-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Underlying Data Makes Up For Jobs Miss

US TSYS: Yields Higher Despite Headline Jobs Miss

Headline Dec jobs figure way off the mark (+199k vs. +445k est), the reaction not what you would expect as Tsys traded weaker until late morning.- Tsy futures traded weaker after Dec jobs gain of +199k missed a +447k estimate -- weak yes, but focus quickly turned to solid underlying data: household survey gain +650k, hourly earnings +4.7% YoY, unemployment drop to 3.9%, not to mention the Nov (modest) up-revision to +249k from +210k.

- Tsys bottomed out by late morning, 30YY hit 2.1432%H, 10YY 1.7992%, recovering near half the move/near midrange by the bell.

- Decent session volumes (TYH2>1.65M) amid otherwise quite late trade. Rates mostly weaker, curves steeper with short end outperforming (heavy TUH volume >445k), long end near middle session range.

- Two-way flow w/better buyers in short end long end since midday as accts look to next week's data: CPI (0.4% vs. 0.8% prior), PPI (final demand MoM 0.4% vs. 0.8% prior) and Retail Sales (+0.0% est vs. 0.3% prior).

- The 2-Yr yield is down 0.2bps at 0.8641%, 5-Yr is up 2.8bps at 1.497%, 10-Yr is up 4.4bps at 1.7655%, and 30-Yr is up 3.7bps at 2.1123%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00143 at 0.07271% (+0.00833/wk)

- 1 Month +0.00115 to 0.10529% (+0.00190/wk)

- 3 Month +0.00485 to 0.23614% (+0.02701/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00986 to 0.37643% (+0.03768/wk)

- 1 Year +0.01400 to 0.66171% (+0.07858/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $262B

- Secured Overnight Financing Rate (SOFR): 0.05%, $942B

- Broad General Collateral Rate (BGCR): 0.05%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $9.301B accepted vs. $38.962B submission

- Next scheduled purchases:

- Mon 01/10 1010-1030ET: Tsy 7Y-10Y, appr $2.425B

- Tue 01/11 1010-1030ET: Tsy 4.5Y-7Y, appr $4.525B

- Tue 01/11 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B

- Wed 01/12 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B

- Thu 01/13 1500ET: Updated NY Fed Operational Purchase Schedule

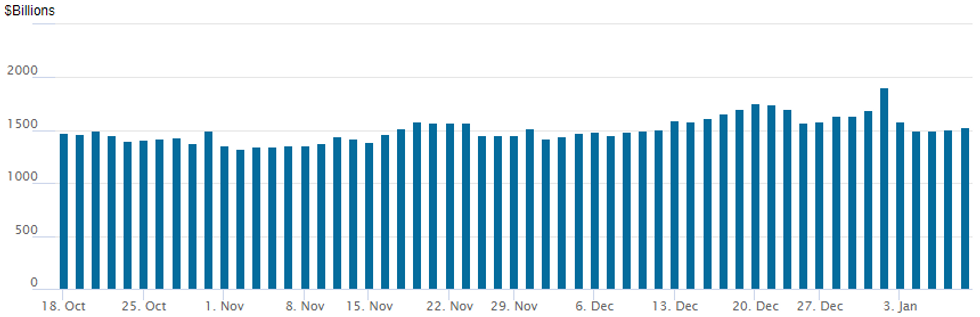

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,530.096B (75 counterparties) vs. $1,510.553B on Thursday.

All-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Green Jun 97.75/98.00 put spds, 9.5

- Block, +20,000 Dec 99.62/99.75 call spds, 1.0

- +7,000 Apr 99.00 puts, 1.25

- -10,000 Sep 98.93/99.06 put spds, 5.25

- Overnight trade

- 8,700 short Jan 98.50/98.56/98.62 put trees

- 2,000 Apr 99.43/99.56 call spds vs. 99.06 puts

- 4,500 Dec 98.18/98.43/99.31/99.56 put condors

- 2,000 Mar 99.50/99.62 2x1 put spds

- +8,000 Red Mar 97.25/97.50/98.00 broken put flys, 4.0

- +5,000 short Jan 98.62/98.75/98.87 put trees, 7.0

- 3,000 short Feb 98.81 straddles

- Block, 10,000 Dec 98.50 puts, 11.0 vs. 98.835/0.19%, 2.5k more/screen

- -5,000 TYH 127 puts, 22

- +10,000 TYH 131 calls, 6

- -7,000 TYH 126.5/130.5 strangles, 25-24

- 4,000 TYH 126/127 2x1 put spds, 2 net/2-legs over

- +5,000 TYG 129 puts, 13

- +2,000 TYG 127.5/128 put spds, 10

- Overnight trade

- +25,000 FVG 120.25 calls, 9

- 3,000 FVH 117.5/119 2x1 put spds

- 2,500 FVH 118/118.5/119.25 put trees

- 10,000 TYH 127 puts, 20-19

- +8,000 wk1 TY 128.5 puts, 10

- -15,000 FVG 120 puts, 19

PIPELINE: High-Grade Debt Issuance: $80.6B Total on Wk

$10.95B Priced Thursday, $80.6B total on week. Nothing on Friday's docket as yet, may see some pop up after today's employment data.- Date $MM Issuer (Priced *, Launch #)

- 01/06 $3.5B *IADB 5Y SOFR+22

- 01/06 $2.5B *GM Fncl $1B 5Y +90, $300M 5Y SOFR+104, $1.2B 10Y +138

- 01/06 $1.5B *UBS Group perp NC5 4.875%

- 01/06 $1B *Genuine Parts $500M 3NC1 +70, $500M 10Y +115

- 01/06 $1B *Federal Farm Credit System Banks 3Y+6

- 01/06 $500M *Banco de Brasil 7Y 4.95%

- 01/06 $500M *Ares Capital +5Y +150

- 01/06 $450M *Protective Life 3Y +50a

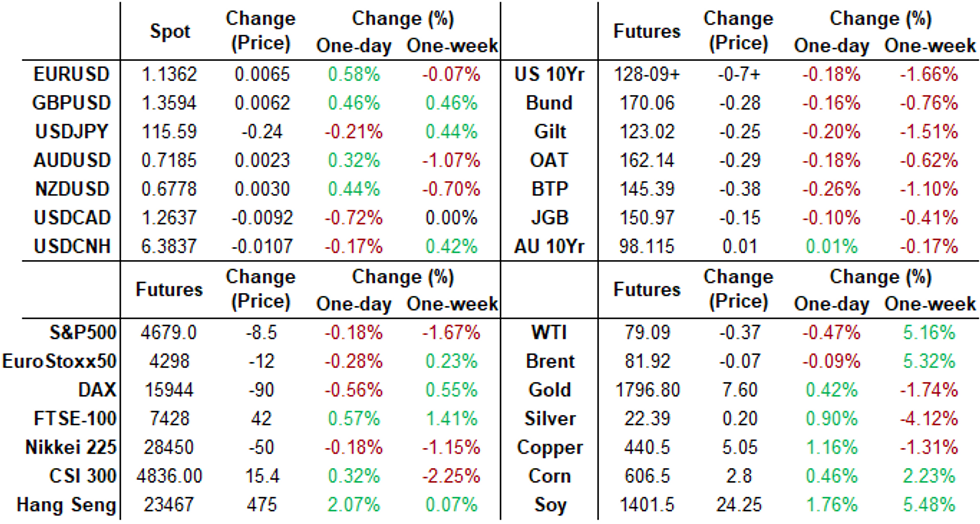

FOREX: Mixed Payrolls Data Results In Greenback Weakness

- Markets were characterised by some two-way action following the mixed US payrolls report. The initial reaction was to sell dollars on a weaker than expected headline figure of 199k vs. an estimate of 450k. Given some moderately positive revisions and a lower unemployment rate, the greenback quickly pared losses, trading within close proximity of pre-data levels.

- As the dust settled, the underwhelming headline figures and potential short-term positioning dynamics prompted the USD to grind lower throughout the course of Friday’s trading session. The dollar index has weakened by 0.6% and sits at the low of the day approaching the close.

- The largest beneficiaries from the dollar’s decline were the Euro and the Canadian dollar, the latter aided by some much stronger employment data with particular advances in the full-time component.

- USDCAD has had the biggest move on Friday (-0.75%) and the pair is re-approaching last week’s low of 1.2621 - a key short-term support. A move below these levels would cancel any possible reversal pattern and initially open 1.2608 and 1.2585, low Nov 19.

- EURUSD, once again, struggled below the 1.1300 mark and the greenback retreat eventually led to a break of Wednesday’s highs through 1.1346. The current consolidation means resistance at 1.1383/86, Nov 30 and Dec 31 high, is intact and that the pair remains inside December’s range. For technical bulls, clearance of these levels would suggest scope for a stronger short-term recovery.

- AUD, NZD and GBP all rallied between 0.3-0.4%, while the Japanese Yen edged higher but remained in a tighter 30 pip range following the data.

- Monday’s data docket is extremely light before the Wednesday’s main event – the release of US December CPI.

Expiries for Jan10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1275-80(E1.1bln), $1.1350(E501mln), $1.1390-10(E552mln)

- USD/JPY: Y114.00($1.1bln), Y116.00($600mln), Y116.50($1.2bln)

EQUITIES: Wall Street Mixed as NFP Indicates Tight Labor Market

- Equity markets trade mixed through the London close, with the recent theme of value over growth/tech extending through the Friday session. As a result, the Dow Jones trades with modest gains of 0.2% or so, while the tech-led NASDAQ sits in negative territory.

- The catalyst for the move originally sat with the Wednesday Fed minutes release, which indicating an FOMC ready to accelerate the pace of an unwind of stimulus - a theme underlined by today's NFP release, which suggested a further tightening in the labor market.

- The energy and financials sectors lead gains in the US, helped higher by fresh multi-month highs for oil as well as a re-steepening of the US yield curve post-jobs report. Banks take more focus going forward, with Wells Fargo, Citigroup, JPMorgan and BlackRock all due to release earnings in the coming week, with Friday 14th marking the unofficial beginning of Q1 earning season.

- S&P E-minis remain vulnerable near-term following a reversal lower this week from levels just above 4800.00. Price has traded below the 20-day EMA and attention is on the 50-day EMA that intersects at 4647.00 today. This average is regarded as a key pivot chart point and a clear break of it would signal scope for a deeper pullback.

COMMODITIES: Oil Ending A Strong Week On A Softer Note

- Crude oil prices have dipped between 0.5-1% today after a string of daily gains that still leaves WTI up 4.5% on the week.

- Prices were initially supported by lower production in both Kazakhstan and Libya before easing after softer-than-expected US payrolls (at least at a headline level) and Germany announcing tighter Covid curbs for restaurants and bars. More optimistic headlines from South African research didn't seem to have much impact.

- WTI is -0.9% at $78.8, firmly between resistance at $81.73 (Nov 10 high) and support at $76.73 (Jan 6 low).

- The most active strikes in the G2 (Feb’22) contract have been $83/bbl, $80/bbl and $82.5/bbl calls.

- Brent is -0.4% at $81.7, closer to first resistance of $83.11 (Nov 10 high) than support of $79.51 (Jan 5 low).

- Gold meanwhile is up +0.4% at $1797.7 having earlier tested key support at $1782.3. Initial resistance is seen at $1811.6 (Jan 6 high) with key resistance at $1831.9 (Jan 3 high).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/01/2022 | 1500/1500 |  | UK | BOE Mann on panel at AEA | |

| 08/01/2022 | 1500/1600 |  | EU | ECB Schnabel at AEA meeting | |

| 08/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 08/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/01/2022 | 0130/1230 | * |  | AU | Building Approvals |

| 10/01/2022 | 0830/0930 | ** |  | SE | Private Sector Production |

| 10/01/2022 | 1000/1100 | ** |  | EU | unemployment |

| 10/01/2022 | 1500/1000 | ** |  | US | wholesale trade |

| 10/01/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.