greenback, with 0.7% losses on the day.

- GBPUSD shone once again, rising 0.55% and likely to close right on the highs just below 1.39. A break of yesterday's highs through 1.3833 sparked a quick 50 pip spike for cable, coinciding with a decent uptick in futures volumes approaching the WMR fix. The pair now trades within close proximity to the 100-day MA at 1.3925.

- The market's focus now turns to the July Fed statement and press conference, due tomorrow. The FOMC will use the July meeting to debate its strategy to taper asset purchases (including timing, pace, and composition).

- Also on Wednesday, both Australian and Canadian CPI data will be published.

FOREX/Expiries for Jul28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1790-00(E1.7bln), $1.1820-40(E2.1bln), $1.1850-60(E1.6bln), $1.1880-00(E1.6bln)

- USD/JPY: Y110.00-20($713mln), Y110.25-40($878mln), Y110.65-70($910mln)

- GBP/USD: $1.3685-00(Gbp569mln)

- AUD/USD: $0.7390(A$710mln)

- USD/CAD: C$1.2555-65($510mln)

PIPELINE: Over $7B High-Grade Debt Priced Monday

Tapping brakes after decent start to wk, latest earnings cycle, Wed's FOMC sidelining issuers:- Date $MM Issuer (Priced *, Launch #)

- $7.35B priced Monday

- 07/26 $2.5B *Temasek $750M 10Y +40, $750M 20Y +65, $1B 40Y +85

- 07/26 $1.5B *Royal Bank of Canada $850M 3Y +30, $650M 3Y FRN/SOFR+36

- 07/26 $1.5B *Novelis Corp $750M 5NC2 3.25%, $750M 10NC5 3.875%

- 07/26 $850M *AutoNation $400M 7Y +95, $450M 10Y +115

- 07/26 $1B Jefferies Finance 7NC3 investor call

- Later in week:

- 07/28 $2.75B Air Canada 5NC, 8NC4.5, investor calls Monday

- 07/?? $1.5B Venture Global 8NC, 10NC

EQUITIES: Stocks Have Rare Down Day as China Rout Unsettles Markets

- Wall Street headed into the close lower, with the S&P500 in negative territory for the first session in six as China fragility bled into US markets.

- Markets initially held up well, with the S&P500 sitting just under the alltime highs posted Monday. Sentiment worsened, however, as Chinese software firm Hello withdrew their plans for a US IPO.

- While the deal itself is relatively small (Hello's offering was valued at around $100mln), markets are clearly concerned that the successful trend of Chinese firms raising foreign capital in the US (e.g. Tencent, Alibaba, JD.com) could be running into trouble. Reflecting the concern, the NASDAQ China Golden Dragon Index extended the sell-off to over 20% from last week's high.

- Focus switches to key earnings reports after the bell, with Apple, Microsoft, Visa, Starbucks among others on the docket.

COMMODITIES: Copper Rolls Off The Highs as China Fragility Spreads

- Copper and industrial metals partially reversed recent gains Tuesday as Chinese equity markets slid sharply. Copper rolled off the overnight highs of $4.628, but may find some support headed into the 50-dma of $4.411.

- Oil benchmarks were similarly soft, with WTI off around 0.9% while Brent retreated 0.4% into the NYMEX close. Recent ranges were largely respected, with support undercutting at the $70.45 50-dma.

- Gold is slightly softer but remains inside its recent range and below $1834.1, Jul 15 high. The outlook is bullish and the recent pullback is considered corrective. Price however needs to clear $1834.1, Jul 15 high to confirm a resumption of the bull cycle. Support to watch is $1791.7, Jul 12 low that was briefly probed on Friday.

- Focus Wednesday turns to the weekly DoE crude inventories update, with markets expecting a draw of 2.4mln bbls following last week's build.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.