-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Big ADP Private Employ Miss

US TSYS: Big ADP Private Employ Miss Spurred Early Rate Bounce

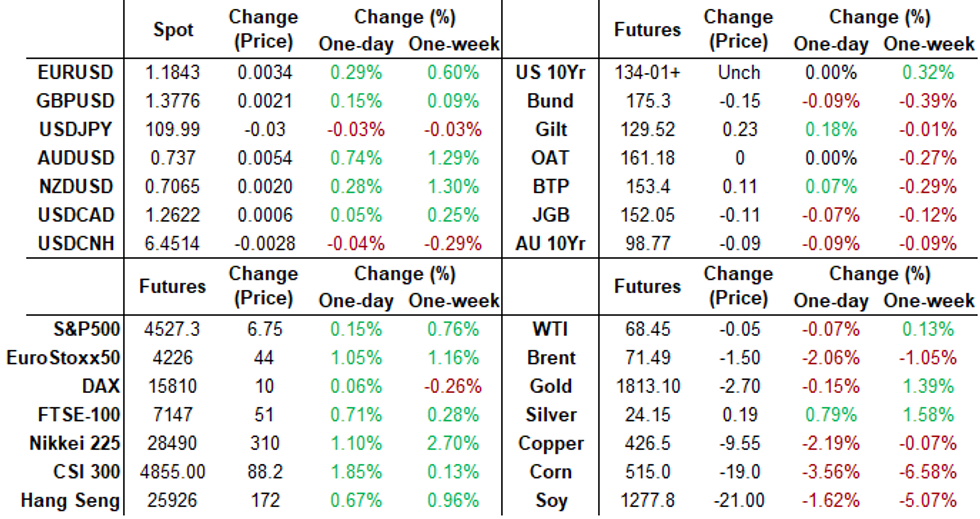

Tsy 10Y futures hold steady into the close, curves flatter with bonds outperforming mildly weaker levels in the short end late Wednesday.- After some brief volatility, Tsys bounced off weaker levels after a huge miss in ADP private employment data (+374k vs. +625k est). While historical correlation between the ADP data and headline Non-Farm Payrolls due Friday is inconclusive -- risk-off support in rates did gain some momentum.

- Tsys started to scale back support prior to the midmorning ISM data: Mfg PMI rose 0.4pt in Aug to 59.9, recovering from July's lowest level since Jan and beating market forecasts (BBG: 58.5). Significant supply-chain issues remain, however, tempering the better than expected data while rates held a narrow range through the closing bell.

- Meanwhile, US$ index continued to inch lower (DXY -.176 at 92.450) and equities held nominal gains (ESU1 +3.25).

- Decent pick-up in swappable corporate issuance ($7.25B) generated some hedging flow as did better put trade across the curve. Otherwise, participants stayed close to the sidelines ahead Fri's August employ data, median estimate of +780k.

- The 2-Yr yield is up 0bps at 0.2094%, 5-Yr is up 0.3bps at 0.7804%, 10-Yr is down 0.7bps at 1.302%, and 30-Yr is down 1.1bps at 1.9215%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00050 at 0.07288% (-0.00325/wk)

- 1 Month +0.00075 to 0.08325% (-0.00275/wk)

- 3 Month -0.00075 to 0.11888% (-0.00100/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00225 to 0.15188% (-0.00288/wk)

- 1 Year -0.00025 to 0.22763% (-0.00750/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $59B

- Daily Overnight Bank Funding Rate: 0.05% volume: $214B

- Secured Overnight Financing Rate (SOFR): 0.05%, $953B

- Broad General Collateral Rate (BGCR): 0.05%, $397B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $360B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.199B accepted vs. $4.710B submission

- Next scheduled purchase

- Thu 9/02 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 9/03 no buy operation ahead holiday, resume Tuesday Sep 7

FED: REVERSE REPO OPERATION

Still above $1T, NY Fed reverse repo usage recedes to 1,084.115B from 72 counter-parties after rising to new record high of $1,189.616B on Tuesday (prior record high of $1,147.089B set Wednesday, Aug 25).

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -10,000 Green Dec 98.62/98.75/99.00 put trees, 4.5

- -5,000 short Jun 98.75/99.00 put spds, 3.5

- +15,000 Green Dec 99.25/99.37 call spds 0.5 over the Green Dec 98.62/98.75 put spd

- +5,000 Green Dec 99.25 calls 1.0 over Blue Dec 99.00/99.50 call spds earlier

- -5,000 short Dec 99.06/99.25 put spds, .5

- 8,000 Oct/Dec 99.75/99.81 put spd spd

- Overnight trade

- total 18,500 (15k Blocked) short Mar 99.12/99.37 put spds, 5.0 vs. 99.475/0.25%

- 2,500 Gold Dec 97.62/98.12/98.37 put trees

- 3,500 short Dec 99.25/99.50 put spds

- 3,500 Green Oct 98.81 puts, 3.5

- 2,750 Green Dec 98.50/98.75 put spds

- +20,000 TYV 133.5 straddles 28 over wk2 TY 133.5 straddles

- +7,000 TYZ 136 calls, 18

- Update +18,000 TYV 132.5/133 put spds -/+1 over 134/134.5 call spds

- -3,000 TYV 132.25/134.25 strangles, 29

- -5,000 TYZ 131/135.5 strangles, 44

- Overnight trade

- 9,000 TYV 132.5 puts, 17-20, 18 last

- 7,300 TYV 134 calls, 19-20

- 3,000 wk2 TY 132.75/133.25 1x2 call spds

- 2,500 wk2 TY 132.75/133/133.5 broken put tree

EGBs-GILTS CASH CLOSE: Afternoon Recovery

Bunds and Gilts overcame early weakness to finish flat/stronger respectively. Periphery spreads mostly tightened, but Greece underperformed amid heavy supply.

- ECB speakers featured heavily again: this time we heard a bit more from the doves, with Stournaras suggesting that the current inflation surge is temporary and policy should remain cautious.

- A miss in US ADP employment helped boost global FI in the afternoon.

- Heavy supply: Greece sold E2.5bln via syndicated dual-tranche tap of 5/30Y GGBs; Germany E5.5bln syndication of 30Y Bund; UK 2.5bln of Gilt. France and Spain auctions Thursday.

- Italy and Spain Aug PMIs surprised to the upside. Also, BOE announced ex-Goldman/ECB Huw Pill would become the new chief economist.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.711%, 5-Yr is down 0.4bps at -0.682%, 10-Yr is up 0.9bps at -0.374%, and 30-Yr is up 2.4bps at 0.116%.

- UK: The 2-Yr yield is down 1.9bps at 0.2%, 5-Yr is down 1.8bps at 0.365%, 10-Yr is down 2.2bps at 0.692%, and 30-Yr is down 2.3bps at 1.033%.

- Italian BTP spread down 2.8bps at 106.4bps / Greek up 0.7bps at 115.7bps

EGB OPTIONS: Oct / Nov Bund Put Buying Continues

Wednesday's rates / bond options flow included:

- RXV1 172.5/170.5ps 1x2, sold at 41 in 1.5k

- RXV1 174/175cs, bought for 10.5 in 2.5k

- RXX1 172/170ps 1x2, bought for 23 and 24 in 5k

- RXX1 172/171/170p ladder, bought for 2.5 in 1.5k

- LU2 99.00 put bought for 3.25 in 7k

- 0LZ1 99.50/99.375/99.25/99.125 put condor bought for 3.5 in 3k

FOREX: AUD Outperforms Throughout, Tops 50-dma

- AUD outperformance persisted throughout the Wednesday session, with prices narrowing the gap with $0.74 - a level not crossed since early August. Prices also traded north of the 50-dma at $0.7382 for the first time since June. This kept the AUD at the top of the G10 currency table well into the close.

- In contrast, the USD Index ebbed to new weekly lows, showing back below 92.50 on a sizeable miss in ADP employment change data. The headline came in at 374k vs. Exp. 625k, raising concerns over Friday's payrolls print. A better than expected ISM Manufacturing read did little to bolster the greenback, with the employment subcomponent slipping below 50.0.

- The JPY was among the largest decliners in G10, with EUR/JPY making progress above 130.00 to touch levels not seen since late July and working further against the recent bearish outlook. JPY weakness came alongside a rebound in global equities, which put the EuroStoxx50 at new cycle highs last seen in March 2008.

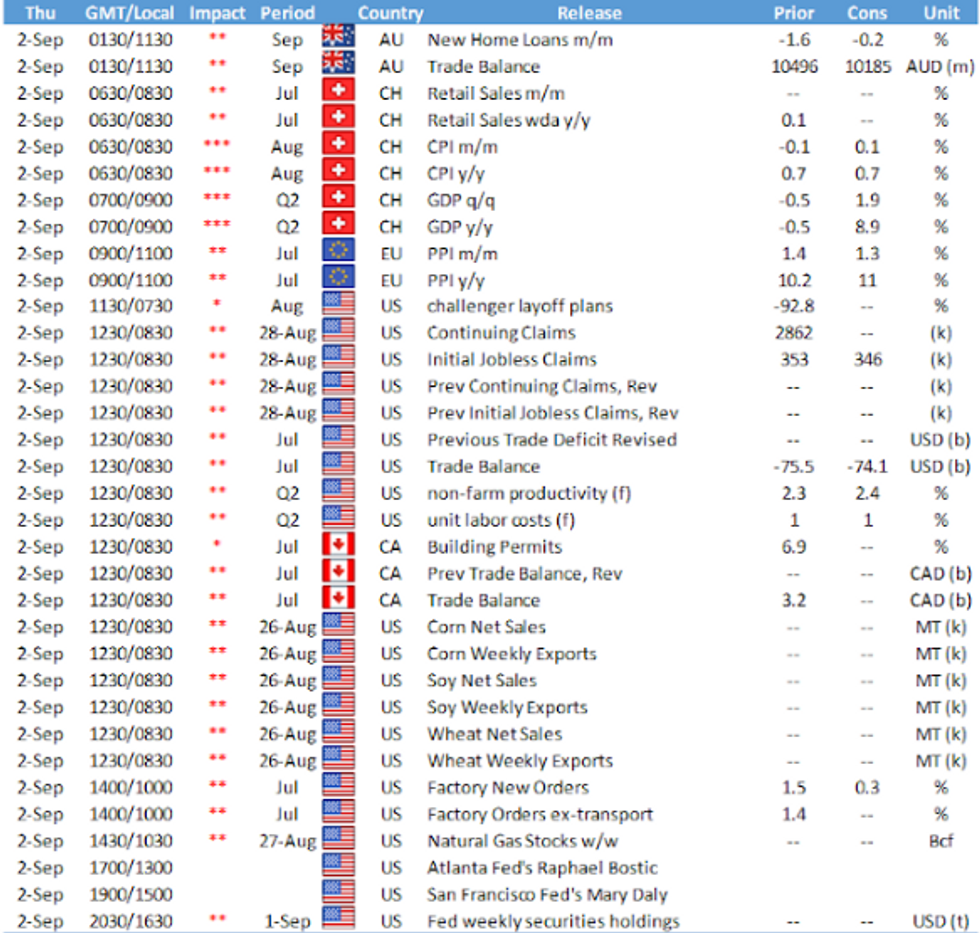

- Australian, US and Canadian trade balance, Eurozone PPI and US weekly jobless claims are the calendar highlights Thursday. Fed's Bostic and Daly are also due to be speaking.

FOREX: Expiries for Sep02 NY cut 1000ET (Source DTCC)

- USD/JPY: Y109.50-70($897mln)

- USD/CAD: C$1.2600($560mln), C$1.2640-50($556mln)

- USD/CNY: Cny6.4570($960mln)

PIPELINE: $7.25B to Price Wednesday, Canada Pension Plan Leads

- Date $MM Issuer (Priced *, Launch #)

- 09/01 $2.5B *Canada Pension Plan Inv Brd 5Y +4

- 09/01 $2B *ESM WNG 2Y -1

- 09/01 $1.25B #Allianz perp NC6.6Y 3.2%

- 09/01 $1B #Verizon WNG 20Y +102

- 09/01 $500M *Kommunalbanken WNG 2023 tap FRN/SOFR

- Expected Thursday:

- 09/02 $Benchmark World Bank 7Y +7a

EQUITIES: Uptrend Puts EuroStoxx50 at New Cycle Highs

- After an unimpressive Tuesday session, the uptrend resumed Wednesday, with Europe bouncing well after a solid Asia-Pacific session. The uptick in risk appetite worked in favour of the EuroStoxx50, in which a rally in consumer discretionary and utilities names to put the index at new cycle highs. The index touched 4251 for the first time since March 2008.

- Across Wall Street, the three major indices also traded in the green, with the S&P 500 higher by 0.2%. Strength in US real estate and utilities countered weakness across energy and financials, helping the index to hold just below alltime highs.

- The resumption of the uptrend for stocks weighed on the VIX index, which hit new weekly lows and narrowed the gap with the post-COVID lows printed in late June at 14.10.

COMMODITIES: Oil Undermined as Russia Could Bump Production Above-Quota

- After a positive start to the session, WTI and Brent crude futures dipped into negative territory shortly after US trade, with Russia's Novak quoted in IFX as saying the country could raise oil output above the OPEC+ quotas - pressing WTI futures to new weekly lows just above $67/bbl support.

- The downside persisted headed into the weekly DoE crude oil inventories numbers, which showed a far larger draw on headline stockpiles than expected, with a drawdown of over 7mln bbls - twice that of expectations.

- Metals markets also saw a tumultuous session, with Dalian-listed iron ore dropping to nearly 40% off the year's best levels, and coming closer to the cycle lows printed mid-August.

- Heavy selling pressure was present in markets from the off, with reports that China had released a third batch of metals supply from state reserves quickly doing the rounds. China confirmed that 150,000 tons of copper, aluminium and zinc had been released from their strategic supply, with the government vowing to continue to monitor price trends going forward.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.