-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stocks Make New Highs

US TSYS: Supported as Equities Make New All-Time Highs

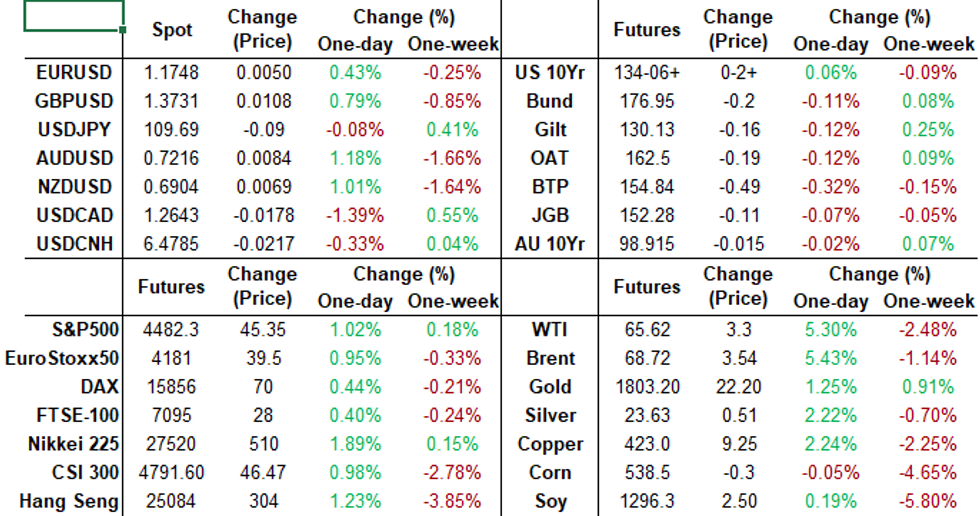

Back to/near midmorning highs after the bell. Take away the quarterly roll volume in Tsys and volumes were pretty light for the late summer session (TYU<950k; >172k TYU/TYZ volume). Meanwhile , equities mad new all-time highs: ESU1 tapped 4485.75 in early noon trade; Crude bounced back to last Wed' levels (WTI +3.4 at 65.54) and Gold surged over 1,806.0.

- Little/no react from rates to weaker than estimated Markit US PMIs (Mfg 61.2 vs. 62.0 est; Srvc 55.2 vs. 59.2 est) tempered by better than expected Existing home sales (+2.0% TO 5.99M SAAR).

- Focus on Friday's now remote economic symposium hosted by KC Fed in Jackson Hole Wyoming.

- Cross-asset positioning, no deal-tied flow but some early pre-auction short sets ahead first leg Tsy supply w/$60B 2Y note auction Tuesday reported.

- Reminder, Sep Tsy options expire Friday while Dec underlying futures takes lead quarterly position from Sep on Aug 31 (first notice).

- The 2-Yr yield is up 0bps at 0.2242%, 5-Yr is down 1bps at 0.7721%, 10-Yr is unchanged at 1.255%, and 30-Yr is up 0.5bps at 1.8735%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00037 at 0.07775% (-0.00025 total last wk)

- 1 Month -0.00150 to 0.08438% (-0.00588 total last wk)

- 3 Month +0.00087 to 0.12925% (+0.00413 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00037 to 0.15300% (-0.00400 total last wk)

- 1 Year +0.00037 to 0.23700% (-0.00212 total last wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $68B

- Daily Overnight Bank Funding Rate: 0.08% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.05%, $902B

- Broad General Collateral Rate (BGCR): 0.05%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $354B

- (rate, volume levels reflect prior session)

- TSY 7Y-10Y, $3.201B accepted vs. $8.131B submission

- Next scheduled purchases

- Tue 8/24 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Wed 8/25 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 8/26 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 8/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION, New Record High

NY Fed reverse repo usage climbs to new record high of 1,135.697B from 76 counter-parties vs. $1,111.908B on Friday. Prior record high of $1,115.656B set Wednesday, Aug 18.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +12,000 Mar 100 calls, 1.0

- -5,000 Mar 100/100.06 call strips, 1.5

- -3,000 short Mar 90/97 strangles, 5.75

- Block, 10,000 Red Dec22 97.50 puts, 1.5

- +10,000 Green Dec 98.37/98.87 put spds, 9.5-10.0

- +2,000 Green/Blue Mar 99.50 call strip, 4.5

- +12,000 short Nov 99.50/99.62 2x1 put spds, 0.5-0.75

- -2,500 short Oct 99.37/99.50 put spds, 2.75

- Overnight trade

- 5,300 Green Dec 99.25 calls, 5

- -5,000 TYV 135.5 calls, 6

- -4,800 USV 165 calls, 113

- Overnight trade

- -12,500 TYU 135 calls, 2

- 5,500 TYU 133.5 puts, 7

- 3,000 TYU 132.5/133 2x1 put spds

- 4,400 TYV 131 puts, 6

- 2,500 TYV 131/132 2x1 put spds

- 3,400 TYZ 130.5/132 put spds

EGBs-GILTS CASH CLOSE: BTPs Underperform Amid Broader Weakness

Bunds and Gilts weakened modestly in Monday trade, with yields coming off late-morning highs to leave curves mixed (UK bear flatter, Germany bear steeper).

- Weakness mirrored a rebound in equities and oil from Friday's lows. And Core FI appeared to shrug off weaker-than-expected but still solid Aug flash PMI readings.

- Notably though, periphery spreads widened, led by Italy (10Y spread above 107bp to Bunds for first time since the start of the month). No particular trigger and slightly at odds with broader risk-on sentiment.

- In issuance, Germany sells 7Y Bund and UK 5Y Gilt tomorrow; Finland also expected to sell E3bln 5Y RFGB via syndication.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.1bps at -0.747%, 5-Yr is up 0.6bps at -0.742%, 10-Yr is up 1.5bps at -0.48%, and 30-Yr is up 2bps at -0.031%.

- UK: The 2-Yr yield is up 1.4bps at 0.115%, 5-Yr is up 1.9bps at 0.261%, 10-Yr is up 1.3bps at 0.536%, and 30-Yr is up 0.6bps at 0.946%.

- Italian BTP spread up 2bps at 106.1bps / Spanish up 0.5bps at 71.1bps

EGB OPTIONS: Plenty Of Oct / Nov German Puts

Monday's European rates/bonds options included:

- RXU1 176/175/174 put fly, sold at 7 in 2k

- RXU1 175.5/173.5ps, bought for 5 in 1.25k

- RXV1 176/176.5/177/178 broken c condor, sold at 2 in 1.25k

- RXV1 176c, bought for 12.5 in ~2.8k

- RXX1 173/172ps 1x1.5, bought for 6 in 1.5k

- RXX1 173p, bought for 68 and 69 in 5k

- DUV1 112.30/20ps 1X4, sold at -1 in 1k

- DUV1 112.20 put, bought for 1.25 in 5.6k

- DUV1 112.40/112.30 1x2 put spread bought for 2.25 in 4k

- DUX1 112.30/20/10 put fly, bought for 1.5 in 3k

- OEV1 135.50/134.75 put spread vs 136.50/136.75 call spread bought for -0.5 in 5k (bought put spread, sold call spread)

- 0LZ1 99.50/37/25 put fly, bought for 2.25 in 3k

- 3LZ1 99.25/99.00ps, bought for 7 in 5k

FOREX: Dollar Retreats From Multi-Month Highs, Commodity-Tied FX Lead Charge

- Broad dollar indices suffered to start the week as a strong bounce in the commodity space helped risk-tied currencies lead global gains.

- Lingering concerns around Covid and the economic recovery have potentially propelled expectations for a slightly more dovish Powell at Jackson Hole, also lending support to risk assets on Monday.

- The >5.5% rally in crude futures exacerbated the relief rally in CAD and NOK, both firming ~1.3% against the greenback. Not far behind were Antipodean-FX with AUSUSD and NZDUSD both snapping 5-day losing streaks and rising between 0.9-1.15%.

- Important to note for USDCAD, Friday's price pattern is a bearish shooting star candle and is a concern for bulls. Should the oil price recovery continue, markets will monitor this pattern as it is a reversal threat.

- European Flash PMIs were mixed but both the Euro and Sterling took their cues from the dollar. EURUSD (+0.40%) rose above 1.17 and gradually climbed towards 1.1750. Pound Sterling, despite a particularly weak UK services PMI figure, was also on a steady grind that saw GBPUSD 0.8% better off, trading around 1.3730 as of writing.

- Final reading of German GDP early on Tuesday before US New Home Sales and Richmond Manufacturing Index headline the US docket.

PIPELINE: $3B EIB 5Y Expected Tuesday

Issuance volume has slowed significantly since the decent start for August, appr $5B total estimate for week after $10B last week and just over $40B prior.- Date $MM Issuer (Priced *, Launch #)

- 08/23 $600M Black Hills 3NC6 +80a

- Rolled to Tuesday:

- 08/24 $3B EIB WNG +5Y +1a

EQUITIES

Key late session market levels:

- DJIA up 264.81 points (0.75%) at 35385.26

- S&P E-Mini Future up 45.5 points (1.03%) at 4482.5

- Nasdaq up 242 points (1.6%) at 14956.61

- EuroStoxx 50 up 28.92 points (0.7%) at 4176.42

- FTSE 100 up 21.12 points (0.3%) at 7109.02

- German DAX up 44.75 points (0.28%) at 15852.79

- French CAC 40 up 56.99 points (0.86%) at 6683.1

COMMODITIES: Sharp Recovery In Crude Snaps Seven Day Losing Streak

- With lingering concerns over the Covid situation in the US and the potential impact on the economic recovery, markets appear more apprehensive of any kind of clear taper announcement at the upcoming Jackson Hole symposium. As such, risk trades on the front foot to start the week with a weaker dollar and a strong rally in the commodity space.

- Oil prices, in particular have recovered a large portion of last week's selloff. As of writing, both Brent and WTI crude futures have risen around 5.5%, erasing a large portion of the near 9% retreat last week with the weaker greenback supporting the general commodity landscape.

- Analysts have also noted oversold conditions with Commerzbank analysts noting the price weakness as excessive and believe it has more to do with the psychology of market participants than with any deterioration of fundamental data". Goldman Sachs also commented in a note that they believe the steadily "tightening commodity fundamentals — will trump the macro trends as we move toward autumn, pushing many markets like oil and base metals to new highs for this cycle". (CNBC)

- Separately, the U.S. Energy Department announced (https://www.energy.gov/fe/articles/doe-announces-notice-sale-crude-oil-strategic-petroleum-reserve-2) that it intends to sell up to 20 million barrels of crude oil from the nation's Strategic Petroleum Reserve.

- Gold spiked back above the psychological $1,800 level on Monday as market participants flocked to bullion amid the weaker greenback. With markets assessing the risk for the week is that Jerome Powell may be unable to give a clear timeline for stimulus withdrawals, precious metals remain underpinned.

- Today's breach of the 50-day EMA that intersected at $1796.50 has strengthened a bullish case and may open key resistance at $1834.1, Jul 15 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.