-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: No Job "Knockout"/Taper Annc Still On

US TSYS: Strong Jul/Aug Uprevisions Keep Taper Annc Expectations Alive

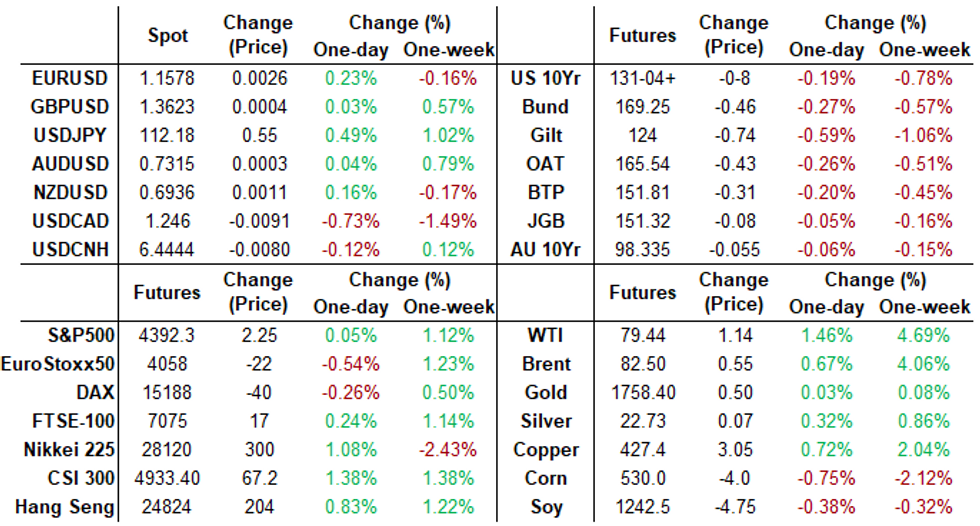

While the Sep jobs gain of +194k fell far short of +500k expectations early Friday, large total uprevisions of +169k to July and August helped keep expectations of a taper annc at the Nov FOMC alive.- Contributing factors: drop in unemployment to 4.8%, longer avg workweek and strong earnings growth should give green light to Fed taper announcement in Nov.

- Sharp two-way trade post-data, as 30Y Bonds blipped higher on the consensus miss before the revision gain took hold and initial data point evaporated. Yield curves bounced (5s30s tapped 113.9 high) as bonds extended session lows from mid- into late morning trade.

- Aside from the initial excitement and decent volumes, tempo fell off in the second half as accts that were already squared and pared migrated back to the sidelines ahead the extended Columbus Day holiday weekend.

- No significant data until Wed next week w/Sep CPI (MoM 0.3% est/YoY 5.3% est) and Sep FOMC Minutes release later in the session.

- The 2-Yr yield is up 1bps at 0.3158%, 5-Yr is up 2.5bps at 1.0465%, 10-Yr is up 2.8bps at 1.6013%, and 30-Yr is up 3.2bps at 2.1582%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00025 at 0.07263% (-0.00175/wk)

- 1 Month -0.00237 to 0.08363% (+0.00838/wk)

- 3 Month -0.00250 to 0.12113% (-0.01200/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00062 to 0.15650% (-0.00175/wk)

- 1 Year +0.00387 to 0.24700% (+0.01212/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $77B

- Daily Overnight Bank Funding Rate: 0.07% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.05%, $911B

- Broad General Collateral Rate (BGCR): 0.05%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $352B

- (rate, volume levels reflect prior session)

- Tsys 0Y-2.25Y, $12.401B accepted vs. $45.100B submission

- Next scheduled purchases

- Tue 10/12 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 10/13 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 10/14 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 10/14 1500ET: Update NY Fed Operational Purchase Schedule

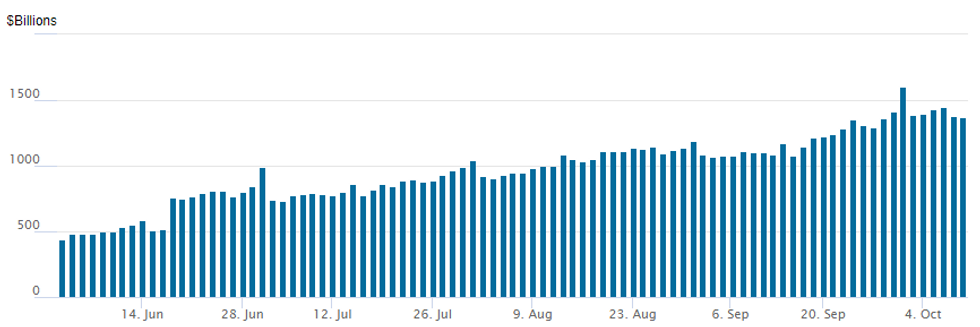

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $1,371.958B from 77 counterparties vs. $1.375.863B on Thursday. Record high remains at $1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 short Dec 99.25 puts, 1.5 vs. 99.435

- Block, 10,000 short Dec 99.37 puts, 3.0

- +10,000 short Mar 98.87 puts, 2.5 vs. 99.325/0.10%

- -10,000 Green Dec 98.62/98.87 2x1 put spds, 4.75

- -10,000 short Nov 99.56/99.687 call spds, 0.75 legs

- -10,000 short Dec 99.37/99.50/99.62 put flys, 4.75

- Overnight trade

- 5,000 short Dec 99.37/99.50 2x1 put spds

- 5,000 Green Dec 99.62 calls, cab

- Block 20,000 TYX 131 puts, 28 vs. 131-00.5/0.35%, total volume >73k

- Update, over 65,500 wk2 TY 131.5 calls from 2-1

- +6,000 FVZ 121.75/122.25/122.75 put tree, 4

- +15,000 wk2 TY 131.5 calls, 2 -- expires today

- near 36,000 TYX 131 puts trading, mostly 23-25 after some 85k bought Thu 14-19

- 6,500 TYX 130/131 3x2 put spds

- Overnight trade

- 5,000 TYX 130/132.5 strangles

- Block, total 10,000 USX 156 puts, 27-29

EGBs-GILTS CASH CLOSE: Yield Rise Remains Relentless

Gilt and Bund yields closed the week by continuing their almost uninterrupted rise since the end of August.

- Friday saw some mid-session respite after US payrolls data missed expectations, but the move quickly reversed and 10Y UK yields ultimately posted fresh post-May 2019 highs, with German counterparts equaling the highest yield since May 2021.

- The short end was not immune either, with Euribor and Short Sterling weakening sharply, pointing to greater scope for rate hikes by end-2022.

- Peripheries weakened but saw spreads tightening, led by Greece.

- No ratings decisions after hours Friday. Next week sees a slew of ECB and BoE speakers.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.4bps at -0.69%, 5-Yr is up 2.7bps at -0.532%, 10-Yr is up 3.6bps at -0.149%, and 30-Yr is up 3bps at 0.332%.

- UK: The 2-Yr yield is up 7.3bps at 0.547%, 5-Yr is up 7.3bps at 0.771%, 10-Yr is up 8.5bps at 1.162%, and 30-Yr is up 7.4bps at 1.503%.

- Italian BTP spread down 1.4bps at 102.7bps / Greek down 2.3bps at 105bps

EGB Options: A Busy End To The Week For Rates

Friday's European rates / bond options flow included:

- RXX1 169.00/167.50 ps, bought for 38 in 20k

- OEZ1 134.75/134.5/134.25/133.75p condor, bought for 1 in 2k

- ERM2 100.50^ (v 100.47) sold at 8.5 in 22k

- ERU2 100.50/100.625/100.75 call fly bought for 1.75 in 40k

- 2RH2 100.125/99.875/99.625 put fly (v 100.17) bought for 3.5 in 20k

- 2RM2 100.12/100ps, bought for 4 in 20k

- 2RM2 100.12/99.87/99.62p fly, bought for 3.75 in 20k

- 3RZ1 100.12/100.25cs 1x3 bought for half in 2k

- 3RZ1 100.375/100.50 call spread bought for 0.25 in 17.5k

- 0LZ1 99.12/99.25/99.37c fly, bought for 2.25 in 2.5k

- 0LZ1 99.25/99.50cs 1x2 bought for 2.5 in 2k and 3.5 in 6k

- 0LZ1 9912/99.00ps sold at 5.75 in 2.5k

- 3LZ1 99.75/99.625/99.50 put fly bought for 1.5 in 10k

- 3LZ1 99.875/99.75/99.625/99.50 put condor (v 98.845) bought for 3.25 in 7k

- 0NX1 99.30/99.40/99.50c fly, bought for 1.5 in 4k

- SFIX1 99.75/99.80/99.85c fly also trades 1 in 2k

FOREX: Jobs Data Puts Fed on Course to Taper

- Beyond the near-term volatility of the September jobs data, markets swiftly resumed their pre-data trends, with the release seen as working in favour of the Fed's plan to taper asset purchases before year-end. Despite the headline change in nonfarm payrolls coming in below expectations, sizeable positive revisions to the two prior months made for a decent report, particularly as the US Unemployment Rate fell below expectations.

- Similarly, Canada's jobs data came in ahead of forecast, with 157k jobs added against expectations of +60k. The release saw CAD outperform the rest of G10, pressuring USD/CAD through both the 200- and 100-dmas to print the lowest level since early August.

- JPY, AUD were among the poorest performers, with CAD, SEK and NOK the strongest.

- The coming week will likely start off on a quiet note, with US Colombus Day keeping markets muted. Focus then turns to UK jobs data, the German ZEW survey, US CPI/PPI and inflation & trade numbers from China. The South Korean central bank rate decision is due as well as FOMC minutes and the beginning of Q3 US corporate earnings season.

FOREX: Expiries for Oct11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550(E502mln), $1.1590-00(E1.1bln), $1.1900-20(E1.1bln)

- USD/JPY: Y111.00-05($671mln)

- USD/CNY: Cny6.4200($592mln), Cny6.4300($760mln)

PIPELINE: High-Grade Issuance for Week Near $35B

No new issuers on tap for Friday as yet, sidelined ahead Sep employ data.

- Date $MM Issuer (Priced *, Launch #

- $6.45B Priced Thursday, $34.95B/wk

- 10/07 $2.4B *Kyndryl $700M 5Y +105, $500M 7Y +135, $650M 10Y +160, $550M 20Y +205

- 10/07 $2.25B *TransCanada Pipelines $1.25B 3Y +45, $1B 10Y +100

- 10/07 $1B *John Deere $600M 3Y FRN SOFR+20, $400M 5Y +32

- 10/07 $800M *Ontario Teachers Cadillac Property Trust 10Y +105

EQUITIES: Stocks Shake Off NFP Survey, Sees Fed on Track

- The e-mini S&P underwent the usual bout of post-NFP volatility on Friday, with the lower-than-expected headline putting prices back toward the day's lows of 4382.25. This swiftly reversed into the close as markets resumed their pre-data trends.

- Across the S&P 500, a sharp rally in energy names helped support the index just into the green ahead of the close despite a lacklustre performance from the majority of other sectors. Buoyant oil prices helped support explorers and refiners, with WTI crude futures inching back above $80/bbl for the first time since late 2014.

- European markets finished the session mixed, with most core indices holding the trends seen throughout the Friday session. UK and Italian indices closed in minor positive territory, while core EuroStoxx50 and French CAC-40 indices finished in the red.

COMMODITIES: WTI Touches Best Level Since 2014

- WTI and Brent crude futures traded positively into the Friday close, extending the recovery off the Wednesday low to touch the best levels in around seven years. The moves follow reports throughout the week that two major sources of supply - OPEC+ and the US Strategic Petroleum Reserve - will not release stockpiles to settle market prices.

- This keeps the outlook for WTI and Brent crude bullish, with $80.57, the 1.50 proj of the Aug 23 - Sep 2 - Sep 9 price swing marking the next upside level.

- Gold followed acute volatility in the US yield curve, with a lower-than-expected headline for change in nonfarm payrolls putting yield lower - initially flattering the gold price. This price action swiftly reversed, however, with markets becoming increasingly of the opinion that the report keeps the Fed on track to taper as soon as November. As a result, yields marched higher and topped 1.60%, dragging gold into negative territory.

OUTLOOK

- Oct-11 Federal Holiday Columbus Day

- Oct-12 0600 NFIB Small Business Optimism (100.1, 99.5)

- Oct-12 1000 JOLTS Job Openings (10.934M, 10.942M)

- Oct-12 1030 NY Fed buy-op Tsy 10Y-22.5Y, appr $1.425B

- Oct-12 1230 Atlanta Fed Bostic on inflation, Q&A

- Oct-12 1800 Richmond Fed Barkin, NPR interview

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.