-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI ASIA MARKETS ANALYSIS: Tsy Yields Grinding Higher Ahead CPI

US TSY SUMMARY: Tsy Yields Grinding Higher Ahead CPI

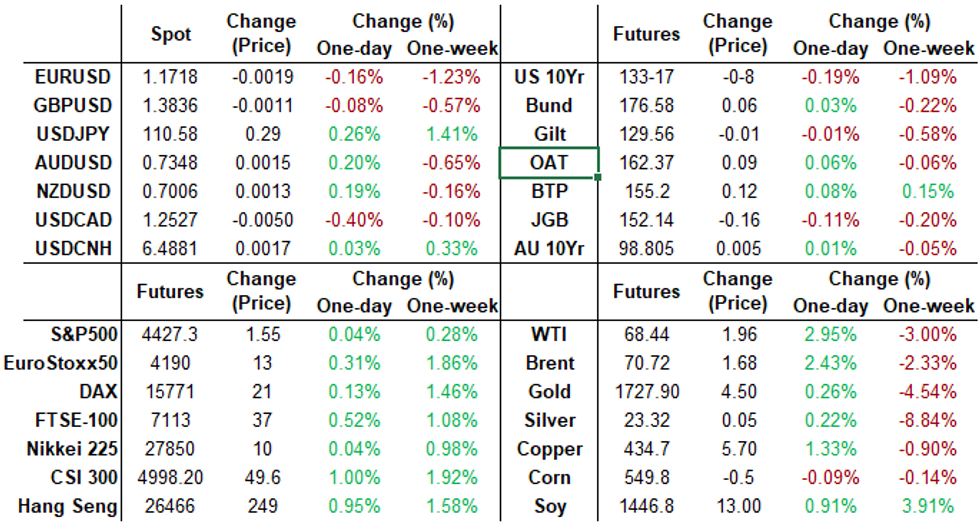

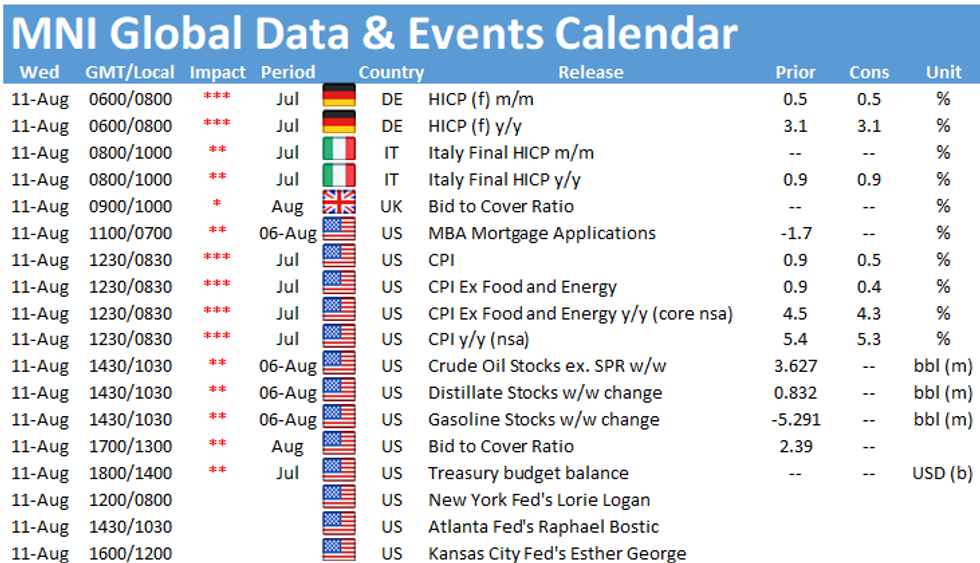

Yields continued to climb higher (10YY 1.3473%, 30YY 1.9915%) on a light data session (US Q2 PREL UNIT LABOR COSTS +1.0% VS Q1 -2.8%; US Q2 PREL NONFARM PRODUCTIVITY +2.3% vs Q1 +4.3%).- Rates near midday lows after the bell, on modest volumes (TYU just over 1.1M) as participants focused on Wed's CPI MoM (0.5% est, 0.9% prior); ex food/energy (0.4% est, 0.9% prior), YoY (5.3% est, 5.4% prior); ex food/energy (4.3% est, 4.5% prior).

- Citi economists say details for inflation metrics like CPI are becoming much more important as they forecast a "solid 0.39% increase in core CPI in July, with some further upside from transitory components such as airfares, but with strength in components like used car prices likely coming to an end."

- Continued surge in corporate debt issuance in intermediates to long end weighed: $5B Intel 5Pt jumbo, $3.5B HSBC and $1.2B Moddy's lead.

- Tsys held steady/near lows after $58B 3Y note auction (91282CCT6) stopped through: 0.465% high yield vs. 0.467% WI; 2.54x bid-to-cover off 2.46x 5 auction avg.

- Indirect take-up remains strong at 55.41% vs. 51.16% 5M avg, while direct bidder take-up climbs to new 1+ year high of 18.43%. Primary dealer take-up slips to 26.17% vs. July's 28.55% still well off 31.10% 5M average.

- The 2-Yr yield is up 1.4bps at 0.2344%, 5-Yr is up 2.4bps at 0.8195%, 10-Yr is up 1.9bps at 1.3422%, and 30-Yr is up 1.7bps at 1.9869%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00012 at 0.07863% (+0.00012/wk)

- 1 Month +0.00125 to 0.09650% (+0.00138/wk)

- 3 Month -0.00450 to 0.12275% (-0.00563/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00662 to 0.15625% (+0.00688/wk)

- 1 Year +0.00188 to 0.23963% (+0.00225/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $68B

- Daily Overnight Bank Funding Rate: 0.08% volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.05%, $884B

- Broad General Collateral Rate (BGCR): 0.05%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $19.629B submission

- Next scheduled purchases

- Wed 8/11 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 8/12 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Thu 8/12 1500ET Update NY Fed Operational Purchase Schedule

FED: Reverse Repo Operations, Closing in on $1T Again

NY Fed reverse repo usage climbs to $998.654B from 71 counterparties vs. $981.765B on Monday. Compares to record high of $1,039.394B on Friday, July 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -5,000 Green Dec 99.25/99.37/99.50/99.62 call condors, 2.0 vs. 98.96/0.10%

- +2,000 short Dec99.50/99.62/99.75 call flys, 3.5 vs. 99.545/0.05%

- +25,000 Mar 99.75/99.87 call over risk reversals, 0.0

- +10,000 Blue Sep 99.00/99.12/99.37 broken call flys, 0.25 earlier

- Overnight trade

- -35,000 Green Sep 99.00 puts, 6.0 (OI 188,379)

- +4,000 Green Oct 98.75/98.87 put spds, 4.0 vs. 98.97/0.12%

- 3,000 Green Dec 99.25/99.37 put spds vs. Green Dec 98.87/99.00 put spd

- 1,780 Green Dec 99.00/99.12/99.25/99.50 call condors

- +3,300 Blue Oct 98.87 calls, 6.0 vs. 98.62/0.25%

- 20,000 wk3 TY 134/134.5 call spds, 8

- -20,000 (10k Blocked) TYU 130/132 put spds, 5

- 5,600 TYU 130/131 put spds

- over 40,000 TYU 134/135 call spds, 17

- Overnight trade

- 34,000 wk3 TY 134/135 call spds, 15

- +5,000 TYV 131 puts, 17

- -4,000 TYV 135 calls, 12

- -13,200 FVU 122.75/123.25 put spds, 3

- -4,600 TYU 130.5/131.5 put spds, 1

- BLOCK, -10,000 TYU 133/134 put spds, 24

EGBs-GILTS CASH CLOSE: UK Short End Underperforms ... Again

The UK curve bear flattened with the short end / belly underperforming, while Germany saw a parallel shift modestly higher Tuesday in a fairly directionless session.

- Fairly modest volumes; core FI leaned weaker amid equities gaining. Periphery spreads were marginally tighter.

- Markets shrugged off a disappointing German ZEW expectations figure. Wednesday sees data flow pick up, with UK 2Q GDP (though more attention on US inflation figures).

- After an unremarkable 10-Yr UK auction today, Wednesday sees the last bond issuance of the week: UK sells GBP 0.7bln of Mar-39 linker and Germany sells E4bln of 10Yr Bund.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.748%, 5-Yr is up 0.2bps at -0.723%, 10-Yr is up 0.3bps at -0.457%, and 30-Yr is up 0.2bps at -0.01%.

- UK: The 2-Yr yield is up 1.8bps at 0.153%, 5-Yr is up 1.8bps at 0.296%, 10-Yr is up 0.5bps at 0.589%, and 30-Yr is up 0.1bps at 0.954%.

- Italian BTP spread down 0.6bps at 100.6bps / Spanish down 0.8bps at 68.6bps

OPTIONS/Sterling Steepener And Some Put Condors

Tuesday's European rate/bond options flow included:

- OEU1 135.25/135.00/134.75/134.50 put condor, bought for 7 in 2k

- 0LV1 99.62/99.50/99.25 put fly, bought for 2 in 1k

- 0LX1 99.37p vs 3LX199.12p, bought the 3yr mid for 2.75 in 5k

- 3LX1 + 3LZ1 99.125/99.00/98.875/98.75 put condor strip bought for 4.25 in 10.5k(ref 99.245)

FOREX: CAD Rebounds, JPY Continues Drift Lower

- A recovery in oil prices benefitted the Canadian dollar on Tuesday, topping the G10 pile. USDCAD fell 0.4%, despite broad dollar indices likely to register a third consecutive day of gains.

- An overall improvement in the commodity space also boosted AUD and NZD, with most notable gains seen against the Japanese Yen.

- USDJPY firmed toward 110.60 as the e-mini S&P printed a new all-time high of 4438.25. Greenback strength also remained resolute against both the CHF and the EUR, with EURUSD edging towards the 1.17 mark, falling just short of 1.1704, the March 31 low and a key support.

- USDCHF is set to extend its winning streak to five days, consolidating well above the 0.92 mark and making a marginal new high from late July at 0.9234. More notable resistance comes in at the early July highs seen at 0.9275.

- Overall, currency market activity remained uneventful as markets prepare for the US July CPI report on Wednesday, the headline data and event risk for the week.

FOREX/Expiries for Aug11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-15(E669mln), $1.1750(E557mln), $1.1795-00(E744mln)

- USD/JPY: Y108.65-70($715mln), Y109.85-90($1.4bln)

- EUR/GBP: Gbp0.8450(E655mln)

PIPELINE: $5B Intel 5Pt Jumbo Launched, $1.2B Moddy's Rounds Out List

- Date $MM Issuer (Priced *, Launch #)

- 08/10 $5B #Intel $1B 7Y +50, $1.25B 10Y +65, $750M 20Y +90, $1.25B 30Y +105, $750M 40Y +120 (Intel issued $8B via six tranches in Mar'20: $1.5B 5Y +290, $1B 7Y +295, $1.5B 10Y +295, $750M 20Y +295, $2.25B 30Y +310, $1B 40Y from +340)

- 08/10 $2B #T-Mobile $1.3B 31Y +140, $700M Tap 11/15/60 +155 (adds to $3.8B issued in Mar'21: $1.2B 5NC2 2.625%, $1.25B 8NC3 3.375%, $1.35B 10NC5 3.5%)

- 08/10 $1.2B #Moody's $600M 10Y +80, $600M 20Y +100

- 08/10 $700M *PNC Financial 5Y +37

- 08/10 $3.5B #HSBC $1.5B 3NC2 fix/FRN +50, $2B 8NC7 fix/FRN +108

- 08/10 $1.5B *Standard Chartered 7Y 4.3%

- 08/10 $1.2B #Universal Health $700M 5Y +85, $500M 10Y +133

- 08/10 $1B *Dominion Energy 10Y +92

- 08/10 $650M *Eversource $350M 2Y FRN/SOFR+25, $300M 5Y +60

- 08/10 $500M *Alleghany Corp 30Y +132

EQUITIES: NY Session Sees New Alltime Highs for E-mini S&P

- After an uneventful European morning, the opening bell was more action-packed, with the e-mini S&P bid up to new alltime highs of 4438.25. The energy and materials sectors were drivers of equity strength, as the bottoming-out of oil benchmarks helped return some strength to oil & gas explorers.

- The tech and real estate sectors suffered, with weakness in tech firms reflected in the Dow Jones' and S&P strength over NASDAQ's weakness.

- Stock markets across Europe finished higher, with the UK's FTSE-100 outperforming (+0.4%), while the French CAC-40 lagged slightly, but still managed to finish in the green.

COMMODITIES: Oil Bounce Sees WTI to New Weekly Highs

- WTI and Brent crude futures rallied smartly Tuesday, with oil topping the Monday open to touch new weekly highs.

- Despite the strength in energy products, the move below the 50-day EMA last week looks convincing, with support now exposes at $66.91 for Brent. To resume any incline, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 - 20 downleg.

- Gold had a relatively more stable session when compared to Monday trade, with the precious metal trading inside a $20/oz range.

- Monday's pull lower found some support at the 61.8% retracement of the 2020 range, but the recovery off the low will have emboldened bulls. To reinforce any upside argument, bulls need to regain $1834.1, Jul 15 high, ahead of $1853.3, a Fibonacci retracement.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.