-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk-Off Tempered on Equity Bounce

US TSY SUMMARY: Equity Bounce Tempers Tsy Risk-off Bid

Second half recovery in equities tempered strong risk-off action in rates in the first half Monday. No significant data -- geopolitical risk drivers.

- Session volumes were already robust on geopolitical risk tied to devolving US pullout from Afghanistan situation, remains strong with equities trading weaker after the bell. 10YY 1.2217% low; 30YY slips to 1.8843% low.

- Sources report real- and fast$ buying 10s and 30s, prop and fast$ selling 2s-5s over last 45 minutes. Modest pick-up in Sep/Dec Tsy futures rolling ahead Aug 31 first notice contributed.

- Bonds extended early curve flattening rally: Tsy 30Y futures made new session highs on the heels of large 5s/ultra-bond flattener's significant buy-through in the ultra-bond leg: ratio slightly over the CME's 6:1 spd ratio, closer to 7:1:

- -17,773 FVU 124-06.5, post time offer at 0927:25ET

- +2,565 WNU 199-23, well through the 199-17 post-time offer

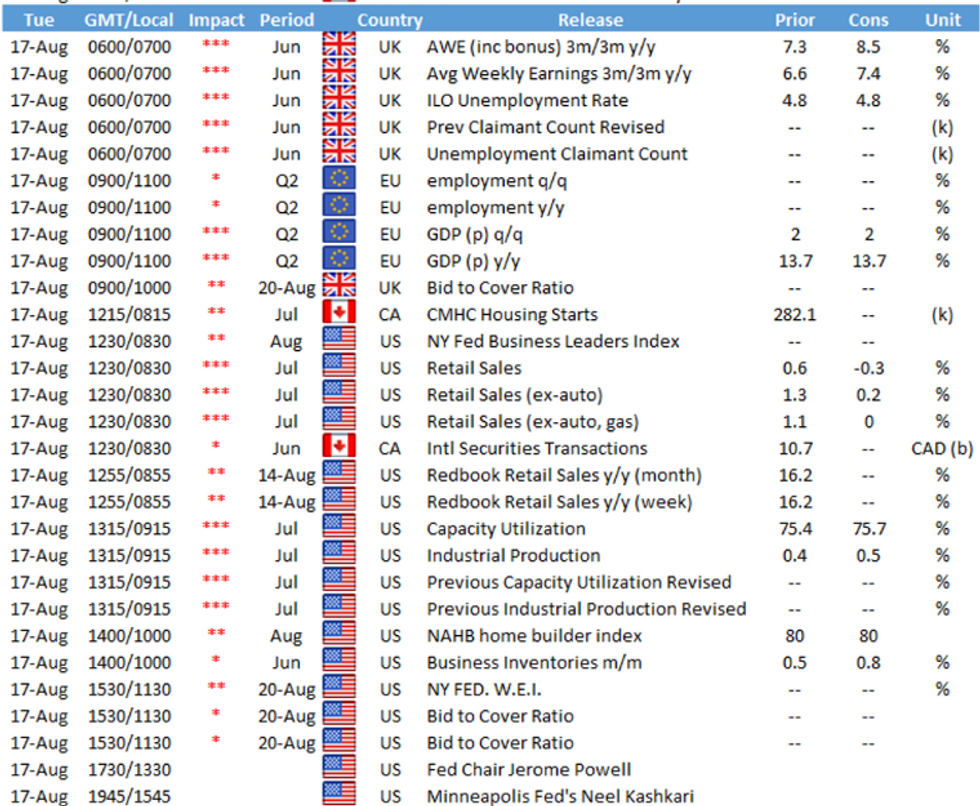

- Data picks up Tuesday w/Retail Sales (-0.2% est vs. 0.6% prior), IP/Cap-U and Fed speak including Fed Chair Powell ahead Wed's FOMC minutes.

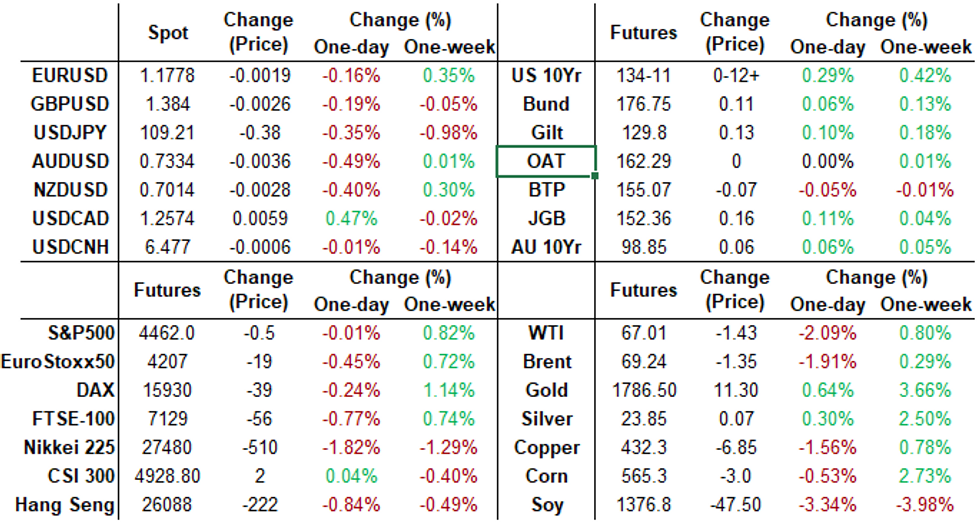

- The 2-Yr yield is down 0.2bps at 0.2052%, 5-Yr is down 2.6bps at 0.7473%, 10-Yr is down 2.8bps at 1.2483%, and 30-Yr is down 1.1bps at 1.9182%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00062 at 0.07825% (-0.00087 total last wk)

- 1 Month -0.00425 to 0.08850% (-0.00250 total last wk)

- 3 Month +0.00025 to 0.12450% (-0.00413 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00125 to 0.15538% (+0.00613 total last wk)

- 1 Year -0.00200 to 0.23675% (+0.00138 total last wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $65B

- Daily Overnight Bank Funding Rate: 0.08% volume: $249B

- Secured Overnight Financing Rate (SOFR): 0.05%, $893B

- Broad General Collateral Rate (BGCR): 0.05%, $385B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $364B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.259B submission

- Next scheduled purchases

- Tue 8/17 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 8/18 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage slips to $1,036.418 from 70 counterparties vs. 1,050.941B on Friday. Record: $1,087.342B on Thursday, Aug 12.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 short Dec 99.62/99.75 call spds 1.5 vs. 99.58/0.10%

- Block, 32,750 short Mar 99.12/99.37 put spds 2.5 over short Mar 99.75 calls vs. 99.49/0.36%

- +10,000 short Jun 98.75/99.00 put spds, 3.75

- Overnight trade

- 2,000 Blue Sep 98.37/98.62 put spds

- 1,500 Blue Mar 99.50 calls

- 65,000 wk3 TY 134.5/135 call spds, 12-9

- 10,000 FVV 124.25 calls, 11

- 2,500 FVU 123.5/123.75 put spds, 1

- 8,000 FVV 123.75/124.25 1x2 call spds

- 4,000 FVZ 124.5 calls

- 6,000 TYU 133.75/134 put spds, 6

- 15,000 TYU 131.5 puts, 1

- 2,000 wk3 TY 133.5/134 2x1 put spds, 1 net/2-legs over

- 1,800 USZ 153 puts, 23

- Overnight trade

- 2,000 TYU 133.25/135 strangles

- 1,200 TYU 133.5/133.75/134.25 broken put tree

EGBs-GILTS: Bund Flattening Reverses

Bunds and Gilts weakened all morning but rebounded in the afternoon as equities headed down. Geopolitical risk (Afghanistan headlines) and weak China economic data weighed on risk appetite.

- The Gilt curve bear flattened, but Bunds notably reversed early flattening (5s30s hit lowest since early Feb) to end steeper. Most yields changed across the UK and German curves.

- Periphery spreads widened, but narrowed vs widest levels in mid-afternoon. BTPs underperformed.

- UK said it would sell a 2nd Green Gilt in October, following the 1st in September.

- No data flow today, but picks up Tuesday with UK and Eurozone employment numbers, and Eurozone 2Q prelim GDP. Also Tuesday, UK sells GBP2bln of Jan-46 Gilt and Germany sells E6bln of Schatz.

- Germany: The 2-Yr yield is unchanged at -0.739%, 5-Yr is up 0.3bps at -0.727%, 10-Yr is down 0.2bps at -0.469%, and 30-Yr is up 0.2bps at -0.02%.

- UK: The 2-Yr yield is up 0.8bps at 0.144%, 5-Yr is up 0.7bps at 0.302%, 10-Yr is unchanged at 0.573%, and 30-Yr is unchanged at 0.961%.

- Italian BTP spread up 2.1bps at 103.4bps / Spanish up 0.8bps at 69.3bps

OPTIONS: Plenty Of 2021 German Puts On Display Monday

Monday's European bond/rates options flow included:

- OEU1 135.25/135.50 call spds sold 12 in 4k

- RXV1 173.00 put bought for 49 and 50 in 2k

- RXV1 170.00 put bought for 7.5 and 8 in 7k

- RXV1 172.00/171.00 1x1.5 put spread bought for 7 in 1.25k

- RXU1 175.00 put bought for 5 in 2k

- RXV1 173.00/172.00 put spread vs 176.00 call sold at 10 (-p/s, +c) in 2k

- RXU1 176/175 put spds vs. 177.5 calls, 24 net cr/package (2x -c/s, 1x +call)

- RXZ1 170.00 put sold at 38 in 3k

- SFIH2 99.85/99.90 1X2 call spread bought for flat in 2.5k (ref 99.82)

FOREX: Souring Risk Sentiment Sees Modest Haven Demand

- Developments in Afghanistan combined with softer Chinese economic activity data overnight kept risk on the backfoot to start the week.

- As such, the Japanese Yen and Swiss Franc were favoured amid a slightly stronger greenback against most other G10 currencies. USDJPY extended Friday's move below 110, putting pressure on the 109 handle. Attention to the downside remains on 108.72, low Aug 04, and then 108.47, a Fibonacci retracement.

- Aussie (-0.45%) faced additional headwinds, following domestic equities lower as markets responded to the NSW state government tightening COVID restrictions and placing the whole state into a strict 1-week lockdown. With cross/JPY falling victim to bearish sentiment, AUDJPY experienced the biggest shift lower, retreating around 0.85%.

- NZD, CAD, and NOK all traded with risk and particular weakness in oil prices weighed firmly on the Canadian dollar and Norwegian Krone.

- Despite US equity indices edging into the green approaching the close, there has been little FX price action of note. In the EM space, broad indices suffered with ZAR and CLP the key underperformers. The Turkish lira bucked the trend, rising 0.77% against the dollar.

- Overnight we will see Australian Monetary Policy meeting minutes before the focus turns to U.K. employment data and Eurozone Flash GDP.

- In the US, the docket will be headlined by July Retail Sales and Industrial Production data.

FOREX: Expiries for Aug17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1775(E556mln), $1.1815-25(E1.6bln), $1.1850-55(E900mln)

- USD/JPY: Y109.05-10($586mln), Y110.00($723mln)

- GBP/USD: $1.3810-25(Gbp535mln)

- AUD/USD: $0.7200(A$800mln), $0.7325-30(A$1.1bln), $0.7450(A$546mln)

- NZD/USD: $0.7050(N$597mln), $0.7080(N$593mln)

- USD/CNY: Cny6.4900($1.1bln)

PIPELINE: Athene, Southwest Energy Outpace Pfizer

- Date $MM Issuer (Priced *, Launch #)

- 04/16 $1.25B #Athene Global Funding $550M 3Y +50, $350M 3Y FRN/SOFR+56, $350M 7Y +95

- 04/16 $1.2B #Southwest Energy 8.5NC3.5 5.37

- 04/16 $1B #Pfizer 10Y +53

- 04/16 $600m #Norfolk Southern 30Y +103

- 04/16 $Benchmark HDFC Bank inaugural 5Y

EQUITIES: Stocks Sensitive Amid Taper Talk, Kabul Chaos

- Equities were offered for much of the Monday session, with Wall Street opening lower and holding the losses into the Monday close. Tech-led NASDAQ was the underperformer, with cyclicals softer across the S&P 500 also. Defensive names including healthcare and utilities held recent gains more effectively, stemming the S&P500's losses to around 0.3%.

- A broad sense of risk-off was evident across asset classes, with markets responding to the scenes of chaos in Kabul, Afghanistan as well as a WSJ report pointing to agreement among the FOMC for asset purchases to conclude as soon as mid-2022.

- European trade was similarly negative, with continental markets down 0.3-0.9%. The UK's FTSE-100 lagged, dropping toward last week's lows.

COMMODITIES: Oil Slips, But OPEC Stems Decline

- Energy products traded lower for much of the Monday session, with both WTI and Brent crude futures falling as much as 3.5% at some points of the trading day. This saw WTI edge briefly below the 100-dma at $66.93/bbl briefly, before markets found bottom and recovered into the close.

- A Reuters report citing OPEC+ sources helped stem the decline, rebuffing requests last week from the US for the group to turn on the production taps. The report went on to say that OPEC and Russia believe oil markets do not need more oil than they plan to release in the coming months.

- Gold and silver traded in minor positive territory, benefiting from the over-arching risk-off theme as markets watched the chaotic scenes in Kabul as well as the poorer-than-expected macro data from China overnight.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.