-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Inside Range for Rates

US TSYS: Inside Range, Little React Weekly Claims, Dec/Mar Roll Gets Underway

Rates trading firmer after the bell, inside range day for Tsys, short end curves mildly flatter on average overall volumes: TYZ1 just over 1.2M. Pick-up in Dec/Mar quarterly futures rolling contributing to volumes (TYZ/TYH near 100k in late trade.- Not much of a react to data: weekly claims slipped -1K to 268K, continuing claims -0.129M to 2.080M; though Philly Fed mfg index climbed 39.0 vs. 24.0 est the report looked very similar to Empire from earlier this week so has less shock for markets (hence very little reaction in Tsys), but inflationary pressures continued to intensify within the details.

- Not as much of a positive correlation between rates and equities today with the former rallying as equities pared gains after the open (only to recover by noon). Mixed flow two-way positioning/squaring ahead next week's shortened Thanksgiving holiday.

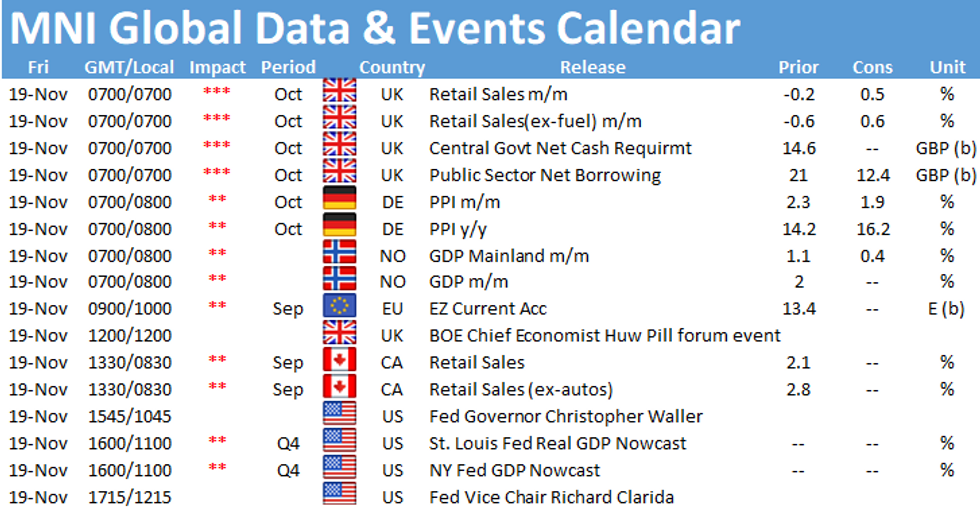

- No data on tap Friday, but Fed Gov Waller will discuss eco-outlook and take moderated Q&A (1045ET) followed by Fed VC Clarida, discussing global mon-pol coordination, w/ text and moderated Q&A at 1215ET.

- The 2-Yr yield is up 0bps at 0.4981%, 5-Yr is down 1.1bps at 1.2196%, 10-Yr is down 0.5bps at 1.5838%, and 30-Yr is down 0.8bps at 1.9678%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00100 at 0.07425% (-0.00050/wk)

- 1 Month +0.00238 to 0.09113% (+0.00200/wk)

- 3 Month +0.00213 to 0.15963% (+0.00688/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00513 to 0.22350% (-0.00263/wk)

- 1 Year -0.00888 to 0.38975% (-0.00875/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $271B

- Secured Overnight Financing Rate (SOFR): 0.05%, $893B

- Broad General Collateral Rate (BGCR): 0.05%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $1.576B accepted vs. $3.762B submission

- Next scheduled purchase

- Fri 11/19 1010-1030ET: TIPS 1Y-7.5Y, appr $1.775B

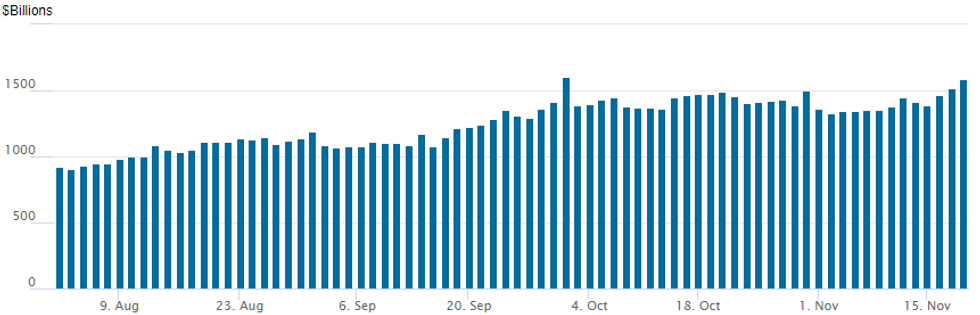

FED Reverse Repo Operation, Closing In On All-Time High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new month high of $1,584.097B from 74 counterparties vs. Wednesday's $1,520.000B. Closing in on record high of 1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options- +30,000 short Dec 99.12/99.31/99.62 1x3x2 call flys, 2.25

- +10,000 Red Dec'22 98.00/99.00 2x1 put spds, 10.5 vs. 99.10/0.20%

- Update, +27,000 short Dec 98.87/99.18 call over risk reversals vs. 99.095/0.50%

- +28,900 Green Dec 98.00 puts, 1.0

- -5,000 Blue Dec 98.00 puts, 3.0

- Overnight trade

- -6,000 Green Dec 98.25/98.50 put spds, 10.5

- 9,000 Green Jan 97.75/98.00/98.25 put flys

- +2,000 Green Jan 97.62/97.75/98.00/98.25 put condors 4.5

- 3,200 Jan/Feb 99.87 call spds

Treasury Options:

- 3,000 FVF 121.5/122/122.5 call flys

- +10,000 TYF 129/130.5 strangles, 54

- +15,000 TYZ1 130/TYF2 128 put calendar spd, 6 net/Jan bid over

- 1,000 TYH 133.5/136.5 1x3 call spds

- Overnight trade

- 4,600 USZ 161/USF 160 call spds, 37

- -10,000 TYZ 129.75 puts, 6

- +20,000 TYZ 129/129.5 put spds, 2

- -13,400 TYZ 130 puts, 9

- Block, -4,500 USZ 159 puts, 14

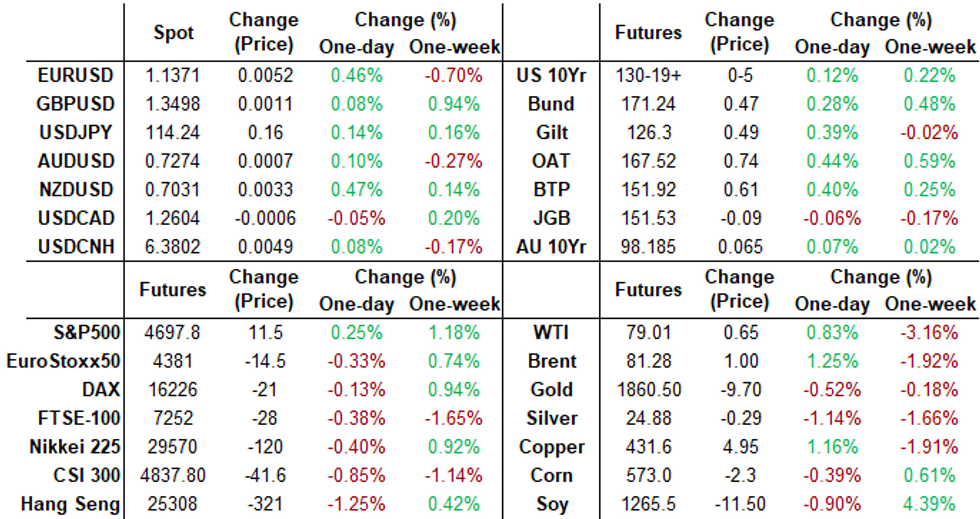

FOREX: Euro Extends Bounce Off Lows As Dollar Momentum Halted

- EURUSD rose the best part of half a percent on Thursday as broad dollar indices consolidated at lower levels. The single currency strengthened to around 1.1370, edging toward initial resistance at 1.1386, Tuesday's high.

- NZDUSD matched the Euro's ascent and remains atop the G10 leaderboard. The currency took the lead from 2yr inflation expectation data released overnight, which surged to 2.96% from 2.27% previously - the highest rate since 2011. NZD/USD rallied to narrow the gap with the 50-dma of 0.7056. A break above here would see the short-term outlook improve toward 0.71 and the 200-dma.

- Elsewhere EURNOK had a notable move higher of around 1.2%. EURNOK finds itself back above 10.00 for the first time since early October. The move came amid news from the central bank that they are halting their krone purchases carried out on behalf of the government for the rest of the month, effective from Nov. 19.

- In emerging markets, there was continued focus on an extremely volatile Turkish Lira. Liquidity evaporated in USDTRY above 11.00, sparking a rapid acceleration to print fresh all-time highs at 11.3118. This extended the daily range to a massive 8.25%, before the pair consolidated somewhat back towards the 11 handle, currently up 3.3% for Thursday. The days advance strings together 8 consecutive positive sessions, strengthening roughly 17% at its Thursday peak.

- UK October retail sales kicks off tomorrow's data calendar before ECB's LaGarde is due to deliver opening remarks at the Frankfurt European Banking Congress. Canadian retail sales is the highlight of the US session before Fed's Clarida speaks at 1715GMT/1215ET on global monetary policy coordination.

FX: Expiries for Nov19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1375-00(E1.4bln), $1.1445-50(E581mln), $1.1500(E1.6bln)

- USD/JPY: Y114.75-76($637mln)

- EUR/GBP: Gbp0.8590-00(E1.1bln)

- USD/CAD: C$1.2650($526mln), C$1.2800-20($1.1bln)

- USD/CNY: Cny6.3700($1.1bln)

EQUITIES: Stocks Erase Opening Losses as Earnings Underpin Recovery

- Wall Street opened poorly Thursday, with the S&P 500 immediately coming under selling pressure as a recent rally across a narrow range of stocks include Rivian and Lucid Group ran out of steam. Both shares traded under heavy pressure alongside Cisco Systems, which slipped close to 10% on earnings. The stock provided a solid headwind for the Dow Jones Industrial Average, knocking over 30 points off the index.

- Having printed a low at 4668.00 - on heavy volume - the e-mini S&P staged a solid recovery off the lows. This further cements the underlying bullish theme, backed up by the prominence of buy-the-dip strategies. A recovery back above 4700 opens 4717 initially (1.50 proj of Jul 19 - Aug 16 - Aug 19 price swing), should earlier highs at 4711.75 give way.

- Perhaps importantly, the in-focus Semiconductors sector traded very well, with NVIDIA and AMD surging thanks to NVIDIA's particularly strong Q3.

COMMODITIES: Oil Prices Stabilise, Gold Down

Oil prices stabilise after a period of weakness, but uncertainty remains on SPR release details.

- Brent futures stabilised off the lows having come under modest selling pressure during early Asia hours. Brent heads through the London close higher by 0.8% at $80.93 having briefly breached the short-term support of $80.20 (Nov 4 low) earlier in the session. The break of this level signals scope for a deeper corrective pullback as the recent overbought condition unwinds. Potential is seen for weakness towards $78.42, Oct 7 low.

- WTI is lagging very slightly, up 0.5% to $78.76 which sees the Brent-WTI spread nudge out to $2.16, largely unchanged today and still at late Oct highs. The benchmark continues to underperform with markets remaining on watch for any comments from the White House on a possible SPR release.

- Gold has dipped lower today at $1861.33 as it pulls back from the recent bullish trend on marginally more hawkish Fedspeak. It remains above the previous resistance level of $1834 (the Sep 3 high) ever since last week's US CPI, although has just dipped below $1863.3, 76.4% of the Jun-Aug sell-off.

- Potential USD risk tomorrow with Clarida speaking at 1215ET on Global Monetary Policy Coordination.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.