-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI ASIA MARKETS ANALYSIS: Taper Timing Spurs Heavy Yr End Trade

US TSY SUMMARY: Heavy Year-End Positioning Eurodollar Trade

Rates trading firmer after the bell, off early session highs on moderate overall volumes. Not much of a reaction to early session data, futures firmer but remain off pre-open highs after weekly claims (348k/-29k vs. 364k est), continuing claims (2.820M vs. 2.800M est) and fourth consecutive Philly Fed read (19.4 vs. 23.1).- No data Friday, markets do have Dallas Fed Kaplan to listen to at 1100ET.

- Heavy Eurodlr volumes in front end, EDU1-EDH2 >1.1M. Year-end theme:

- Near 40k EDZ1/EDH2 spds sold -0.035 late overnight, largely driven by nod towards Fed tapering before yr end Wed's July FOMC minutes. Traders also posit general funding worries in the event of a stock rout contributing to the sell interest.

- Over 350k EDZ1 sold from 99.81 to 99.79 (-0.020-0.030) in late trade, total volume near 650,000; appr 50,000 EDU1 sold as well from 99.87 to .865.

- Tsy announced offering amounts for next wk's 2-, 5- and 7Y note auctions -- as expected: $60B, $61B and $62B respectively. New addition: 67D-Bill CMB (Cash Management Bill): $40B with Nov 1 maturity -- "suggesting confidence that they will have room through Nov 1 for those concerned about the debt ceiling" one desk posited. Whether the 119D-Bill CMB that is annc'd one day prior, remains to be seen.

- Strong $8B 30Y TIPS auction re-open: stops through -0.292% vs. -0.285% WI.

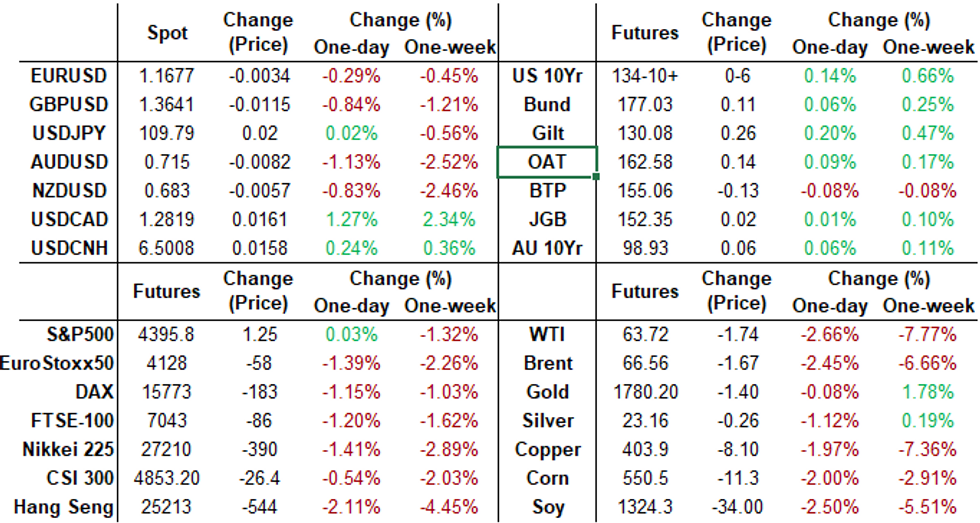

- The 2-Yr yield is up 0.2bps at 0.2176%, 5-Yr is down 0.5bps at 0.7637%, 10-Yr is down 1.7bps at 1.2417%, and 30-Yr is down 2bps at 1.8776%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00013 at 0.07850% (+0.00088/wk)

- 1 Month -0.00050 to 0.08788% (-0.00388/wk)

- 3 Month -0.00013 to 0.13075% (+0.00650/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00375 to 0.15463% (-0.00200/wk)

- 1 Year +0.00025 to 0.23525% (-0.00350/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $65B

- Daily Overnight Bank Funding Rate: 0.08% volume: $255B

- Secured Overnight Financing Rate (SOFR): 0.05%, $935B

- Broad General Collateral Rate (BGCR): 0.05%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $357B

- (rate, volume levels reflect prior session)

- TSY 4.5Y-7Y, $6.001B accepted vs. $21.522B submission

- Next scheduled purchase

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION, Holding above $1T

NY Fed reverse repo usage slips to 1,109.938B from 78 counter-parties vs. Wed's new record high of $1,115.656B. Prior record of $1,087.342B from Thursday, Aug 12.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -7,500 Red Sep'22 99.50 puts, 5.0

- -5,000 Red Dec'22 99.25 puts, 7.5

- +20,000 Mar 100 calls earlier, 1.0

- Update, +13,000 Green Dec 98.37/99.00 put spds, 12.5-13.0

- +4,000 short Mar 99.00/99.75 strangles, 5.5

- Overnight trade

- Block, 7,500 Green Dec 98.62 puts, 4.5 cs. 99.00/0.10%

- 4,000 Green Dec 98.37/99.00 put spds

- 3,400 short Dec 99.18/99.37/99.56 put flys

- 3,000 wk3 TY 134.25/134.5 1x2 call spds, 8

- BLOCK, 5,000 USV 165/166 call spds, 26

- 10,000 TYU 134 puts, 12-15, appr half tied to TYU 134/135 strangle

- 9,500 TYV 135 calls, 16-18

- 5,500 TYV 132 puts, 12

- 4,500 TYU 134.5 calls, 13

EGBs-GILTS CASH CLOSE: Strong But Underwhelming Rally

Bund and Gilt yields fell Thursday, but the magnitude of the drop was relatively tame considering the broader risk-off context.

- 10Y Bund yields tested -0.50% for the 2nd time this week as a safe haven bid built up over the morning, but finished above -0.49%. Gilts outperformed.

- European stock indices fell by more than 2% at one point and oil prices more than 3%, amid renewed concerns over global growth/COVID, but ended up off the lows.

- Periphery spreads widened (Italy underperformed) amid the risk asset sell-off.

- Supply this morning came from France (OATs, EUR6.997bn, & OATi/OATei, EUR991mn).

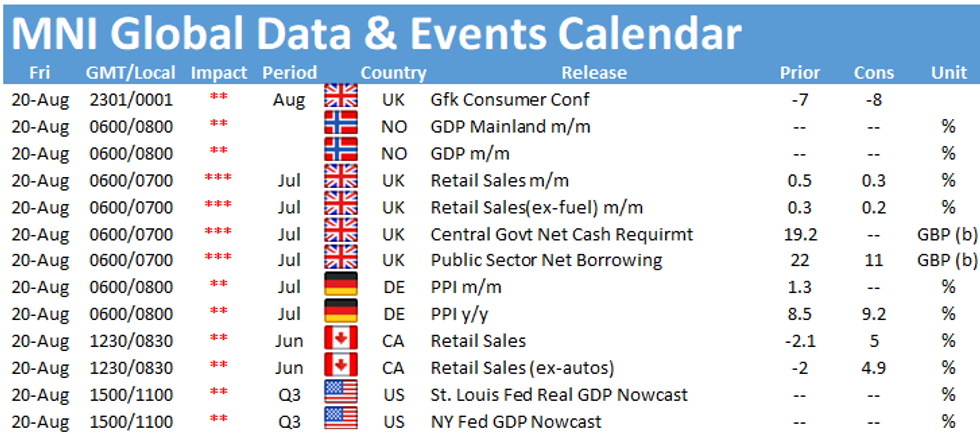

- Quiet schedule Friday: no bond supply; German PPI and UK Retail Sales data feature.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.3bps at -0.747%, 5-Yr is down 0.6bps at -0.744%, 10-Yr is down 0.7bps at -0.489%, and 30-Yr is down 1.7bps at -0.051%.

- UK: The 2-Yr yield is down 2.5bps at 0.116%, 5-Yr is down 3bps at 0.262%, 10-Yr is down 2.7bps at 0.538%, and 30-Yr is down 2bps at 0.941%.

- Italian BTP spread up 1.8bps at 105.1bps / Spanish up 0.8bps at 70.8bps

EGB OPTIONS: Buying Spreads And Combos

Thursday's European bonds and rates options flow included:

- RXV1 173.00/172.00 1x2 put spread bought for flat in 1.5k

- 2RH2 100.125 puts bought for 2.25 in 10k (underlying 2RH4 is 100.41)

- 0LZ1 99.75/99.875 call spread bought for 0.75 in 10k

- 0LZ1 99.00 / 99.875 combo bought for 0.25 in 20k (+call, -put)

FOREX: Dollar Index Extends To Fresh 2021 Highs

- The greenback extended past the March peak to fresh nine-month highs amid concerns over global growth that weighed heavily on risk and most other G10 currencies.

- The additional slump in commodities prices placed commodity-tied currencies under particular pressure, with both AUD(-1.13%) and NZD (-0.89%) extending their recent downtrends.

- Specific weakness in oil prices heavily affected the Norwegian Krone and Canadian dollar, the biggest laggards in G10 FX, both retreating well over 1% against the US dollar. USDCAD has taken out the July highs at 1.2807 and the next point of focus will be the year's highs residing at 1.2881.

- GBP also performed poorly losing 0.8%, however EURUSD, while still below the 1.1704 breakout, held a more contained range as potential expiries at 1.1700 for the NY cut appeared to cap the price action. As such, EURGBP squeezed higher back above 0.85, rising half a percent.

- Despite the demand for the US dollar, other haven currencies such as JPY and CHF held firm on Thursday and were the notable outperformers, broadly unchanged for the session.

- Moves in emerging market currency indices were inversely correlated with the dollar index, however, there was notable underperformance in the South African Rand, sliding 1.75%.

- Possible comments from RBA Assistant Governor Christopher Kent expected overnight, before UK retail sales and public sector borrowing data headline the European docket. Canadian retail sales data will close off the weekly data schedule with potential comments from Dallas Fed's Kaplan.

FX/Expiries for Aug20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1675(E506mln), $1.1700(E831mln), $1.1800(E737mln)

- USD/JPY: Y106.80($1bln), Y108.70-75($1.1bln), Y110.00-20($880mln)

- AUD/USD: $0.7425(A$750mln)

- USD/CAD: C$1.2575-85($630mln), C$1.2600($693mln), C$1.2700($570mln)

- USD/CNY: Cny6.4700($1.4bln)

PIPELINE: ADB Priced

- Date $MM Issuer (Priced *, Launch #)

- 08/19 $1B *ADB 5Y FRN/SOFR +18

- 08/19 $750M Pilgrims Pride 10.5NC5

EQUITIES: Europe Tumbles, But US Manages to Eke Out Gains

- Markets globally started the session poorly, with the e-mini S&P following European cash markets to new monthly lows. The 50-dma once again proved solid support at 4342.50, with dip-buying emerging ahead of the level to help tip the index back into positive territory ahead of the close. Tech and consumer staples helped buoy US markets back into the green, but it was a different story in Europe.

- France's CAC-40 led the continental decline, with the high concentration of luxury goods makers and miners denting the index. Some of the largest names in the market including Kering and ArcelorMittal dropped 7% or more on concerns over a Chinese wealth crackdown and lower commodities prices respectively.

- The lower open and swift turnaround for the S&P 500 helped support the VIX, which traded up to just shy of 25 points and a new monthly high. These gains faded into the close as markets bottomed and plotted a more steady course.

COMMODITIES: Oil Set for Lowest Close Since May, On Track to Enter Bear Market

- Both energy and metals markets tumbled Thursday, with demand concerns from China, a solid showing from the greenback and volatile equities all contributing to a down day for commodities.

- Iron ore was an early focus, with the Dalian-listed metal dropping as much as 12% from the week's highs on reports that China are looking to curb steel production on pollutant concerns, severely denting demand for iron ore - a key input.

- This weakness bled into the likes of copper and crude oil, putting WTI futures on track for the lowest close since May. The WTI benchmark is now over 18% off the July highs, meaning further weakness could tip oil into bear market territory.

- Gold and silver initially held up well against weaker equity market, but eventually succumbed to pressure from the firm greenback. This kept gold inside a range, with the 50-dma at 1795.6 still key resistance.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.