-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 5Y Yld 2Y Highs, 30Y Yld 200DMA

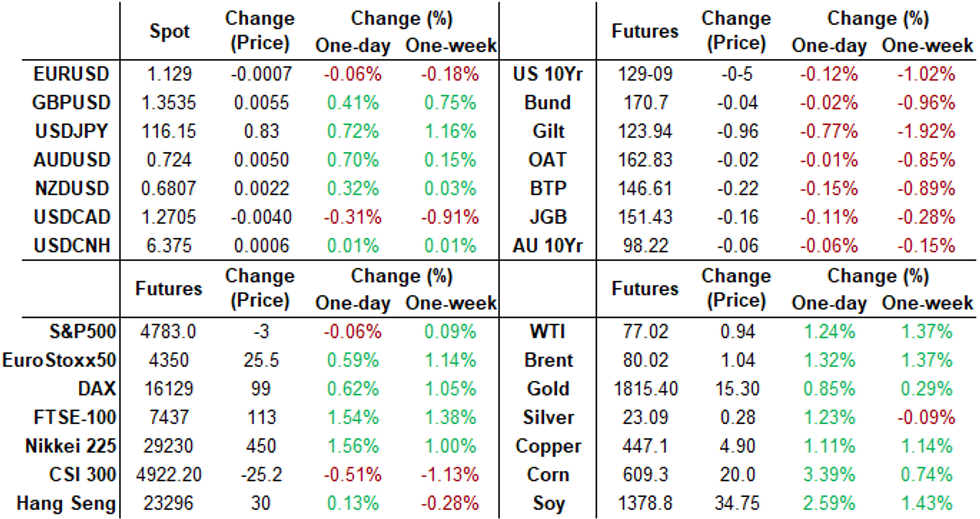

US TSYS: 10Y Real Yields At Post Dec FOMC High

- A decoupling between 10Y Tsy yields and breakevens has seen the breakeven-derived real yield rise 7.5bps to -0.945% (and 12.5bps since the new year).

- This is the highest since the immediate reaction to the Dec FOMC decision and prior to that since pre-Omicron levels.

- Both 10Y nominal yields and breakevens remain elevated, but the 10Y nominal yield is up 3.5bps today at 1.665% whereas the breakeven has dipped 4bps to 2.608%.

- Today’s further rise in the nominal yield takes it to the top end of the post-pandemic range, close to the 1.7% it has struggled to clear in recent months.

- FOMC minutes tomorrow with markets looking for any discussion on how soon they might hike rates after taper is over and any more detail about balance sheet normalisation.

- Yield curves holding steeper but slightly off midday highs (5s30s +4.07 at 70.75 -- steepest since late November.

- Contributing flow in addition to large 5Y Block buy, trading desks report two-way in short end with foreign real$ selling 2s, domestic real$ buying 3s vs. leveraged acct selling.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00791 at 0.07229% (-0.00537 total last wk)

- 1 Month +0.00246 to 0.10371% (+0.00000 total last wk)

- 3 Month +0.00687 to 0.21600% (-0.00875 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00411 to 0.34286% (-0.00450 total last wk)

- 1 Year +0.01987 to 0.60300% (+0.01600 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $249B

- Secured Overnight Financing Rate (SOFR): 0.04%, $972B

- Broad General Collateral Rate (BGCR): 0.05%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $321B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $1.501B accepted vs. $5.048B submission

- Next scheduled purchases:

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

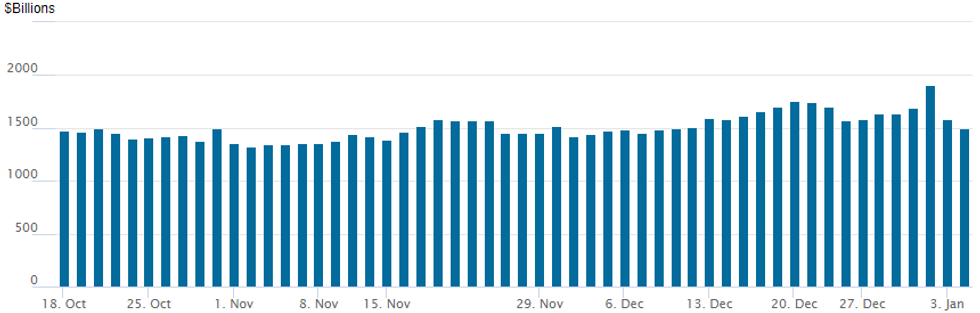

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage continues to recede after from last Friday's all-time high of $1,904.582B -- down to $1,495.692B (72 counterparties) from $1,579.526B on Monday.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -2,000 short Mar 99.25/99.37 call spds 1

- Update, total 50,000 Green Mar 97.50 puts, 1.0

- +10,000 Green Mar 98.00/98.25 2x1 put spds, 2

- -5,000 Blue Mar 97.50/97.87 put spds, 5.5

- +5,000 Mar 99.62/99.68/99.75 call trees, 1.0

- Overnight trade

- 5,000 Dec 98.37/98.50 put spds

- 10,000 Green Mar 97.87/98.12 put spds

- 5,000 Mar 99.25/99.43/99.50/99.62 put condors

- 1,000 Green Mar 97.87/98.00/98.12/98.25 put condors

- 2,000 short Mar 98.25/98.37/98.50/98.62 put condors

- 4,700 TYG 130.75 calls, 6

- +5,000 TYH 126/127/128.5 2x3x1 put flys, 8

- 5,000 FVG 119.25 puts, 4

- 2,500 FVH 118.25/119/119.5/120 put condor

- Overnight trade

- Blocks 12,000 TYH 125.5/127.5 put spds, 16-18; 5,011 Blocked earlier on a 3x2 ratio earlier, 21 net

- Block 15,000 FVG 120/120.5 put spds, 11

- 5,000 TYH 126.5/127/127.5 put flys

- 4,500 TYG 128/128.5 put spds

- 3,000 TYH 129/130.5 2x1 put spds, 3 net/2-legs over

- 3,500 TYG 130.5 calls, 11-12

- 5,000 TYH 126/127/129 2x3x1 put flys, 8

- 1,000 TYH 125/126.5/129/130 broken put condors

EGBs-GILTS CASH CLOSE: Post-Holiday Gilt Sell-Off

German bonds vastly outperformed the UK's Tuesday, though this was distorted by the return to Gilt cash trading from holidays.

- Overall it was a risk-on session in Europe with equities gaining and curves steepening.

- Gilts sold off sharply (vs Dec 31 levels), with short-end/belly yields rising to 2+ year highs. The 10Yr segment underperformed though, with yields up 11+bp (to 'just' 2-month highs).

- GBP strength vs EUR was notable, and largely attributable to a relatively more hawkish policy rate outlook in the UK vs Eurozone.

- Italian curve steepening was exacerbated by a syndication mandate for new 30Yr BTP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at -0.613%, 5-Yr is down 0.7bps at -0.418%, 10-Yr is down 0.4bps at -0.122%, and 30-Yr is up 0.5bps at 0.257%.

- UK: The 2-Yr yield is up 8.1bps at 0.768%, 5-Yr is up 9.3bps at 0.913%, 10-Yr is up 11.4bps at 1.085%, and 30-Yr is up 9.5bps at 1.212%.

- Italian BTP spread up 1.3bps at 133.7bps / Spanish down 0.3bps at 71.2bps

EGB Options: Largely Downside Structures

Tuesday's Europe rates / bonds options flow included:

- DUG2 112.00/111.90 ps bought for 2.5 in 15k

- RXH2 168.00/173.50 combo bought for 2.5 in 6k (bought put, sold call)

- 0RU2 99.75/99.50/99.37 broken p fly, bought for 3.25 in 5k

- 2RH2 100/99.875ps vs 100.12/100.37cs, sold the ps at 2 in 10k

- 3RM2 99.75/99.50/99.12 broken p ladder 1x0.5x0.5 vs half 0RM2 99.87p, bought for 8.75 in 10k

FOREX: JPY Stays Weak Despite Equity Backtrack

- JPY headed into US hours at the bottom of the G10 table, and holds that position into the NY close. USD/JPY made light work of resistance ahead of the 116 handle, topping the mark and rallying to touch the best levels since early 2017.

- USD/JPY front-end risk reversals rose in sympathy with spot, prompting 1m RR to almost entirely reverse the omicron-inspired plunge at the end of November, with the contract closing in on the -0.2 points last seen on Nov25.

- Stocks charged higher at the open, helping boost the likes of AUD, NOK and CAD, which held their strength despite a moderation in equity prices after the open.

- The greenback held its ground for much of the European morning, but a miss on expectations for the ISM Manufacturing release worked against the USD Index, with particular attention paid to the subpar prices paid index - another metric that may suggest inflation could be nearing a medium-term peak.

- Final Eurozone PMI data crosses Wednesday as well as the December ADP Employment Change report. Fed minutes are also on the docket.

FX: Expiries for Jan05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1190-00(E673mln), $1.1285-90(E539mln)

- USD/JPY: Y113.45-55($960mln)

EQUITIES: Markets Edge Off Record Open

- Markets edged to new alltime highs at the open, with the S&P 500 rising to touch 4,818.6 on decent volume, as markets re-adjust to normality after the holiday break. Despite the solid open, markets retraced from there, with a weaker than expected ISM Manufacturing read weighing on sentiment and turning prices lower.

- Tech names led the decline, with healthcare and consumer discretionary not far behind. Markets tended to mimick the price action in Apple, which crested at new alltime highs and tipped their market cap above $3 trillion - albeit briefly. Shares then turned lower after a few hours, dropping around 1%.

- European trade erred more positively, with the FTSE-100 and CAC-40 adding 1.4-1.6% to cap a solid start to the year.

COMMODITIES: Oil Bid Returns Having Got Past OPEC+

- Crude oil futures have increased 1.5% today, nudging Brent above $80/bbl.

- Oil was steady after OPEC+ approved the 400kbpd production increase for Feb (as expected) although its analysts saw a smaller surplus in 1Q22 than previously thought.

- Separately, there appeared some support for oil prices as Texas Eastern announced a compressor will be out of service for repairs, hampering the gas delivery system to north-eastern US.

- WTI is +1.4% at $77.1 having earlier tested the initial resistance level of $77.44 (76.4% retracement of Oct-Dec downleg). Next resistance is $78.59 whilst support is seen at $74.27, the Jan 3 low and a key short-term support.

- Brent is +1.5% at $80.1, breaking through $80.03, the Dec 29 high and bull trigger. Next resistance is seen at $81.17 whilst previous support was seen at $77.04, yesterday’s intraday low.

- Gold meanwhile has bounced 0.7% to $1814. Key near-term resistance is seen at $1831.9 (Jan 3 high) whilst initial support is yesterday’s low of $1798.5.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.